The empty chair. Jeff Bezos had one in every Amazon meeting to ensure that the consumer always had a seat at the table. The ride-along. Dara Khosrowshahi served as an undercover Uber driver to understand drivers as customers and revamp their experience to attract more of them. The customer usage metrics. When he took the helm at Microsoft, Satya Nadella focused on customer obsession and on building products that create “customer love” and usage—consistently asking about customer usage metrics at the start of meetings. Executives and their organizations go to great lengths to immerse themselves in the mind and behaviors of consumers. But why all the fuss over the customer?

It’s the Box Office Numbers

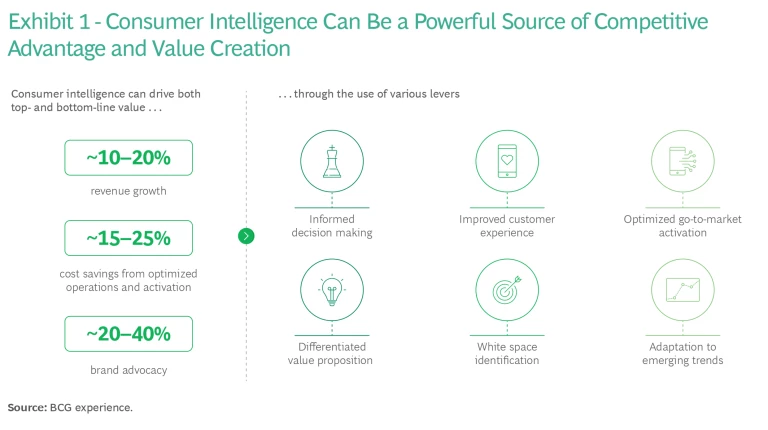

Consumer-centric companies deliver far better results: uplifts of approximately 10% to 20% in revenue growth, 15% to 25% in cost savings, and 20% to 40% in brand advocacy, in our experience. The unlock is superior consumer intelligence—a deep, holistic, actionable understanding of the consumer that translates into everything from better decision making to improved go-to-market and customer experience, along with superior responsiveness to market shifts and changes in consumer preferences. (See Exhibit 1.)

The Long-Form Montage

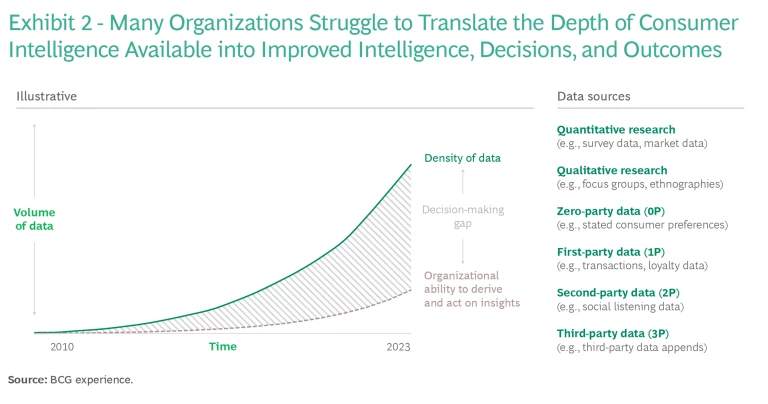

In recent years, the consumer intelligence available to organizations has grown explosively. (See Exhibit 2.) Consumers now engage with brands across more platforms and channels than ever before, leading to a dramatic rise in the sources of consumer intelligence—from qualitative and quantitative research to a multitude of other sources, from zero-party to third-party data. However, many organizations have struggled to translate this increase in available data into improved decision making and outcomes.

