Global demand for computing power is surging, and leading data center players are readying a massive deployment of capital—$1.8 trillion from 2024 to 2030—to meet the need. This rapid expansion reflects a growing bet on data-intensive technologies, from traditional enterprise workloads to GenAI applications.

Several significant barriers, however, could slow the industry’s development. Among the most pressing of these are power infrastructure bottlenecks, supply chain constraints, community concerns over resource use, and the growing environmental impact of data centers. With a focus on actionable solutions, we outline a set of strategies that operators and ecosystem stakeholders can adopt to navigate these complexities and capture the opportunities ahead.

Stay ahead with BCG insights on energy

Rapid Growth Ahead

Although it’s clear that the data center sector is experiencing rapid growth, the mix of forces driving that expansion is less well understood. Our work, leveraging BCG’s proprietary Global Data Center Model, sheds light on the forces underpinning demand for data centers, the unprecedented levels of capital investment underway, and the global dynamics shaping this emerging

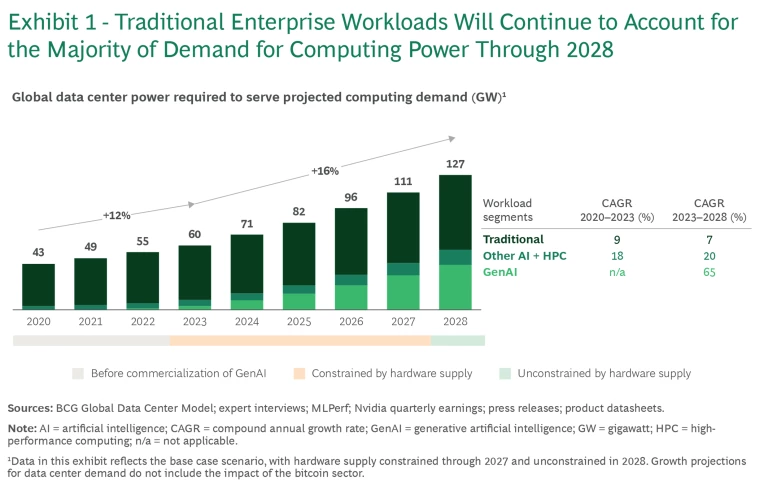

Data center computing demand is surging. We expect global demand for data center power to grow at approximately 16% on a compound annual basis from 2023 to 2028—33% faster growth than from 2020 to 2023—reaching about 130 GW by

Traditional enterprise workloads—non-AI applications such as file storage and sharing, transaction processing, and other conventional business applications—actually represent the majority of data center power demand today and will continue to do so in the future, accounting for roughly 55% in 2028. That translates into a 7% compound annual growth rate from 2023 through 2028, fueled by the continued rise of enterprise data volumes and further digitization of company businesses. Wider usage of cloud services, which can increase cost efficiency, operational flexibility, and scalability, is a key enabler of this growth.

In parallel, GenAI-related computing demand now ranks as the fastest-growing segment, and we project that it will account for roughly 60% of total growth in data center power demand from 2023 to 2028. The training of large foundational models, such as OpenAI’s GPT models, will grow at a compound annual rate of about 30%, while inferencing workloads—the use of pretrained models to generate insights and predictions—will increase at an explosive 122%. Still, despite that ramp-up, we expect GenAI to represent only about 35% of data center power demand by 2028.

The precise trajectory and timing of computing demand—and, by extension, of data center buildout—could depend to a significant extent on the uncertain future of GenAI computing growth. For example, technological progress and innovations in model architecture and hardware might curb power demand for GenAI training computations. Conversely, wider adoption of inferencing paradigms such as chain-of-thought reasoning, which requires multistep processing per prompt, might trigger faster growth in computing power needs.

