Please note that this survey was fielded prior to the announcement of US tariffs. Our findings, which are already conservative compared to market forecasts, anticipate a moderate impact on overall IT spending, with the most significant reductions likely in devices, hardware, and server infrastructure. Additionally, we anticipate that cloud-to-on-premise repatriation may involve additional infrastructure purchases, potentially impacted by tariff-related price increases.

IT budgets have entered a new growth phase—and it’s not just about increased spending. After years of prioritizing cost control above all else, companies are renewing their emphasis on strategic advantage. They’re growing their spending and they’re spending to grow.

Why the shift? To hear IT leaders tell it, artificial intelligence is too good to pass up. By fueling new efficiencies and experiences, AI brings opportunities for growth. As it gets more of the spotlight, it’s getting more funding. So, too, are the technologies that enable AI and help companies use it in secure, responsible ways that align with new regulations and stakeholder expectations. This is leading to notable changes in IT spending patterns and priorities.

BCG’s latest IT buyers survey, our eighth, sheds light on these shifts. It shows how the emergence of AI—and in particular, a new category of AI-powered solutions known as AI agents —is impacting the crucial yet delicate balance between growth and cost control.

Getting that balance right requires surgical precision: turning up investment in just the right places while applying cost efficiency levers—like outsourcing and vendor consolidation—to optimal effect. As companies invest more, learn more, and do more around AI, their insights around spending are evolving, too. New strategies are propelling organizations that are leading on, and with, AI. But they can also jumpstart the journey for companies just starting out—or still on the sidelines.

Tech Spending Is Up—But Not for All Tech

The survey—which assessed the spending trends and priorities of 602 IT buyers across North America and Europe—finds tech budgets accelerating their climb. (See “Survey Methodology.”) On average, respondents expect their 2025 IT spending to grow 4.6% year over year. In 2024, the bump was 3.5%. But more telling, perhaps, is where companies are loosening the purse strings—and where they are tightening them.

Survey Methodology

This edition of the IT Spending Pulse is based on a survey conducted in December 2024. Of the 602 respondents, 71% are based in North America and 29% in Europe. Nearly two-thirds (63%) of participants represent large companies (over $1 billion in revenues) and 37% hail from mid-size organizations. Respondents are at the director level and above and represent a broad range of industries, including technology, industrial goods, banking, health care, retail, energy, and transportation.

As in past surveys, IT buyer sentiment and strategic priorities—across the full tech stack—were key focal areas. But this edition also zeroed in on how companies are approaching the emerging topics of GenAI and AI agents. The goal is to better understand how organizations are adopting, implementing, and funding these technologies—and to home in on strategies that may help spark value.

