Asia-Pacific’s decades-long globalization journey has entered a new phase. Where once they primarily seized upon cost and resource advantages, companies in the region are now also expanding globally through innovation , cultural influence, and a combination of increased capital availability and risk tolerance. As geopolitical shifts and technological disruptions reshape global markets, these firms are not just adapting—they are leading.

For companies across Asia-Pacific (APAC), the message is clear: While globalization remains a no-regret move, the playbook is changing. Success will depend not just on scale and cost efficiency, but on the ability to connect with global consumers in new ways. Developing nimble operating models will be just as crucial.

For global incumbents, it’s time to tune in. These rising Asia-Pacific powerhouses aren’t just your competitors; they are also potential partners in navigating the new era of global commerce.

Leading the Pack

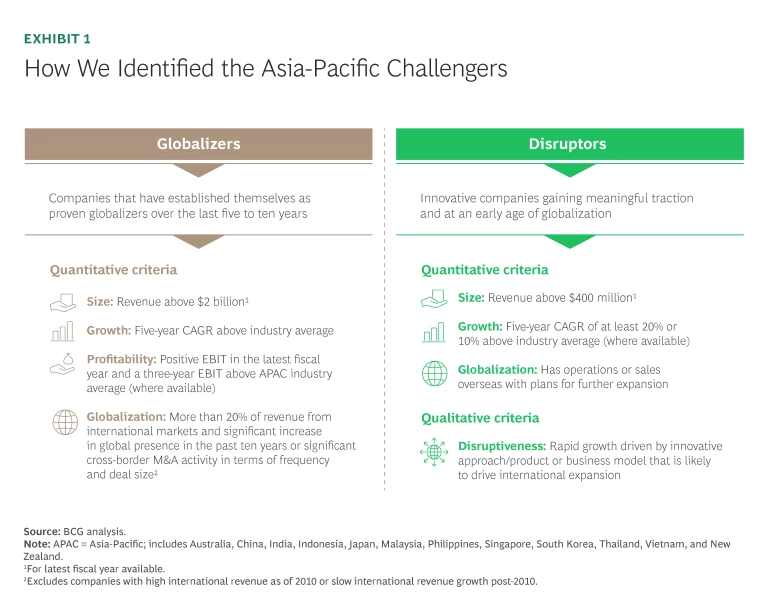

Since 2006, BCG’s Global Challengers series has regularly identified companies from emerging markets that are driving global growth. In this edition, we zoom in on the challengers from the Asia-Pacific region. They include globalizers—companies that over the past five to ten years have firmly established themselves as competitors to global incumbents. And they include disruptors—innovative companies that, while at an early stage of globalization, are showing high growth using new operating models.

The globalizers and disruptors we’ve identified have fulfilled specific quantitative and qualitative criteria to make the list. (See Exhibit 1.) For the globalizers, we looked at companies with revenue of $2 billion or more for the 2023–2024 fiscal year that generated at least 20% of their revenue from international markets. For the disruptors, we focused on companies with at least $400 million in revenue that had operations or sold products overseas and had plans for further expansion.

