At a Glance

The European automotive aftermarket is supported by a large vehicle parc and demonstrates strong resilience to short-term fluctuations. However, digitalization is rapidly transforming industry dynamics. Traditional purchasing methods are being replaced by eCommerce and digital platforms—a trend that is set to continue, fundamentally reshaping how workshops and consumers procure aftermarket products.

Online channels with transparent pricing are drawing a growing number of B2B and B2C customers. Simultaneously, an aging vehicle parc is driving demand among DIY customers for affordable, quality parts, a need that independent channels are increasingly fulfilling. Online parts retailers such as AUTODOC, Kfzteile24, and Oscaro, alongside established general online retailers like Amazon and eBay, are disrupting traditional business models by offering lower prices and simultaneously addressing various stages of the value chain. While this shift often results in longer delivery times compared to conventional wholesale models, both workshops and end customers are adapting their purchasing behavior accordingly.

To assess these developments, this study draws on insights from more than 40 independent experts and approximately 50 secondary sources and industry reports. As the market evolves, businesses must embrace digitalization and adapt to shifting customer expectations to maintain their competitive edge.

The Market Environment: Authorized and Independent Aftermarket

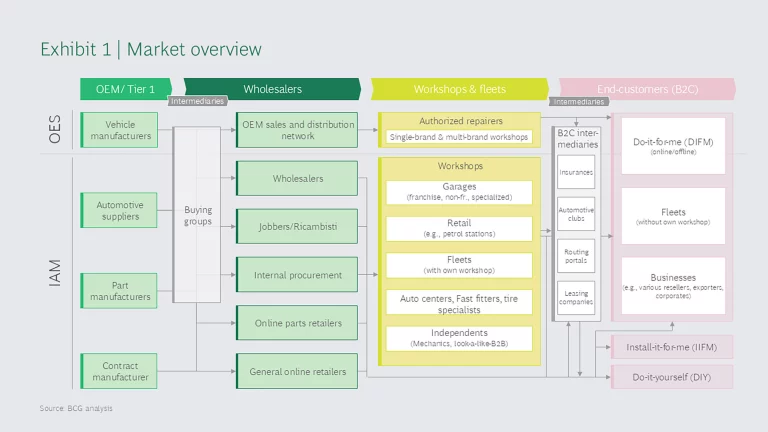

The automotive aftermarket functions through two main channels: authorized repairers (AR) and the independent aftermarket (IAM). This study focuses on the IAM, which serves three distinct types of end customers—Do-it-for-me (DIFM), Install-it-for-me (IIFM), and Do-it-yourself (DIY). Each group has specific purchasing and service channels. DIFM customers, along with businesses and fleets without in-house workshops, typically purchase both parts and services through local workshops. DIY customers, by contrast, buy parts from online platforms or retail stores and handle installation themselves. IIFM customers buy parts online or through retailers but depend on local workshops for installation services.

In the IAM, a diverse set of players cater to end customers, including workshops and retailers. These include franchised, non-franchised, and specialized garages, as well as auto centers, fast fitters, and tire specialists. The group further encompasses retailers, such as petrol stations, and independents, mechanics who are trained and largely operate without affiliation to a specific workshop. At the core of the IAM value chain are wholesalers, which purchase parts from suppliers of parts and physically deliver parts to both retailers and directly to workshops. Retailers include both physical brick-and-mortar and online parts retailers (such as AUTODOC, Kfzteile24 and Oscaro), which in turn resell parts to customers (normally DIY and IIFM).

12 Trends Will Transform the Aftermarket Until 2035

Macroeconomics & Regulation: The vehicle fleet is aging and growing slowly, while regulations continue to support independent repair access and sustainability gains importance.

Technology & Electric Vehicles: The rise of BEVs reduces frequency of maintenance needs but increases complexity and adds new components, while ADAS lowers accident-related repairs while boosting demand for sensors.

Customer Behavior & Ownership: DIY repairs remain popular, fleet operators gain influence, and insurers steer repairs through digital platforms.

Value Chain & Business Models: eCommerce and private-label parts are expanding, while OEMs push deeper into the independent aftermarket.

