Family offices (FOs) and private principal investors (PPIs) are unique powerhouses in the global economy. Representing trillions of dollars in assets, they stand out in the investment world for their long-term (patient) capital and a mix of financial and family-specific nonfinancial objectives. Over the last several months, we have spoken with senior leaders at dozens of FOs and PPIs worldwide to glean insights into how they are navigating an increasingly complex business environment. These conversations revealed one opportunity and highlighted two challenges.

More than ever, the world needs patient capital to power the ongoing digital and AI revolution, deal with climate change, and address other long-term issues. Additionally, some private-capital general partners (GPs) are facing difficulties raising funds, creating the potential for alliances. To capitalize on this opportunity, FOs and PPIs must address the first of two challenges, a comprehensive review of the business model that includes converging on the family’s purpose and objectives, structuring the organization accordingly, setting the right level of governance, and defining dividend and other policies. The second, more recent, challenge is how to operate in the current investment landscape, which is characterized by more volatility and uncertainty, greater risks, higher interest rates, technological change, and a rapidly adapting private-capital industry.

To respond, FOs and PPIs must consider all aspects of their strategy and operations. That means reconfirming their purpose; reviewing their investment strategy, including the organization’s positioning as a limited partnership or direct investor; reviewing the investment portfolio; putting the right operating model and talent in place; and building scale, potentially through partnerships.

A Powerhouse in the Global Economy

FOs and PPIs vary significantly by size, history (number of generations since their creation), objectives, organization, involvement of family members, asset class allocation, sources of capital, and level of intervention in portfolio companies. Nonetheless, they share several characteristics that make them a force in the global economy.

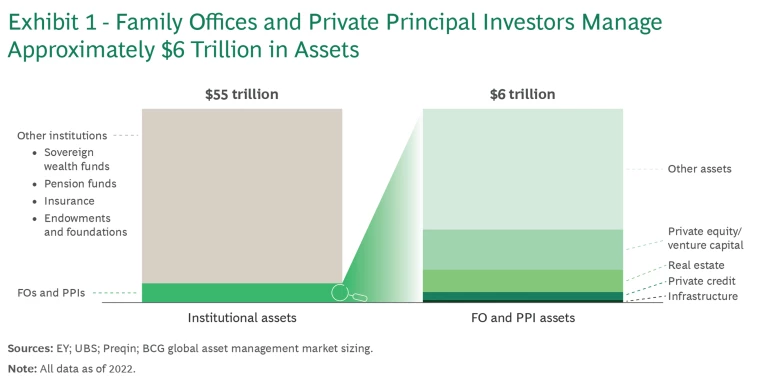

Financial Firepower. Collectively, FOs and PPIs control more than $6 trillion in capital, representing about 10% of all private markets. (See Exhibit 1.)

Access to Family-Owned Businesses. Because many FOs and PPIs retain a connection to the entrepreneurial ecosystem, they can often source deals that other investors may not know about. Family-owned businesses represent an enormous cross-section of the economy, with approximately $8 trillion in annual revenue worldwide.

Patient Capital. FOs and PPIs can make long-term bets. For example, they can fund emerging technologies that require significant capex but generate limited returns in the short term. They can stay the course over long investment cycles—required in industries such as health care and deep-tech R&D—and patiently wait for the right time to sell or acquire companies or assets. Thus, they can capture opportunities that players with shorter investment timelines cannot. As a senior executive at a European FO observed, “We think in generations. This long-term perspective gives us resilience, particularly in times of economic uncertainty, as we’re not driven by short-term market pressures.”

A Commitment to Having a Positive Impact. Because of their ownership, FOs and PPIs can balance their objectives for impact and financial returns. Some do this by establishing philanthropic foundations regularly funded by dividends or capital gains from portfolio companies. Others select investments strictly in line with their impact goals or provide blended finance or catalytic capital to mission-oriented companies that align with their values.