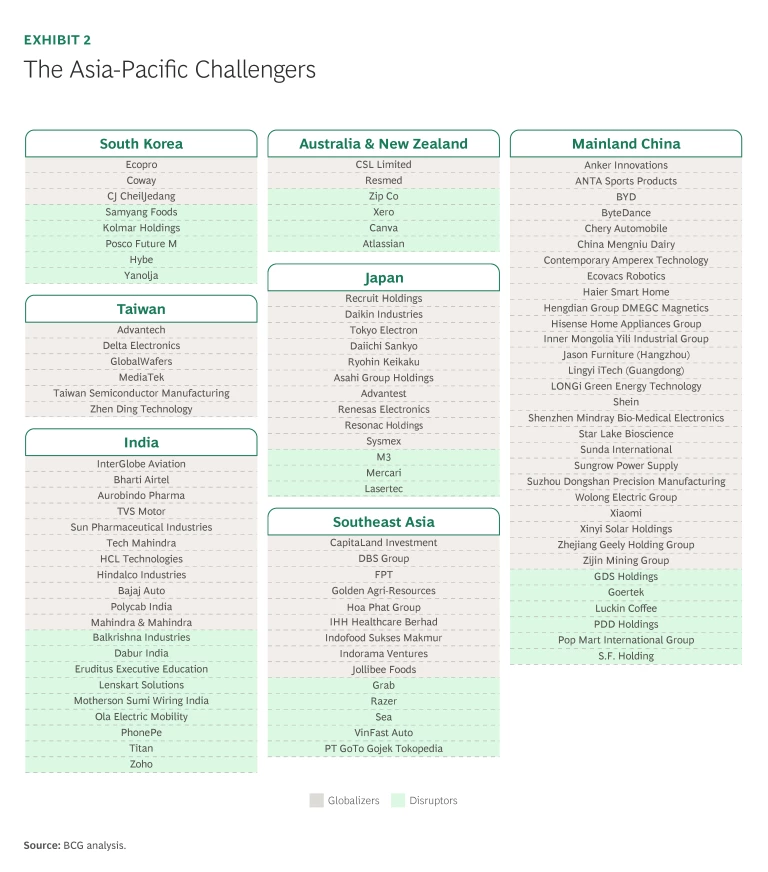

Exhibit 2 shows the full list of globalizers and disruptors. Given our focus on recent trends in Asia-Pacific, we have excluded incumbents that gained prominence during earlier stages of APAC’s globalization journey. This includes giants such as Toyota and Sony from Japan, Hyundai and LG from South Korea, Huawei and Alibaba from mainland China, and Tata and Reliance Industries from India.

The APAC Edge: Five Advantages

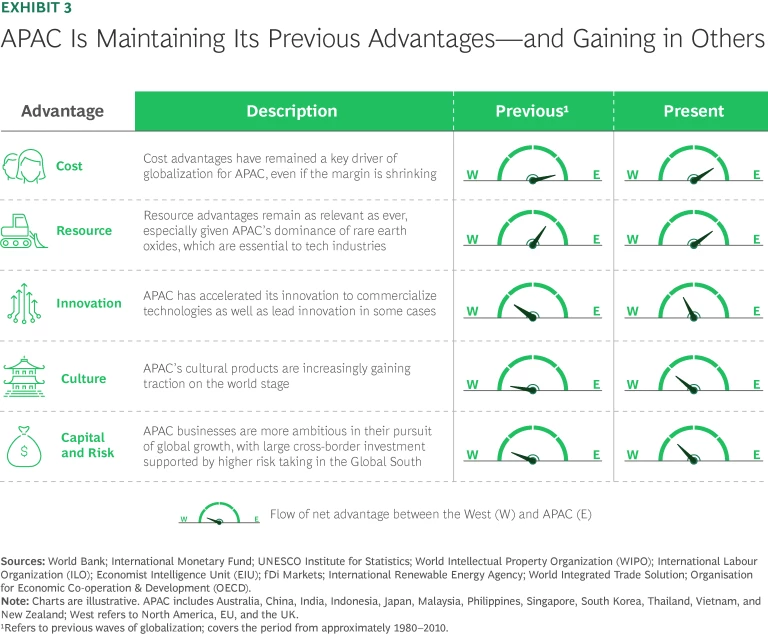

The advantages the Asia-Pacific challengers have leveraged can be divided into two categories: legacy advantages (cost and resources) and leapfrog advantages (innovation, culture, and capital and risk). The categories aren’t mutually exclusive—among challengers that have relied on legacy advantages, over 60% have also leveraged one or more leapfrog advantages.

The region continues to hold a significant advantage over the West in cost and resources, even if the magnitude of those advantages has lessened over