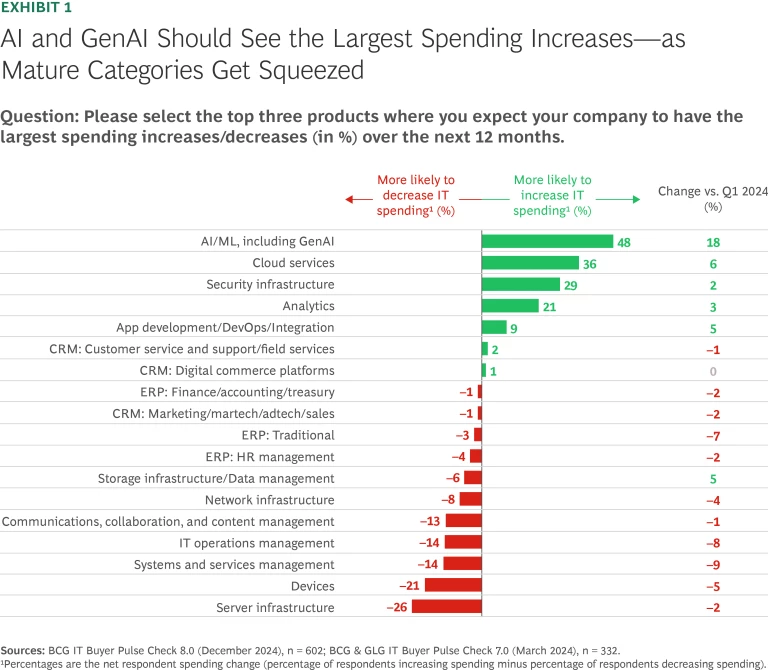

We asked respondents to select the top three areas in which they expect the largest spending increases and decreases in 2025. AI and generative AI (GenAI), cloud services, security infrastructure, and analytics led in increased spend, while server infrastructure, devices, systems and services management, and IT operations management saw the largest decreases. (See Exhibit 1.)

This pattern suggests two important and interlocking trends. First, companies are ratcheting up investment in technologies that drive competitive advantage:

- AI and GenAI have the potential to revolutionize operations and customer experiences. This hasn’t escaped notice: Four out of five responding companies have adopted some level of GenAI.

- Cloud services and security infrastructure are indispensable for scaling, resilience, and safe and reliable operations. They’re prerequisites for unleashing transformative technologies like AI.

- Analytics spark actionable insights, optimize processes, and enhance strategic planning.

While spending is up, the pie is still only so large. This leads to the second trend we saw: squeezing mature categories to fund AI, cloud, and security initiatives. IT leaders are making deliberate choices to reallocate budgets. Survey responses indicate that companies are reducing their spending on traditional software areas (like enterprise resource planning) and pushing to extend the useful life of hardware—which explains the low-priority rankings of devices and server infrastructure.

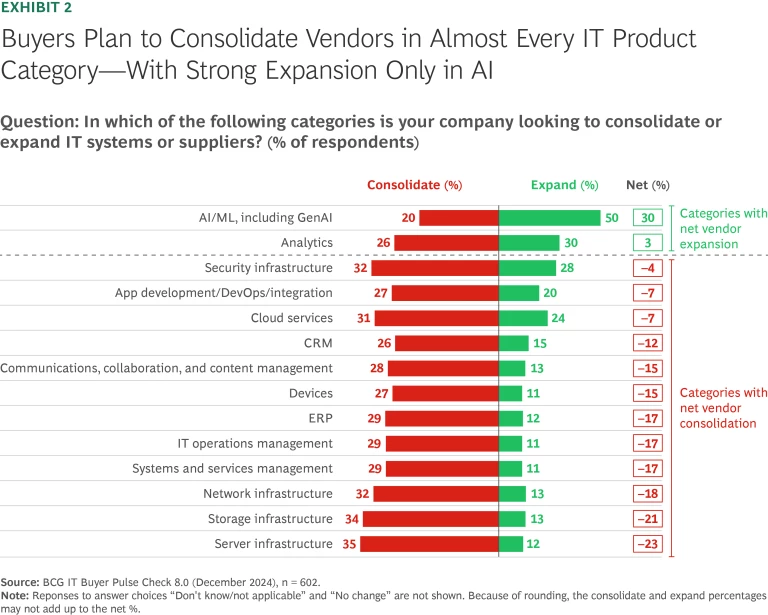

We also saw growth vs. savings balancing through another lens: vendor consolidation. Notably, companies are reducing their vendor rolls almost—but not quite—everywhere. AI and GenAI, and to a lesser extent analytics, are notable exceptions. (See Exhibit 2.) The apparent logic is that in most areas, moving towards suite-based solutions rather than maintaining a patchwork of standalone tools is a pragmatic approach to managing costs. But for emerging areas, like AI, an expansive roster of vendors lets companies try different solutions and zero in on the ones that matter most.

Secret Agents No More

One of the survey’s most striking findings is the rapid adoption of AI agents. These intelligent virtual assistants are revolutionizing enterprise workflows, offering automation capabilities that extend beyond routine-task execution. AI agents are accelerating a growing and increasingly complex range of processes, in everything from customer service to software development. And they are making significant inroads among survey respondents: 58% of companies report that they are already deploying AI agents; another 35% are actively exploring potential use cases. That leaves just 7% on the fence.

