In a world marked by change and uncertainty, telecom operators have been resilient. As new technologies and competitors emerge—particularly the big-tech hyperscalers—telcos are adjusting, transforming, and seeing results: revenues are ticking higher. Yet margins haven’t kept pace. From software licensing to labor and energy, costs are up, eating into profits and putting a damper on growth.

To get margins heading north, telcos will need to continue making adjustments, but in a surgical way. They’ll need to focus on levers that cut costs and boost efficiency while keeping performance steady—and then some. It’s a crucial balancing act. But it doesn’t have to be an elusive one.

This year’s telco IT benchmark (TeBIT) study, jointly developed by ETIS—The Community for Telecom Professionals—and Boston Consulting Group, reveals that two of the most promising levers are in plain sight: sustainability and process efficiency. The survey, conducted in November 2023 and covering European operators’ IT spending and performance, finds that both are already high priorities. By reducing energy consumption, sustainability programs can reduce energy costs. By cutting process waste—creating faster, leaner, more automated journeys—efficiency projects can also cut costs. When done well, these initiatives help telcos optimize margins while delivering dividends for customers and society.

So how are telcos doing on these two fronts? TeBIT finds each initiative very much a work in progress. But the study also sheds light on where telcos are gaining ground fastest, where they should redouble their efforts, and how certain enablers—like generative AI—can accelerate the journey. (See “About the TeBIT Benchmark.”)

About the TeBIT Benchmark

Collaboration is a key component of TeBIT. The survey’s goal is the same as that of ETIS working groups and community gatherings: to identify, and even shape, the best practices that can help telcos better serve customers in a rapidly changing world. In return for allowing their organizations to be compared with other telcos, TeBIT participants can access a full set of benchmark results along with further trend analysis.

A Slow, Steady Squeeze for Margins

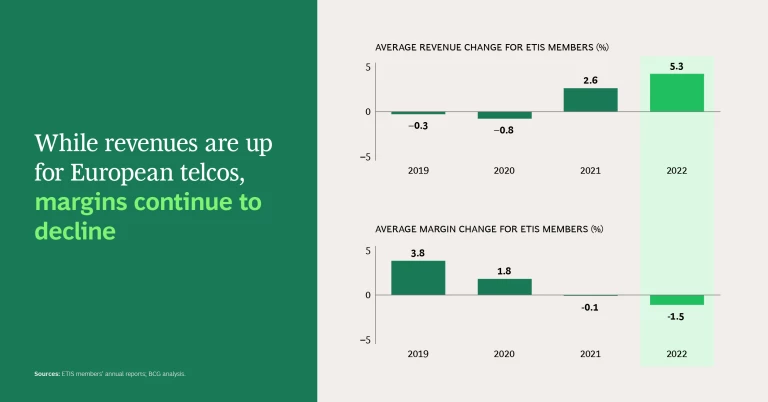

On the revenue side, ETIS members continue to show positive, if not electrifying, momentum. Overall, revenues rose 5.3% in 2022, up from a 2.6% increase in 2021. Digital and ICT services, price premiums, and expansion beyond the core—in areas like media, eHealth, and even financial services—all gave the top line a bump.

Yet telcos continue to struggle with EBITDA margins, an indication that they aren’t managing costs and efficiency as well as they’d like. Margins have fallen steadily over the past several years. While the shift hasn’t been dramatic, from a 3.8% increase in 2019 to a 1.5% drop in 2022, the decidedly downward trend is concerning. The more margins are squeezed, the harder it becomes for telcos to fund the transformations and expansions that are integral for thriving in increasingly competitive markets.

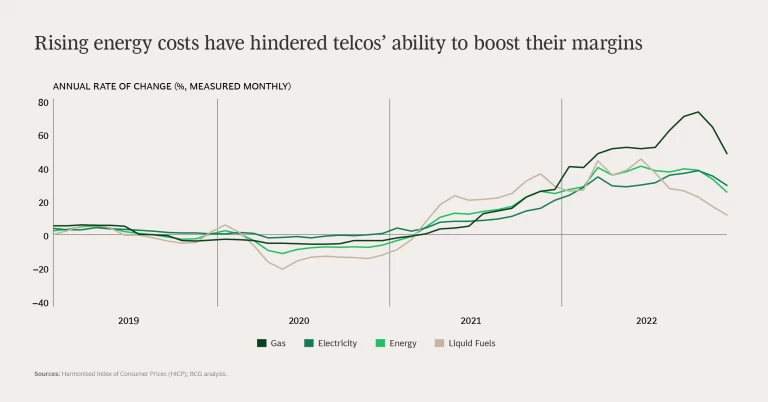

The squeeze is coming from multiple fronts, but two factors, energy costs and inefficient processes, are particularly noteworthy. Energy prices reached record levels in Europe in 2022 and are prone to quick, often unfavorable, shifts. Inefficient processes are both time-consuming and resource intensive. But the main reason to call out these factors is that telcos have new tools—and increasingly strong incentives—to manage them.