Focusing the Shot

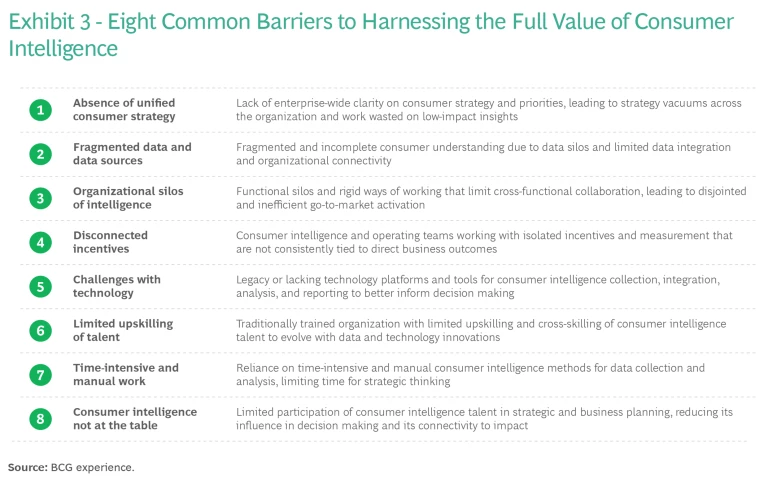

Why is harnessing the abundance of consumer data to create competitive advantage and value so difficult? We see eight common challenges, many of which are systemic and involve the entire organization, as opposed to ones that are limited to the consumer insights or customer data platform (CDP) teams. (See Exhibit 3.)

For instance, some organizations lack a unified customer strategy, which leads to wasted work on activities that don’t support a singular strategic plan. Often, significant fragmentation of data sources and limited or subpar data integration are underlying problems, exacerbated by organizational silos and rigid ways of working that limit cross-functional collaboration. In many cases, organizations establish incentives that are function-specific or conflict with the overall customer strategy or with certain aspects of it. The predictable result is disjointed, uncoordinated, and inefficient go-to-market activation. For example, we frequently see different groups within an organization reach out to customers across the customer journey with emails or promotions that lack institutional coordination. In addition, many companies suffer from legacy or lacking technology platforms and tools to support consumer intelligence collection, integration, and reporting.

Today, few traditional consumer insights practitioners are upskilling talent quickly enough to keep pace with the speed of data and technology innovations. Traditional approaches to consumer insight development are time-intensive and manual, whether they involve qualitative consumer interviews or survey drafting and execution, and this cuts into the amount of time available for strategic thinking. Finally, many organizations do not include consumer intelligence experts in their strategic and business discussions, which limits the extent to which consumer intelligence insights influence decision making and drive impact.

The Award Winners

With the rise of AI and GenAI, organizations have an opportunity over the next three to five years to address these challenges more effectively and to transform their consumer intelligence capability into an enterprise-wide ecosystem that creates a more holistic view of the consumer than has ever before been possible. Leaders who adopt a more multidisciplinary and cross-functional operating model will be able to more effectively leverage data sources across journey touchpoints and monitor larger volumes of input in real time.

Best-in-class organizations will excel across the following seven BCG consumer intelligence pillars:

- Consumer Intelligence North Star. Elevate customer strategy and consumer-based decision making across the entire organization.

- Consumer Intelligence Execution. Leverage AI and GenAI to stand up faster intelligence-to-impact cycles, with a focus on higher-impact insights.

- Consumer Intelligence Data and Technology. Create an integrated data ecosystem that provides a comprehensive view of the consumer.

- Ways of Working. Adopt multidisciplinary, cross-functional pods to support more cohesive go-to-market activation.

- Talent. Invest in dynamic upskilling and cross-skilling of talent to evolve at pace with technology and innovations.

- Culture. Establish shared incentives that transcend organization silos and regularly measure progress tied to real business outcomes.

- Governance. Outline new governance and risk management processes to mitigate new risks associated with AI.

But Have We Seen This Movie Before?

The longstanding quest to create a better consumer intelligence engine has remained elusive to most organizations. On its own, the increase in data hasn’t been the key to solving the equation, but AI and GenAI represent a powerful new accelerant for generating insights.