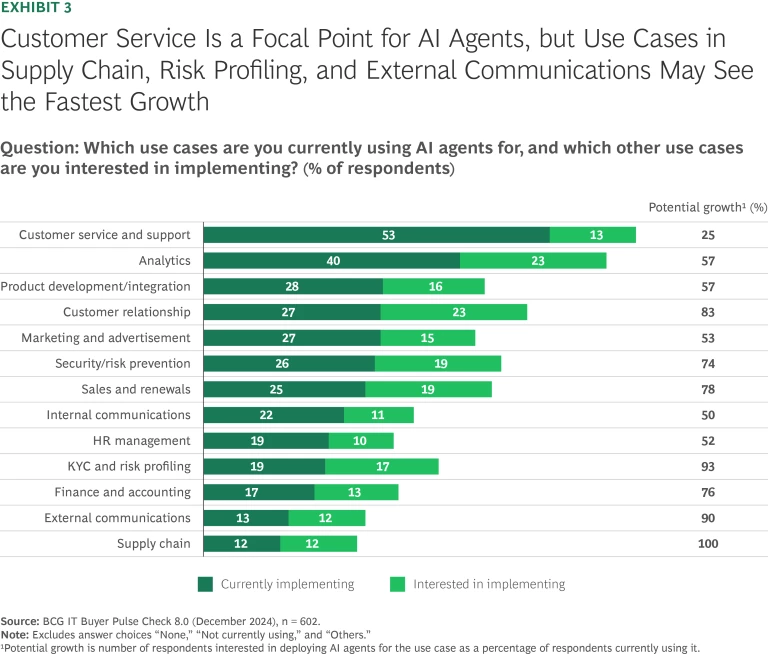

Customer service and support remains the leading application of AI agents: 53% of companies now use the technology in this area; another 13% are interested in implementing it. Use of agentic AI is also expanding into analytics, product development, marketing, and security. And survey responses suggest strong growth is coming in areas that, so far, have not seen heavy adoption, including KYC and risk profiling, supply chain management, and external communications. (See Exhibit 3.)

These findings indicate that businesses no longer view AI agents as experimental novelties, but as essential enablers of efficiency and optimization. And they expect returns to reflect this. On average, respondents anticipate an ROI of 13.7% from AI agents, surpassing the 12.6% they expect from non-agentic GenAI applications.

Prime Time for GenAI

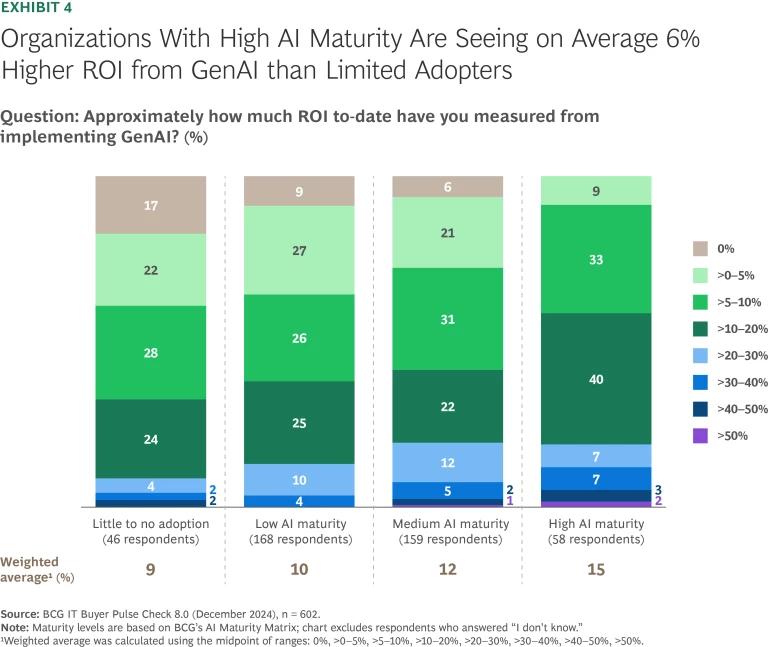

GenAI continues to be a cornerstone of IT spending. And those most invested in the tech are reaping the biggest rewards. Respondents with the highest AI maturity report greater ROI—up to 6 percentage points more—than limited adopters. (See Exhibit 4.) Factor in, too, that nearly two-thirds of adopters (65%) report satisfaction with their GenAI solutions, and one can make a case that companies with little or no adoption (19%) risk falling behind.

