Although the full phase-in deadline for the Basel IV regulatory framework may be delayed, financial institutions around the world are anticipating the impact that the more-stringent capital requirements may have. The minimum capital requirements are likely to increase by as much as 6% for institutions designated as global systemically important banks (G-SIBs) and as much as 5% for other large banks.

Some banks have enough capital reserves to provide resilience against risks. But other banks, large and small, must raise more equity or lend less to meet the rising capital demands. At the same time, they face a growing list of external risks and rising costs. The risks include the likelihood of reduced earnings as inflation cools and central banks lower interest rates, as well as the growth of macroeconomic and political uncertainties in many parts of the world. The costs include those for personnel, which have continued to increase since the inflationary spiral of 2022 and 2023. Banks must also factor in rising costs for adhering to regulations, such as those for environmental, social, and governance (ESG) reporting and account management compliance. In addition, over the next several years, many banks are going to be making large IT investments, updating their IT infrastructure and fully digitizing their processes while implementing AI technology.

For many banks’ chief financial officers (CFOs), this is the time not only to assess their institution’s ability to meet its expenses and capital costs but also to ensure that it can continue to be resilient over the long term. We have found that the key to long-term resilience is having a strong risk-adjusted performance—that is, having systems and processes in place that are able to perform well in the face of current and future risks.

Most banks need to improve their performance, adjusting it at every level for additional risk scenarios. In this article, we look at how CFOs should take the lead and guide this effort across the organization, setting measurable targets and creating a change management program that can help each line of business contribute to a stronger whole.

The Importance of an Organization-Wide Effort

Many banks have undertaken efforts to address their exposure to risk, most recently after the 2008 global financial crisis. Leaders often restructured their bank to comply with the Basel III capital requirements, significantly deleveraging and selling or winding down complete business units, as well as making severe cost reductions.

However, these efforts often failed to improve performance because they were siloed within one particular division or at a single organizational level, rather than part of an institution-wide change. For example, some management teams adopted a program to increase agility, but they did not set targets or incentives for employees at the process level, so those who performed the processes weren’t encouraged to change. Other managers implemented cost-reduction programs that demotivated talented employees and, in the end, resulted in sharply declining revenues.

As banks address the most recent regulations from the Basel Accords, CFOs should develop a risk-adjusted performance-oriented culture.

Now, as banks once again take steps to address the most recent regulations from the Basel Accords, CFOs should take this opportunity to develop a risk-adjusted performance-oriented culture in their bank by engaging the entire organization. As senior leaders responsible for the financial aspects of business planning and processes, CFOs can select the metrics that quantify success. They can also prioritize transparency, communicating with all stakeholders, explaining the importance of this cultural change, and delivering a clear plan and process.

To effect such change requires a transformation. Therefore, CFOs need to not only lead the effort but also act as a full partner in the process. CFOs should advise other executives on the best ways to achieve their targets and bring about change. And they should work with managers to make the necessary structural adjustments to their teams. Managers may also need help developing skills and garnering the resources needed to measure and reward performance-driven behavior. However, by taking this approach, CFOs can ensure that new ways and behaviors are built into the institutional culture.

Measurable Targets

The first step in establishing a performance-oriented culture is defining the performance metrics that will be the targets. Without measurable targets, no one can transparently or objectively evaluate the success of a program.

Superior performance metrics align opportunities with risks. Weighing a bank’s profitability against its risk-based capital provides a measure of the losses that the bank can absorb. Moreover, allocating the bank’s risk-based capital to the bank’s business lines or products on the basis of their risk-weighted assets (RWAs) makes it possible to determine the minimum regulatory capital that is needed for each.

The CFO can then use the RWAs to determine which business units offer the highest potential economic profits and allocate operating capital accordingly. It falls to each line of business to perform an in-depth analysis of its customer portfolios and optimize its RWAs, but the CFO should determine the optimization targets and oversee the levers used to measure the risk-adjusted performance of a business line. The levers can be classified into two categories:

- Model Levers. These levers are adjustments to the models that assess the potential effects of a given risk or the possible impacts of improvements in data quality. These levers are designed to reduce RWA consumption without having an impact on clients and products. An example of a model lever is the optimization of collateral netting sets in derivative trading. Another is the choosing between internal and standardized models to calculate market risk under the implementation of the Fundamental Review of the Trading Book and being introduced under the Basel IV accord.

- Customer Levers. These levers are management decisions about which customers to serve and which products to offer. These decisions are based on information provided by risk models. When examining risk impact with a clearly defined set of goals for RWAs, a CFO is able to allocate capital only to portfolios and new business opportunities in which the hurdle rate guarantees that the cost of capital will be earned.

The findings from each business line’s in-depth analysis of its customer portfolios can be striking. For example, a review of a long-term customer’s probability of default and the related capital charges may lead to the discovery that the bank needs to reprice that particular business. Or the bank may find that it needs to cancel its outstanding committed credit lines, discontinue certain products, or stop serving a specific region or group of customers. In some cases, it may prove more profitable to outsource services for noncore products under a white-label approach.

These are the types of findings that come from rewarding managers for meeting measurable targets instead of conducting business as usual with long-term clients. Such a shift can be disruptive, but doing so enables a bank to continue creating value.

