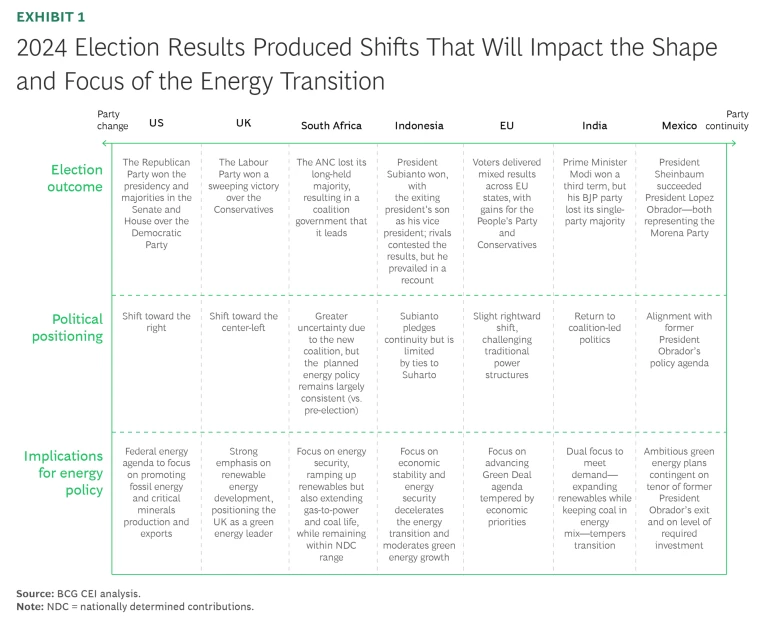

The 2024 electoral super-cycle marks a shift in the way many governments will approach the energy transition in light of voters’ concerns with jobs, growth, and the cost of living. We reviewed elections in India, Indonesia, Mexico, South Africa, the UK, the US, and the EU. We believe that these elections reflect and accelerate three dynamics in energy policy. (See Exhibit 1.)

Governments will devote more attention to energy affordability and energy security. Concerns about supply disruptions, exacerbated by ongoing conflicts in Ukraine and the Middle East, had an unsettling effect on many voters and government leaders, especially in economies—such as those in the EU, the UK, India, and South Africa—that rely on energy imports.

At the same time, changes in demand and the limitations of many energy grids are prompting politicians to explicitly link energy policy to macroeconomics and national security. Their goal is to ensure that energy remains accessible and affordable, even if inflation persists. We expect governments with climate ambitions to place greater emphasis on the role that low-carbon energy sources can play in delivering on those objectives while managing the risk of the transition.

Governments must resolve the fiscal, economic, and equity implications of who pays for the transition. Ultimately, funding for the transition will have to come from one or both of two sources: taxpayers and consumers. The policy considerations attached to these two options differ considerably. Funding through taxpayers means making large public investments in infrastructure that typically lasts for decades and can create long-term growth. It is also de facto a progressive tax; higher earners will pay a larger share because of their higher marginal tax rates. But taxpayers resist approving higher taxes, and most governments are fiscally constrained from relying on public debt to defer the bill.

On the other hand, shifting the costs to energy users will translate into higher energy bills, disproportionally impacting low-income families and energy-intensive industries, who often pay the same as higher earners. Aside from questions of equity, this arrangement can undermine competitiveness, stifle investment, and stoke inflation—consequences that incoming governments have strong incentives to avoid.

Resolving this question is key to ensuring that the transition will progress without increasing economic inequality or eroding voter support for climate policies.

As they seek to bolster economic growth and employment, governments are likely to prioritize investment in technologies and industries that will drive economic competitiveness. This challenge requires immediate attention, innovative thinking, and enhanced collaboration among governments, regulators, private investors, banks, and international institutions. The resulting imperative creates opportunity for renewable energy producers offering low-carbon energy at competitive prices and for fossil fuel producers working to stay relevant in the energy transition. More and more governments recognize that green tech will be a trillion-dollar industry in the 2030s. At the same time, government leaders must address public concerns over industries and workers whose futures are at risk from the energy transition, including Germany’s auto sector and Denmark’s agricultural sector.

