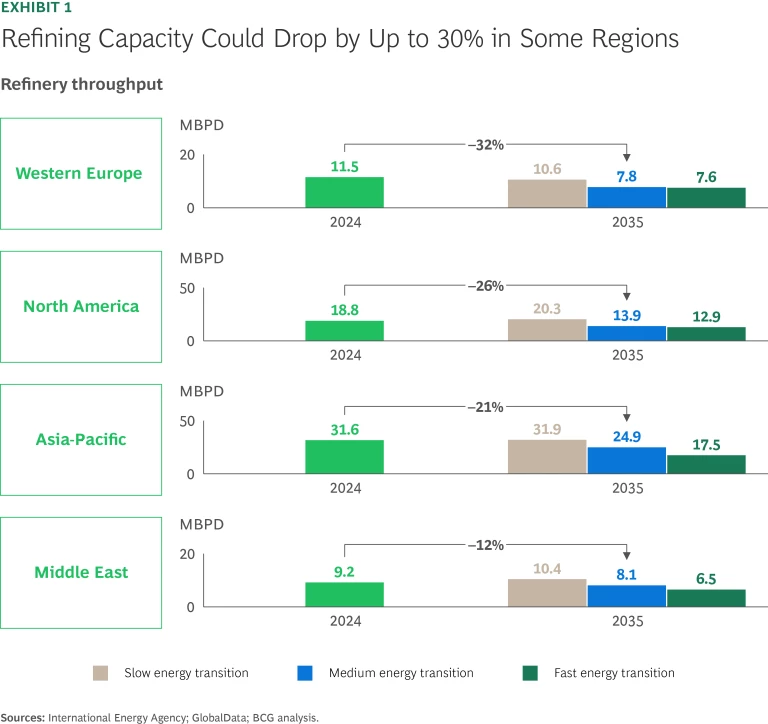

Oil refiners face a structural decline in demand over the next decade. Alternative sources of energy, such as electricity and biofuels, are taking a growing share of the market. We expect refining capacity to shrink by as much as 10% to 30% over the next ten years, depending on the region, with the most severe reductions taking place in Europe. Margins, which have already retreated to prepandemic levels from their highs in 2022, will be volatile but under sustained downward pressure.

The pending shakeout will define winners and losers, with cost and margins being the deciding factors. Some refiners have already moved aggressively to improve their cost structures with comprehensive transformations that have produced big savings. Others have been slower to address inefficiencies. All refiners, regardless of current cost position, need to strengthen their positions and their capabilities.

An Unrefined Future

Refiners are already under pressure. Margins fell throughout 2024 as supply more than met increases in demand. As margins tightened, downstream earnings for integrated oil companies dropped by about 50% in 2024 from 2023 and are some 60% lower than they were in 2022. Several companies have underperformed market expectations.

Worse, the outlook going forward is uncertain, with demand for oil and refined products expected to peak or plateau by 2030 as alternative energy sources grow their share. We modeled needed refinery capacity in three scenarios: a slow, medium, and fast transition to alternative sources of energy. They all show big drops in refining capacity over the next ten years. (See Exhibit 1.)

As demand declines, it will also shift among refined products, with jet fuel proving the most resilient and gasoline facing the greatest risk. Refiners will feel these shifts in the cost structure per barrel of transport fuel. For example, as demand for gasoline falls faster than for diesel, refiners may have an oversupply of gasoline (or precursor) molecules that they will redirect into naphtha. But the surplus naphtha will need to be absorbed by the petrochemical sector at growth rates up to five times historical CAGRs, creating significant pressure on naphtha cracks and increasing the cost per barrel of transport fuels. The overall decline and evolving cost picture will push marginal operations into the red, and a likely shakeout will force companies to decide where to focus their resources.

A Playbook for the Strong

In a shrinking industry, it’s axiomatic that the strongest companies control the future. Trade disruptions and environmental regulation, which is likely to become more financially onerous, add to the pressure on weaker competitors. In the EU, for example, there is potential for increasing emissions costs from the phasing out of free allowances in the bloc’s emissions-trading system. This will alter the merit order of refining configurations, making some refineries less competitive.

We have worked with numerous refiners that are moving to shore up their cost structures. Some call it building resilience, others are undertaking cost transformations. Whatever the terminology, the measures these companies are taking, and the capabilities they are building, amount to a playbook that any refiner can follow to improve its competitive strength, regardless of starting point or future plans.

