This article was originally published in April 2021; it was updated in April 2025 with new data and analysis.

From a CEO’s perspective, M&A is a catalyst for innovation, top-line growth, and strategic transformation—objectives that go far beyond consolidation and cost synergies. At the same time, CEOs increasingly recognize that leveraging data, analytics, and AI-driven digital capabilities is essential for driving growth and unlocking new revenue streams. Capturing these benefits requires not incremental adjustments but a fundamental rethinking of business processes and technology infrastructure.

Post-merger integration offers a unique opportunity to accomplish these transformative growth objectives. With the right mindset, organizations can turn PMI from a cost-cutting exercise into a platform for broader enterprise reinvention—what we call “full-potential PMI.” Rather than focusing on cost reduction targets, this approach integrates traditional PMI elements with high-impact initiatives, such as commercial portfolio realignment or innovation-driven revenue growth.

By treating PMI as both an integration and a transformation effort, companies can achieve operational synergies while embedding the capabilities needed for future growth. BCG’s assessment of the two-year post-execution performance of deals from 2017 to 2022 indicates that investors recognize the value created by this dual approach. We found that companies combining PMI with transformation outperformed those using conventional PMI approaches by 8 percentage points of total shareholder return.

M&A activity is expected to surge as companies seek to boost resilience, accelerate growth, and respond to competitive pressures. By implementing these deals the right way—using full-potential PMI—CEOs and their management teams can ensure that they’re emerging not only with the right cost structure but also with an organization poised to win for years to come.

CEOs Need More Than “Good Enough” PMI

The integration phase is where deals often fall short. Even the most intuitive transactions—the ones that look great on paper—often miss their targets by failing to effectively combine the companies involved. To avoid this outcome, organizations launch a PMI that is just good enough, focusing on structured initiatives to achieve cost synergies, retain key talent, and ensure smooth operations for the new entity on day one after the deal closes. In effect, the company aspires to nothing better than avoiding mistakes.

From a CEO’s vantage point, this approach is necessary but insufficient, and it’s also ultimately self-limiting: a purely cost-focused, risk-averse PMI fails to meet today’s broader strategic aspirations. These include top-line growth, innovation, and resilience, as well as any new digital or AI capabilities that could spur transformative gains. At a minimum, good-enough PMI delays the full upside of the deal—a growing challenge in the current fast-moving and highly competitive environment.

In contrast, full-potential PMI, when done right, ensures that a deal not only hits all the objectives that justified the deal in the first place, but also capitalizes on the full combined opportunity offered by both organizations in a more transformative way. Notably, it calls for unlocking growth, efficiency, capability, and strategic value by encompassing measures not directly linked to the deal. Transformation initiatives that go beyond merger synergies are crucial to positioning the new company for outsize performance.

Conventional wisdom holds that a newly combined entity can only absorb so much change. We disagree. Full-potential PMI demonstrates that pursuing simultaneous integration and transformation can yield clear competitive advantages, the right cost structure, the best growth path, enhanced organizational structures, and a roadmap to sustained success. Additionally, it often shortens the duration of the transition—a faster, more intense transformation followed by relative stability is a better approach than a prolonged, slow-burn integration.

By embracing full-potential PMI, CEOs can align the merger with their overarching vision—from operating model decisions to technology investments—thereby delivering on both immediate performance metrics and long-term growth ambitions.

Four Key Levers of Success

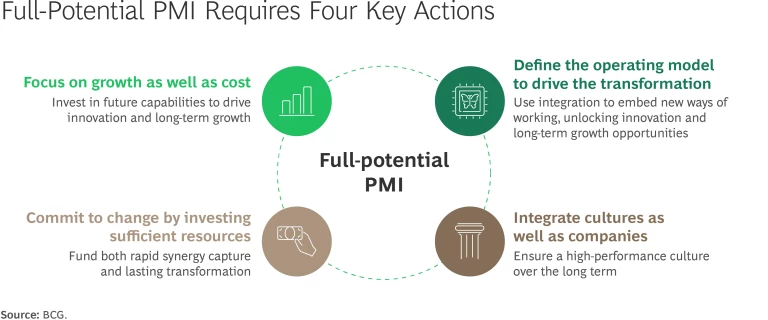

On the basis of our work with clients, we believe that full-potential PMI requires management teams to take four key actions. (See the exhibit.)

Focus on growth as well as cost, emphasizing both short-term and longer-term sources of value. Historically, companies closing a deal have given lip service to the growth component. They talk about growth as a justification for the deal but then prioritize short-term measures to capture synergies and reduce costs. Full-potential PMI calls for a more balanced approach. Near-term wins that reduce costs are certainly critical—and full-potential PMI can help companies not only hit but exceed their targets in that area. But companies also need to think about broader medium- and longer-term transformation initiatives, ensuring that the combined organization can operate the business in new ways and promote innovation. Driving both growth and efficiency, in parallel, is essential.

Notably, companies need to provide the same level of specificity and detail in their plans for growth through a full-potential PMI as they do in their plans to reduce costs. What’s more, many growth initiatives may lie outside of the core integration process but are crucial to long-term performance. AI-driven digital transformation is a good example: in order to rethink processes and engage with customers and suppliers in new ways, companies are investing in new technologies across all business units and functions. That can have a transformative effect on operational and financial performance. But companies shouldn’t wait until after a deal has closed to start thinking about it. Planning for growth before the close is critical to increasing the value creation potential of the deal. Early planning also enables growth initiatives to be launched as soon as possible and in the right sequence to maintain business continuity.