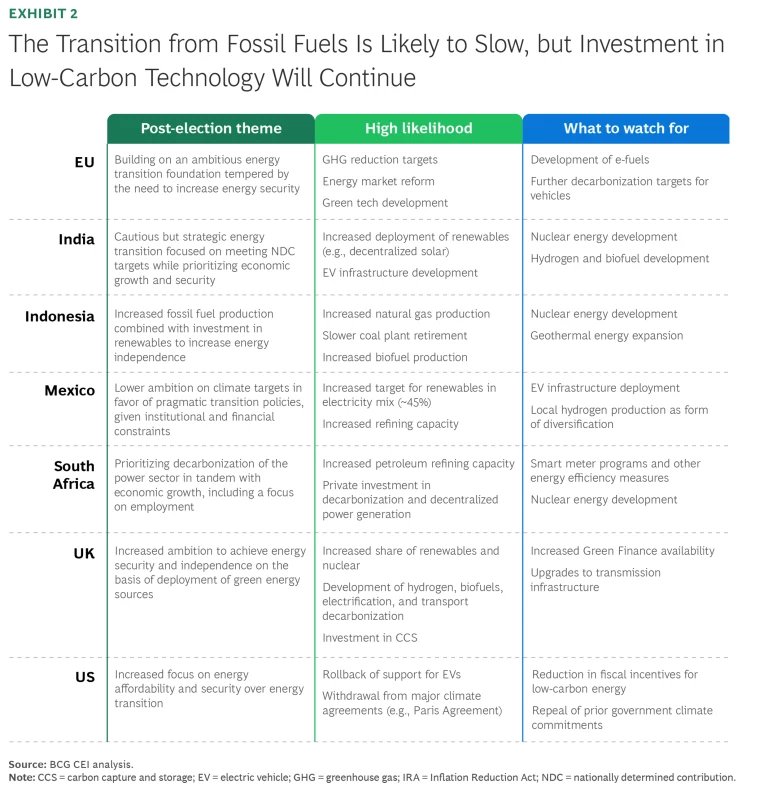

Over time, these trends may lead to a more fragmented approach to energy policy development globally, with each country prioritizing its own dominant industry players. Investors may focus on a more limited set of technologies driven by national priorities beyond the energy transition. For their part, governments may relax regulations aimed at bolstering shifts toward low-carbon energy sources. This is likely to slow the transition from fossil fuels, even as investments increase in proven low-carbon technologies such as nuclear and renewable energy. Alternative energy sources such as biofuels and hydrogen will likely see slower growth than these established sources. Accordingly, countries such as the UK that are moving toward the political left may push low-carbon energy deployment, while countries such as Indonesia and South Africa, where the energy transition is still building momentum, may progress more slowly. (See Exhibit 2.)

Considering a subset of examples from the 2024 elections may help clarify this dynamic.

India: Balancing Sustainability Goals with Aims for More Jobs and Less Inflation

Prime Minister Narendra Modi secured a third term in office last June, with his Bharatiya Janata Party forming a coalition government that has prioritized economic growth, energy security, and a balance between traditional and innovative low-carbon solutions. This focus comes in the wake of an election in which unhappy voters reacted to persistent inflation, rising unemployment, and turbulence in the powerful agricultural sector.

Subscribe to our Energy E-Alert.

To reduce its dependence on energy imports, India aims to generate 500 gigawatts (GW) of renewable energy by 2030 and expand the country’s electric vehicle (EV) infrastructure. But realizing these ambitious goals will be a challenge, given India’s increasing energy needs and its likely continued reliance on fossil fuel to supply them. On a positive note, creating more jobs in green industries could help improve India’s unemployment statistics, which have fluctuated in recent years.

As rising energy costs and inflation continue to affect Indian households, Prime Minister Modi and his coalition could face pressure to demonstrate how their climate initiatives can deliver affordable electricity, cleaner air, and other benefits. Young voters’ concerns about unemployment could also spur the government to provide incentives to sustainable energy companies that create new jobs.

The coming year will test the depth of Prime Minister Modi’s commitments to low-carbon energy. Plans to build more small nuclear reactors and solar-powered EV charging stations are progressing, as are hydrogen and biofuel initiatives. Increased investments in these and other alternative energy technologies through production-linked incentive schemes should accelerate the timeline for India’s energy transition.

EU: Targeting Climate Action and Renewed Competitiveness

The EU has long been a leader in climate action. Despite a strong showing by far-right parties, the 2024 European Parliament elections ensured that the government will continue to uphold its existing commitments to the energy transition. And building on its landmark 2019 European Green Deal, the EU plans to launch a new European Clean Industrial Deal in February that balances environmental goals with economic competitiveness.