Legacy Advantages

Cost

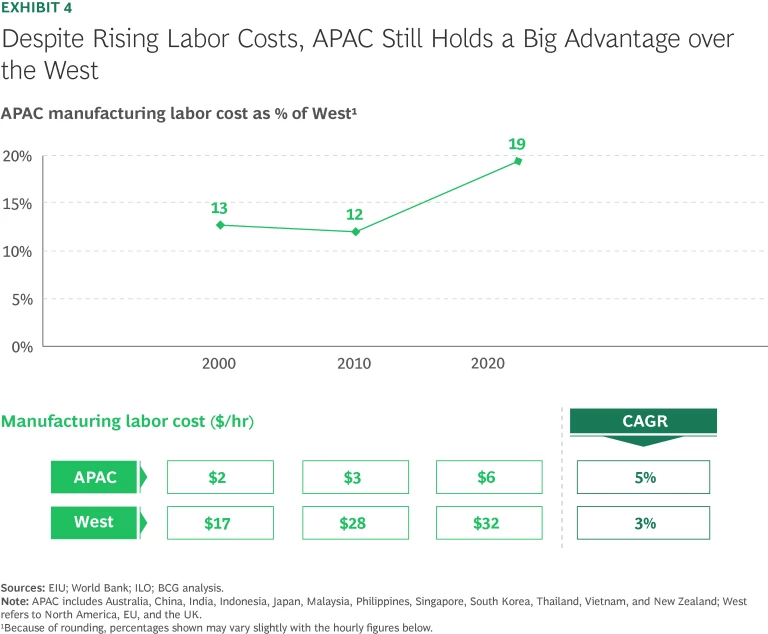

This advantage has long been the foundation of APAC’s manufacturing strength. The region accounts for over 75% of the global manufacturing labor force while maintaining labor costs about 80% lower than the West. (See Exhibit 4.) Combined with Asia-Pacific’s large domestic markets, this enables companies in the region to buy in bulk, optimize resources, and reduce expenses, making their price competitiveness difficult to match.

Let’s look at some examples.

India-based Aurobindo Pharma is leveraging its cost advantage to become one of the key suppliers of generic medicines worldwide. While most pharma companies focus on a limited product range, Aurobindo efficiently manufactures hundreds of products for multiple markets, ensuring agility in responding to global demand. As a “pharma factory to the world,” it operates in most global markets, including the US—where it supplies a significant share of prescriptions—along with Europe and many emerging economies.

Further strengthening its cost and competitive advantage, Aurobindo has invested heavily in backward integration, using a substantial portion of its own production of active pharmaceutical ingredients for captive purposes, reducing dependency on external suppliers. The company has also recently set up one of the world’s largest penicillin facilities in India, reinforcing its dominance in antibiotics production. By combining scale, supply chain excellence, and deep integration across the pharmaceutical value chain, Aurobindo has positioned itself as a cost-efficient, globally competitive player, driving growth beyond India to establish a substantial international footprint.

Mainland China-based LONGi Green Energy Technology, a leading solar manufacturer with revenues of approximately $13 billion, leverages its cost advantage to stand out globally. As the world’s largest manufacturer of monocrystalline silicon wafers, which are critical to the performance of solar panels, LONGi achieves economies of scale, driving operational efficiencies and pricing power among raw material producers. Its vertically integrated operations reduce reliance on external suppliers, ensuring better cost control across the solar photovoltaic production process.

Additionally, LONGi benefits from natural cost advantages by basing its manufacturing facilities in countries such as Malaysia and Vietnam, which have established supply chains for solar manufacturing—allowing easier access to raw materials like silicon and reducing transportation and procurement costs.

Operational efficiencies and a more technically capable workforce now complement APAC’s traditional cost supremacy, ensuring the region’s status as a global manufacturing leader.

While APAC’s cost advantage was initially built on low-value manufacturing and services, its mature value chains and experienced labor force have kept it cost-competitive. Operational efficiencies and a more technically capable workforce now complement its traditional cost supremacy, ensuring the region’s status as a global manufacturing leader even as the wage gap with the West narrows.

Looking ahead, emerging Asia-Pacific economies such as Vietnam will increasingly leverage the cost advantage to expand their manufacturing roles; however, as businesses initially drawn by cost savings recognize the region’s growing manufacturing expertise, quality products are likely to be a draw as well. Meanwhile, established players in Japan, South Korea, and China will continue refining operations to sustain their edge, reinforcing Asia-Pacific’s position as the world’s manufacturing powerhouse.

Subscribe to receive BCG insights on the most pressing issues facing international business.

