As we progress through the second half of this decade, corporate climate action is becoming an increasingly vexing challenge. Evidence is mounting that the tangible impacts of climate change are being felt now, and stakeholders are demanding action. As 2030 climate targets approach, companies are increasingly having to integrate their climate action into their strategic capital allocation decisions.

Unfortunately, achieving these targets is proving harder and more expensive than anticipated, partly due to rising project and capital costs in the post-COVID era. Adding to the pressure, the stakes and compliance costs are escalating. Heightened scrutiny from the ACCC and ASIC, coupled with recent legislation on Mandatory Climate-Related Financial Disclosures, requires companies to have credible plans and assess risks across a range of uncertain, and often unknowable, future scenarios. It’s getting complicated.

Shareholders have always wielded significant influence over company plans in this space. They vote directly on executive remuneration, climate strategies, corporate actions and the election of directors. Indirectly, shareholders exert even greater influence; persistent selling by large investors can pressure share prices, adding further strain on management teams and boards.

In late 2024, BCG surveyed Australian ESG and responsible investment specialists at firms managing a combined $11 trillion in assets. The goal was simple: understand what they truly value.

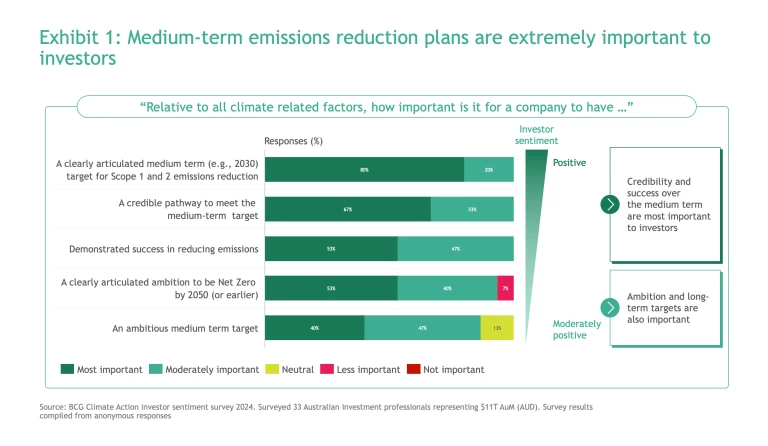

Credible Medium-Term Targets and Actions Are Paramount

Investors overwhelmingly emphasised the importance of credible, well-articulated medium-term (2030) emission reduction targets. These targets must be realistic and are increasingly judged by a demonstrated track record of success. See Exhibit 1.

Subscribe to our Climate Change and Sustainability E-Alert.

This need for credibility is reinforced by increasing efforts from regulators. With superannuation funds and fund managers coming under increasing scrutiny in their own organisations, it is no surprise that they are applying the same lens to portfolio companies.

Problematically, many companies are finding that their original plans to meet 2030 targets are coming up against the hard realities of project approvals, higher costs of capital, supply chain constraints and technical delays. Investors want to see climate action, but they want that action to be commercially feasible. This is not always possible. The only way through requires continued visible effort, some measure of flexibility and an honest conversation with investors.

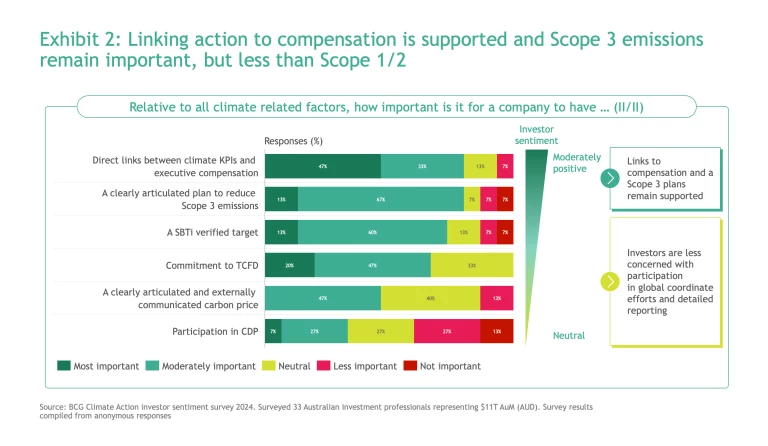

Companies Should Link Longer-Term Goals and KPIs to Controllable Outcomes

Of the investors we surveyed, 80% believe that directly linking climate action to compensation is important. See Exhibit 2.