Stay ahead with BCG insights on principal investors and private equity

The Opportunity: The Growing Need for Patient Capital

In the new reality, addressing large-scale issues will require massive amounts of capital, often with longer time horizons than many institutional investors can abide. For example:

- The ongoing AI revolution, including generative AI, will require heavy investment in new technologies, data, and infrastructure, along with enterprise-level transformations at companies.

- Addressing climate change—including measures to slow atmospheric warming and adapt to increased risks—will require massive investments, most of which remain unplanned at this time. A BCG analysis found that the funding gap between current sustainability commitments and the overall need to stay on track with net zero goals by 2030 amounts to roughly $18 trillion.

- Reorganizing industrial footprints and global supply chains to reflect decoupling and deglobalization will be extremely capital-intensive.

FOs and PPIs can invest over the long term in initiatives that reflect their purpose, objectives, and values.

FOs and PPIs are well positioned to capture these opportunities. They have the financial firepower and can invest over the long term in initiatives that reflect their purpose, objectives, and values. As a senior leader at a US PPI told us, “Companies appreciate [that] we are not a buyout general partner. We can tailor what they need—for example, the mix between equity and debt.”

In addition, FOs and PPIs can consider partnering with private-capital GPs to diversify the investment portfolio and create alliances with complementary capabilities. This is particularly relevant given that GPs may more easily attract and retain talent, and many have vast networks of experts at their disposal. One PPI, for example, signed a partnership with a large GP, both to create co-investing opportunities and to draw on operating partner resources as needed. When the Covid pandemic hit and pricing became a key issue in one of the PPI’s portfolio companies, it was able to tap into the GP’s team of operating partners to address it rapidly.

The First Challenge: A Comprehensive Review of the Business Model

To take advantage of these opportunities, FOs and PPIs must address some fundamental issues—particularly when they form an investment structure, anticipate a transition to the next generation, or face internal conflict (for example, among family members who disagree about the organization’s direction).

Purpose and Financial Objectives. Many FOs and PPIs have a clearly stated purpose, but others do not. All the leaders we spoke with agreed that this is essential because it will provide a compass for navigating the new environment and potential future crises, both internal and external.

The company’s purpose should be rooted in the family's heritage, culture, and unique viewpoint. This varies across families, from serving a cause to ensuring entrepreneurial opportunities for subsequent generations. Financial objectives may emphasize preserving wealth, growing wealth, or meeting the cash flow needs of family members. For example, a European PPI leader explained: “We anchor the family on realistic returns while aligning our investments with our long-term vision. It’s not just about financial returns but also about how our portfolio reflects the values and purpose of the family.” Regularly reviewing the portfolio of companies, investments at large, and the operating model to ensure alignment with the company’s purpose is essential.

Family Charter. FOs and PPIs also need to determine the rights and privileges of family members, the governance structure for shareholders (such as a family council that establishes membership and voting rights and resolves disputes), and future ownership plans. An FO stakeholder we spoke with agreed: “Clarity in the role of each family member is essential. Each family member must understand their role—beneficial owner, shareholder, board member, or manager—to ensure alignment with our long-term purpose and financial goals.”

Structure and Governance. Finally, FOs and PPIs need to set the right overarching legal structure, including the linkages among family holdings, investment arms, and the underlying portfolio companies—each requiring its own governance, with clear roles for family members, succession planning for the chair, and policies regarding dividends and voting rights and employment in portfolio companies.

The Second Challenge: Adapting to the New Reality

In today’s more volatile and uncertain environment, inflation, interest rates, geopolitical tensions, and other factors are complicating investment decisions and affecting the performance of current positions. (See Exhibit 2.)

The investment industry at large is moving fast to take into account this new reality: asset owners and asset managers (including alternative asset managers) are shifting their mix of asset classes, their risk appetite, and their investment thesis in each asset class. For example, the current interest rate regime is pushing many leveraged buyout funds to move from a primarily financial play to a wider range of value creation strategies, including business transformation as a key lever.

