Introduction

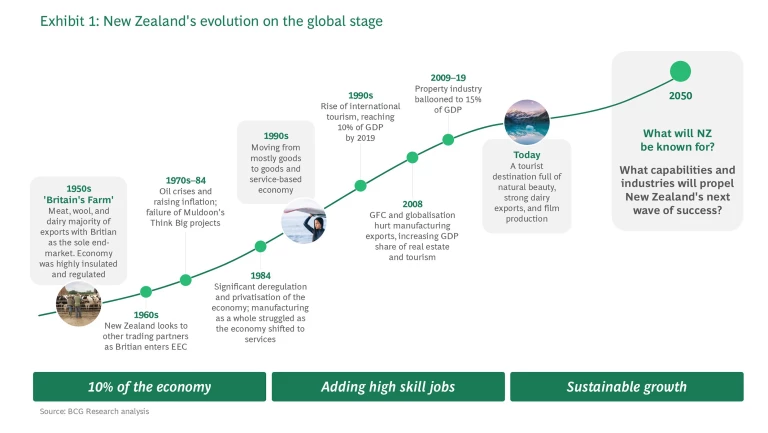

Aotearoa—the land of the long white cloud or, more recently, the land of dairy herds, hobbits and globally renowned great walks. Over the last 50 years, New Zealand’s economy has been reshaped and bolstered by growth as export industries, such as dairy, film and tourism, benefit from a prospering middle class, particularly in Asia, that wants safe nutrition, rich cinematic experiences, and beautiful places to holiday.

However, as we look ahead, economic growth will need to come from new industries. The local dairy industry says that New Zealand has reached peak milk production, film and television production is limited to serving the outsourcing needs of US-based studios, and travellers are choosing more affordable and lower-carbon holiday options. Additionally, global headwinds such as climate change, the war for talent, technological innovation and global fragmentation will threaten New Zealand’s current and future industries.

If we imagine New Zealand in 2050, what will it be known for? And what will foster growth in its existing and upcoming industries?

Globally, nations are focusing resources and investment on specific, high-potential industries to create vibrant ecosystems interconnected businesses, research institutions and government bodies collaborate to share resources and create synergies. In this article, we explore what makes a successful ecosystem and which ecosystems New Zealand is best placed to play in.

This report is the first stage of BCG’s investigation into the future of NZ Inc.

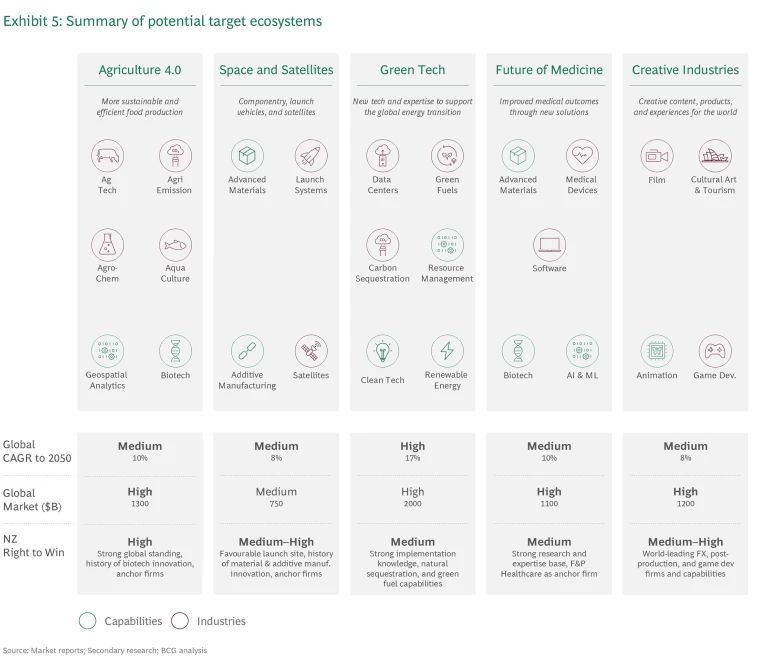

Drawing on the robust expertise of our New Zealand team and the wealth of resources and access enabled by BCG’s global network, we identified 5 ecosystems for further exploration:

- Agriculture 4.0

- Space and satellites

- Green tech

- Future of medicine

- Creative industries

This report is not an end in itself. It is an invitation from BCG to decision-makers in business, government, and other institutions that comprise the fabric of NZ Inc, to engage with the material presented in this report.

We welcome your discussion, debate, and dialogue, as progress with this ongoing investigation and look to share further insights and findings.

The NZ Inc of today

‘NZ Inc’ is a term used in New Zealand to refer to players across government, export businesses, and industry organisations who promote and enhance New Zealand’s economic interests globally. As our economy has evolved, so has what NZ Inc is known for.

