The tech sector has experienced slowing growth and well-publicized restructurings by global leaders, but one category remains extremely resilient: B2B SaaS players. The sector continued to thrive in 2023, thanks to sustained innovation and strong demand from enterprise customers.

The SaaS sector continued to thrive in 2023, thanks to sustained innovation and strong demand from enterprise customers.

For the second year, BCG X surveyed more than 100 B2B SaaS providers in Europe to understand their current growth prospects, fundamental challenges, and marketing and sales priorities. (See “A Profile of Participants.”) The initial study showed strong growth among B2B SaaS players in Europe, and this year’s analysis confirmed sustained growth amid a significantly different market landscape. To help companies capture that potential, we developed a playbook centered on four priorities that leading players are applying: target new customers more effectively, automate marketing processes, link pricing to products, and continue to innovate.

A Profile of Participants

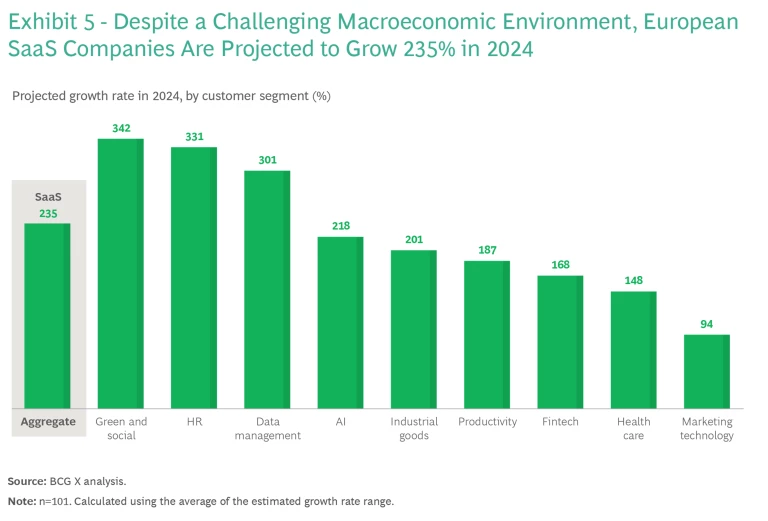

Although funding for SaaS companies has dropped, growth in the category is still significant: 19% annually in 2023 for the overall industry and 187% for the select group of 101 hypergrowth companies in our sample. The outlook for 2024 is even more positive, with growth of 235% projected.

Declining Funding but Continued Growth

SaaS companies can scale up quickly, but the competition is fierce. Digitization and cost pressure lead to soaring demand from enterprise customers. Winning products can catch on extremely rapidly, resulting in hypergrowth among top performers.

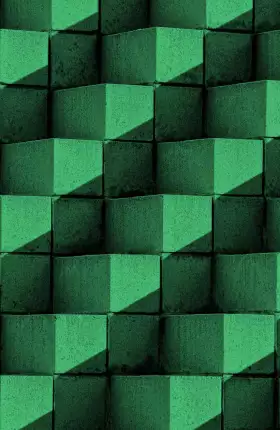

Of all software segments we analyzed, HR showed the fastest growth, as companies seek to better manage human capital, address issues such as remote and flexible work, and compete for talent in a competitive market. (See Exhibit 1.)

Health care was the second-fastest-growing segment, with companies helping providers, payers, and governments navigate increased complexity in the provision of care.

That was followed by green tech and social, as organizations implement environmental sustainability initiatives across their operations and strive to meet heightened expectations among customers, regulators, investors, and even employees regarding their social performance.

Subscribe to receive the latest insights on Technology, Media, and Telecommunications.

In contrast, the top segment in our analysis last year (reflecting performance in 2022) was fintech, which, at 113% growth in 2023, may have shown regression to the mean.