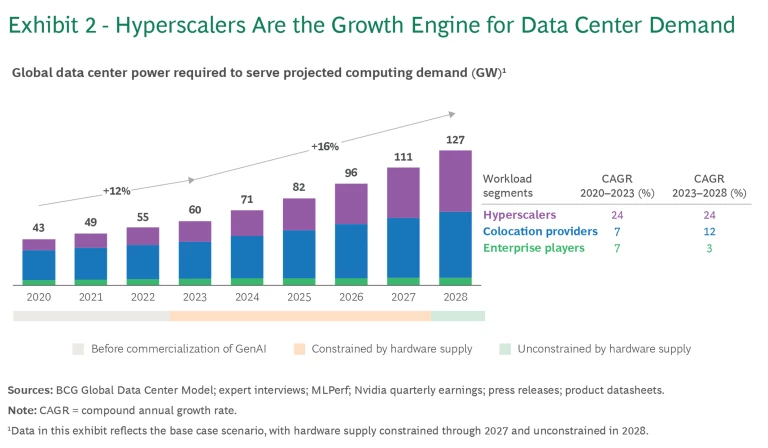

Hyperscalers drive growth and major investments. We expect that hyperscalers—technology players such as Amazon, Meta, Microsoft, and Google—will generate approximately 60% of the industry’s growth from 2023 through 2028, increasing their share of global demand for data center power from 35% to 45%. Within this time frame, the power demand share for enterprise players—companies that maintain on-premises facilities for their own use—will decline from 10% to 5%. In part, this reflects continued migration of businesses’ data to the cloud and to colocation providers. Colocation providers, which rent sites to tenants or develop specialized cloud offerings, will account for the remaining 50% of data center power demand by 2028, as hyperscalers continue to rely on them to meet growing needs. (See Exhibit 2.)

To realize this growth, hyperscalers will need to spend an estimated $1.8 trillion in data center-related capex in the US from 2024 to

Hyperscalers will also drive growth in facility size. The average size of a US data center will increase from 40 MW today to 60 MW by 2028, with about a third of campuses above 200

Regional Dynamics Evolve

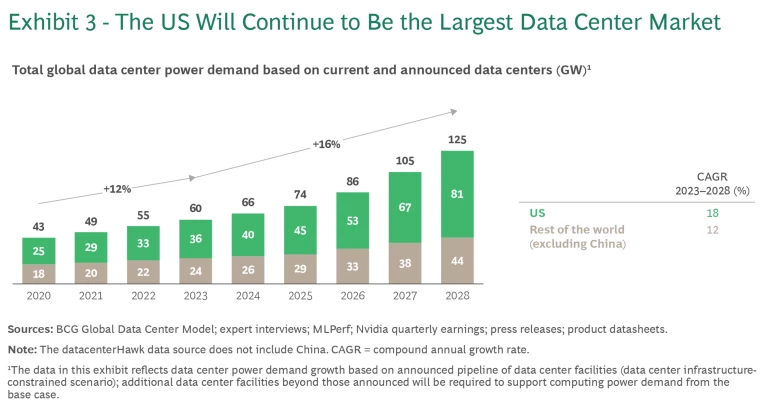

The US currently represents approximately 60% of globally installed data center capacity. Taking into consideration the base of currently installed data centers and those expected to come online in light of public announcements, our model estimates that the US will account for the majority of data center power demand growth from 2023 to

This expansion will be concentrated in specific electricity market regions. We project that about 70% of the installed base for US data centers will be located in the PJM Interconnection (which includes Virginia and Ohio), Midcontinent Independent System Operator (which includes Illinois and Iowa), Northwest (including Oregon), and Southeast (including Georgia) in

Our projections based on current and planned data centers show that locations outside the US will capture the remaining 30% of total growth during the period from 2023 to 2028, owing largely to three factors:

- Data Security and Sovereignty. Stringent requirements governing localized data storage, where computing activity may be conducted, or even where chips can be imported and exported will influence data centers’ geographic location. Often, such requirements stem from regulations or concerns related to sanctions. For example, the EU’s General Data Protection Regulation imposes strict rules on the transfer of individual personal data, thereby encouraging organizations to store and process data within the European Economic Area to simplify

compliance.7 7 Source: European Commission. Similarly, multiple countries in Asia have enacted or are planning to enact data localization laws that would accelerate the buildout of data centers in the region. For example, Indonesia’s Government Regulation 71 mandates data localization for the country’s public and financial sectors. Beyond regulatory pressures, customer preferences may influence data center location. For instance, cloud customers may specify data processing location requirements in service level and security agreements. - Increasing Options for Access to Reliable, Low-Cost Power. The availability of clean energy that meets both cost and reliability standards for data center operators is further incentivizing development in regions outside the US, especially for players seeking to align their energy needs with sustainability goals. For example, the Nordics are emerging as a region of interest for data center operators, given their combination of access to abundant renewable energy sources, robust grid infrastructure, and energy prices that are among the lowest in