The European Aftermarket Shows Resilience and Reaches a Volume of €202B in 2035

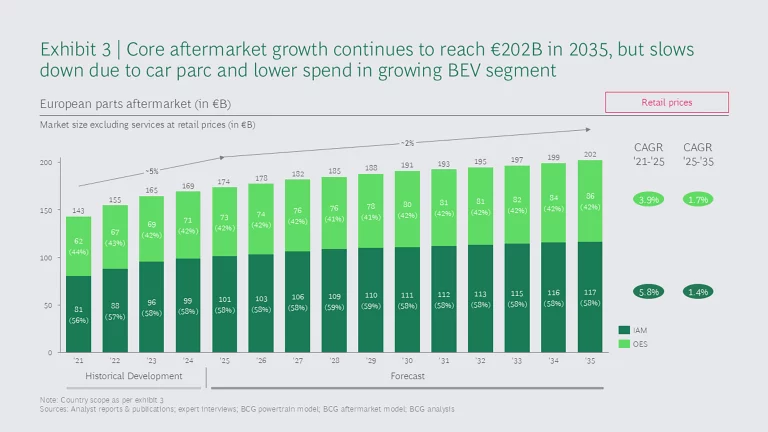

The independent aftermarket (IAM) is projected to grow to approximately €117 billion within a total aftermarket value of €202 billion. However, overall aftermarket growth is expected to slow after 2025 due to slower growth in the car parc and effects from the EV transition.

The authorized repairers (AR) channel will experience steady growth at a compound annual growth rate (CAGR) of 1.7% from 2025 to 2035. This growth is driven by strong ties between manufacturers, restraints embedded through software and demand for specialized components such as body parts, electrical systems, and BEV-related components. Meanwhile, the IAM will continue to expand but at a slightly slower pace (CAGR of 1.4%) over the same period. (see Exhibit 3)

A key factor influencing aftermarket volume growth is the age distribution of the vehicle parc. Vehicles between 4 and 8 years old exhibit the highest per-vehicle spending across both the IAM and AR channels, while vehicles older than 16 years generate about half that amount. However, spending patterns vary significantly between the two channels. IAM spending is highest for vehicles aged 12 to 16 years, and even vehicles older than 16 continue to contribute a substantial share. As a result, aging significantly drives long-term growth of the IAM.

Subscribe to our Automotive Industry E-Alert.

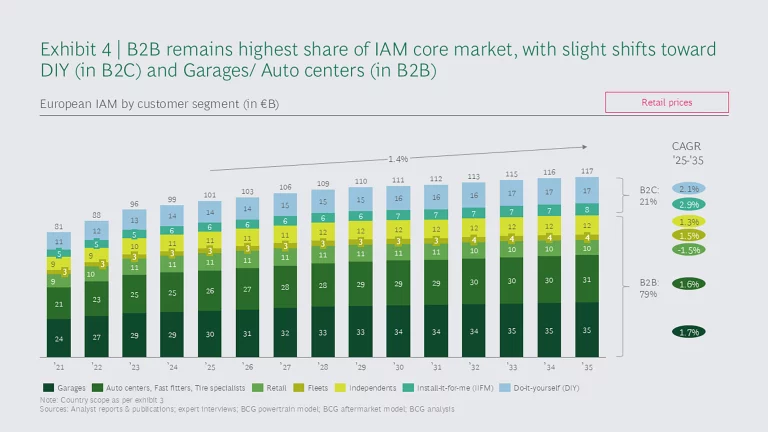

Customer Segments: B2B Still Most Significant, With B2C Increasing

The total independent aftermarket (IAM) is expected to reach ~€117B by 2035, with the B2C segment making up 21% of the total market. End consumers are gradually shifting their purchasing behavior, with cost considerations playing a key role in this change. In a challenging macroeconomic environment, more customers are moving away from traditional Do-it-for-me (DIFM) services at garages and opting for Install-it-for-me (IIFM) or Do-it-yourself (DIY) solutions. Accordingly, the DIY segment reaches a volume €17B by 2035, while IIFM grows from €6B to €8B. (see Exhibit 6). The DIY growth is also related to the aging car parc, as ability and willingness to spend on services for older cars declines.

Meanwhile, the B2B segment remains the key driver of the overall IAM, reaching €92B by 2035, which equals a 79% share of the total. Within this, location-based service providers (garages, auto centers, fast fitters, tire specialists and fleets) will generate €71B (77% of B2B) of business. The remainder is split between retail (€10B) and independents (€12B).