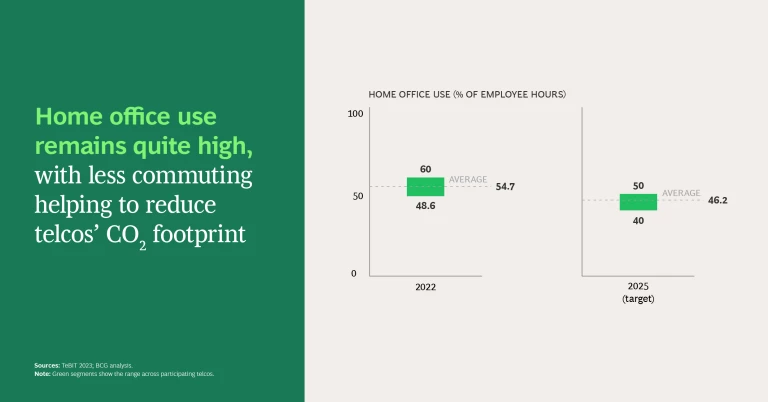

Across TeBIT participants, sustainability programs are growing both in scope and profile. As customers, shareholders, and regulators call for faster movement towards net-zero goals, telcos are implementing more measures, with more intensity, to reduce their energy use. At the same time, they are pursuing programs in automation, digitization, advanced analytics, and AI to increase the speed and efficiency of business processes, from activating service to troubleshooting problems. As the momentum for these initiatives grows, so does their potential for reducing costs.

These are long-term efforts. As such, snapshots are valuable: they show a telco where it stands and how it compares to peers. But blueprints are important, too, revealing what is possible and how to get there. The goal of this year’s TeBIT deep dive is to provide both views: assessing progress but also suggesting how best to move forward.

Reducing Energy Use and Expanding AI

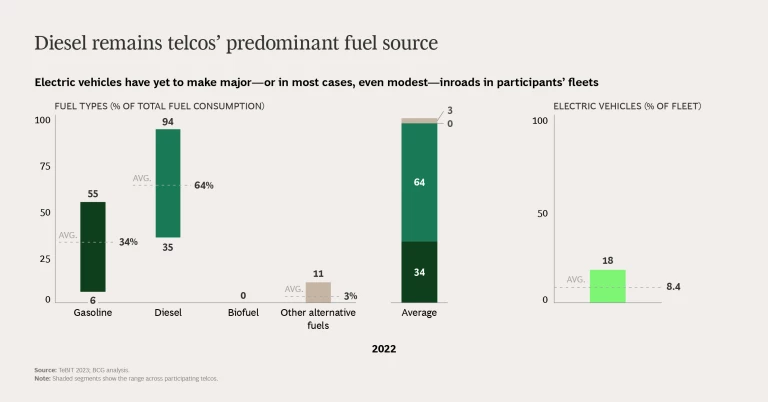

Our analysis of telcos’ sustainability programs revealed some overall trends and areas for improvement. Vehicle fleets, for example, are still largely dependent on carbon-based fuels. On average, diesel accounts for 64% of total vehicle fuel consumption, gasoline for 34%, and alternative sources less than 3%. Electric vehicles (EVs) comprise just 8.4% of participants’ fleets, though we did see significant variance: the telco leading the pack has transitioned nearly 20% of its fleet to EVs, while the operator bringing up the rear has yet to plug in its first vehicle.