Europe.8 8 Sources: Bloomberg; Bulk Infrastructure Group AS; Data Center Dynamics. - Expansion of AI Applications Without Latency Requirements. Latency—the time it takes for a data center to respond to an end user’s request—is becoming less critical for a growing range of AI applications. The most latency-sensitive computing workloads rely on edge computing, in which servers are located closer to end users to minimize delays. However, innovations in AI paradigms—for example, chain-of-thought reasoning—tolerate response times of several seconds or more, making ultralow latency less critical. This shift allows operators to prioritize other factors, such as cost or sustainability, over proximity to users when building data centers, which in turn gives them greater flexibility in choosing data center locations.

Our model captures only publicly disclosed plans for data center construction. The variables mentioned above, along with undisclosed data center projects, could ultimately lead to faster-than-expected growth and a shift in growth trajectories outside the US. Although not a focus of this analysis due to data limitations, China will likely continue to emerge as a major AI player with strong access to talent, capital, and power resources. For example, Alibaba’s Qwen large language models (LLMs) are achieving performance comparable to US models despite limited access to advanced chips due to export restrictions that the US has

Confronting Challenges to Seize the Data Center Opportunity

Around the globe, national and business leaders see innovating in AI as a mission-critical priority. But players throughout the data center ecosystem face significant challenges as they push to develop new and larger sites. A close look at those issues reveals a path forward to address them.

Access to Power

The growing number and size of data centers will have a transformative impact on electrical grids. Global power demand by data centers is expected to total roughly 130 GW in 2028, reflecting a 16% compound annual growth rate from 2023 through 2028—up from the 12% rate over the years 2020 through 2023. In the US, data center power demand will account for up to 60% of total load growth from 2023 through 2030, outpacing load growth in sectors such as transportation electrification.

In this context, access to the power needed for ever-larger data centers is emerging as a critical bottleneck. Primarily, this results from a mismatch between the development period of two to three years for a typical greenfield data center and the time required to complete associated interconnection studies and infrastructure upgrades, which usually spans four to eight

To overcome this challenge, data center operators can work proactively with energy providers to accelerate grid infrastructure development. Two steps are especially important:

- Collaborate in planning and siting. Data center operators and utilities can collaborate to "intelligently site" facilities, balancing developer needs (such as proximity to urban centers) with utilities’ preference to optimize for system affordability and reliability. This collaboration requires early integration into utility planning cycles and data sharing. It could also involve having public sector bodies (for example, regulators) steer data center development toward preferred development zones via mechanisms such as streamlined permitting processes.

- De-risk grid expansion. Misalignment of planning horizons is a key challenge in grid buildout. Utilities and regulators require long-term offtake agreements to justify investments with 25- to 30-year payback periods. In contrast, data centers typically operate on shorter cycles due to uncertainty in demand, regional patterns, and evolving workloads (particularly with regard to GenAI). Operators can help utilities proactively invest in grid upgrades by offering take-or-pay contracts or financial guarantees, which de-risk large grid capital expenditures in the event that load growth forecasts overestimate demand. Operators can also explore co-ownership models for new or upgraded energy infrastructure, sharing financial risks and rewards with utilities. In addition, operators can collaborate with large electricity users to pool demand across regions, signaling sufficient and stable demand to justify new large-scale investments.

As companies develop plans to meet the surge in demand for computing power, they are trying to gauge the degree to which new approaches could reduce the need to bring new grid-connected power capacity online. A close look at two trends—the development of behind-the-meter resources and continued technological innovation—reveals that neither is likely to change the power equation significantly in the near term. (See the sidebar, “No Easy Fix for Data Center Power Demands .”)

No Easy Fix for Data Center Power Demands

Behind-the-Meter (BTM) Resources. Co-located energy resources have recently gained attention as a way to overcome grid bottlenecks in data center projects and enable faster time to power. Although still in the early stages of adoption, BTM resources such as co-located gas power plants, hydrogen fuel cell farms, and solar parks equipped with backup systems are poised to play a larger role in powering data centers. Certainly, we need all of these resources. However, the current focus on BTM is not commensurate with its likely contribution toward delivering the nearly 70 GW of additional data center capacity needed from 2023 through 2028. That reflects several important issues related to large-scale implementation.

