For the CEO

Tumultuous times forge formidable leaders—or those who are soon forgotten. As CEOs ponder their agenda for 2025, there are forces at play that promise to fundamentally reshape the global business landscape. How leaders navigate these evolving conditions may well determine whether their companies falter or thrive in the months and years ahead.

Informed by proprietary research and over a thousand conversations with leaders, BCG has identified five dynamics that will test the mettle and ingenuity of CEOs across industries and regions—from trade and AI to growth and climate imperatives, to maintaining a positive workplace culture in a changing political and social environment.

CEOs who master these dynamics are more likely to gain greater clarity on what lies ahead and free up valuable resources to drive growth—helping them mitigate the ever-increasing array of risks more successfully and seize emerging opportunities before their competitors.

Dynamic #1: Tariffs, Competitiveness, and the Rise of the Global South

This much seems clear about global trade in 2025: tariffs are likely to rise in many markets. What’s unclear is how high those tariffs will be and how quickly and broadly they’ll be implemented. The answer will have implications for company supply chains, market access, and costs.

US President-elect Donald Trump made tariff hikes a key promise on the campaign trail and in the run-up to his inauguration. If new levies are forthcoming, countries on the receiving end will likely respond in kind, further recontouring an international business landscape in which economic statecraft is enjoying a resurgence.

CEOs can prepare for this by developing capabilities that give them a clear understanding how their business and investment strategies would be impacted under different trade scenarios. Those that gain insights quickly are more likely to preserve market share and capture emerging opportunities before their competitors.

CEOs should develop capabilities that give them a clear understanding how their business and investment strategies would be impacted under different trade scenarios.

One key question CEOs are grappling with is whether tariff hikes will arrive en masse or be phased in gradually and target specific sectors.

“A pragmatic approach would give companies time to adjust their manufacturing and global sourcing footprints, keeping the inflationary impact contained,” says Aparna Bharadwaj, a BCG managing director and partner who leads the firm’s Global Advantage practice. “Policy changes at the extreme end of the spectrum, however, could lead to a significant contraction in trade, freeze global supply chains, and drive-up costs.”

Under a baseline scenario that assumes no new tariffs, BCG estimates the value of annual US–China trade would contract by $159 billion by 2033. But an aggressive scenario in which the US imposes 60% tariffs on all goods imported from China and 20% on imports from the rest of the world would see US–China trade contract by a further 27%. Retaliatory actions by trade partners could further amplify the magnitude of these shifts, heightening the risk of trade wars and potentially pushing exporters who are shut out of big markets to flood those that remain open to them with goods—triggering yet more protectionist measures.

Companies and countries that fail to consider how these scenarios could impact their businesses are more likely to struggle to fill production gaps, possibly compromising market share. And tariffs are not the only tools that could alter the business landscape. Many business leaders expect policy shifts under the incoming Trump administration to supercharge the US economy, raising the competitive stakes and injecting new considerations into how CEOs—especially those in Europe—allocate investments geographically.

A related outgrowth of these changing dynamics is the rising power of the Global South—a group of 133 low- and middle-income countries, not including China, whose economies account for 18% of global GDP, 62% of the world’s population, and most of the world’s fastest-growing markets, including India , Southeast Asia, and Africa.

Global South nations are ‘swing states’ that everyone wants to do business with. The competitive battles for access will be intense. — Aparna Bharadwaj

Many Global South nations are moving up the industrial ladder from commodities to sophisticated manufactured goods. And they’re trading more with each other, easing their dependence on Western markets. Crucially, most of them are unaligned, leaving them well-positioned to benefit from shifting global trade patterns.

“These are ‘swing states’ that everyone wants to do business with,” Bharadwaj says. “The competitive battles for access will be intense.”

CEO Action Items:

- Invest in intelligence. Establish the capabilities and systems to track trade policy, regulatory changes, and geopolitical developments and to assess the potential vulnerabilities and opportunities they create.

- Build scenario-based decision making. In a fast-evolving, unpredictable global environment, supply chains can be both a source of competitive advantage and risk. Build robust, flexible strategies to adapt to multiple possible policy outcomes.

- Focus on the long game. Prioritize sustainable growth in rising markets with limited geopolitical constraints, including those within the Global South, while maintaining resilience in established markets.