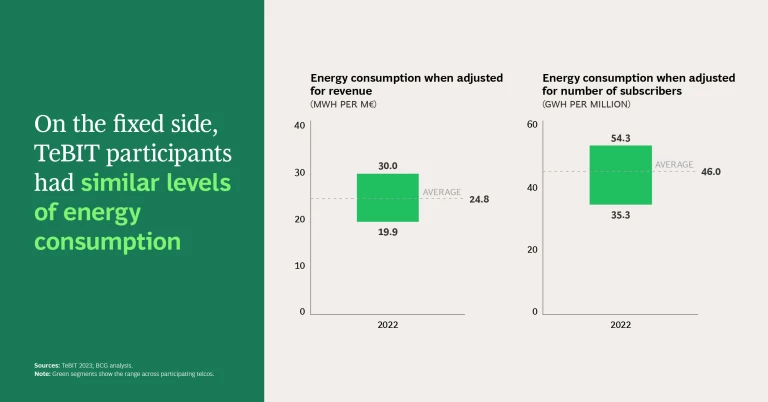

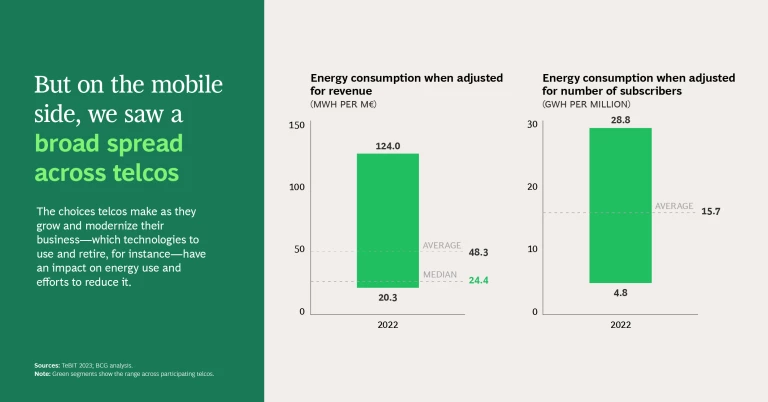

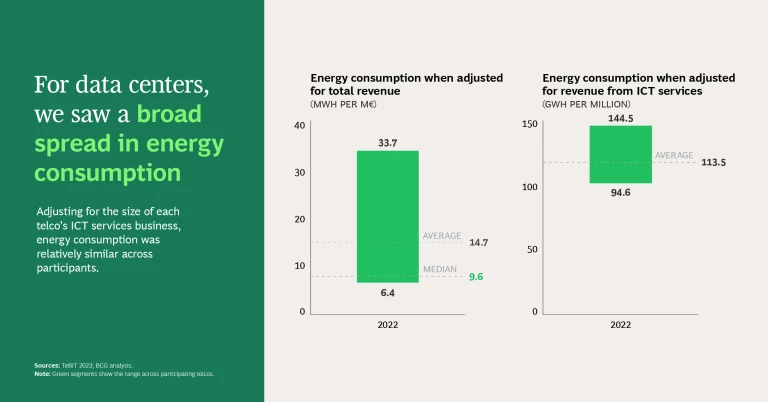

EV adoption wasn’t the only place where the study revealed sharp differences. Looking at overall energy consumption, we saw a broad spread on the mobile side, both when we adjusted for revenue and when we factored in number of subscribers (for fixed, consumption was relatively even in each analysis). Why the variance? Possible explanations quickly come to mind. Some telcos operate in countries with large rural areas, which require more towers and more energy than densely populated urban areas. And different network technologies, such as 5G, 4G, and 3G, have different impacts on energy use. This spotlights a critical point—that a telco’s energy consumption and costs are impacted by decisions they make on issues like what network and IT components to use, what traffic management tools to embrace, how and when to employ power-savings modes or cell sleep modes, and whether to replace certain technologies, such as copper or coax in fixed or 2G/3G in mobile.

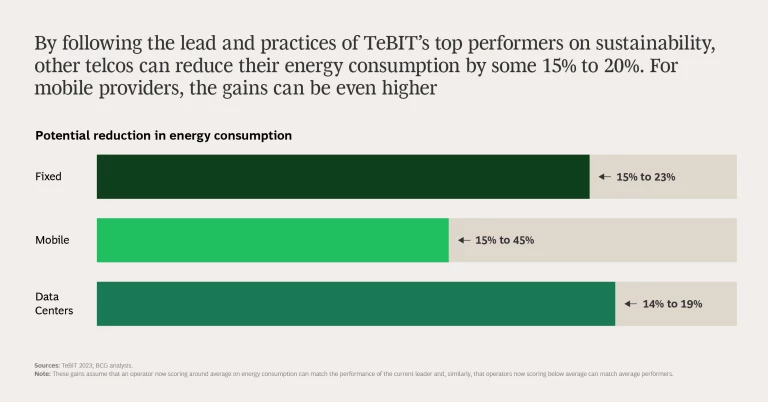

The best performing telcos—those that have made the biggest strides in optimizing their energy use—show the potential that other operators are leaving on the table. They also show the decisions that are paying off, such as using energy-efficient components and optimizing networks with respect to energy consumption. Stepping up one’s game has clear and achievable rewards. By our estimates, TeBIT participants now falling around or below the average in energy consumption can reduce usage by some 15% to 20% in their fixed and data center businesses—and up to an eye-opening 45% in mobile.