As with AI agents, we’re seeing a shift in GenAI from experimentation to large-scale implementation. While initial pilot projects centered around content creation and process automation, businesses are leveraging GenAI in increasingly complex and strategic applications. As they embed the technology more deeply in organizational workflows, concerns about security and compliance are rising. This is reflected in IT spending patterns. Respondents are increasing investments in zero-trust architecture and identity and access management (IAM) solutions, underscoring the need for robust access control mechanisms. They’re also stepping up spending on regulatory compliance tools—spotlighting the need to stay on top of, and aligned with, emerging AI regulation.

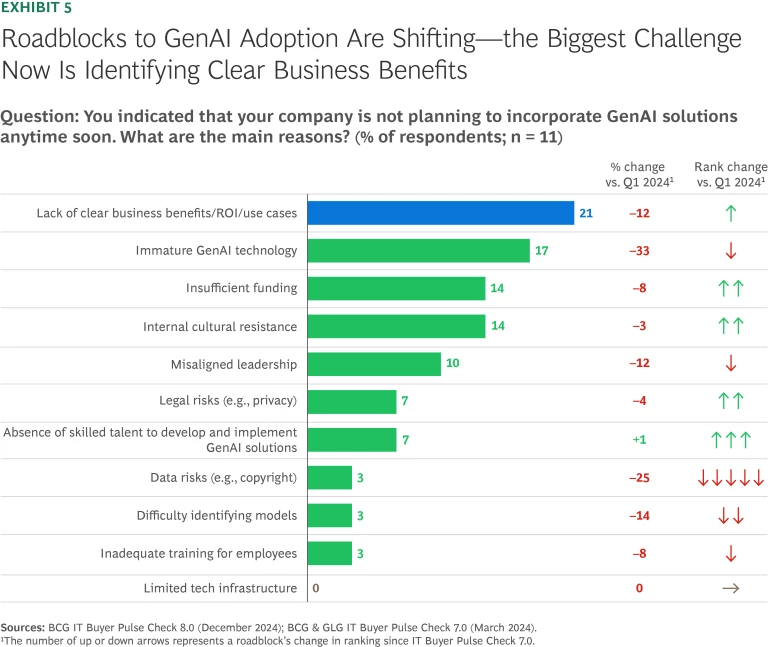

Barriers to entry are shifting, as well. The survey reveals that among companies with little or no GenAI adoption, the biggest roadblock is no longer data risks, such as copyright concerns. The key challenges now are finding the business benefits of GenAI (identifying use cases to pursue), change management, and having sufficient talent to develop and implement GenAI use cases. (See Exhibit 5.)

Strategic Priorities Shift

The spending trends align with how organizations are redefining their IT priorities. The focus is now firmly on growth and digital transformation. We asked respondents to select their major priorities for 2025 from a list of 40 different initiatives (incorporating GenAI, modernizing HR systems, reskilling, and so on). Overall, initiatives that drive strategic advantage—such as advanced analytics and enhancing AI infrastructure—ranked highest in priority. Risk management is also top of mind, with 44% of respondents grading it a major priority (up 5% from Q1 of 2024). Business operations ranked lowest, with just 28% of companies viewing it as a major priority.

More specifically, the top-ranked priorities include:

- Advanced analytics and predictive AI. Companies are investing heavily in data science capabilities to enhance decision-making and unlock value-generating insights.

- Enhanced AI infrastructure. By modernizing their IT environments, businesses are better positioning themselves to support scalable AI-driven workloads.

- Cybersecurity innovations. In addition to IAM solutions and zero-trust frameworks, companies are increasing funding for endpoint protection.