First, BTM resources are subject to unique reliability considerations, including the need to manage planned and unplanned maintenance and risks associated with outages independent of the grid. Consequently, data center operators, which require exceptionally high levels of energy reliability and redundancy, have historically shied away from exploring fully islanded and off-grid solutions. There are potential technical solutions—such as load bridges—that may help address reliability concerns, but these approaches will take time to develop and mature.

Second, scaling BTM resources to meet the demands of data centers operating at a multi-megawatt or gigawatt scale presents significant technical hurdles. Although developers may have experience with smaller off-grid solar systems, few have expertise integrating diverse resources—including natural gas, solar, and batteries—on a massive scale. Managing the unique power flows and dynamic loads associated with data center operations—such as delivering near-instantaneous responses and managing wide load fluctuations—adds complexity and increases project risk.

Third, the adoption of BTM solutions could be slowed by regulatory uncertainty. For example, questions persist about grid cost allocation and stability impacts, as reflected in recent Federal Energy Regulatory Commission rulings rejecting interconnection agreements for BTM data center

As a result, we expect grid-connected data centers to remain the favored choice for operators. At the same time, to facilitate these grid-connected solutions, we expect to see regulatory reforms in large-load interconnection processes and the emergence of contractual innovations to de-risk and expedite utilities' investments in new grid infrastructure. In this evolving landscape, regulated utilities—particularly vertically integrated ones—are well positioned to capture substantial value from data center expansion through investments in new grid infrastructure and power generation.

Technological Innovation. A common question we hear from clients is whether quantum computing, which has garnered attention with breakthroughs such as Google’s Willow, will help curb data center energy needs through more efficient processing of computing workloads. The reality is that quantum computing will not offer practical solutions to address data centers’ immediate and growing demands for energy for at least the next decade. Quantum computers are probably unsuitable for inferencing tasks and for most enterprise workloads, and its application to LLM training remains speculative. Even if technically viable for AI training, scalable quantum solutions for this space are many years away.

Real progress in hardware is expected to come from incremental but impactful advances in chips developed by leading players like Nvidia and emerging challengers, and from innovations in essential supporting technologies such as liquid cooling that will continue to propel critical gains in performance and efficiency. Innovations in software and algorithms will likely play a similar role.

Supply Chain Issues

Amid rapid growth, supply chain management has moved to the forefront of concerns among data center operators and developers seeking timely access to the resources they need to build data centers. Access to chips is a well-known issue today. However, disruption can emerge from any component of the supply chain, from power and cooling systems to networking infrastructure and even the construction workforce. For example, lead times for procuring critical equipment such as backup generators have gone from months to

To ensure a resilient supply chain and alleviate capacity bottlenecks, data center operators can implement a set of practical strategies:

- Bulk-purchase components that have long lead times. Data center operators can significantly accelerate development and construction timelines by working with engineering, procurement, and construction partners to secure equipment with extended lead times and then store it centrally with third-party logistics providers. A recent BCG analysis of 15 data center projects found that bulk purchasing and centralized storage of critical equipment can shorten timelines by as much as six

months.13 13 Sources: Data center construction benchmarking; BCG analysis, May 2024. - Pursue partnerships and co-development. Data center operators can establish more-strategic relationships with their suppliers, including co-investments, to help scale manufacturing. Partnerships can also play a role in giving suppliers longer-term visibility into data centers’ capacity requirements, thereby enabling better-informed planning and production processes.

- Invest in talent development. Recruiting specialized labor, particularly in remote areas, remains a challenge for data center operators, utility companies, and specialized contractors. Companies can address this by creating workforce development programs, including programs undertaken in partnership with educational institutions. For example, Microsoft has joined forces with local community colleges to operate nearly 20 data center academies

globally.14 14 Source: “Microsoft in your community,” company website.

Community Engagement

As data centers expand, they face increasing scrutiny from host communities regarding their impact on local resources, such as land and water. Specifically, cost allocation rules for the grid upgrades required to support data center growth and the expanded data center’s impact on energy affordability are key concerns for many communities.