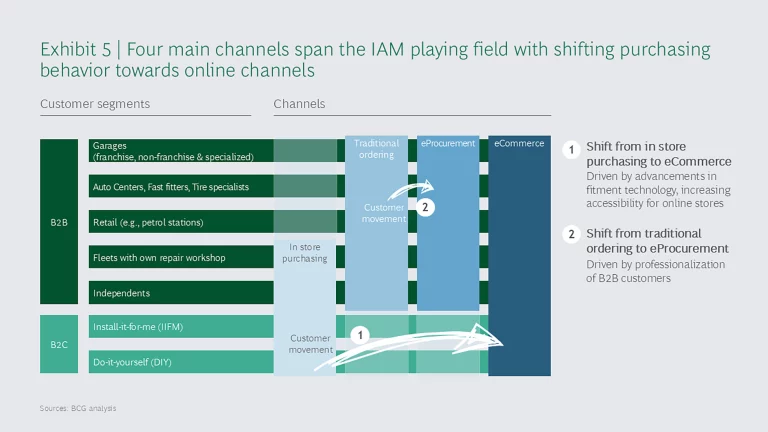

Four Distinct Channels Describe How B2B and B2C Customers Buy Parts

- In store purchasing: Physical retail stores where customers browse and buy products on-site

- Traditional ordering: Manual B2B product ordering process via phone, fax, or paper forms

- eProcurement: Digital (closed) B2B procurement systems to streamline purchasing

- eCommerce: Open online platforms for browsing, buying, and transacting products

The European automotive IAM is evolving rapidly, with digital tools and platforms reshaping purchasing behavior. Across European markets, a landslide shift from traditional ordering and in-store channels toward eProcurement and eCommerce is underway. This transformation is driven by technological advancements, increasing digital adoption, and a higher price sensitivity in both B2C and B2B segments. As adoption accelerates, businesses must embrace eCommerce and eProcurement to remain competitive in an increasingly digital landscape. (see Exhibit 7) For DIYers and IIFM customers, eCommerce penetration is expected to grow from ~30% to ~70% by 2035. Improved parts identification, seamless digital shopping experiences, and consumer preference for online convenience are fueling this trend. Omnichannel solutions, such as click-and-collect and integrated service offerings, further enhance adoption.

Workshops and fleets are undergoing a similar transition, with eProcurement replacing traditional ordering methods. Currently, 58% of workshops use eProcurement, a number projected to exceed 70% by 2035. Moreover, eCommerce platforms offer competitive pricing, broader product selection, and increasingly venture into offering integrated garage management systems. Workshops are shifting from reactive to planned ordering, leveraging predictive analytics and digital tools to optimize inventory and improve cost transparency.

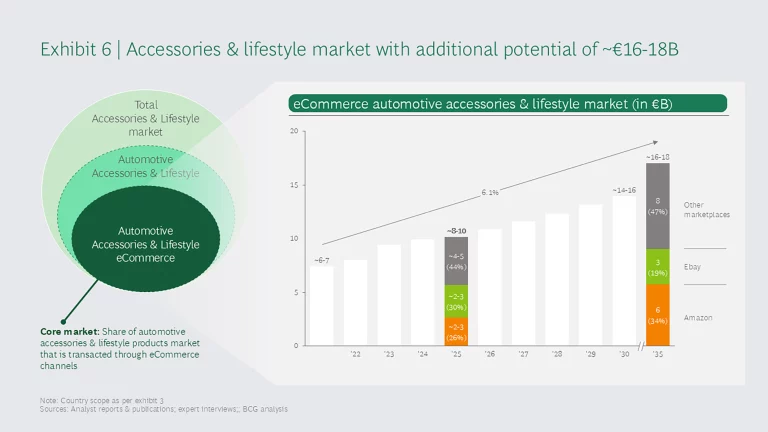

Untapped Potential: The Accessories and Lifestyle Market

Next to the core automotive parts market of €117B (IAM), we have identified the adjacent market for eCommerce auto accessories and lifestyle products - valued at approximately €16-18 billion. It specifically encompasses automotive-related accessories and lifestyle products purchased online, such as travel and adventure gear, and lifestyle products like cushions and keychains. Currently, this market is largely dominated by U.S.-based eCommerce players, with Amazon and eBay being the major two platforms. Both platforms benefit from extensive supplier networks and marketplace models, offering a vast assortment of products combined with logistics advantages like Prime shipping.

The customer base for automotive accessories and lifestyle products differs from the traditional auto parts market, creating potential opportunities for aftermarket players and new entrants. As traditional market boundaries blur, automotive parts businesses are increasingly expanding into adjacent segments. Leveraging their existing customer base, they can use core car parts as anchor products to drive additional sales. From the other end, accessories serve as an entry point for new customers who may not have initially considered purchasing auto parts, thereby expanding overall market potential.