This is the fourth chapter of a four-part annual report on the global asset management industry and the trends shaping its future. The full 2025 Global Asset Management Report: From Recovery to Reinvention is available as a PDF download.

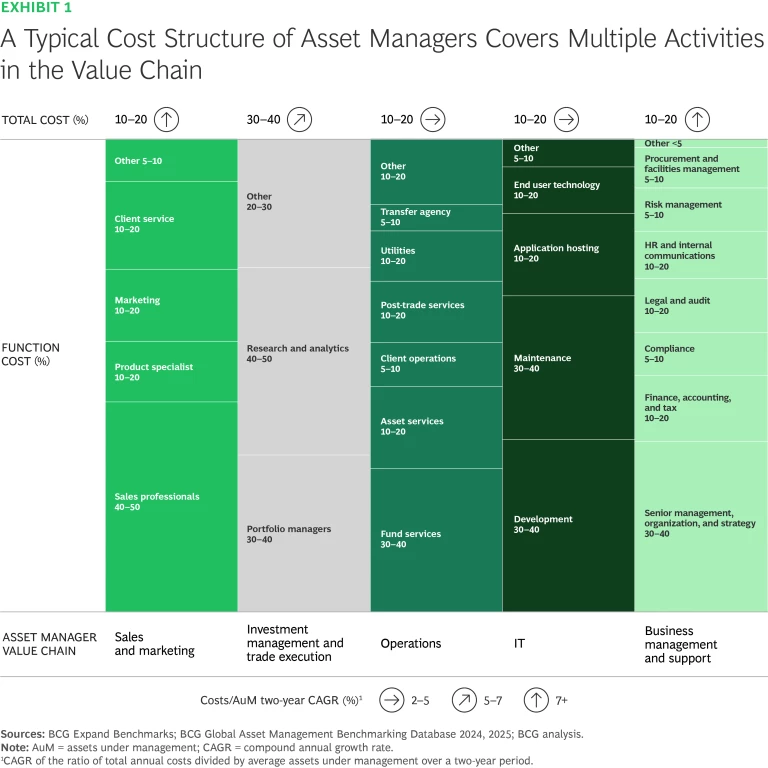

Cost optimization is an urgent strategic priority if asset managers are to be resilient enough to thrive at every phase of the market cycle. Most firms, however, have struggled to streamline operations and reduce costs. In our proprietary benchmarking sample, we found that total costs have grown at a CAGR of 6% from 2022 to 2024.

The greatest proportion of costs is in investment management and trade execution, which represent about 30% to 40% of total costs and grew at a CAGR of 6% over the past two years. (See Exhibit 1.) The increases came primarily from increasing competition for talent and from a shift toward private market products.

The Trifurcation of Cost Structures

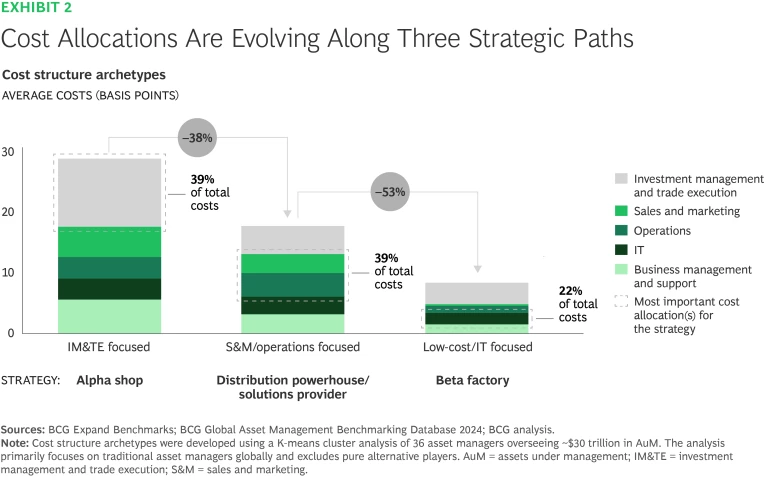

Overall cost allocations have remained relatively stable. A closer look at individual firms, however, reveals a growing trifurcation in spending patterns as asset managers increasingly align their cost structures with their strategic models—alpha shops, beta factories, and distribution powerhouses and solution providers.