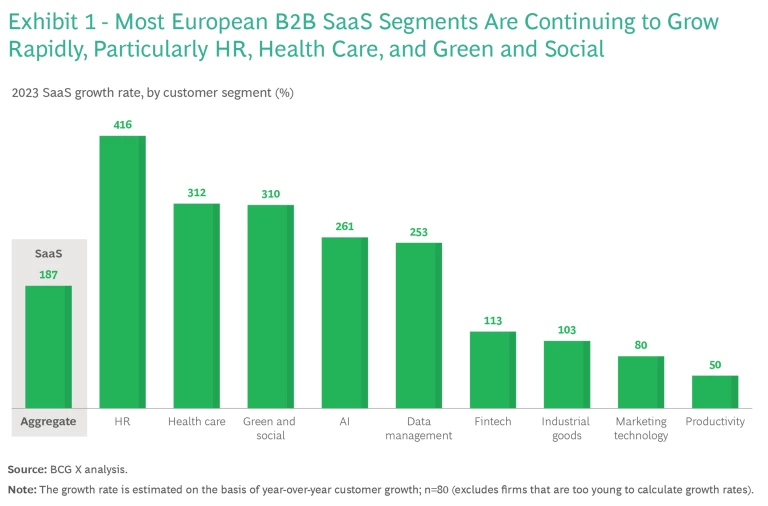

If there is a limiting factor on the industry right now, it is funding. Capital is still available, but as VCs become more selective than in the past, they are focusing their investments on a small number of market leaders. Overall funding for SaaS players in Europe decreased by 55% in 2023, in part reflecting a 37% decline in VC financing across industries, including a 28% drop in the share of funding going to SaaS players. (See Exhibit 2.)

Personalization as a Key Enabler for Growth

A key insight from our research is the importance of personalized marketing across channels according to the preferences and needs of potential customers. In our data, companies that personalize marketing show dramatically faster growth—40% speedier than competitors that have basic or no personalization.

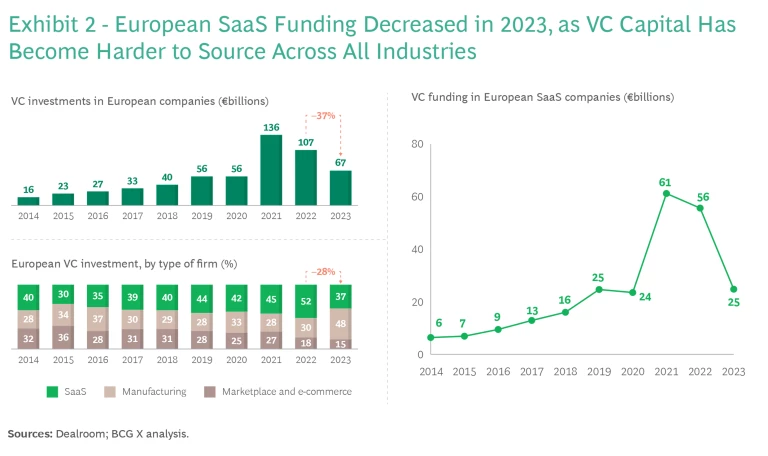

Overall, the sales and marketing functions of the hyperscalers in our sample are relatively nascent. The biggest acquisition channel among the companies we surveyed is word-of-mouth referrals, cited by 30% of respondents—a modest decline from 34% in last year’s results. (See Exhibit 3.)

Of the more formal channels, including email, paid social, paid search, and partnerships, none exceeded 12%. Notably, the number of respondents citing paid search and partnerships declined from last year, potentially a consequence of tightened marketing budgets.

Lead Acquisition Still a Risk

It’s not enough to close a deal; customers need to get the full use and value from the product they’re buying. In our survey, 39% of companies said that lead acquisition and sales are their main risk. That was followed by product differentiation—a related issue. Spending money to acquire customers that may have other needs misaligned with a company’s product, or that can buy a similar product elsewhere, benefits neither side.

For that reason, investments to better understand customer needs, target customers in a timely manner and with relevant content, and ensure that a given product is a better match than a competing offering are all key levers for SaaS companies to win. One bright spot is that lead acquisition and sales were a bigger risk in last year’s results, when 50% of respondents cited this threat.