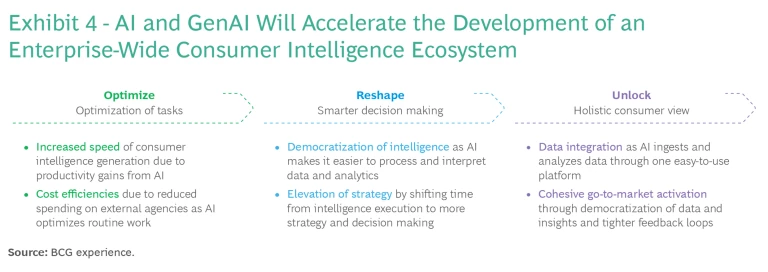

AI and GenAI will drive three fundamental shifts (see Exhibit 4):

- Optimize tasks to move faster and save costs.

- Reshape decision making by democratizing data and analysis, as well as by freeing up more time for strategic thinking.

- Unlock a more holistic view of the consumer by integrating data and tightening feedback loops to enable more cohesive go-to-market activation.

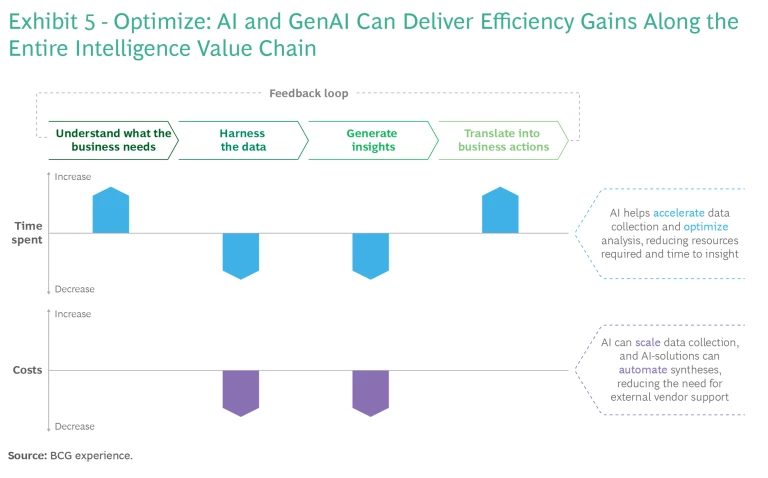

Optimize. There are four key steps in the value chain for consumer intelligence generation, and AI accelerates the speed and quality of the middle two—harness the data and generate insights. (See Exhibit 5.) AI sharply reduces both the time needed to gain useful insights and the resources and potentially vendors required to execute on the basis of that intelligence. This acceleration of the process can translate into cost efficiencies and faster speed to market. Organizations can then direct these savings to the bottom line or reinvest them to further advance their consumer intelligence ecosystem.

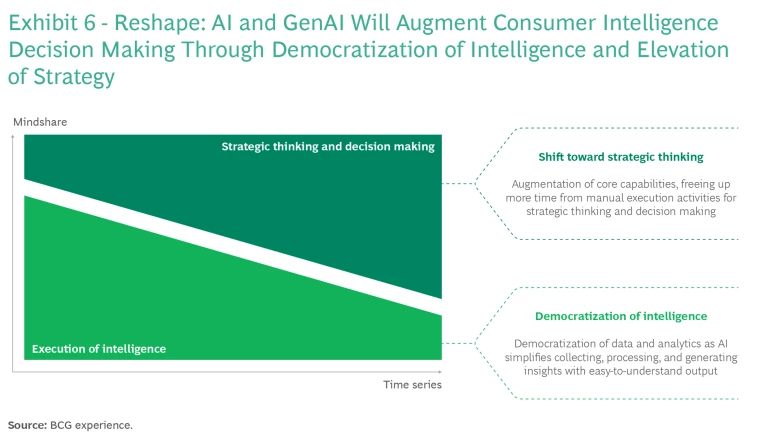

Reshape. Thanks to GenAI’s natural language processing interface, data analysis and insight generation will not be limited to the rarefied investigations of analysts, researchers, and data scientists. AI will make it easier for many others to access, collect, and clean data, as well as to generate outputs and insights from that data. (See Exhibit 6.) For example, we already see research companies building new tools that will use GenAI to execute hundreds of interviews via chatbots online and synthesize them in a short period of time. These more automated activities will free up time that researchers today typically spend on manual execution, which in turn will change the talent and resourcing required to complete tasks and permit more focus on strategic thinking and decision making.