Resources

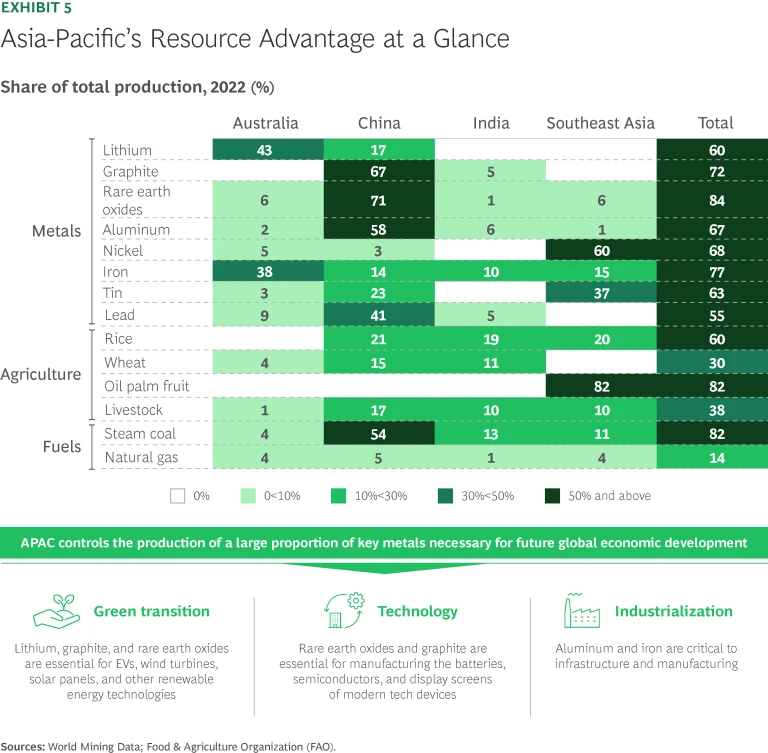

Asia-Pacific has long been a key supplier of primary goods in agriculture, minerals, and metals. The region accounted for 18% of global primary resource exports in 2020 and 52% of nonferrous metal exports in 2023. Its dominance in critical materials remains strong, with the region producing 68% of the world’s nickel, 60% of its lithium, and 84% of rare earth oxides—essential inputs for battery production and EV manufacturing amid the green transition. (See Exhibit 5.)

Beyond supplying raw materials, companies from the region are securing greater control over supply chains, particularly where scarce resources are involved. Many APAC companies have expanded investments in Africa’s agriculture and minerals sector, strengthening partnerships with key suppliers and reinforcing their competitive edge.

Golden Agri-Resources is a leading agribusiness that benefits from vertical integration. The company owns extensive agricultural assets, allowing it to build industry-leading, responsibly managed agricultural businesses that supply products globally. Golden Agri-Resources is part of Indonesia-based Sinar Mas, a diversified conglomerate, sharing a common heritage and brand with companies operating in diverse sectors including pulp and paper, agribusiness, mining, financial services, real estate, energy, digital infrastructure, and health care.

Hindalco is the world’s largest aluminum company by revenue. Along with its overseas subsidiary Novelis, Hindalco is the global leader in flat-rolled products and the world’s largest recycler of aluminum. With 52 manufacturing units across 10 countries, it has captive capabilities to source its own major raw materials for aluminum production along with aluminum refining, smelting, and downstream product manufacturing. The company currently holds leases for 4 coal mines and 27 bauxite mines; this has allowed it to access critical raw materials, offering cost and supply-chain efficiency advantages.

As technology and clean energy industries have evolved, Asia-Pacific’s resource advantage has only grown. The region’s dominance in rare earth oxides makes it indispensable to the global tech industry, and diversified supply chain investments are bolstering its resilience. With geopolitical risks threatening supply chains, the region’s preemptive moves to secure resources through diversification will be crucial in sustaining its leadership on the global stage.

Leapfrog Advantages

Traditionally, competitive advantages in areas like innovation, culture, and capital and risk have been concentrated in the West. However, Asia-Pacific is increasingly tapping into these strengths to “leapfrog” over the competition. While these advantages are still more developed in Western markets, their growing presence in Asia-Pacific signals a shift—one that will become more significant as the region’s economic influence continues to expand.