This group also believes that it is important to expand targets to include Scope 3 emissions. For our clients, we advise that both of these activities should be directly tied to the practical realities of the business. KPIs and Scope 3 targets are most relevant when the activities are within the control of the company. For example, executives do not have a direct ability to control the activities of related parties where their company owns a minority interest.

Investors still appreciate participation in global initiatives like the SBTi and TCFD. However, support for these efforts is not universal. The takeaway is clear: while long-term and global goals are valuable, they should not overshadow immediate, actionable and measurable efforts within the company’s direct control.

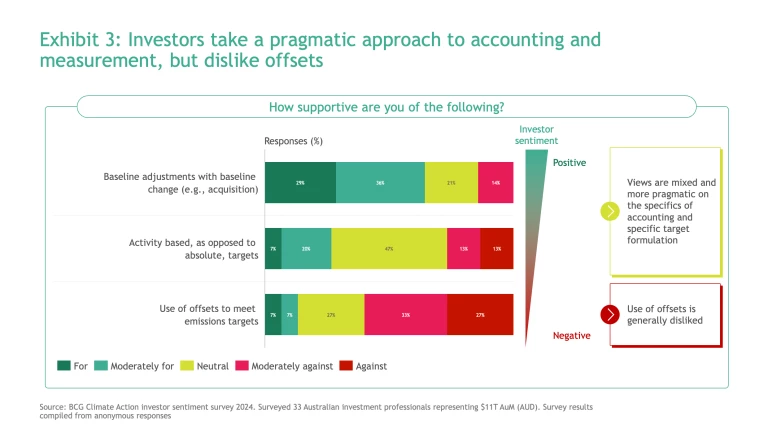

Baselining, Intensity-Based Targets and Offsetting Are Worthy of Debate

In the actual execution of baseline and target setting, investors seem to broadly understand the need for adjustments to baselines in response to material changes in business structures, such as acquisitions or divestments. Investors are also reasonably supportive of intensity-based targets; especially when companies have strong volume growth aspirations, and when associated with interim targets.

However, there is substantial scepticism about the reliance on offsets to meet targets. This mirrors public discourse and aligns with many of the conversations we’ve had with corporate leaders and market participants. See Exhibit 3.

We believe that offsetting warrants robust debate. Offsetting is far from perfect – it can delay direct, on-site action. And no offset project can perfectly guarantee permanent removal of greenhouse gases. Yet, there is broad consensus that achieving net zero will require significant investment in both nature-based and engineered carbon removals. The purchase and retirement of offsets are vital to funding and sustaining these projects.

At BCG, alongside delivering our ambitious SBTi-validated carbon reduction targets, we purchase high-quality carbon credits to support nature-based solutions and pioneering technologies like direct air capture and storage. This helps us to meet our own commitments and provides capital to scale new technologies to combat climate change.

Additionally, recent progress under Article 6 of the Paris Agreement, which establishes mechanisms for global carbon trading, signals a strong international commitment to using tradeable carbon credits to meet reduction targets for heavy emitters.

The challenge ahead lies in ensuring that the quality, reliability, financial viability and scale of these activities grows over time. We encourage investors and corporates to participate in these efforts rather than disengage entirely. In Australia specifically, the use of Australian Carbon Credit Units (ACCUs) which are certified by the Clean Energy Regulator is a strong starting point for ensuring offset projects have genuine activities assured by credible third parties.

Our Advice to Australian Companies

- Ensure your medium-term targets are realistic

Ambitious near and medium-term targets that fail to materialise can cause significant reputational and regulatory problems across all stakeholder groups. - Link your targets to controllable and material activities

Focus on actions tied to your business. Heavy emitters should prioritise Scope 1 emissions, followed by Scope 2 emissions. Companies managing extensive supply chains (e.g. Walmart or Amazon) may choose to prioritise Scope 3 emissions. - Focus on the real goal: slowing climate change

Be transparent with shareholders; let them know that when circumstances change, plans may also need to change. Addressing climate change is proving to be far messier in practice than in theory. If your company demonstrates it is part of the solution rather than the problem, you will be well-positioned to secure support from regulators, customers and capital markets.