Services represent a key revenue and profit stream for many manufacturers of industrial machinery. The third BCG services benchmark study reaffirms that companies that prioritize selling aftermarket services generate one-third or more of their total income through these additional offerings. For the vast majority of companies, the growth rate for these services now exceeds that of new equipment sales.

In 2023, revenue growth from services increased by 10% over the previous year, and survey participants said they expected another 8% rise in 2024. This reflects the strong customer demand for services such as maintenance and repair, remote monitoring and diagnostics, and other offerings that improve the performance and lifespan of critical equipment within a company’s operations. For industrial manufacturers, such services not only carry gross margins that are twice the 15% to 25% typically earned from equipment sales, they also create a sticky relationship with customers that drives loyalty, retention, and repeat business.

Aftermarket services create a sticky relationship with customers that drives loyalty, retention, and repeat business.

Going forward, the opportunity to deliver new digital services more efficiently—coupled with growing customer demand for environmentally friendly “green” services—will position industrial manufacturers to expand into these higher-margin offerings.

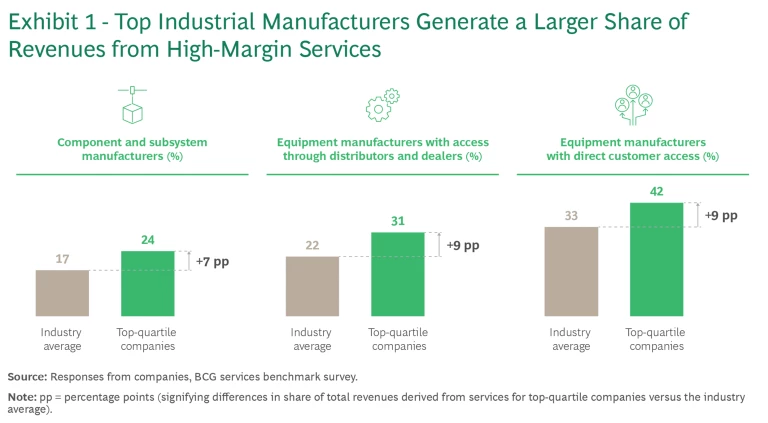

The study further reveals that companies that have elevated services to a core competency reap even greater rewards, with high-margin services representing a larger proportion of their revenue—as much as 9 percentage points above the industry average. (See Exhibit 1.) This advantage is particularly pronounced among companies that maintain direct relationships with their buyers, highlighting the value of creating deep customer connections.

Companies that directly engage with customers see even more service revenue: around 33% for equipment manufacturers compared with 17% for makers of components and subsystems. The survey, which included roughly 100 industrial machinery companies averaging more than $2 billion in annual revenue, highlights the importance of direct customer relationships. Among survey respondents, 60% are equipment manufacturers with direct customer access, 20% are equipment manufacturers with indirect customer access, and 20% are components suppliers from various industries.

The study revealed that between a quarter and half of all companies struggle to leverage the potential of providing services. For some, this underperformance is due to a lack of information about installed equipment, including its condition, location, usage, and service history.