Innovation

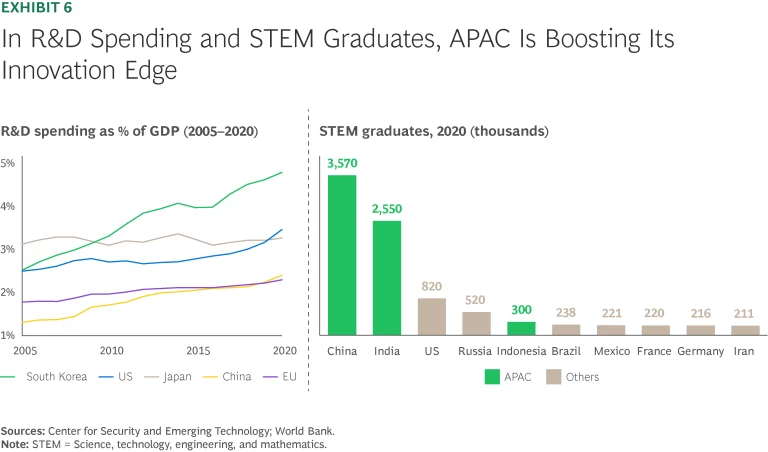

Asia-Pacific’s innovation landscape is rapidly evolving, with increased R&D investments and patent activity driving its competitive edge. Once dominated by Japan and South Korea—in the electronics and automotive industries, for example—innovation is now emerging from a wider range of countries, including China and India, and in industries such as AI, fintech, medtech, and green technology. R&D spending has surged, with South Korea, Japan, and China now outspending Europe as a percentage of GDP. The region’s academic strength is also growing, with Chinese universities expected to produce 75,000 PhD graduates in STEM fields this year—nearly double the US total. (See Exhibit 6.)

Taiwan Semiconductor Manufacturing Company (TSMC), the multinational semiconductor contract manufacturer and designer, has $90 billion in revenues. It cemented its market leadership in chip manufacturing by investing more than $5 billion annually into R&D after pioneering the pure-play foundry model. This has led to advancement in nodes from 7 nanometer (nm) to 3nm for better chip performance. The 3nm nodes are manufactured by only a handful of world’s companies at scale and enable the production of high-performance, energy-efficient chips. TSMC’s focus on innovation has positioned it to consistently break technological frontiers, helping it establish a reputation for producing industry-leading chips at scale.

Online retailer Shein, with over $30 billion in revenue in 2023, illustrates how an Asia-Pacific firm leverages innovation to globalize. Its highly responsive, consumer-driven design approach is powered by proprietary machine-learning applications that analyze customer preferences in real time and predict demand. These demand-driven insights are integrated into its supply chain, enabling rapid production in small batches that quickly adapt to changing market trends. Combined with broad social media marketing, this model has allowed Shein to continuously capture global fashion trends, scale efficiently, and expand its international footprint.

APAC innovation is not only expanding—it’s proving highly cost-efficient. From India’s Chandrayaan moon mission to China’s DeepSeek AI, countries in the region are delivering world-class advancements at costs that are a fraction of their counterparts in the West. With a larger, more diverse group of innovators shaping breakthroughs across multiple sectors, APAC’s role in global innovation has never been more pronounced.

Culture

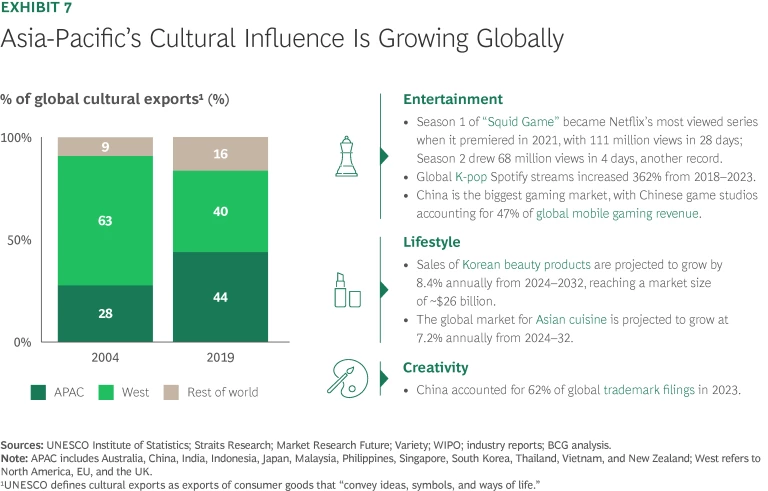

As Asia-Pacific’s economic strength rises, so does its cultural influence. Companies across the region are leveraging its rich cultural heritage to fuel their globalization journeys in areas ranging from entertainment and luxury goods to cuisine and beauty. The impact is clear—according to UNESCO Institute of Statistics, Asia-Pacific’s cultural exports grew 3.5 times between 2004 and 2019, compared to 1.4 times for the West. (See Exhibit 7.) K-pop, anime, Bollywood, and Asian beauty trends have gained global traction, while regional cuisines continue to shape global tastes.

