Every company trading across borders must adhere to complex and varying sets of laws and regulations governing the import, export, and transfer of goods, services, and technology. This means complying with export control laws, sanctions, customs regulations, and other trade-related requirements designed to prevent unauthorized transactions and ensure lawful international trade.

In the current environment, trade rules are no longer mere background noise for global business. They have become a top-line risk. Sudden shifts in export and import controls, sanctions, and other regulatory barriers such as country-of-origin requirements can rapidly block access to markets, suppliers, and technologies. Leaders who focus only on tariff costs spurred by

recent geopolitical developments

risk missing these deeper threats, which can inflict far greater damage through sudden market exclusions, supply chain disruptions, or operational

In response, companies need to prepare for the full spectrum of trade compliance risks, especially those tied to export controls, licensing regimes, and geopolitical retaliation. Resilience is key. Leaders must gain a clear understanding of their trade flows, including which goods and associated services move between which locations. And they must consider how they are affected by trade restrictions, so they can steer compliance efforts and adjust risk mitigation strategies accordingly. Here’s how.

The Shifting Geopolitical Environment

The dynamics of trade compliance are playing out in real time. In the US, for example, the Trump administration has announced technology-focused trade restrictions. In late March 2025, the US added about 80 companies, including dozens of Chinese high-tech firms, to its export blacklist, aiming to stall China’s advances in supercomputing, quantum technology, and AI. At the same time, new US rules have tightened controls on items like high-bandwidth memory chips, semiconductor manufacturing equipment, and certain AI software, signaling an intent to keep cutting-edge technologies out of the hands of rivals.

China’s recent actions underscore the growing role of export controls and sanctions as instruments of economic statecraft. Alongside new tariffs on US imports, Beijing has introduced a range of non-tariff measures, including import restrictions on selected US agricultural goods, anti-dumping and anti-monopoly investigations, export limitations on key rare-earth minerals, and the inclusion of certain US companies on its Unreliable Entities List. These developments have implications beyond cost increases, affecting market access, supply chain stability, and broader business continuity considerations.

Geopolitical conflicts are driving similar moves elsewhere. The EU, for instance, has added more than 550 entities to its sanctions lists since 2023, and European enforcement actions have increased almost 600% since 2020. Meanwhile, the US Bureau of Industry and Security placed more than 300 additional companies on its export blacklist in 2024 alone. And both the US and EU are increasingly regulating software and hardware based on origin, given concerns about data exfiltration, weaponization, and other security risks.

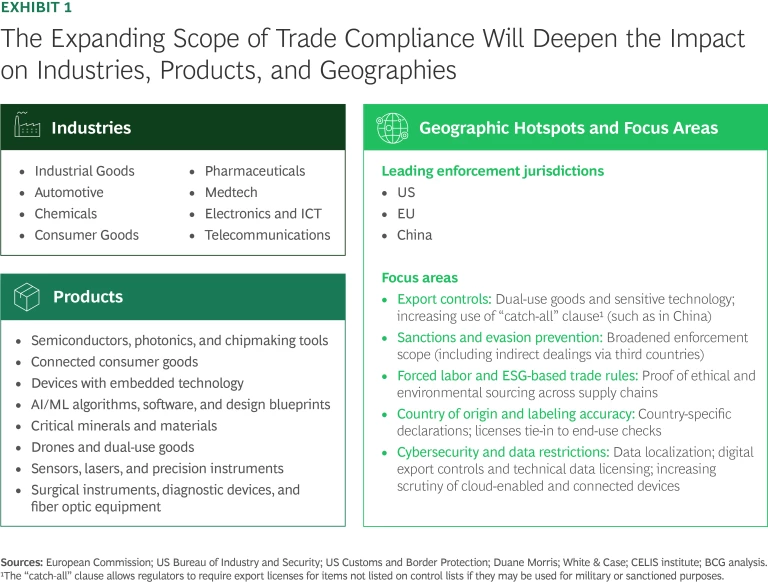

This surge in fast-paced regulatory changes underscores a dramatically changing global trade compliance landscape—one where enforcement now cuts across a much broader set of industries, products, and geographies. The result is a rapidly broadening trade compliance scope, spanning everything from high-tech manufacturing to raw materials and consumer products. (See Exhibit 1.)