Key players in the data center ecosystem can take two primary actions to address these concerns:

- Design equitable rates. Regulators, utilities, and data center operators can work together to revise cost recovery frameworks for commercial and industrial customers. These frameworks should ensure a fair distribution of costs among impacted energy users, and they should protect ratepayers from increases in power prices or a decline in energy reliability. Such protections—including minimum capacity commitments, upfront payments, or take-or-pay clauses—can shield ratepayers from stranded asset risks in cases where load growth falls short of forecasts. Similarly, data center operators can create contractual mechanisms to directly finance any new capacity needed to ensure the high level of energy reliability they need for their operations. At the same time, collaboration among data centers, utilities, and regulators is essential to ensuring the fair allocation of costs for large grid upgrades associated with data center interconnection. These stakeholders can develop incentives that encourage utilities to explore ways to temper the need for grid upgrades or expansion, including replacement of wires and cables, battery storage, virtual power plants, and grid-enhancing technologies. Failing to implement such mechanisms could lead to higher energy costs and less reliable energy for all ratepayers.

- Proactively engage with host communities. Data centers can amplify their positive community impact through such initiatives as funding energy efficiency programs for low- and middle-income households, partnering with academic institutions for workforce training, and providing direct relief to ratepayers. Highlighting the ways in which data centers contribute to local economies, such as through job creation, is also crucial. A 100 MW data center, for example, creates approximately 500 full-time equivalent (FTE) construction jobs during its two- to three-year build phase and 50 FTEs during its twenty-year operational

phase.15 15 Sources: expert interviews; datacenterHawk; Uptime Institute; Microsoft; data center operator press releases; BCG analysis.

Climate Change Impact

Rising energy demand over the next five years, fueled in part by the data center boom, will drive the largest five-year expansion of energy capacity in history. Achieving this unprecedented growth will require scaling diverse energy sources, including wind and solar, battery storage, and conventional nuclear. A key factor shaping the energy buildout is data centers’ critical need to have a continuous, redundant supply of energy. Renewables with storage can provide that firm power supply, but fossil-fuel-based generation currently has an economic advantage over renewables after accounting for storage requirements. Consequently, although energy providers continue to broaden their adoption of renewable energy, many are also expanding—or slowing the retirement of—unabated fossil generation in order to meet immediate customer demand.

Some data center operators have taken important foundational steps to address the climate impact of their operations, including by procuring renewable energy credits and by contracting PPAs with renewable energy generators. In addition, operators can take further action to address the climate challenge:

- Mitigate the environmental impacts of fossil fuel plants. Newly built energy generation plants designed to run on unabated fossil fuels will have lifespans of 25 to 40 years, posing a substantial challenge to the goal of meeting long-term sustainability goals. Data center operators can work with utilities to define transition roadmaps for these assets, including plans for integrating carbon capture and storage (for example, by strategically siting plants near suitable pore spaces) or ensuring hydrogen readiness early in the development process. Operators can also advocate for and help design offsetting market mechanisms such as carbon taxes or regulatory incentives to fund power plant retrofits, enabling a smoother transition to renewables.

- Drive adoption of emerging climate technologies. Mature technologies will play a critical role in the near-term, but data center operators can achieve long-term impact by supporting the development of emerging climate technologies. These solutions, such as small modular reactors and enhanced geothermal, could play a key role in meeting the energy needs of data centers while balancing sustainability commitments. The technologies still require large-scale demonstrations, and they remain at a premium relative to more mature energy generation technologies. By making early investments in them, data centers operators can contribute to pushing them down the cost curve and help drive mass adoption.

- Catalyze system-level change. Data center operators can move past isolated transactions to accelerate a system-wide adoption of renewable energy. The barriers to clean energy deployment vary significantly by region—due to differences in such variables as regulatory constraints, access to natural resources, and financing hurdles—but large energy buyers such as data center operators are in a unique position to catalyze change by leveraging their scale and buying power. For example, operators can provide long-term stability and demand signals to energy providers by establishing partnerships or signing offtake guarantees. They can also act as stakeholder conveners, supporting the emergence of coalitions to advocate for policy and regulatory change at the local level. Through these coordinated efforts, operators can secure the clean energy necessary to meet their needs while also accelerating its adoption across other industries.

The data center industry stands at a pivotal juncture, and the path ahead is edged with uncertainty. As operators confront power bottlenecks, supply chain hurdles, and rising community expectations, the industry’s growth depends on creative collaboration throughout the ecosystem. Forward-thinking strategies and partnerships will drive the industry's transformation and separate the leaders from the laggards.