Ryohin Keikaku, the Japanese retail company behind Muji, has established itself as a global lifestyle brand, generating over $4 billion in revenue in 2023. Muji’s style is rooted in simplicity, imperfection, and natural beauty. Muji’s “no branding” philosophy, shaped by the graphic designer Ikko Tanaka, has led to the creation of products that adapt to individual lifestyles rather than cater to a fixed demographic. This universal approach has resonated globally, allowing Muji to expand beyond household goods into Muji Stay, an accommodations business. By tapping into Japanese cultural values, Muji has successfully positioned itself as a globally recognized brand, offering products and experiences that appeal to a broad, diverse audience.

Hybe is a South Korean multinational entertainment company that has turned its cultural advantage into global success. Managing some of the largest K-pop artists—including BTS, Seventeen, and NewJeans—Hybe’s unique multilabel structure supports diverse artists while maintaining a cohesive brand. Its global fan community platform, Weverse, is the first such platform offering exclusive content, direct artist–fan interactions, and multilanguage accessibility. This approach has built a strong international following for K-pop, especially in Japan, the US, and Southeast Asia. Hybe’s global expansion took a major leap with its acquisition of Ithaca Holdings, bringing global superstars like Justin Bieber and Ariana Grande under its management—further solidifying its position as a leader in blending K-pop’s cultural appeal with innovative business strategy.

Asia-Pacific’s cultural influence is now expanding across industries, with firms embracing their unique heritage not just as a differentiator but as a competitive edge. While Western cultural dominance remains strong, APAC’s exports are proving that it is no longer just a consumer of global culture—it is actively shaping it.

Capital and Risk

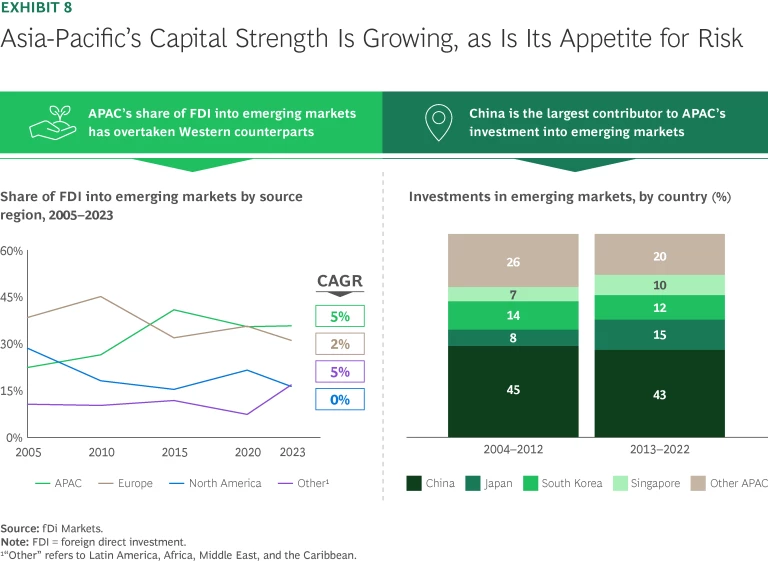

Asia-Pacific’s investment landscape is shifting from a domestic focus to a broader global outlook, driven by greater capital availability and risk appetite. While Japan once dominated cross-border investments, companies across the region are now making larger bets in midsized and emerging markets. This is reflected in Asia-Pacific’s outflow of greenfield foreign direct investment (FDI), which grew from 24% of the global total from 2004 to 2012 to 31% of the total from 2013 to 2022, and its share of FDI into emerging markets, which rose from 32% to 42% in the same period. (See Exhibit 8.)

Daikin Industries exemplifies how an APAC company can globalize by leveraging capital strength and high-risk tolerance—key drivers of the shift from domestically focused investments to global expansion. Expanding from Japan to markets including China, Europe, US, Southeast Asia, and India, Daikin followed a step-by-step strategy for expansion. Its “produce and develop near the market” strategy ensures localized innovation, with R&D centers and service hubs tailoring products to regional needs—such as air conditioners in New Delhi built for frequent power outages and compact outdoor units in Jakarta for dense urban living.