Yet beneath this renewed commitment lie political realities on the ground. The Middle East conflicts and disruptions to gas supplies caused by the Russia-Ukraine war have compelled governments in the EU to reassess their energy supply mix, with a partial reversion to liquefied natural gas (LNG) and to legacy high-carbon energy sources such as coal. For example, Germany has extended the life of its coal plants, and the EU continues to use large amounts of LNG. Although the EU remains committed to achieving carbon neutrality by 2050, the bloc’s dependence on coal and LNG will limit the pace of the energy transition.

The agenda of the incoming European Commission (EC) focuses on four priorities. First, the EC plans to update the EU Climate Law with a binding goal of reducing greenhouse gas (GHG) emissions by 40% by the year 2040. Second, it will support the transformation of energy-intensive industries. Third, energy market reforms will help keep energy costs affordable as the EU tries to prevent future energy shocks by integrating its energy production and transport, including CO2 transport. Finally, the EC will accelerate the development of low-carbon technology, particularly in areas such as hydrogen production and carbon capture and storage.

Meanwhile, business leaders are increasingly focusing on maintaining Europe’s competitiveness, particularly against China. Drawing on recommendations from the Draghi report, EC President Ursula von der Leyen and the European People's Party view reducing energy costs as crucial for success. Pressure on this front could lead to new financial incentives and streamlined regulations, especially in the areas of monitoring and reporting requirements. Individual member states may adjust their approaches in response to local political currents, but the EU's collective commitment to climate action remains firm, albeit with a sharper focus on economic and security implications.

UK: Refocusing on Climate Ambitions amid Challenging Economics

After 14 years of Conservative Party rule, the Labour Party’s decisive victory in July 2024 opened the door to advancing the party’s vision of making the UK a “clean energy superpower.” Nonetheless, with a commanding parliamentary majority based on a relatively small share of the overall vote, Prime Minister Keir Starmer is in a complex position: he must navigate a challenging economy, a lack of bipartisan consensus on climate action, and the need to satisfy local planning regulations before breaking ground on key projects.

Despite these hurdles, the new Labour Party government has outlined an ambitious plan to decarbonize the country’s electricity system by 2030. Through creation of the proposed state-owned Great British Energy, the government hopes to take equity stakes that will unlock private investment in areas such as offshore wind, hydrogen, and decarbonization technologies.

The Labour Party has already pledged to reinstate the prospective ban as of 2030 on sales of vehicles with internal combustion engines, it and has introduced the Warm Homes Plan to provide grants and loans for insulation, solar panels, and low-carbon heating. The party also aims to decarbonize the power supply by tripling solar, doubling onshore wind, and quadrupling offshore wind by 2030.

However, these ambitious plans face practical challenges. The government needs to balance its investments in low-carbon energy with affordability to ensure that its efforts to advance the energy transition do not burden households with higher energy costs. Although the Labour Party's strong electoral mandate reinforces its commitment to the transition, the party will have to navigate the realities of a tough economy and the lack of majority support for low-carbon initiatives among its political parties.

In November, the UK updated its energy policy to reduce economy-wide GHG emissions by at least 81% by 2035, compared to 1990 levels. This represents a significant step up from the previous target of a 68% reduction by 2030.

Mexico: Empowering a Climate Scientist to Take the Helm

Mexico made history in October 2024 when climate scientist Claudia Sheinbaum became the country's first female president, leading the Morena party to a supermajority in both chambers of Congress. President Sheinbaum campaigned on increasing Mexico's reliance on renewable energy, aiming to achieve a 45% market share by 2030. But like many leaders elected in 2024, she faces competing priorities.

The country’s electricity sector is plagued by blackouts and failing infrastructure, while state-owned oil giant Pemex struggles with declining production and heavy debt. To capitalize on nearshoring opportunities and to revive manufacturing, the government may focus on bolstering its electricity, transmission, and refining infrastructure.

As part of her administration’s National Energy Plan, President Sheinbaum has proposed investing $12.3 billion in electricity generation, $11.1 billion in grid infrastructure, and $9 billion in increasing the nation’s renewable capacity to 13.7 GW. The plan allows private companies to own up to 46% of Mexico's renewable energy generation capacity, leaving room for up to 9.6 gigawatts of new capacity by 2030. However, President Sheinbaum’s intention to expand oil refinery capacity and prioritize state-owned energy generation could deter private foreign direct investment in renewables.