This alignment reflects the winning strategies that BCG identified in the 2016 Global Asset Management report. The distinct paths to competitive advantage outlined there are now driving differentiated cost allocations across the industry. (See Exhibit 2.) Each model comes with inherent cost tradeoffs, and each firm must decide where it can best position itself to remain competitive. Each firm also needs to consider how a further entrenchment of these trends would affect its cost base and monetization strategy.

Alpha Shops. Firms that adopt this model focus on generating returns with active trading strategies, so they prioritize spending on IM&TE to sustain their ability to generate differentiated returns. The associated costs account for about 39% of their total costs. Although our data primarily covers traditional players, we expect IT and IM&TE to represent a higher proportion of costs for alpha specialists such as hedge funds and proprietary trading firms.

In order to establish stronger differentiation in active management, alpha shops may increase the proportion of their costs in IM&TE as the competition to find top investment talent intensifies. Instead of maintaining in-house distribution teams, they can use distribution powerhouses to curate their offerings, thereby reducing costs in the areas of sales and marketing and operations.

Beta Factories. This model tries to reduce costs across the board for passively managed products while strategically investing in IT, which comprises 22% of total costs, to drive scalability and automation.

Because of their IT investments, beta factories are in a position to become tech providers for the broader industry, offering infrastructure, execution platforms, and advanced analytics to partners. As a strategy for the future, beta factories can make a purer play for IT as their cost base while reducing their relative spending on IM&TE.

Distribution Powerhouses and Solution Providers. This model concentrates on the sales and marketing and operations functions so that the firm can strengthen client engagement and service delivery. These functions, when combined, account for about 39% of their total costs—and if anything, that share will have to increase over the next few years.

As the industry experiences further separation between alpha shops and beta factories, distribution and solution providers are serving as the gateway to clients across channels. To stay competitive in this role, they should consider strategies to get closer to key intermediaries such as outsourced chief investment officers (OCIOs) and consultants.

Reimagining Costs with a Zero-Based Mindset

Regardless of the cost model that an asset manager follows, the best way to ensure resilience is by adopting a zero-based approach in which the firm rethinks its cost structures from the ground up. We see three key levers that asset managers can use to optimize their cost structures: outsourcing, automation, and avoiding dual-run costs.

Outsourcing. Asset managers can reduce operational costs by shifting their noncore cost-intensive functions such as mid- or back-office operations to third-party providers. For small and midsize players, it increasingly makes sense to outsource technology and data management functions.

As the value of bespoke customer data utilization grows and technology’s role in differentiation becomes more salient, the largest asset managers and dedicated tech firms are investing heavily in technological infrastructure. For their part, however, small and midsize players should carefully weigh the benefits of building in-house capabilities against the costs and the ease of integration that third-party platforms provide.

Automation. Most firms are adopting advanced technologies such as GenAI to improve cost efficiencies, particularly in the areas of investment research, trading, reporting, and compliance. As our 2024 Global Asset Management report discussed in detail, asset managers should be proactive in integrating AI-driven tools into their research workflows and should redesign portfolio management teams to fully capitalize on these advances. For example, diversified firms have a unique opportunity to leverage customer data gathered at one end of their business to inform and strategize about pricing and marketing decisions in other parts of their product suite.

Our clients are combining levers such as automation and outsourcing to reduce costs by forging partnerships with AI specialist companies that can serve the needs of noncore operations such as software development.

Avoiding Dual-Run Costs. With expansion comes the risk of duplicated team structures, inefficiencies in decision making, and increased operational complexity. As asset managers venture into new asset classes, they should, wherever possible, deploy the expertise of their existing teams across new disciplines to avoid dual cost structures.