In the 1950s, New Zealand was colloquially known as ‘Britain’s farm’, exporting wool, meat, and dairy products to Britain. Post-war demand for these products rose to an all-time high and New Zealand was one of the world’s wealthiest countries, with a per capita income 88% of the

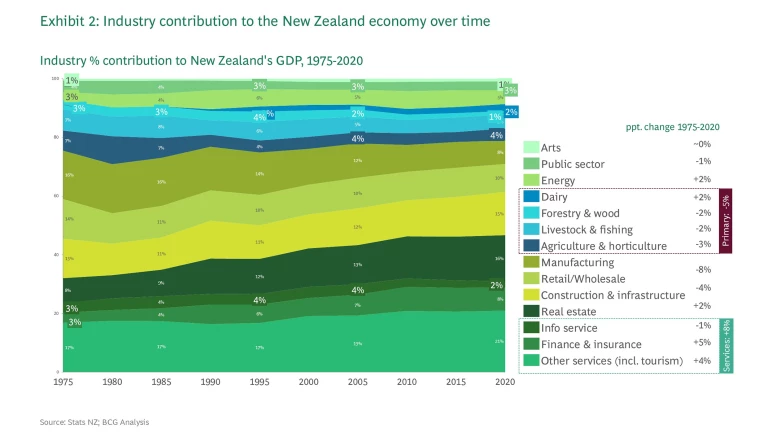

As global markets evolved in the 1960s and 70s, New Zealand diversified its economy. It shifted away from its reliance on Britain and expanded into forestry, fishery, and manufacturing. Deregulation and privatisation reforms in 1984 further opened New Zealand to the world, seeing it pivot from goods to services, particularly in tourism and real estate. However, manufacturing began to wane due to intense global competition.

In the early 2000s, the launch of the Lord of the Rings catapulted New Zealand’s stunning vistas and special effects expertise to the global stage, bolstering an already thriving international tourism industry and laying the groundwork for ongoing film industry growth.

By 2019, international and domestic tourism contributed over $25 billion to the economy each year, both directly and indirectly, amounting to nearly 10% of

Today, New Zealand is known for 100% Pure New Zealand

The dairy, film, and tourism industries have supported New Zealand’s wealth creation and reinforced its reputation as a stable and eco-friendly economy.

Subscribe to Our Corporate Finance and Strategy E-Alert.

Challenges now and into the future

In recent years, New Zealand's economic outcomes have lagged global peers. While in the 1950s, New Zealand’s per capita income was 88% of the US, while today it is 64% compared to 69% for Canada and 79% for

- Declining productivity: While New Zealand’s productivity growth averaged 1.4% per year between 1993 and 2013, it has dropped to 0.2% per year over the last decade. In addition, New Zealand’s GDP per hour worked is now more than 20% below the average of OECD peers; in 2000, it matched the

average.7 7 Treasury, The productivity slowdown, 2024 - Eroding comparative advantage: In just the last 5 years, IMD’s World Competitiveness Rankings have seen New Zealand’s overall rank drop from 22nd to 32nd out of 67 countries, with declines across all IMD’s key metrics, including Economic Performance (40th to 46th), Government Efficiency (8th to 15th), Business Efficiency (30th to 42nd), and Infrastructure

(25th to 31st).8 8 IMD World Competitiveness Rankings, New Zealand Country Profile, 2024 - Growing talent gap, particularly in highly skilled industries: A significant number of skilled immigrants, including doctors and engineers, are choosing to move to countries such as Australia and Canada over New Zealand. Furthermore, emigration of New Zealand citizens to other countries has steadily increased over the past 5 years. In the EMA’s 2023 Skills Shortage Survey, 90% of New Zealand employers said they are struggling to fill vacancies and 71% said that highly skilled jobs were the hardest to

fill.9 9 EMA, Skills Shortage Survey, 2023 This talent drain has left New Zealand with a gap of around 60,000 people in net migration over the last 4 years versus pre-covid levels. Of this, 70% are 15–34 year-olds, posing a long-term risk to theeconomy.10 10 Boston Consulting Group, The ‘Top 10’ Focus Areas for New Zealand Executives in 2024

In the coming decades, numerous global challenges could also threaten New Zealand’s trajectory or limit its ability to innovate:

- Climate change threatens major New Zealand sectors and industries, including agriculture, tourism and property. Agriculture will continue to be vulnerable to increasingly common natural disasters and extreme weather events as evidenced by Cyclone Gabrielle in 2002. Climate-related insurance claim costs of $352.2 million in 2022 are just the

beginning.11 11 Insurance Council of New Zealand, 2022 Confirmed as Record Year for Climate Claims, 2023 Tourism faces challenges as people look to reduce their carbon footprints by avoiding long-haul flights to New Zealand, and climate change is affecting the country’s natural tourist attractions. In property, 20% of homes are on floodplains, and some homeowners can no longer afford the increasingly high insurance premiums required to protect theirhomes.12 12 RNZ, Australia, New Zealand property markets face creeping climate risks, 2024 - Technological innovation is intensifying competition.