President Sheinbaum's scientific background and support for renewables presents an opportunity for Mexico to make progress in its energy transition. Time will tell whether her administration's policies accelerate or downshift Mexico's transition to a more sustainable future.

South Africa: Pushing a Weakened ANC to Emphasize Economic Issues

South Africa is actively working to secure its energy supplies while balancing its economic needs and its long-term climate ambitions. The May 2024 election, which saw the African National Congress (ANC) lose its majority for the first time in 30 years, has created a unique opportunity for collaborative governance. By working together, the ANC-led coalition government can partner on pressing issues such as persistent poverty, high (32%) unemployment, and shortages of clean water, electricity, housing, and other services, all while navigating the country’s energy transition.

In the energy sector, one sign of progress is the passing in August 2024 of the Electricity Regulation Act , which lays the foundation for a multiple-market power model. By shifting the historically vertically integrated monopoly to a more liberalized structure, the act encourages competition in energy generation and paves the way for accelerated deployment of new grid infrastructure, utility-scale renewables, and embedded generation. These changes are likely to attract significant private investment. According to the government’s latest capacity planning document, South Africa could add approximately 15 GW of renewable energy to the grid by 2030—a threefold increase—with additional plans for approximately 14,000 km of new grid capacity by 2035. The government is also promoting expanded nuclear and gas power, although funding challenges remain.

The country’s shift to a competitive electricity market could speed up renewable adoption and attract private investment in low-carbon technologies. For instance, South Africa recently enacted a tax incentive of 150% of the equipment and building costs of producing electric and hydrogen vehicles. With its strategic location, access to raw materials, and skilled workforce, government leaders hope to unlock approximately $27 billion in investments in its nascent EV industry.

Still, South Africa’s energy transition faces challenges. Uncertainty in the financial markets could disrupt the climate funding that has helped South Africa support the transition. And though the country’s acute power shortages have subsided, its reliance on coal adds complexity to the energy transformation ahead. Despite these challenges, however, South Africa's bold policy reforms and growing renewable sector show the country's commitment to the energy transition.

Indonesia: Repositioning Economic Growth in the Front Seat

The February 2024 election of President Prabowo Subianto signaled a slowdown in Indonesia’s climate priorities. In office, President Subianto has emphasized economic growth and energy security—recognizing that reliable, low-cost energy is crucial for the country’s industrial competitiveness. His plans to boost natural gas production, restart idle oil wells, and slow the scheduled retirements of coal plants aim to wean Indonesia off unreliable and costly trading partners. Although these moves are likely to keep energy prices low, they will probably slow the progress that his predecessor, Joko Wildodo, made toward boosting renewables to at least 23% of the nation’s energy mix by 2025.

President Subianto has been eager to maintain Indonesia’s economic momentum, driven by global demand for its natural resources and by public works projects, including the construction of Nusantara, a new capital city that will replace the flood-prone and overcrowded Jakarta. His climate policies, however, are complex and seemingly at odds with one another.

Although President Subianto promises to gradually phase out coal use—a striking move for one of the world's largest coal exporter—his administration is also ramping up nickel processing, which relies heavily on coal power. And his initiative to ensure that Indonesian biodiesel contains 50% palm oil could accelerate deforestation, threatening Indonesia's vast carbon-storing peatlands and rainforests.

The new administration has said that it plans to sustain its commitment to the Paris Agreement, but President Subianto’s emphasis on boosting energy production, particularly with coal, suggests a slowdown of the energy transition agenda. Although initiatives such as electrifying public transport could help offset emissions, the nation’s reliance on coal could affect its ability to meet its climate targets. The government’s shift in priorities indicates that Indonesia's decarbonization journey will follow a more gradual trajectory.

US: Prioritizing Domestic Energy and Mineral Production

The most significant policy shifts are occurring in the US, where the Republican Party won control of the Presidency and the Senate, and retained control of the House of Representatives. Since coming into office on January 20, President Donald Trump has taken immediate action to deliver on a number of his campaign promises, and three emerging policy themes offer insight into both the new administration’s overarching policy goals and the means it will use to implement them.

The administration is pursuing an “energy dominance” agenda that prioritizes the production and export of fossil fuels and critical minerals. A complementary policy agenda emphasizes accelerating infrastructure permitting, targeting the use of new and expanded executive authority to accelerate energy infrastructure development. In support of these goals, Trump has issued multiple executive orders (EOs) directing agencies to adapt their approaches to issuing leases and permits. Other early EOs from the Trump administration have curtailed executive action on climate, including by limiting the use of climate action plans and withdrawing from the Paris Agreement.