Dynamic #2: Crunch Time for Scaling AI and GenAI

Two years on from ChatGPT’s world-storming debut, AI and GenAI still hold a commanding position on the CEO agenda , with 75% of executives surveyed by BCG listing it as a top-three strategic priority for 2025.

But with three out of four executives saying they have yet to realize tangible value from their AI and GenAI investments, the AI impact gap is widening. It’s crunch time for the laggards to catch up and move from potential to profit.

“Today you have high AI potential and a significant level of investment, but not a lot of value being unlocked,” says Nicolas de Bellefonds, a BCG managing director and senior partner and global leader of the firm’s work in AI tech and software. “Meaningful AI value will only be realized if CEOs get personally involved, because only they can align the AI agenda to the broader enterprise agenda.”

BCG has found, for example, that most companies are spreading their AI resources too thin by chasing too many initiatives—sometimes hundreds. “This fragments resources and you never reach a critical mass of impact,” says de Bellefonds.

De Bellefonds advises CEOs to concentrate on a handful of high-value initiatives—reshaping critical functions to drive efficiencies and inventing new products and services to build long-term competitive advantage. Companies that take this approach scale 2.3 times more AI products across the enterprise and achieve a higher ROI. (See Exhibit 1.)

It is also imperative that CEOs lead the cultural and organizational change to make AI transformations successful—including by learning about technology and using it themselves.

“AI dramatically changes how people work,” says de Bellefonds. “It is fundamentally a people transformation, which means changing behaviors and the culture across the organization.”

De Bellefonds advises CEOs follow the 10-20-70 principal: put 10% of their resources into algorithms, 20% into tech and data, and 70% into people and processes.

Finally, CEOs need to prepare for evolving AI opportunities and risks. Some 67% of executives BCG surveyed are considering autonomous agents—AI that has learned to use tools to accomplish a given task—as part of their AI transformation. Around 30% have already committed to having them play a central or complementary role.

CEOs operating across multiple geographies also need to plan for how shifting geopolitical dynamics could impact their AI value chains—including access to chips, talent, data, and data centers.

“Tech sovereignty and the partner ecosystem is a critical topic to start thinking about right now,” says de Bellefonds. “Some countries will want companies operating in their borders to use domestic cloud providers as well as AI hyperscalers, platforms, and models.”

CEO Action Items:

- Align the AI agenda with the enterprise’s and focus efforts. Concentrating on a few initiatives that build long-term competitive advantage and efficiencies and carving out a meaningful share of resources devoted to them can deliver higher ROI.

- Lead the people change. AI is, at its core, a people transformation. CEOs need to spearhead the cultural change to encourage employees to test and learn, and ultimately be faster and more agile when augmented by AI. CEOs can model this behavior by bolstering their own AI knowledge and getting hands-on with the technology.

- Prepare for the next value play and potential geopolitical disruptions. Early movers have already committed to having autonomous AI agents as part of their AI transformation mix. And with geopolitical tensions rising, CEO that create a more resilient partner ecosystem are less likely to have their AI efforts derailed by potential disruptions.

Dynamic #3: The Rising Cost of Climate Inaction

Devising global business strategies to reduce greenhouse-gas emissions and prepare for the consequences of a warming planet is already immensely challenging. Shifting political dynamics make it even more so.

The European Union, Japan, China, and other major economies are pressing ahead with their agendas to accelerate the green-energy transition, build scale in the associated innovation-driven industries, and achieve net zero emissions. But others—most notably the US—appear poised to roll back environmental regulations and financial incentives for renewables.

While some global companies have pulled back on public commitments made before they fully realized what it would take to fulfill them, most remain committed to building resilience and decarbonize in ways that can create value, lower costs, and meet customer expectations.

“There’s a risk that even smart, value-creating climate action could become a casualty of political polarization in some countries,” warns Wendy Woods, a BCG managing director and senior partner who is vice chair of the firm’s work in climate and sustainability and social impact. “This can make it more difficult for companies to align with their stakeholders on investments and business strategies for driving innovation and achieving their green transition.”

CEOs cannot ignore changing economics and incentives, and diverging regional policies will alter the near-term calculus for some as they decide where and how to invest for future growth. Regardless of the political climate, severe climate events and the financial risks they pose will continue to intensify.

If global warming stays on its current trajectory, extreme weather could place up to 25% of EBITDA at risk within the next 25 years.