Unlock. AI will support data integration that creates a deeper and more holistic 360-degree view of the consumer through a singular platform that supports coordinated, effective activation across the customer journey.

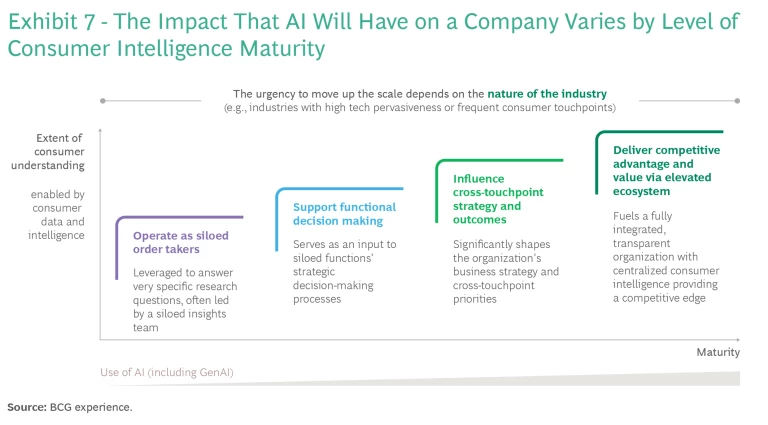

Writing Your Screenplay

Before they can determine how to get started, organizations must understand their starting point. (See Exhibit 7.) For organizations with less mature consumer intelligence capabilities, we recommend focusing on getting the right foundational elements in place to better leverage consumer intelligence as part of business strategy and everyday decision making. For these organizations, the most important immediate task is to establish basic capabilities and selectively leverage AI where it is easy to do so. For organizations with more advanced consumer intelligence capabilities, one critical objective is to jump-start the AI transformation journey, which entails thinking through how AI and GenAI might disrupt the company’s business ahead of any external or competitive disruption.

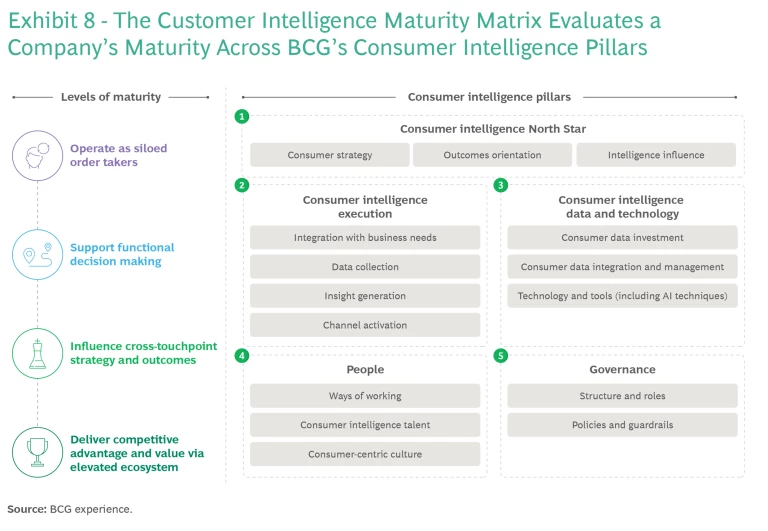

BCG’s Consumer Intelligence Maturity Matrix (CIMM) evaluates companies across the BCG consumer intelligence pillars to determine which stairstep of the maturity scale each company is starting from. (See Exhibit 8.) The assessment identifies key gaps and opportunities for improvement along the organization’s journey toward developing its consumer intelligence capability.

The Opening Scene

At the outset, we recommend that companies invest in refining their data strategy, operating model, and talent to build consumer intelligence into a source of advantage:

Data:

- Set a mission-focused data strategy. Identify priority data sources needed to drive impact for specified business objectives.

Operating model:

- Reorient teams for impact. Restructure the operating model toward mission-oriented, cross-functional teams with rapid feedback loops. (See Exhibit 9.)