The Trump White House has also taken steps to roll back administrative requirements that would drive further climate action funding and has signaled its intention to significantly revise regulations governing implementation of the National Environmental Policy Act, vehicle emissions (Corporate Average Fuel Economy) standards, and the Clean Power Plan.

Finally, the administration aims to restrict disbursement of funds set aside by the Inflation Reduction Act and the Infrastructure Investment Jobs Act, totaling $369 billion over ten years to support renewable energy and a range of low-carbon technologies.

As highlighted in the Trump administration’s early EOs, the new administration’s energy agenda is likely to shift toward initiatives that prioritize economic growth and fiscal restraint at the expense of the energy transition. The new administration’s energy agenda seems likely to prioritize fossil fuels over

sustainable energy.

Technologies such as carbon capture and storage and battery energy storage—which enhance the country's energy independence while enabling the US to lean into the trillion-dollar market for low-carbon technologies—may maintain their support, however, if companies can leverage them to create jobs and generate growth. Nuclear energy, which provides 18% of US power, should also maintain its momentum, particularly as tech companies seek reliable long-term power for their AI data centers. In addition, the new administration has made reducing the planning and permitting timelines for large projects a priority. This approach to energy policy suggests that the administration’s stance may prove to be more nuanced than its statements during the campaign and shortly after President Trump's inauguration might have indicated.

Looking Ahead: Implications for Global Climate Action

The 2024 elections signaled a fundamental change in how many nations view the energy transition—one in which governments see legacy technologies such as natural gas and nuclear power as key components of a more holistic approach to the transition.

The results of the various 2024 elections reflect the societal upheaval that has arisen in recent years as a result of economic challenges and geopolitical instability. These outcomes offer strong evidence of the ongoing struggle of governments to navigate an electorate that prioritizes lower costs and greater security over ambitious climate goals. But the shift in popular priorities does not signal the end of the transition; rather, it resets the balance that governments should seek to achieve between the current economic realities and the longer-term transition.

The debate will continue as nations such as Canada, Germany, and Australia go to the polls in 2025. Later this year, Canadian voters will choose a new government. Already, the opposition Conservative Party under Pierre Poilievre is framing the contest as being in part a referendum on the carbon tax that the center-left Liberal Party’s Prime Minister Justin Trudeau implemented to make polluting activities more expensive. Poilievre's “axe the tax” rhetoric has resonated with voters who are wrestling with higher prices of groceries and other necessities. Nevertheless, other policies of the current government, such as its industrial carbon pricing policies, may remain in place.

Meanwhile, in Australia, the center-right Liberal Party and its coalition partners are challenging the incumbent center-left Labor Party on its approach to the energy transition. The issue of how and when to replace the country’s aging fleet of coal power plants is at the heart of the debate. The Labor Party has emphasized solar, wind, and battery power, while the Liberal Party has advocated for nuclear power in the mix, which may require extending the life of the coal fleet.

In Germany, the country’s approach to the energy transition is a major point of the political contention, as industry and consumers still suffer from elevated energy prices in the aftermath of Europe’s energy crisis. Without openly challenging Germany’s high climate ambitions, its conservative future majority party seems likely to more strongly emphasize cost efficiency—for example, by decelerating programs for building heat electrification or green hydrogen and to some extent trimming Germany’s extremely high near-term targets for renewable expansion.

As the global effort to combat climate change continues, voters have made clear that they want policymakers to strike a better balance between sustainability, security, and affordability. The 2024 elections confirmed that the climate transition is not linear but will require continuous recalibration. For many governments, balancing sustainability with security and affordability is the new mandate—one that requires a nuanced understanding of the complex tradeoffs involved.

The authors thank Audrey Saul-Tarrade and Jennifer Michael for their contributions and partnership in the conceptualization and development of this report. They also thank Maria Hohaus and Aman Mehan for their support in research and analysis.

The Center for Energy Impact

Our deep expertise spans markets and economics, carbon and technology, capital and investors, the macrodynamics of geopolitics and resilience, and the microdynamics of politics and specific policies. We offer nuanced, constructive ideas and solutions covering the future availability, economics, and sustainability of the world’s energy sources—and the implications for energy companies, industries, investors, consumers, and governments. The CEI team is committed to facilitating informed, innovative discussions to make our world sustainable.