Stay ahead with BCG insights on industrial goods

Where the Top Performers Excel

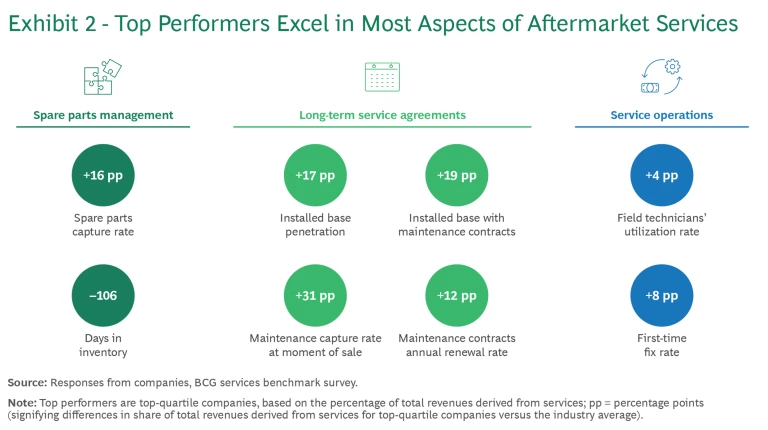

What separates the champions from the pack is that they excel in every aspect of their service operations. Analysis of the top performers covered such performance metrics as the spare-parts capture rate, installed base penetration, maintenance contract uptake at the time of sale, and the share of the installed base under maintenance contracts. The study also examined the annual renewal of maintenance contracts, first-time fix rate, field technician utilization rate, and the days of inventory on hand.

What separates the champions from the pack is that they excel in every aspect of their service operations.

These top performers consistently outpace competitors in several key areas:

More Spare Parts Sales. The leading companies capture significantly more sales of spare parts and consumables that would otherwise be made by third-party distributors. Our research shows that spare-parts sales by top performers are 16 percentage points higher than those of other companies. (See Exhibit 2.) With the gross margins of spare parts and consumables averaging 50% of sales, selling more aftermarket services can boost profits sharply.

More Long-Term Service Agreements. Leading companies significantly outperform the industry average in securing long-term service agreements and repair and field services, exceeding the industry benchmarks by 11 and 3 percentage points, respectively. For example, they sign 31% more of their customers to maintenance contracts at the time of purchase compared with the industry average.

More Efficient Operations. The top performers also operate more efficiently on everything from field services to warehouse management. For instance, by streaming their supply chains, leading companies are able to stock 38% fewer days of inventory than the industry average. This reduces the risk that the spare parts in stock will deteriorate or become obsolete. As a result, these companies enjoy gross margins of around 42% and earnings before interest and taxes (EBIT) of approximately 20% from services.

The Next Frontier: Digital Services

Digital services remains one of the most significant opportunities for industrial machinery manufacturers. Many companies have made great strides in developing digital capabilities—particularly in internal support functions. The most notable progress has occurred in incident handling and employee training, with one-third of companies rating their performance in these discrete services as best in class. Companies have also improved in digitalizing remote services, spare parts management, installation, and field services. Overall, one-fourth of the companies surveyed now consider themselves to be leaders in service delivery and support.

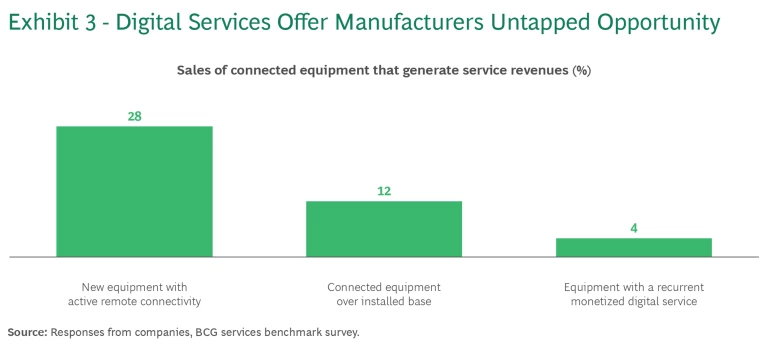

Despite these gains, the development and monetization of more complex digital applications, such as predictive maintenance and efficiency optimization, remain a significant challenge. For example, companies have struggled to develop and monetize digital technologies such as predictive maintenance and efficiency optimization. Only 4% of companies say they have succeeded in generating recurring revenue from digital services linked to their equipment (See Exhibit 3.) This creates untapped opportunity, now that 28% of new machines feature remote connectivity, or nearly triple the historic average. Giving new equipment buyers a year of free connectivity would help manufacturers gather the usage and condition data to sell services in the future.

The Green Service Revolution

OEMs are also placing a greater emphasis on services that help customers reduce their carbon footprint. These green services encompass a broad range of offerings, including modernization and upgrade kits, responsible end-of-lifecycle management, and emissions monitoring and offset programs. While current revenue from these services remains modest—reflecting, in part, the relatively small number of monetized offerings—the opportunity is significant, particularly in modernization and end-of-lifecycle solutions.