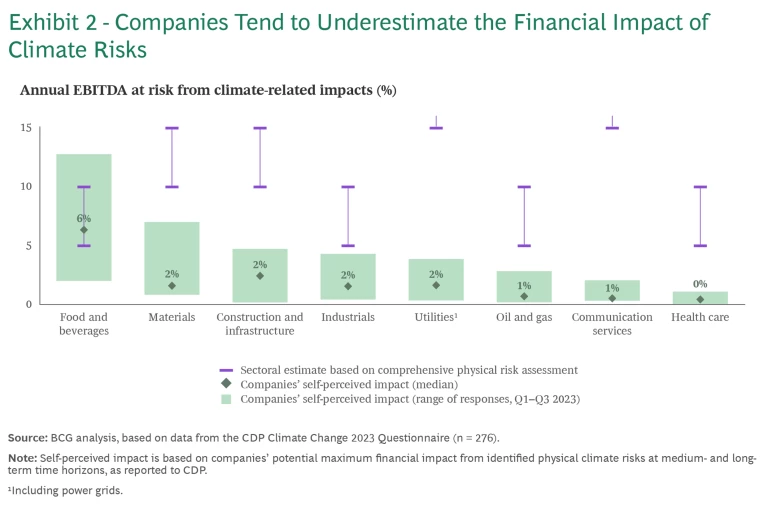

BCG and the World Economic Forum estimate that if global warming stays on its current trajectory, extreme weather could place up to 25% of EBITDA at risk within the next 25 years, especially in sectors like agriculture, utilities, construction, and communications. Asset values and market position could also erode in regions poised to ramp up carbon pricing and introduce stricter emissions regulations.

While physical and transition risks will vary depending on the region and industry, it is imperative that CEOs fully understand their current exposure—an area where many appear to be falling short.

“By our analysis, many companies are significantly underestimating the risks from climate change, especially as catastrophic floods, hurricanes, droughts, and wildfires continue to become more frequent and extreme,” says Woods.

For example, materials companies analyzed by BCG indicate that 1% to 7% of their EBITDA is at risk from climate-related events. By contrast, BCG estimates their exposure at 10% to 15% of EBITDA by 2050. (See Exhibit 2.)

CEO Action Items:

- Gain a clear, comprehensive picture of climate-related risks and the cost of inaction. Extreme weather is unpredictable. CEOs should plan for a range of climate scenarios—and assess the best course for reducing their companies’ exposure to financial risk.

- Stay focused on your customers. Many companies, governments, and policymakers remain committed to lowering emissions, and customers in these markets are likely to continue favoring suppliers that help them meet their climate targets. The upshot: companies that scale back efforts to lower large carbon footprints, especially in high-emissions sectors, risk being disadvantaged in key markets and value chains.

- Work with partners. Companies can’t always rely on consistent government support for green initiatives. Working with suppliers and industry peers, however, can help companies spread the costs and risks of major investments in emerging technologies that could be major value drivers in the future.

Dynamic #4: Powering Growth with Enduring Cost Management

CEOs who struggle to keep costs in check not only risk today’s performance, but tomorrow’s as well.

Some 67% of executives surveyed by BCG say they need to reinvest cost savings into innovation and growth. That’s not the only reason cost management continues to keep CEOs up at night, though. Among C-suite executives, 40% feel unprepared to weather a market shock in 2025—perhaps because they report achieving less than half of their cost savings targets on average. Their companies also struggle to maintain efficiencies.

Paul Goydan, a BCG managing director and senior partner and leader of its accelerated cost-advantage offering, says the problem often stems from reactive belt tightening.

“Piecemeal cost-cutting measures which are rapidly forced through an organization top-down are like a crash diet. They may lead to rapid weight loss, but the weight usually comes back,” he says. “CEOs need to approach cost management like a healthy eating plan. They need to step back and rewire their operating model to fundamentally transform their organization into a lower-cost business. They also need to stick with it for 12 to 18 months after the initial savings are achieved to make it last.”

Piecemeal cost-cutting measures which are rapidly forced through an organization top-down are like a crash diet. They may lead to rapid weight loss, but the weight usually comes back. — Paul Goydan

While cost management is a priority across industries (33% of executives list cost reduction as their most critical priority this year, an 8 percentage-point increase over last year), companies need tailored solutions to strengthen their competitiveness. For example, supply chain optimization can drive competitive advantage in consumer and industrial companies, while streamlining product portfolios can give a leg up to insurance, tech, and financial firms.