- Increase intelligence influence. Create a customer-centric culture, and establish shared, impact-driven incentives to increase the influence of consumer intelligence.

- Build new governance. Establish oversight and risk management policies and processes to supervise technology and mitigate risks.

Talent:

- Upskill talent. Augment strategic skill sets and technical acumen to leverage AI effectively in consumer intelligence. (See Exhibit 10.)

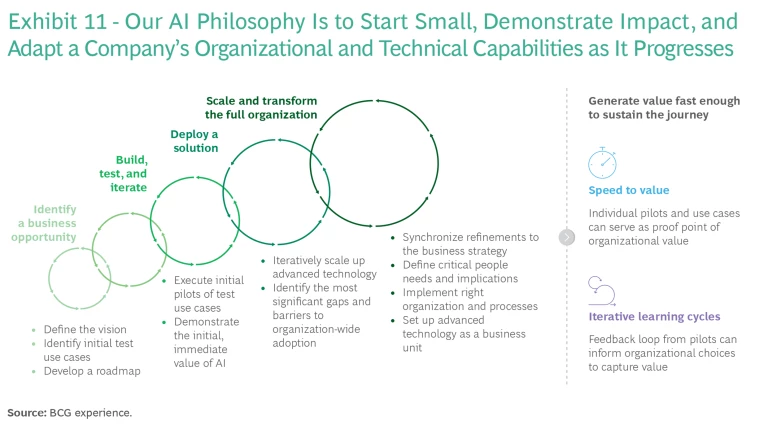

We also suggest identifying and launching two or three key use cases or missions that have a high likelihood of achieving success in a relatively short amount of time. Our philosophy with AI and GenAI is for companies to start small, demonstrate impact, and adapt over time—building capabilities and technical skills as they go. (See Exhibit 11.) The strategy of starting small and moving fast creates an early value proof to drive organizational buy-in, and it also encourages the use of quick and iterative learning cycles to deliver continuous improvement along the way.

The Director’s Chair

Whether it’s a chair, a ride-along, or usage metrics, any technique that helps a company get a better view of its customer delivers real value.

As AI and GenAI grow over the next three to five years, companies will have the tools to build a more holistic consumer intelligence ecosystem that will deliver higher-quality customer insights in less time and at lower cost, allowing organizations to focus more on strategic thinking, decision making, and coordination of go-to-market activities.

Perhaps then, with this ecosystem in place, we will fill the empty chair—with a full view of the consumer.

About the Research Study Leaders

Ben DeStein is a managing director and partner in the firm’s New York office, focused on customer growth and marketing across a range of consumer sectors. He has deep expertise in the travel and tourism sector and is the North America leader for BCG’s customer demand and innovation business. You may contact him by email at destein.ben@bcg.com.

Gaby Barrios is a partner and director in the BCG’s Paris office, focusing on consumer intelligence at the center of strategy across a variety of industries globally. She is currently the leader for BCG’s Center for Customer Insight in EMESA (Europe, Middle East, Africa South America). You may contact her by email at barrios.gaby@bcg.com.

Elisia de Smet is a principal in the firm’s New York office. She has experience in the fashion and luxury sector with a focus on growth strategy, consumer insights, marketing and sales effectiveness, and go-to-market excellence. You may contact her by email at desmet.elisia@bcg.com.

Acknowledgments

Thank you to the following for input and advice: Mark Abraham, Yotam Ariav, Lynne Biggar, Julien Dangles, Nicolas De Bellefonds, Alan Iny, Brad Jakeman, Rodolphe Mouvet, Brian Nadres, Derek Rodenhausen, Alison Sander

About BCG’s Center for Customer Insight (CCI)

About BCG’s Center for Customer Insight (CCI)

About BCG

To succeed, organizations must blend digital and human capabilities. Our diverse, global teams bring deep industry and functional expertise and a range of perspectives to spark change. BCG delivers solutions through leading-edge management consulting along with technology and design, corporate and digital ventures—and business purpose. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, generating results that allow our clients to thrive.