Mindset is critical, too. Savvy telcos are always asking how they can leverage emerging technologies to foster efficiencies and growth in their business. That same thinking can pay dividends for sustainability, as well. For instance, telcos could deploy AI to predict and prevent outages, reducing truck rolls and associated energy costs. They could leverage machine learning to identify usage patterns and more efficiently manage network traffic, powering down the right nodes at the right time—or even reducing the number of nodes on the network. AI can also foster intelligent IT usage, optimizing server and cloud usage so telcos can shrink their IT infrastructure without impacting performance. The possibilities for using technology to improve sustainability are expanding, and the most successful telcos will keep adding to the list.

Making Progress on Processes

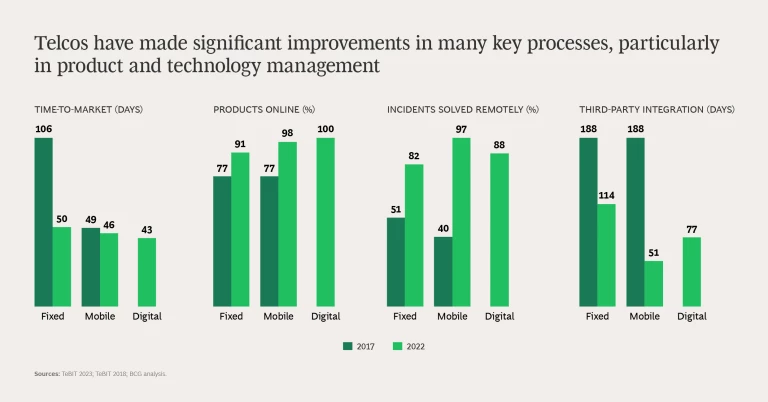

Efficiency is one of the main goals—and hallmarks—of digital transformation. Digitization allows telcos to operate faster yet more precisely. It enables new ways to serve and interact with customers. And it makes telcos more flexible while removing waste—and costs—from their processes. In 2018, the TeBIT study refined a set of digital KPIs to measure the impact of digital initiatives and help telcos focus their efforts. Back then, we saw that telcos were still early in the digitization game.

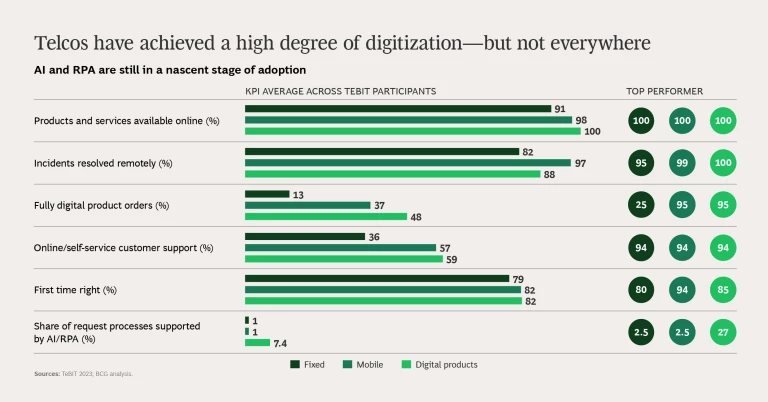

That’s changed with time—but not across the board. This year’s study looks at the same KPIs and, in many areas, finds a high degree of digitization or marked improvement. On average, TeBIT participants now offer more than 90% of their products and services online. On the mobile side, 97% of incidents are resolved remotely (for fixed, the average is 82%). Yet AI and robotic process automation (RPA) are still very much in a nascent stage. On average, these technologies support just 1% of customer requests, for both fixed and mobile. Even the “leaders” aren’t much ahead, with AI and RPA supporting just 2.5% of requests.

In other areas, some telcos are breaking clear of the crowd. For fully digital product orders and self-service customer support—KPIs where the average is well below 50% for fixed and mobile—the best performer scores above 90%.