- Process automation and optimization. Respondents are deploying AI-powered tools to streamline workflows and reduce operational inefficiencies.

- Customer experience transformation. To help grow revenue, companies are utilizing AI to deliver hyper-personalized customer interactions and improve digital engagement.

Balancing Growth and Cost Control

As companies do more with AI and GenAI (including AI agents), they need to navigate budget constraints while ensuring that their investments yield meaningful results. That’s no small task, but the challenge is heightened still by the additional requirements—and outlays—AI demands, in areas like compliance, security, and talent. One strategy we see gaining traction is on-premises repatriation: bringing cloud-based workloads, to some degree, back in house. Again, balance is key. By repatriating the right work, in the right amount, companies can manage costs while increasing flexibility and control around AI.

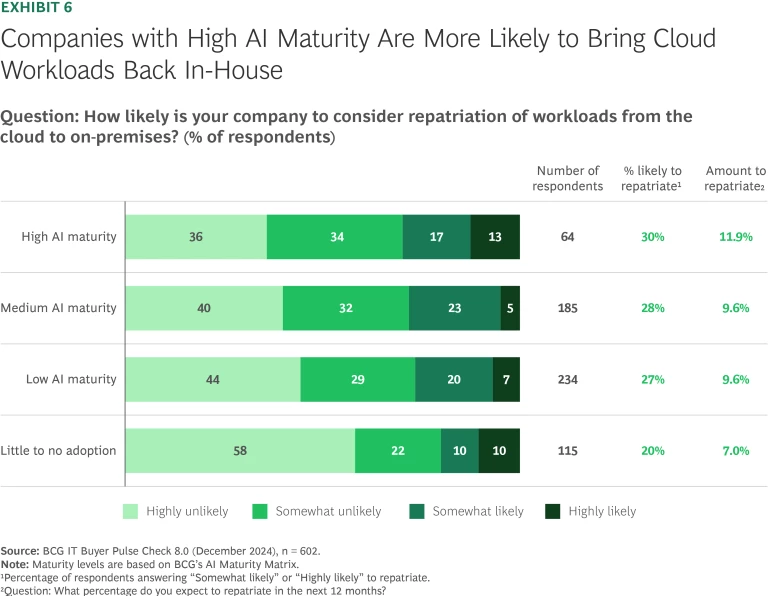

But companies aren’t embracing repatriation equally, and the survey reveals a telling pattern. Organizations with high AI maturity are the most likely to move workloads from the cloud to on-premises—and they plan to move the highest percentage of their work. (See Exhibit 6.) In all, nearly a third (30%) of high-maturity companies say they are likely to repatriate, and on average, they expect to bring back 11.9% of their workloads in 2025. Companies with little or no AI adoption are the least apt to repatriate, with 20% likely to make the move. And they expect to bring back the least work: just 7.0%.

This relationship between AI maturity and repatriation isn’t, perhaps, surprising. Mature AI companies typically have the skillsets to deftly balance cloud-based and in-house resources, letting them reduce unpredictable cloud costs while optimizing fixed-cost infrastructure. Having functions on premises also enables better control around AI, offers low latency, and lets companies tailor resources for high-intensity AI workloads—levers a company that’s more invested in AI and has more riding on it would want to apply. And data governance is easier to manage on premises, helping companies align with stricter, and rapidly changing, regulatory requirements.

AI is quickly evolving, becoming a powerful and critical enabler of growth. How organizations see the technology, and use it, is evolving, too.

Companies are embracing AI agents as a catalyst for operational efficiency. They’re viewing GenAI as a key driver of digital transformation. And increasingly, they’re sharing a mindset: Integrating these capabilities, along with advanced analytics and security solutions, is no longer an option.

But to get it right, IT spending must also evolve. This means redefining strategic priorities and re-evaluating spending strategies. It means fine tuning the balance between growth and cost control not just carefully, but continually. This is essential for unlocking the full value of AI and creating—and sustaining—competitive advantage.