Canada’s over-55 population isn’t just the fastest-growing demographic—it’s the most financially powerful. But with their growing economic influence comes heightened skepticism and selectiveness about where they spend their money. With Boomers frustrated by soaring prices, reaching them and satisfying them is both a challenge and a golden opportunity for businesses.

For companies looking to succeed over the next decade, the message is clear: capturing the 55+ market demands building trust and delivering real value.

Canada’s Biggest Spenders Are Growing in Numbers, but Shrinking in Confidence

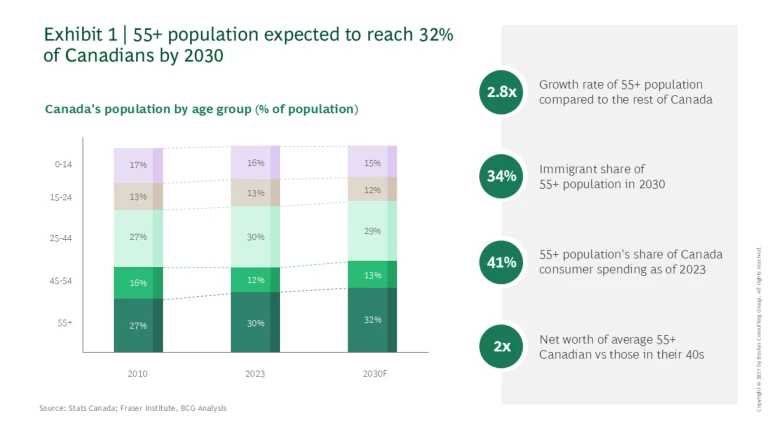

The 55+ segment is the largest and fastest-growing demographic in Canada. By 2030, this segment, will make up 32% of the population and nearly 45% of total consumption. They hold immense financial power, with an average net worth twice that of people in their 40s, bolstered by investment gains and rising property values.

Yet, especially compared to their American peers, Boomers are feeling financial strain. Since 2016, median wealth of the over 55s has increased by >40% in the US while only increasing by 12% in Canada. This has led to a different economic outlook on consumption than south of the border.

- Housing wealth is restricting liquid spending: While Boomers appear financially secure, much of their wealth is tied up in real estate, limiting their ability to spend freely. Many are also supporting younger family members with housing costs—31% of first-time homebuyers receive financial gifts from Boomers, and the size of those gifts has jumped 73% in five years. This intergenerational wealth transfer has reduced disposable income for Boomers, curbing their discretionary spending despite their overall financial strength.

- Rising prices are driving “consumer rage”: In just one year, the number of Canadians over 55 feeling financially insecure has jumped from 21% to 27%. Escalating housing, healthcare, and other costs are major contributors, with 50% of Boomers spending more on housing and 18% expecting to pay more for healthcare in the coming year. Frustration is mounting, with Boomers feeling exploited by sharply rising prices. Over 60% of Boomers report a more negative view of grocery stores than they did three years ago, and 46% feel more negatively toward telecom companies.

- Boomers are spending selectively and focusing on value: To offset the rising cost of essentials, budget-anxious Boomers are pulling back on dining, entertainment, and apparel. Even the highest earning seniors are cutting back on these everyday luxuries. However, travel stands out as one area where higher earners plan to increase their spending. While this reflects pent-up demand following pandemic closures, it is also indicative of a longer-term trend as a more experience focused generation ages into their senior years.

How to Win Over Canada’s Most Powerful Consumer Segment

Boomers are a discerning group with evolving preferences that provide a clear roadmap for businesses seeking to secure their trust and loyalty. Here’s how to win them.

- Build trust, not gimmicks: What Boomers value most is trust, built over time through consistency, reliability, and transparency. Boomers are twice as likely as younger generations to cite brand equity as a top purchasing consideration and are 35% less likely to switch brands —even when cheaper alternatives are available. To win their loyalty, businesses should focus on delivering consistently high-quality products, honest pricing, and superior customer service. Clear communication—whether it’s about product features, pricing, or return policies—will resonate deeply with this group.

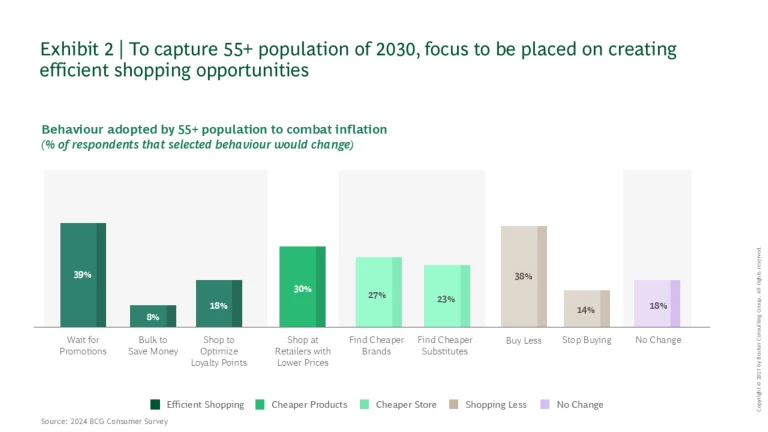

- Price perception is paramount: Like younger consumers, price perception is the top purchasing criteria for older shoppers. However, how they think about and respond to pricing can be very different. Boomers are far less likely to factor the value of loyalty programs or bulk discounts into their price perception. Instead, they are patient consumers with over 40% opportunistically waiting for promotions. While online savviness continues to grow, Boomers are still far more likely to shop brick and mortar for their everyday items and building trust requires sharp everyday pricing on key value indicator products compared to local competitors.

- Blend digital efficiency with human touch: Boomers have become increasingly comfortable with digital shopping with a +6p.p growth in Ecommerce penetration since the pandemic. But to successfully attract these shoppers, companies need to ensure online platforms are intuitive and easy to use. These older shoppers complete their interactions 40% slower than younger shoppers and are more likely to give up when they find the process difficult. Smart businesses will optimize the online experience for these shoppers - whether it’s easy to complete forms, live customer support, real-time chat functions, or UIs customized for tablets (Boomers are avid users). An online experience catered to older shoppers can help unlock a strong base of consumers and help foster deep, lasting loyalty across all channels.

Final thoughts

The Boomer demographic represents a massive opportunity for businesses that understand and adapt to their shifting preferences. Their financial power, combined with their growing selectiveness, makes them a market that is too large and powerful to be ignored. To win their loyalty, companies must offer consistent value, build trust through transparency, and tailor offerings to their unique needs. Those that move quickly to capture this segment will position themselves for long-term success in a rapidly evolving consumer landscape.