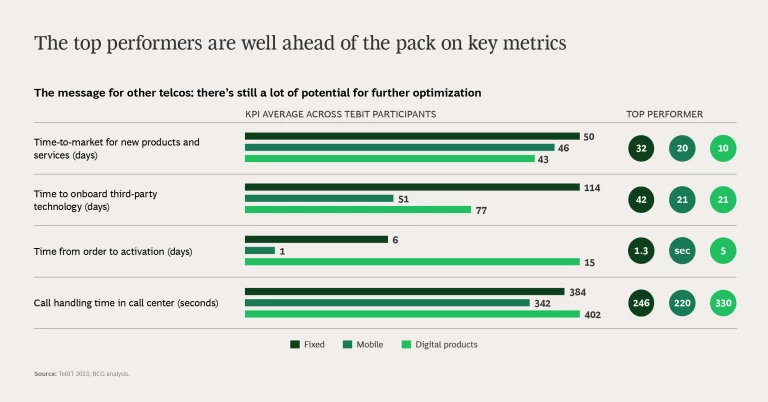

Indeed, the gap between top and average score is often pronounced. On the fixed side, for instance, time from order to activation averages six days. But the best performer does it in just over one day. For digital products, the average time-to-market is 43 days. But for one participant, it’s 10 days. For telcos trailing the leaders, the message is clear: there is significant potential for further optimization.

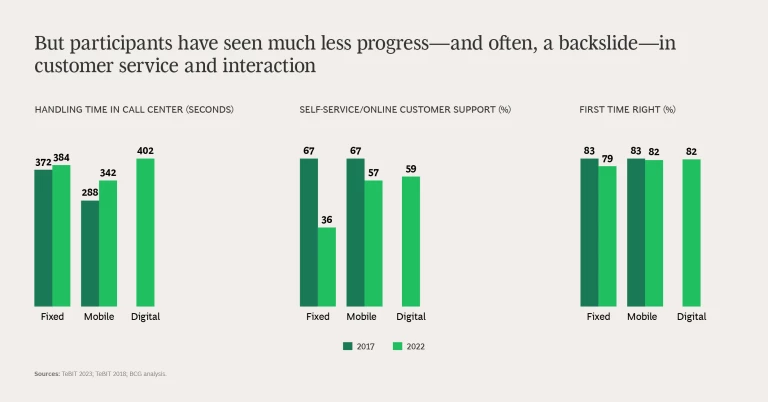

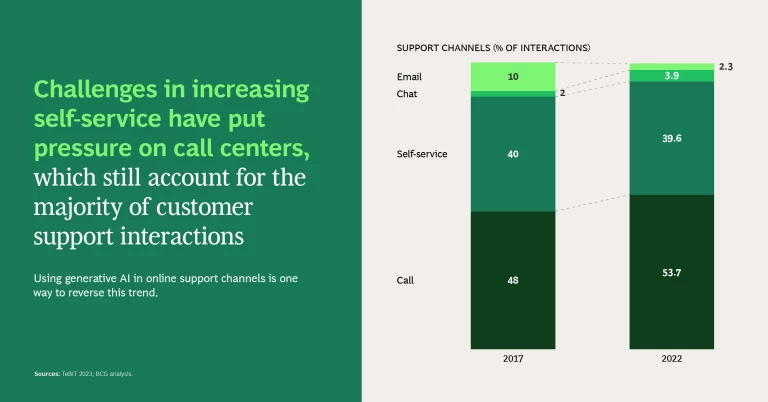

But one other message is also clear. While telcos have made significant improvements in key processes, particularly those related to product and technology management, customer service remains a weak spot. Call handling time actually has increased since TeBIT 2018, for both fixed and mobile, with call centers—not online channels—now accounting for the majority of customer support interactions. This makes the slow uptake of AI and RPA all the more concerning, as these technologies can bring dramatic improvements to how, and how quickly, telcos respond to customer issues and requests.

Faster, Better, Leaner with AI

One reason online isn’t the main support channel for many telcos is that the experience is often dissatisfying. But if customers can talk with AI agents in the same way they talk to human agents, they’ll be more likely to use self-service, freeing up humans for more complex requests and improving efficiency. Enter generative AI. This emerging technology has the ability to create original content, whether text or dialogue, enabling richer, more efficient online experiences—and faster, more successful self-service.

At the same time, AI can improve human-powered processes. Consider those call center handling times. A big impediment to reducing this figure is the increasing complexity of the technology telcos use and sell. The more complex the tech, the longer it can take agents to zero in on a solution. By leveraging AI to create intelligent knowledge management that quickly provides recommendations to agents, telcos can decrease call handling time. Even better: through predictive maintenance, they often can avoid trouble in the first place.

AI is a game-changer for both improving processes and reducing energy consumption. Telcos need to double-down on the technology and adapt their culture and ways of working to use it in innovative and responsible ways. But other approaches also warrant attention. Savvy operators simplify and open IT architectures to improve flexibility and efficiency, leverage data to optimize network traffic and vehicle fleet usage, and decommission older, energy-intensive infrastructure where and when possible. Telcos that employ these enablers carefully and creatively won’t just win on the margins. They’ll win in an increasingly competitive, complex, and challenging landscape.