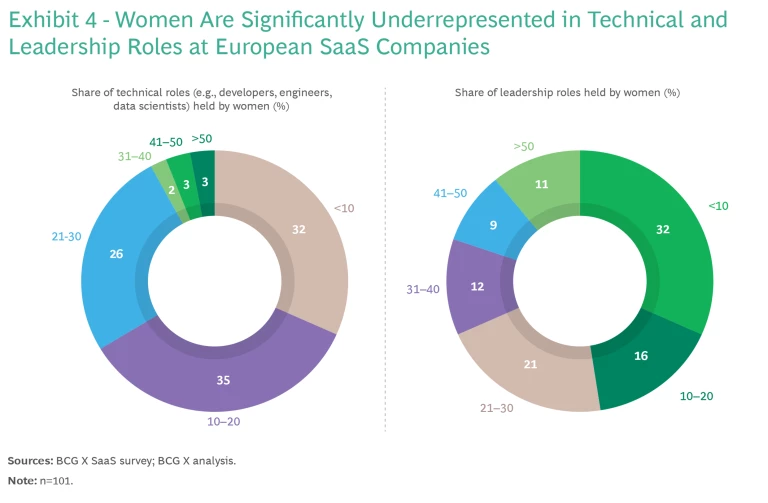

Women Significantly Underrepresented

Most technology companies face a gender imbalance, and SaaS is no exception. In the vast majority of companies in our sample, women fill less than 30% of technical roles. Leadership teams are similarly male-skewed, with approximately half of surveyed firms saying that women hold less than 20% of leadership positions. (See Exhibit 4.)

The good news is that the share of women increases in rough line with revenue. Smaller companies of less than €5 million tend to have the lowest proportion of women in both technical and leadership roles, while those with more than €50 million have the highest share.

Beyond reasons of basic equity, there is a business case for hiring more women: according to our data, a company workforce made up of more than 30% women correlates with much higher customer retention.

The Outlook for 2024

Despite a challenging macroeconomic environment, our SaaS hypergrowth companies are expected to grow 235% in 2024—a sizable increase from the 187% they posted in 2023. In the green and social, HR, and data management segments, companies are projected to grow at a median rate of more than 300%. At the opposite end of the spectrum are marketing technology firms, which are expected to grow at the slowest rate in 2024: approximately 94%. (See Exhibit 5.)

Looking at company size, organizations follow the law of large numbers. Firms with revenue of less than €10 million are targeting aggressive growth, with a substantial number projecting revenue increases of 200% to 500% (and a few forecasting 500% to 1,000%). Above a revenue threshold of €50 million, however, companies are more circumspect, with most expecting growth of less than 100%.

When it comes to profitability, there is less of a correlation to company size; regardless of revenue level, most organizations aim for EBITDA margins of more than 10% within three years. (The smallest companies are less willing to project profit margins at all, with most saying it is too early to tell.)

Four Priorities to Win in 2024 and Beyond

Despite the challenging macroeconomic environment, our trend data shows that companies were less likely to point to specific challenges than they were last year. For example, while customer targeting remains the top challenge for SaaS companies, the share of respondents citing it as a challenge decreased from 63% in 2022 to 48% in 2023. Customer acquisition cost, automation, product vision, customer retention, and talent shortages all declined as well—though their overall ranking remained consistent. Only pricing strategy increased, from 19% to 26%.

Even though the industry is still growing, companies are doubling down on four core capabilities to maintain their advantage and stay relevant in a highly competitive business environment.

Target new customers more effectively. The biggest challenges for SaaS companies lie in targeting and acquisition. Improving paid media capabilities and focusing on productive targeting could increase efficiency and reduce customer acquisition costs.

Automate marketing processes. Automation makes sales and marketing processes more efficient. For example, leveraging generative AI for content creation and marketing personalization could translate to savings and improved customer engagement.

Link pricing to products. Pricing strategy became a substantial challenge for SaaS companies in 2023 as they faced pressure to balance profitability with an expanding customer base. Applying the right pricing strategy—aligned with product offerings and marketing segments—is vital for organizations to remain competitive and profitable.

Continue to innovate. Building the right features and prioritizing product development are consistently among the most critical elements for innovative product development. Companies should actively identify client needs and insights and integrate those into the design process on an iterative basis. AI is a critical tool in supporting innovation efforts.

The future offers continued growth for B2B SaaS players worldwide, but the top European performers in our sample are far exceeding the average—roughly tripling their revenue every year. By taking the steps we identified, they can continue that trajectory and outperform no matter what the future holds.