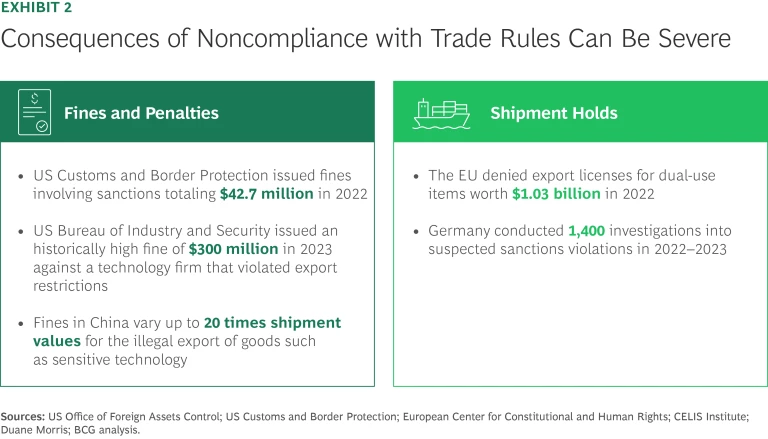

Compounding the challenge is a fast-fragmenting trade environment, driven by a broader breaking of markets into fractured, geopolitical trade blocks. Not long ago, US and European export regimes were relatively in sync; now a widening gap between them is increasing the strain on global companies. A customer or technology transaction that receives EU approvals might be blacklisted in Washington, and US extraterritorial reach means that even deals with no direct US involvement can trigger penalties if American technology is in the mix. Meanwhile, regulators worldwide are stepping up enforcement, handing down penalties that reach into the billions of dollars. (See Exhibit 2.)

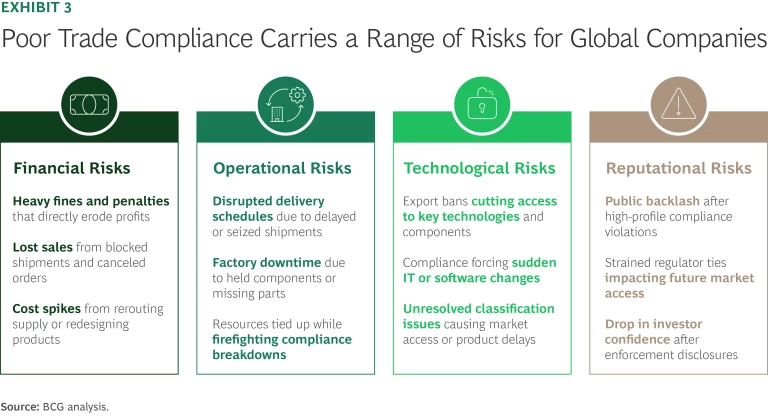

In this environment, one-size-fits-all compliance processes no longer work. Companies must be flexible and agile enough to toggle between different rulebooks and adapt as the global trade landscape shifts. Failing to keep up can carry immediate and severe consequences: not just regulatory fines and censure, but missed deliveries, stalled product launches, and lost revenue. If a product launch is slowed by a licensing issue or a shipment gets tangled up in customs paperwork, the result is delayed revenue and lost sales. These issues may stem from external forces, but their consequences are felt on multiple levels, from finance to operations, technology, and even company reputation. (See Exhibit 3.)

Subscribe to our Risk Management and Compliance E-Alert.

From Compliance Chaos to Coordination

All too often, at too many companies, when a shipment is blocked at the border, or email squabbles break out due to authority requests, or a new business partner raises red flags during screening, the typical response is an unstructured scramble across functions. Sales, procurement, customs, logistics, IT, and business leaders rush to respond—often through parallel, uncoordinated actions.

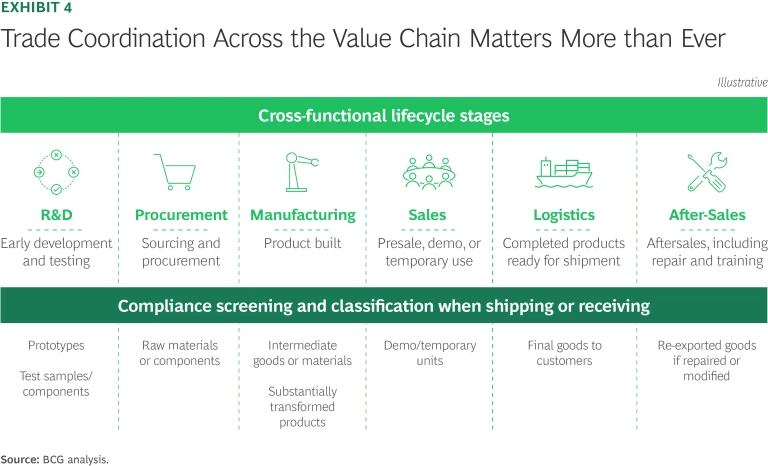

That will no longer work. The only way to properly manage the increasing challenge of trade compliance is with a coordinated approach—becoming a value-chain-wide responsibility, not just the concern of an isolated customs department or compliance team. This integrated perspective recognizes that trade compliance touches every stage of the value chain. From

product development

and supplier onboarding to logistics, IT systems, and post-sale servicing, each step carries compliance risks and responsibilities.

Companies that break down silos and coordinate compliance across all functions can catch problems early, often avoiding hefty fines or shipments stuck at borders. This enables them to closely monitor regulatory changes and make sure information is shared rapidly between functions and allows for rapid adjustments to compliance processes.