Stay ahead with BCG insights on risk management and compliance

The Change Management Program

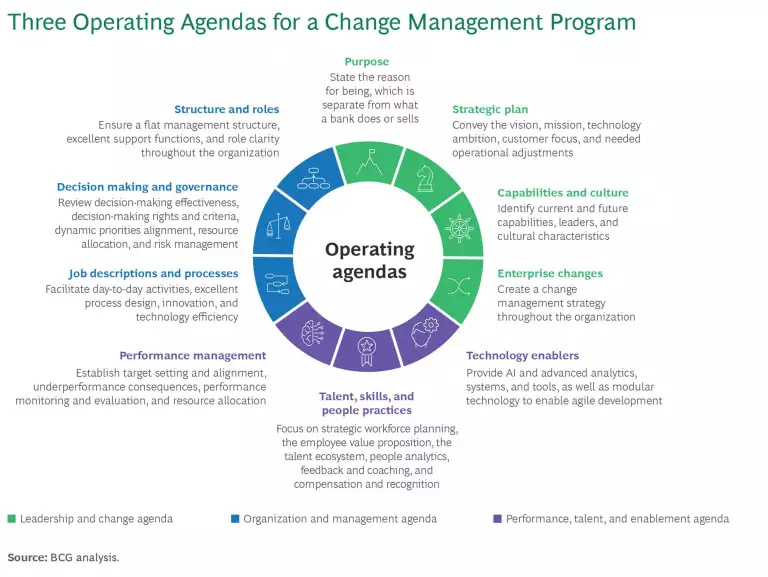

After determining the measurable targets, CFOs need to create a comprehensive change management program to develop a performance-oriented culture. Such programs are based on three operating agendas. (See the exhibit.)

A Leadership and Change Agenda. CFOs need to win the support of their bank’s leaders and work with them to create a leadership and change agenda that demonstrates a clear commitment to the transformation. The agenda should begin with a clearly articulated purpose about the bank’s reason for being—which is separate from what it does or sells, as well as from its aim to achieve sustainable results.

In addition to the bank’s purpose, the agenda should have a strategic plan that includes which customers and regions the bank intends to serve and which products it will offer, along with the adjustments to be made to the current business model. The strategic plan should incorporate the current economic outlook and a go-to-market approach that allows the bank to earn the cost of capital. Furthermore, it should be aligned with the bank’s ESG strategy. The agenda should also support a view of shareholder returns that concurs with the perspective of the CFO and the bank’s investor relations team.

A successful transformation requires all senior leaders to set a good example when it comes to actively supporting the change management program and managing costs effectively. In addition, the senior leaders’ teams must ensure that the bank’s business units have all of the capabilities they need to maximize their performance.

An Organization and Management Agenda. CFOs should enlist senior leaders to help prepare their bank for change by crafting and promoting an organization and management agenda that covers the necessary adjustments to the day-to-day business. For example, the agenda should include the alterations to the organization structure and to certain roles in order to establish who is accountable for managing the performance strategy. CFOs should review functions’ decision-making and governance practices with function managers to ensure that they understand the performance targets.

Inevitably, there are changes to job descriptions and processes to foster performance-oriented behavior. The CFO’s team needs to develop the formulas and structures for managing data, measuring performance, and allocating cost and capital budgets. It may be necessary to adjust existing planning and budgeting processes to improve both efficiency and alignment among different departments and groups.

At a time when business outlooks and capital costs can change rapidly, a bank needs efficient processes that make it possible to adapt quickly.

At a time when business outlooks and capital costs can change rapidly, a bank needs to have efficient processes that make it possible to adapt quickly when needed. For example, it may be important to incorporate sudden changes to a key region’s economic outlook into both short-term forecasts and longer-term strategic plans. A bank can enhance its ability to adapt to change by performing dynamic scenario analysis using standardized data and AI processes.

Furthermore, it may be necessary to make changes to the operating model of the finance department itself to ensure that it acts as a true business partner to the front office. The finance department’s analytical capabilities must be embedded into all of these functions in order to best support their goals. The financial reporting structure must factor in the needs of the front office, including its product and client responsibilities.

A Performance, Talent, and Enablement Agenda. The performance, talent, and enablement agenda should establish prerequisites for the organization to become performance oriented. The bank can improve performance, for example, by adopting zero-based budgeting methodologies that factor in all costs as well as existing client margins. Cost structures should be based on best-in-class industry standards.

At the same time, CFOs must be very clear that all employees are responsible for adhering to cost budgets and achieving savings targets. Transparency is key. Employees must understand how their bank evaluates achievements and goals, as well as how it sets the incentives and the consequences for underperforming. The right incentives need to be in place to make performance management an obligation on the part of all employees, while also rewarding behavior that adds value.

CFOs also need to ensure that their bank invests time and money in strategic workforce planning so that the bank can acquire and develop the talent and skills that are essential to developing a performance-oriented culture. The bank also needs to support the employees’ efforts to meet performance targets. State-of-the-art IT tools, data sources, and data storage facilities will be essential to the day-to-day operations. Furthermore, the employees need to be equipped with up-to-date knowledge of data management and analysis skills, as well regulatory, ESG, and accounting knowledge, so that they can serve as ambassadors for performance-focused behavior.

When CFOs build a performance-oriented culture that is attuned to risk, they are creating long-term resilience that makes it possible for their bank to thrive in spite of rising costs and a deluge of external risks. However, adjusting performance to risks typically requires nothing short of an organizational transformation. Yet it is not merely an option. For most banks, it is a necessity in order to comply with increasing capital requirements and essential to creating value. A bank that consistently exhibits superior operational and financial performance will be attractive to investors and other stakeholders, thus bringing in additional capital and revenues that can be reinvested in technologies, tools, and talent that can continue to help fuel performance.