Digital and hardware innovation is transforming industries, reducing barriers to entry, and intensifying competition in global markets. For example, smart and vertical farming could threaten New Zealand’s agricultural advantage in fertile land mass, as it allows farming to move closer to demand or to areas with poorconditions.13 13 Boston Consulting Group, Navigating Future Uncertainty in New Zealand with Megatrends, 2022 - Rising geopolitical instability and reshoring are disrupting global supply

chains.14 14 Boston Consulting Group, The Unwinding of Global Tech Supply Chains, 2023 New Zealand must rethink its export market strategy in the context of today’s geopolitics. Many New Zealand exporters are already recognising the need to diversify. As growth slows and local market execution remains challenging, many companies are shifting from a China-centric strategy to a China-plus export strategy, and making an effort to win share in more nascent markets like South East Asia or the Middle East.

Where to next? The advantage of ecosystems

In the face of these challenges, NZ Inc can’t rely on historically successful industries to drive wealth creation. NZ Inc must build new industries for its future, and the way we go about this matters.

Instead of spreading finite investment across a broad range of industries as it does today, NZ Inc needs a focused approach. By concentrating its efforts on 3 to 5 high-value ecosystems, NZ Inc can build and sustain an advantage in key industries.

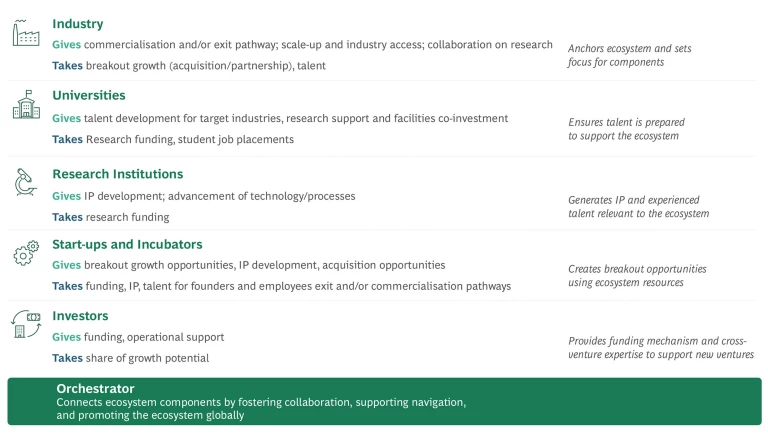

An ecosystem is a dynamic environment in which businesses, research institutions, and government bodies collaborate to leverage shared resources and synergies, often based in the same geographical area. Ecosystems are focused on industries and capabilities. They aim to accelerate economic development and create competitive advantages that lead to self-sustaining industry growth.

NZ Inc’s current approach to industry development

Historically, NZ Inc has underinvested in the innovation needed to drive sustained advantage in high-value industries. In 2019, New Zealand’s total R&D expenditure as a proportion of GDP was 1.4%. This is well below the OECD average of 2.5% and even further behind innovation leaders such as Denmark (3%) and Israel

In the private sector, limited resources are allocated to innovation. Industry participation is a key component of successful ecosystems but, of NZ Inc’s leading businesses, only a few standouts—such as Fonterra, Fisher & Paykel Healthcare, and Rocketlab—actively contribute to their ecosystems.

Meanwhile, the historic approach to public sector investment drove fragmentation. For example, 15% of government research investment ($200 million) is spread across 7 Crown Research Institutes covering agriculture, environmental science, geology, land care, water, plant and food, and forestry. Furthermore, public investment, incubation and acceleration vehicles are largely industry-agnostic (e.g. New Zealand Growth Capital Partners, Callaghan Innovation). This approach likely spreads investment too thinly to unlock growth and makes it difficult for investors to navigate the landscape. Recently announced reforms take positive steps to simplify the architecture of the public innovation system, with 3 Public Research Organisations (PROs) replacing the 7 existing crown research institutes, and the disestablishment of Callaghan Institute with functions moved into other public organisations.

The advantage of ecosystems

High-value ecosystems are not just for world super-powers; in fact, it is even more important for smaller nations to develop a specialty and focus innovation and investment in an ecosystem built around that specialty. By focusing on 3 to 5 high-value ecosystems aligned with its overall strategy, NZ Inc can more efficiently build scale and density in future industries, create comparative advantage and position New Zealand as a global leader while stimulating economic growth and skilled employment.