Effective compliance requires coordinated action across departments and clear accountability. (See Exhibit 4.) Unless compliance processes are built to be data-driven, adaptive, and integrated into core workflows, companies will struggle to manage today’s regulatory pace and complexity. Even the best-written policies will not succeed if they are not embedded into how the company works. And it is up to the CEO and other senior leaders to initiate the effort; their guidance and support are key to coordinating the effort. (See “CEO Trade Compliance Checklist.”)

CEO Trade Compliance Checklist

To assess whether your company’s trade compliance is prepared for today’s risks, answer the following questions.

- Does your enterprise risk map explicitly account for the operational and strategic impacts of export controls?

- When was the last time your board reviewed trade exposure scenarios?

- Does your trade compliance framework span legal, IT, product, and supply chain?

- Are product classifications regularly validated against new regulations?

- Is there one accountable leader overseeing global trade compliance?

- Can your systems flag real-time regulatory changes?

- Are you investing in tech to enable automation and early warning?

From Exposure to Strategic Asset

Forward-looking organizations recognize that compliance must be designed in, not simply layered on. To stay ahead of sanctions, export controls, and trade complexity, leaders must empower cross-functional teams, align technical and legal capabilities, and make trade compliance part of the digital backbone of the business. That is the only way to transform compliance from a source of risk into a driver of strategic control, operational speed, and long-term resilience.

As products become more digital and embedded with software, and as supply chains increasingly rely on data and automation, the compliance mandate extends deep into IT, engineering, and product development. Controls must be built into systems, workflows, and architectures—from automated license management and real-time third-party screening to encryption controls in software and integrated classification logic across business applications. (See “Trade Compliance Management System Overview.”)

Trade Compliance Management System Overview

Strategy and Objectives

- Understand evolving regulatory expectations and define trade compliance goals accordingly.

- Set your strategic posture on trade compliance, including ambition level and risk appetite, in alignment with business objectives and regulatory requirements.

Governance

- Establish global oversight with clear executive ownership.

- Clarify roles and escalation paths and embed trade compliance into core business decisions.

Risk Management Processes

- Strengthen end-to-end controls for screening, classification, and licensing.

- Standardize and document critical procedures and regularly assess exposure across business partners and markets.

IT and Technology Solutions and Data

- Centralize trade compliance data for full visibility and traceability.

- Automate internal controls such as license checks, embargo screening, and recordkeeping of export controls.

- Use generative AI tools to support product classification, leveraging regulatory databases (such as the EU’s dual use regulations and US’s Export Administration Regulation), historical expert classifications, and technical inputs such as part descriptions or drawings.

Culture, Communications, and Training

- Make trade compliance a visible, organization-wide priority.

- Provide targeted, role-specific training—especially in high-risk functions such as R&D, procurement, and sales.

- Make trade compliance part of decision making, not a check-the-box exercise.

In practice, this means driving four critical actions across the organization:

Elevate trade compliance to a top-tier risk and governance priority.

Explicitly include export controls and sanctions in the risk register, and ensure the board of directors regularly reviews trade exposure scenarios and preparedness.

Establish clear ownership and cross-functional accountability. Designate a senior executive responsible for global trade compliance and regulatory monitoring and break down silos by involving all key functions (R&D, procurement, production, IT, legal, sales, and others) in a unified compliance framework. A cross-functional approach builds a culture of shared responsibility, making compliance everyone’s business across the value chain.

Integrate compliance into core processes and product design.

Build regulatory checkpoints into key workflows, such as when screening for dual-use risks in R&D, verifying supplier compliance during sourcing, confirming export control classifications during manufacturing, and assessing sanctions exposure and export restrictions before entering new markets. Ensure that product classifications and supply chain decisions are continuously vetted against the latest regulations. Catching issues early—before a shipment is seized or a product launch is delayed—saves time and protects revenue.

Leverage technology for real-time monitoring and control.

Invest in modern compliance tools that can flag regulatory changes in real time and automate compliance workflows. Implement automated license management systems and real-time screening of customers and suppliers. Enforce encryption controls in software products and integrate trade-classification logic into core business applications. These technologies provide early warning of risks and help teams respond quickly.

Design compliance into the company’s digital backbone.

Embed trade compliance requirements into enterprise systems and architectures from the start, rather than layering them on later. This might involve aligning IT and engineering teams with compliance experts to embed controls (such as the tools and checks noted above) into new products, processes, and data platforms by default.

Readiness Is All

Proactive trade compliance is now a strategic imperative. It not only averts the rising consequences of inaction but also protects a company’s ability to operate globally and maintain credibility with customers, regulators, and investors. The onus is on CEOs and other senior executives to act decisively, leading from the front by making trade compliance an integral part of enterprise strategy and culture so the organization remains resilient amid mounting complexity.