Right now, many traditional car manufacturers are facing a perfect storm of challenges that threatens profitability, operational efficiency, and long-term viability.

With some leading automakers reporting full year results this month, many are already seeing substantial declines in profit and highlighting the need for cost reductions and productivity improvements.

The So What

“Traditional automakers are currently experiencing structural headwinds and a very high degree of uncertainty. Making step changes in terms of costs and productivity is the key focus this year and in the years ahead,” says BCG managing director and senior partner Felix Stellmaszek who leads the firm’s global automotive and mobility work.

Among the challenges are:

- Declining sales volumes due to slower than anticipated take-up of electric vehicles.

- Inflationary forces driving up production costs across the supply chain.

- The impact of tariffs on trade and the price of raw materials and components. Uncertainty around tariffs also complicates long-term strategic planning, disrupting supply chains and increasing operational complexity.

- Intense competition from Chinese automakers which can produce new models faster and more cheaply, and which are expanding their footprint in Europe and beyond.

In previous years, companies could expect headwinds of rising costs of 2% or 3%, Stellmaszek explains. Currently, they are facing rising costs of nearer 10%.

At the same time, concern around affordability is a major factor influencing car purchases, limiting the extent to which automakers can adjust prices in response to rising costs.

Subscribe to our Automotive Industry E-Alert.

Now What

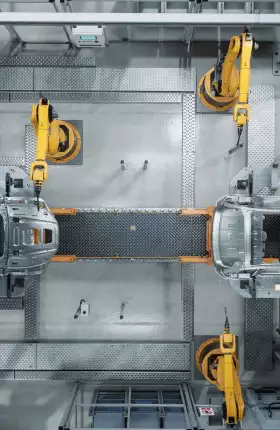

“Companies need to take a clean sheet approach to cost management,” says BCG’s Kristian Kuhlmann, a managing director and partner based in Germany who specializes in factories of the future.

“To remain competitive, automakers must fundamentally rethink how their manufacturing plants operate: Plants need to be more flexible and have leaner processes. They also need to incorporate the full benefits of digitalization,” he says.

These are some steps automakers can consider as they reposition their plants for future success.

Short-term moves. Over the next three years, each site will need tailored solutions to optimize production costs and eliminate inefficiencies. This could include reducing capital expenditure by adopting innovative asset leasing models for new and essential equipment. Indirect functions such as maintenance should also be included in the efficiency review, with predictive maintenance playing an important role. Digital twins—which allow manufacturers to visualize, test, and refine processes before implementing physical changes—can help improve material flows and in-plant logistics. And AI-driven visual inspection systems can be used to replace manual processes, improving throughput and reducing quality-related costs. It’s also important to increase staffing flexibility to allow automakers to react quickly to changes in demand. This could include using more contractors to flex up and down where necessary.

Medium-term moves. Over the next five years, automakers will need to make bold choices and adjust their networks to new market realities. AI can be used to analyze networks against key manufacturing KPIs and benchmarks to identify the root causes of underperforming factories. The overhaul should include developing and evaluating scenarios for reallocating product lines to more strategically competitive locations. For low-performing factories, companies should conduct a comprehensive assessment to compare closure costs versus potential efficiency improvements.

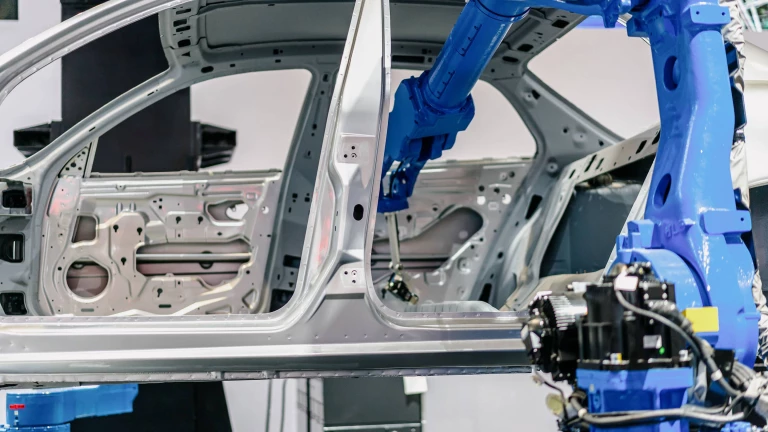

Future-proofing moves. Companies should model future scenarios to develop long-term competitiveness strategies. This is likely to include possible shifts in demand, tariffs, and the regulatory landscape. They should also plan how to integrate advanced frontier technologies such as gigacasting to improve factory capabilities and ensure they can compete on the global stage. Firms will also need to assess how next-generation robotics can be deployed. These include autonomous mobile robots for logistics, truck unloading robots to streamline deliveries, and humanoid robots to perform assembly tasks in complex environments.

It is also important to adopt cross-functional approaches to achieve the next level of manufacturing efficiency. Close interaction is especially important with the R&D function which has a key role in new designs to simplify manufacturing. Tesla, for example, is a leading example of integrating design-for-manufacturing principles. For instance, it defined an approach to mount seats directly on the structural battery pack enabling the manufacturing team to follow a significantly simplified assembly process.

“Automakers need to reduce costs immediately while simultaneously investing in innovation and the future megatrends of electrification, connectivity, and geopolitical shifts,” says Stellmaszek.

“Automakers will need to make difficult choices. But it’s really a question of survival or success.”