This potential is expected to translate into significant growth in green services. According to the survey findings, manufacturers expect that nearly one-third of customers will contract for modernization and upgrade kits by 2027. In addition, roughly one-quarter are anticipated to seek end-of-lifecycle management services. And while manufacturers have found it hard to charge for some services in the past, the leaders of roughly seven out of every eight companies surveyed believe they can generate revenue from green services such as modernization and upgrade kits and end-of-lifecycle management.

The AI Advantage

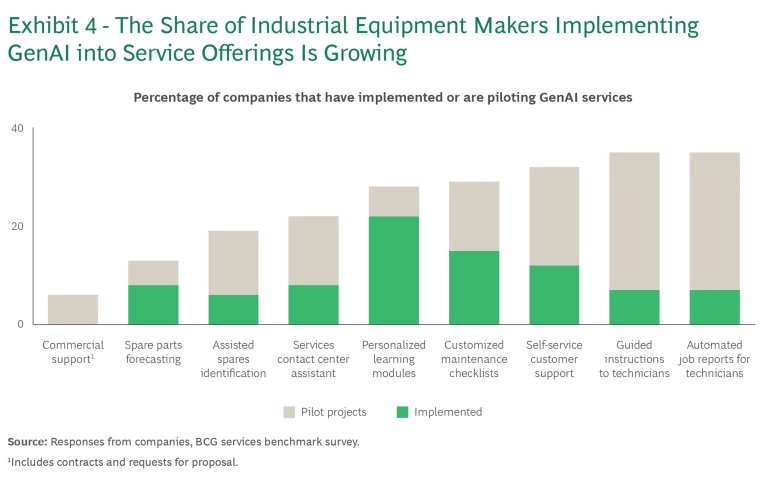

Artificial intelligence, including generative AI (GenAI), is rapidly gaining traction in the industrial services sector. The study shows that about a third of companies have moved beyond the pilot stage and are successfully implementing one or more AI applications in areas like field technician support and guided troubleshooting.

However, the deployment of AI in other critical areas, such as spare parts forecasting and analyzing customers’ service-related requests for proposals, is still in the early stages, with only 5% to 8% of companies advancing to pilot projects. (See Exhibit 4.) This highlights a significant focus on enhancing field service efficiency through GenAI, yet underscores the broader challenge of scaling these technologies across more diverse service functions.

Unlocking Your Company’s Service Potential

For industrial companies looking to harness the power of services, our research identified many strategies worth adoption, including the following five.

Monetize the Installed Base. There’s significant potential to increase revenue by better leveraging companies’ existing customer base. The work we have done with machinery companies has shown that it is possible to expand penetration by 20 percentage points. When combined with the work of inside sales teams, machinery operations could boost their services revenue by 15%.

Optimize Pricing Strategies. In the face of inflationary pressures, many companies have implemented across-the-board price increases. However, a more nuanced, value-based pricing approach, supported by AI, can lead to significant improvements in profitability. AI-supported value-based pricing has allowed for an increase in EBIT of three to four percentage points in spare parts sales.

Embrace Digital Tools. Supporting operations with digital technologies can generate cost savings ranging from 5% to 15%. Moreover, creating new digital revenue streams can drive top-line growth of 10% to 15%.

Develop Green Services. As discussed earlier, companies that proactively develop green service offerings will be well positioned to capture this emerging market.

Invest in AI and Connectivity. While the monetization of connected equipment and AI-driven services is still in its early stages, companies that invest in these technologies will be prepared to capitalize on future opportunities.

The industrial landscape is changing, and services are at the forefront. By focusing on service excellence, embracing digital innovation, and preparing for the green service revolution, industrial companies can unlock new sources of revenue and profits, improve customer relationships, and drive sustainable growth. Those that recognize the power of service excellence and take proactive steps to enhance their offerings will be best positioned to thrive.