Daikin initially dominated Japan’s commercial air conditioning sector before expanding into consumer markets and new product categories, building the capital reserves needed to take on riskier, less-tested markets. Its on-the-ground engagement and patient approach to growth prioritize long-term success over short-term gains, bolstering its risk appetite and fueling its global rise.

India’s TVS Motor has successfully expanded into emerging markets in Africa, Latin America, and Southeast Asia. While a large part of the two-wheeler market in India is used for personal mobility, customers in Africa also rely on them for commercial purposes, such as bike taxis. Recognizing this opportunity, TVS placed an early bet on Africa—an underserved market largely overlooked by Western competitors—and adapted its products, go-to-market strategy, and value proposition to local needs, modifying its vehicles for rugged terrains and commercial use cases. Expanding into Africa was a calculated risk, as TVS had no guarantee of success in a new and relatively untested market; its success demonstrates how APAC companies can strategically take risks, leverage their existing manufacturing strengths, and scale globally.

Asia-Pacific firms are showing increasing ambition in global expansion, particularly in the Global South, where investment and trade opportunities continue to grow. As geopolitical uncertainty rises, this momentum is set to accelerate, positioning the region as a stronger force in shaping global economic flows.

The Future for Asia-Pacific’s Globalizers and Disruptors

Globalization remains a winning play for Asia-Pacific companies as they pursue growth and profitability. But while the region’s challengers are already drawing on the five key advantages, no company, whether an existing or aspiring challenger, can rely on these strengths alone. To cement their global presence, these firms must build new capabilities focused on execution and tailored to an increasingly complex business landscape. These capabilities include:

- Building Geopolitical Muscle. Heightened geopolitical tensions are increasing volatility in markets, trade, and supply chains. Companies need to build the requisite geopolitical muscle that will allow them to anticipate changes, plan for multiple scenarios, and proactively manage risks in an increasingly multipolar world.

- Adapting to Local Market Dynamics. Winning internationally means understanding consumer preferences, localizing products where necessary, and balancing global brand strengths with market-specific adaptations.

- Maintaining a Competitive Edge in Tech. Asia-Pacific is already driving key innovations, but technological advantages are fleeting. Companies must continuously invest, iterate, and be prepared for the next big disruption—as seen with China’s DeepSeek AI, which has emerged as an unexpected and formidable global competitor.

- Navigating Climate and ESG Regulations. Many APAC firms come from home markets with less stringent climate and ESG regulations than those in Western economies. As they expand, compliance with higher regulatory standards in markets such as Europe will be critical to success.

- Evolving Operating Models for a Multipolar World. With businesses operating across geopolitical fractures and alliances, rigid centralized structures are no longer viable. Companies must enable local leadership, establish decentralized decision-making models, and create flexible structures to navigate geopolitical shifts and regional complexities.

With the rise of artificial intelligence, clean energy, and new economic alliances, the global business landscape is entering a transformative era. Asia-Pacific firms have a unique opportunity to shape this future—but they will likely not follow a conventional, linear path to progress. Their scale, speed, and ability to reimagine their global strategies will set them apart.

The most successful challengers will be those that leverage their legacy and leapfrog advantages while continuously evolving their execution strategies. Each company must determine the right mix of core strengths and new capabilities to navigate an increasingly complex global environment.

This is neither simple nor straightforward, but it can be done if CEOs prioritize and plan for it. For those that embrace this challenge, the next decade offers an unprecedented opportunity to transition from challengers to global leaders—not just participating in globalization but defining it.

The authors would like to thank their colleagues Vikash Agarwalla, Nishant Gupta, Hyungjune Hwang, Janggyun Im, Rahul Jain, Satoshi Kiyama, Carol Liao, Grant McCabe, Akira Morita, Mustafa Rangwala, Munal Rathore, Natarajan Sankar, Yasushi Sasaki, Ernest Saudjana, Matt Sweeny, Sek-loong Tan, Chun Wu, and Yulius Yulius for their invaluable insights and counsel on local markets. The authors also wish to offer a special note of gratitude to Buddhi Mahindaratne for his research and analysis.