Geographically concentrated ecosystems have many advantages. Players can share specialised resources, including infrastructure, training programs, and venture capital. Proximity also concentrates talent, creating a common labour pool and making it easier to match employers to employees. All of this facilitates knowledge transfer between startups, established firms, universities, research institutions and investors, keeping players up to date on the latest innovations and best practices.

This concentrated approach is a radical change for NZ Inc and will require coordination across government, universities and research institutions, established industry players, startups and incubators, and private investors.

The following case studies provide examples of how these components have come together to create successful ecosystems across the globe.

Case studies: Ecosystems in action

United Kingdom’s Life Sciences Golden Triangle and MedCity

Switzerland’s Medical Technology Ecosystem

Netherland’s Top Sectors Policy

Taiwan’s semiconductor ecosystem

Defining where NZ Inc can play

To define its 3 to 5 target ecosystems, NZ Inc must understand the global market, growth rates and New Zealand’s right to win in key industries and capabilities.

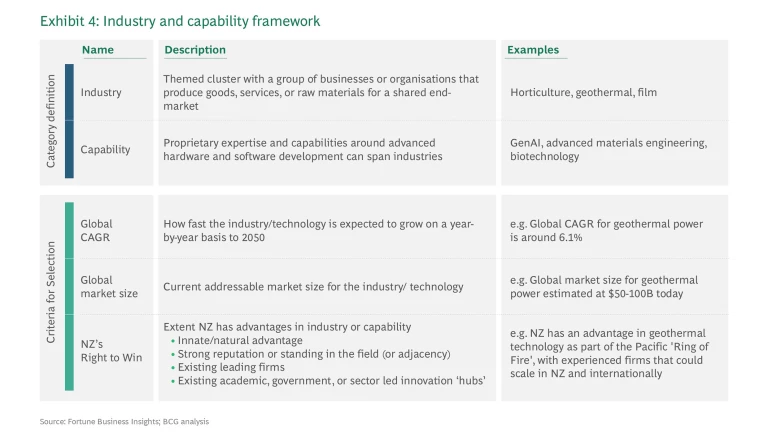

The first step to cultivating an ecosystem is to define its scope, in particular the industries and capabilities that it will comprise.

We developed a framework to define and evaluate potential industries and capabilities (Exhibit 4). Industries are tied to a specific end-market (e.g. horticulture, geothermal, film) and capabilities are tied to a skillset (e.g. AI or biotech) with room for growth within New Zealand. An industry or capability has room for growth if it has the capacity to develop new higher-value products and services, access new markets with existing products and services, or upsell existing products and services.

Industries and capabilities are then evaluated against 3 selection criteria:

- Global market size: The industry or capability’s economic potential (even a high growth industry will not contribute significantly to New Zealand’s GDP by 2050 if it is very small today)

- Global rate: The industry or capability’s future growth prospect

- New Zealand’s right to win: New Zealand’s natural advantages (e.g. climate, landscape, strong indigenous culture) and existing infrastructure (e.g. dairy R&D centres, leading engineering, and medical departments in universities)

By applying our framework to a preliminary list of industries and capabilities, we identified 5 potential ecosystems as a starting point for investigation. These are:

- Agriculture 4.0: Supporting more sustainable and efficient food production

- Space and satellites: Designing and manufacturing componentry, launch vehicles, and satellites

- Green tech: Developing new technologies and expertise to support the global energy transition

- Future of medicine: Improving medical outcomes with new practices, pharmaceutical discoveries, health IT advances, and novel medical devices

- Creative industries: Leveraging New Zealand’s unique talents and expertise to produce new content, products, and experiences for the world

Each of these ecosystems consist of several industries or capabilities in which New Zealand has a natural advantage or potential for competitive advantage, and which have the potential to be large global markets in coming decades.

What next?

In 2001, Michael Porter, Professor and leader of Institute for Strategy and Competitiveness at Harvard Business School, spoke to a room of New Zealand’s business and political leaders about the importance of ecosystems and focused investment to transform New Zealand into an innovation-driven

NZ Inc needs to channel investment into high-value ecosystems where New Zealand has a strong right to win, and players across government and industry need to work together to set up the components required for these ecosystems to thrive. Applying New Zealand’s capabilities to their highest potential now is essential to help Kiwis prosper in the future. NZ Inc has exciting opportunities ahead, and we cannot wait another 25 years to act on them.

Keep an eye on BCG’s social media and website in 2025 for more to come on the future of NZ’s economy.