In our experience, successful transformations depend on short-term initiatives to both fund the journey and drive complex initiatives that will help the company win in the medium and long terms. In the portfolio for a full-potential PMI, revenue and cost initiatives are balanced with immediate value drivers and medium-term transformation initiatives. Many of these may not have much to do with merger synergies, but they are crucial to building long-term competitive advantage.

The CEO plays a pivotal role in setting the overarching vision, ensuring that short-term decisions align with the organization’s broader strategic goals. However, even when the company has full-potential aspirations, sequencing is critical. Prioritizing business continuity, day one readiness, and regulatory constraints—while meeting cost synergy targets—must come first, ensuring that growth initiatives don’t compromise these fundamentals.

Define the operating model to drive the transformation. A well-designed operating model is essential to capturing the benefits of full-potential PMI. Unlike good-enough PMI efforts that seek minimal disruption, a full-potential PMI treats integration as a catalyst to embed new ways of working, thereby unlocking long-term growth opportunities. To achieve this, leaders must be prepared to make difficult choices—restructuring business lines, reallocating resources, or rethinking governance—in order to set the stage for future expansion rather than merely merging two organizations.

From a CEO’s perspective, aligning structure, governance, and accountabilities is critical to realizing synergies at scale. The operating model should enable faster decision making and more effective execution of strategic priorities.

By establishing a robust operating model upfront, leaders can ensure that the newly merged entity will be able to act on both incremental and transformative goals without losing day-to-day momentum. Such a model breaks down silos, streamlines processes, and embeds new ways of working that good-enough PMI efforts might overlook—allowing the combined entity to fully leverage digital and AI innovations.

Take the example of two global medical technology companies whose integration was supported by BCG. To fully redesign the business units of the merged entity, it was critical to agree upfront on the goals of the operating model. The plan included creating a new organizational unit—integrating talent, processes, and capabilities—to support a restructured product portfolio for the combined company. To capture future growth, customer-facing units were reorganized around combined product families to better serve specific hospital departments where those products were used. Additionally, innovation and R&D processes were restructured to align more closely with customer needs across product lines, accelerating both development and commercialization. This approach ensured that the combined company was not just a sum of its parts but a fully integrated entity with an optimized, future-ready operating model.

Ultimately, a successful operating model requires a CEO who is willing to challenge historical norms and drive necessary, and sometimes uncomfortable, changes. By doing so, he or she can position the organization to pivot quickly, capture emerging market opportunities, and deliver sustained value from the merger.

Subscribe to our M&A, Transactions, and PMI E-Alert.

Integrate cultures as well as companies. Companies must consider cultural alignment in the PMI, and they should capitalize on the natural inflection point that the process creates to do so. In a sense, deals give management a window of opportunity to reset and reorient the new organization around a new, unified purpose and narrative. This will ensure that the company emerges with a reengaged workforce—provided that leadership thinks about this process systematically and proactively.

In a full-potential PMI, it is critical to start early and make the culture change roadmap a central part of the integration program—embedding it into both planning and implementation to ensure alignment from day one. Management teams will need to consider how the two organizations will mesh and how to create a high-performance culture. They will need to weigh such considerations as whether the two companies are global or have workforces concentrated in a particular country (in the latter case, organizational cultures may be more distinctive and ingrained). Management will also need to consider whether the companies involved in the deal have long legacies of operations or are in vastly different industries.

If the two companies have different cultures, management will need to focus even more deliberately on integrating them. The scope of the cultural integration will vary by deal. Combining two US-based analytics startups, for example, may not involve significant cultural differences. But combining a US-based analytics startup with a German auto parts manufacturer that has been in business since the automobile was invented will require more targeted interventions.

Commit to change by investing sufficient resources. Transformations and traditional PMIs both demand focus, discipline, and dedicated resources. Though the full-potential PMI approach requires no less, the return on investment is massive given the potential value at stake. Companies need to allocate sufficient resources, such as full-time internal project managers, leadership time and attention, and external resources in critical areas. Skimping on a full-potential PMI will generate false savings at best. (We’re continually surprised at how many companies seek to generate hundreds of millions, or billions, of dollars in value through a deal but balk at designating a full-time project manager to oversee the process.)

The practical reality of full-potential PMI is a large volume of workstreams and initiatives that collectively result in outsize success. The only way to execute across so many projects and programs with speed and a high degree of financial accountability is to establish a dedicated integration management office with the requisite processes, structure, and authority. The office can act as a catalyst for value amplification—driving results beyond synergy targets and shaping the future state of the combined company.

Leadership teams need to set a bold ambition, prioritize the short-term and long-term measures that will generate the biggest value, and ensure that the business continues to operate throughout the process. An executive action agenda will provide early direction and timely decision making throughout the program, including critical launch point decisions—such as leadership appointments, operating model structure, and technology integration priorities—that accelerate progress and jumpstart the transformation. Direct involvement by the CEO is crucial to maintaining governance, stakeholder alignment, and rapid decision making, ensuring that short-term execution and long-term transformation remain in sync.

Integrating two companies is one of the most complex leadership challenges a CEO faces. When combined with a transformation, it becomes an even greater test of strategic vision and execution. Yet CEOs who take this dual approach can unlock transformational performance gains and establish a lasting competitive edge. As more companies embrace always-on transformation—rather than discrete programs with clear endpoints—a full-potential approach to PMI becomes imperative.

Whether steering a distressed company, a stable business, or an industry leader, CEOs must ensure that their integration efforts not only meet immediate objectives but also position the organization for long-term success. By balancing short-term execution with long-term value creation, designing a new operating model, aligning corporate cultures, and investing sufficient resources, CEOs can lead their organizations toward the full range of benefits to be gained from the combined company.

The authors thank Mic Rosiello for his contributions to this article.