How to Thrive in the New Reality

Most of the leaders at FOs and PPIs we interviewed concur: to capture the opportunities and address the challenges of the new investment landscape, they will need to change. They can start by taking five key steps.

Treat purpose as a compass. Rightly defined, purpose can inform the often tough decisions that must be made during a strategic reorientation or smaller-scale operational pivots. For example, the head of a European FO said, "A big part of our relationships is that they span two or four generations. That is a relationship that works. Trust builds over time. Our focus is to build intergenerational relationships with our stakeholders."

Review the investment strategy, including positioning as a limited partner or direct investor. The value creation models of FOs and PPIs show a range of control over investments. There are several main options: hands-on management, majority control, co-investor or minority stake, and asset allocator. The choice should reflect the investment thesis, capabilities, and scale of the FO or PPI. A business leader at a Middle Eastern FO explained: “The family has realized that value creation today requires being much more hands-on. We’re shifting to a model where we go beyond passive investments to play a crucial role in transforming and growing the businesses we own.”

Review the investment portfolio and make explicit keep-or-sell decisions. All the shifts we have described require FOs and PPIs to assess their investment portfolio and understand where they may be exposed to growing risks or missed opportunities. As one PPI leader told us, “Nothing is off the table when it comes to adjusting the portfolio strategy.” That includes direct versus indirect investing, equity versus debt, private versus public markets, majority versus minority stakes, expansion into new sectors and geographic markets (and divestment from others), and investment in portfolio companies of various maturity levels, from venture-stage startups to well-established firms.

To capture the opportunities and address the challenges of the new investment landscape, FOs and PPIs will need to change.

This review should be conducted on a regular basis and include a “no taboo” assessment of the portfolio. In our experience, many FOs and PPIs tend to retain investments through inertia. Many also tend to concentrate their risk in a specific industry or geographic market, often because a legacy family business represents the lion’s share of the family assets. “After reviewing our strategy, we always ask ourselves if what we’re pursuing is still valid or if we need to change our attitude toward our investments,” the leader of another PPI told us. An FO leader agreed: “We’re actively managing the portfolio with a focus on diversification. We’ve moved beyond just holding assets to regularly assessing which sectors and markets offer the best opportunities for growth.”

Put the right operating model and talent in place. Traditionally, many FOs and PPIs have been quite lean, especially compared with the GPs operating in the same ecosystem. That approach has worked well in the past. Today, GPs are gaining scale and reinforcing their capabilities—for example, by building larger teams of operating partners. Accordingly, FOs and PPIs should question their operating model, organization, HR function, and talent acquisition capabilities in line with their investment strategy.

FOs and PPIs are at a fork in the road. They can decide to be limited partners—with an asset allocation role and minimal input provided to their GP suppliers—and remain very lean. Or they can be direct investors, in which case many will need to professionalize their organization with a new set of investing and operating capabilities built through internal and external talent. “To be successful in the current environment, you need more skills and talent than a decade ago,” said a senior executive at an FO. “The key is to build ecosystems with senior advisors and talents to extract more value from portfolio companies.”

Build scale, potentially through partnerships. The investment industry is now highly sensitive to scale in specific asset classes and sometimes in specific markets. For FOs and PPIs, this often adds to the need to diversify investments. Our interviews suggest various models:

- As a limited partner, allocating capital to investors that are at scale

- Co-investing alongside like-minded investors, such as other family-owned investors or third-party GPs, or bringing other family investors in as co-investors

- Exploring broader partnerships with other families or GPs (an option being considered by the majority of the leaders we interviewed)

The investment landscape is changing rapidly, and FOs and PPIs must adapt to keep pace. They face real challenges in their internal operations and their response to a more volatile business environment. However, they also have a clear opportunity to use their unique advantages in ways that lead to sustainable success. By taking the steps outlined above, FOs and PPIs can continue to generate strong financial returns and create meaningful impact while staying true to the core values that differentiate them.