Regardless of industry, cost efficiency is unlikely to stick unless CEOs create a cost-conscious culture.

“When the entire workforce owns the cost agenda you achieve a lasting competitive edge,” says Goydan. “When management forces top-down cuts you only get short term compliance and limited impact.”

CEOs who model cost-conscious behavior and regularly communicate financial targets, gaps, initiatives, outcomes, and market trends are more likely to secure employee buy-in.

It is also important for senior leadership to have the resources and decision rights to implement cost-management measures. Governance and tracking processes, meanwhile, can increase executional certainty and provide insights to celebrate wins and share setbacks—empowering employees to give real-time feedback and imparting valuable lessons.

Finally, today’s investments in innovation lay the foundation for future efficiency. Some 86% of executives surveyed by BCG plan to invest in AI and advanced analytics for this purpose.

“AI is already making companies more efficient and increasing the pace of innovation,” says Goydan. “Leading companies in the 2030s will be the ones who are able to not only capture the efficiency gains but also leverage technology in new ways to fundamentally transform their workflows and make a step change in their performance.”

CEO Action Items:

- Prioritize productivity and efficiency through disciplined cost management rather than absorbing cost pressures or passing them on to consumers, who are already fatigued by recent inflation.

- Determine what drives cost and complexity in your own business and pursue it to strengthen competitive advantage. For example, eliminating product complexity can lower structure costs and boost profits.

- Lead the cultural change around cost management to embed a cost-conscious culture at every level of the organization as well as in profit and loss. Engage employees to take an “owner mentality” to optimize initiatives.

Dynamic #5: The Need for a Unifier in Chief

Political and social polarization does not only exist in the public arena. It can spill into the workplace, undermining cohesion and threatening company performance. But CEOs can productively step into the breach by becoming a “unifier in chief” of their organizations.

“This could be a fantastic time for CEOs to make their companies a real refuge for employees seeking a haven of productive work and a feeling of agency in an environment of collaboration, civil discourse, and psychological safety,” says Judith Wallenstein, a BCG managing director and senior partner who leads the firm’s global CEO Advisory.

Recent research by the Society for Human Resources Management and other organizations show a sharp rise in incivility in US workplaces related to political differences—and also shows that such incidents significantly impact productivity. In an August 2024 survey by Indeed and Harris Poll, 34% of workers reported that political discussions were having a negative impact on team morale; nearly 40% of millennial and Gen-Z workers said they’d leave a job if their CEO expressed political views they disagree with.

To lower the temperature of discourse and help build bridges among employes with diverse views, CEOs can monitor polarizing political and social issues that could creep into their workplace and prepare strategies for addressing them. They can also promote a culture of tolerance within their company and build a framework for deciding when and how to speak out about divisive issues in a way that aligns with their corporate values and business goals.

“Respect for others’ views and maintaining trust and cohesion should be embedded in companies’ values,” says Patrick Dupoux, a BCG managing director and senior partner and head of the firm’s Social Impact practice in Europe, the Middle East, South America, and Africa.

To mitigate the risk of polarization, many CEOs are now taking a “less is more” approach to public comments, focusing only on topics that impact their businesses or their employees’ welfare. Others try to ban political discussions in the workplace, although that’s often impractical in large organizations. Instead, CEOs can promote civil discourse and psychological support by giving employees tools and training to talk about issues that distress them in a way that fosters mutual respect.

CEO Action Items:

- Anticipate divisive issues. Identify and document emerging social, political, and geopolitical issues and their potential internal impact on your organization. Explore how various scenarios could be proactively managed.

- Align statements with the organization’s values and DNA. Senior leaders should ensure that their public positions on sensitive issues are consistent with their organization’s purpose, values, and culture, and preferably framed in terms of a business case. Promote a culture of tolerance and respect for other views.

- Take actions to promote civil discourse and conduct. Organizations can encourage civil discourse by building psychologically safe environments for employees to discuss divisive issues that distress them. They can also expand programs that help build a sense of community and contribution for their employees.

These five dynamics are not the only ones CEOs will need to navigate; industry- and region-specific dynamics will come into play as well. But with the right tools, capabilities, and mindset, leaders can master all of these forces in 2025 and beyond.