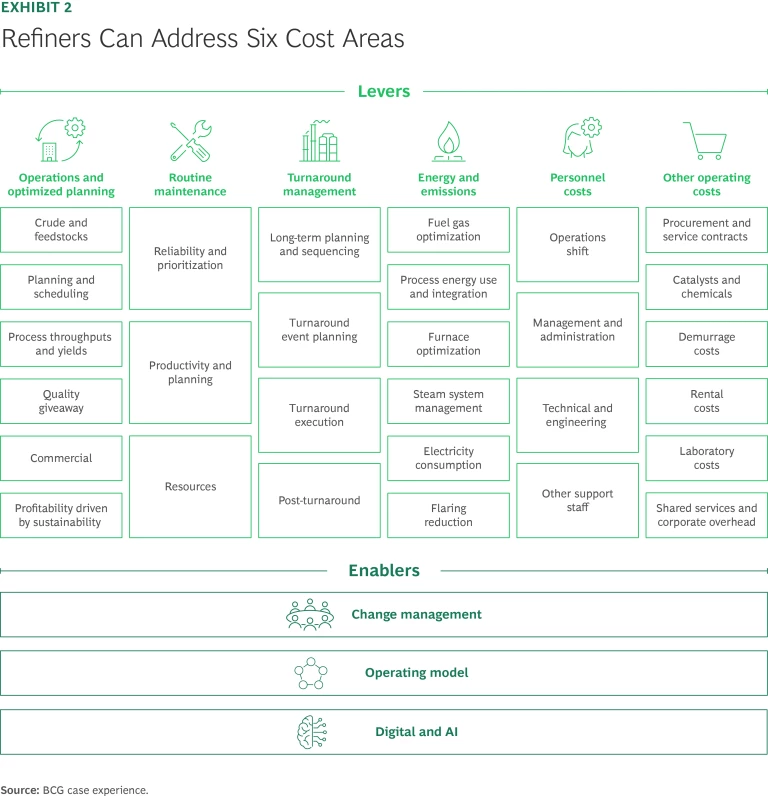

Refiners have plenty of cost improvement levers to pull. They fall into six areas: operations and optimized planning, routine maintenance, turnaround management, energy and emissions, personnel costs, and other operating costs. (See Exhibit 2.)

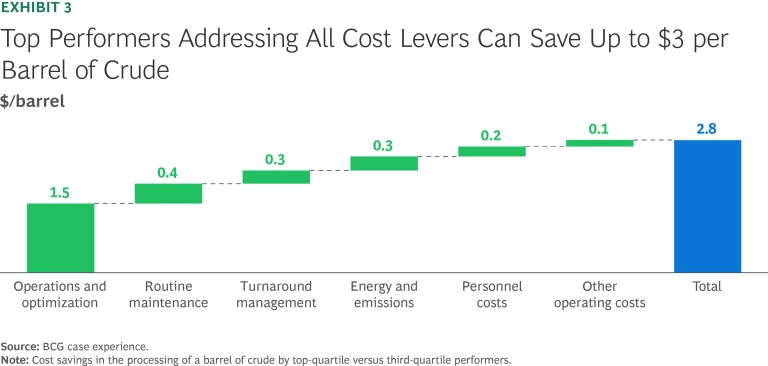

We have seen companies that address all available levers in a comprehensive manner (aided by the enablers discussed below) improve their refining capability by up to $3 per barrel of input crude. (See Exhibit 3.) Depending on starting point, companies can achieve savings in all six areas.

Operations and Optimized Planning. The biggest single area of potential improvement—which involves addressing such issues as crude and feedstock mix, planning and scheduling, and process throughputs and yields—can generate up to 60% of total savings. Many refiners grapple with such inefficiencies as fragmented inputs with incomplete economic data, lack of clarity on risk authority, and an inability to optimize end-to-end process controls. A comprehensive approach to operations and planning can remove process constraints, leverage data-driven techniques to maximize performance, and reimagine process workflows.

Routine Maintenance. Routine maintenance has an impact on the costs and availability of crude and can lower the fixed costs per ton of product. Many refineries operate with maintenance productivity levels (the time staff spend actually working on equipment) below 30%, less than half the world-class standard of about 65%. The causes include permitting delays, lack of coordination between operations and maintenance, and inadequate materials management. Getting the most out of maintenance spending requires ensuring that the correct strategies are in place for each piece of equipment and prioritizing resources toward equipment that is critical for safety and reliability. Companies need a strong working understanding of multiple factors, including:

- Equipment maintenance and operational history

- The consequences of equipment failure

- Potential failure mechanisms and conditions

- The timing and probability of potential failures

- Which mitigating measures justify the risk of intervention

Adherence to good processes and procedures, such as ensuring that teams follow a standardized job prioritization procedure together with disciplined planning and scheduling, are also crucial. Maintaining this rigor, and working to limit interventions in existing maintenance schedules to the most critical, high-priority jobs, enables resources and materials to be allocated in advance, further reducing costs.

Achieving a complete picture of maintenance needs and having the right skills on call at the right time are often impeded by maintenance, operations, and technical functions working in silos, which leads to a fractured view of maintenance data, operating history, and failure modes. Cross-functional teams with end-to-end accountability help make sure equipment strategies, maintenance, and operations are aligned and that internal teams and external contractors work at peak productivity at the lowest cost. AI, including generative AI, can unlock vast potential in the maintenance workflow.

Turnaround Management. Turnarounds are major events with complex logistics at each stage, from planning to execution to documenting lessons learned. There are plenty of opportunities for costly miscues, including outdated long-term plans, inadequate budget planning, late definition of scope, neglected risk management reviews, lack of detailed visibility into daily work requirements, delays in critical pre-work tasks, and lack of adherence to the work plan, to name just a few. Effective turnaround management involves thorough planning and tight execution throughout the process.

Energy and Emissions. In our experience, refiners can reap savings of $0.30 to $0.90 per barrel by improving energy performance. Potential measures include optimizing furnaces, fuel gas, and steam and condensate systems, improving boiler operations, reducing flare losses, and improving planning and monitoring. In many regions with high gas prices or high emissions costs, historical energy efficiency projects or pinch studies are out of date. Refreshing these analyses in the current environment can yield large cost-saving opportunities.

Personnel Costs. A cost transformation program should address both the effectiveness and the efficiency of personnel. The former is a matter or organization design; the latter involves aligning headcount with current and projected needs. We have found that on the frontlines, grouping all the needed competencies into interfunctional teams that are based in a single location helps address both sides of the equation and provides a single point of accountability.

Other Operating Costs. Catalysts and chemicals, demurrage, and laboratory costs typically contribute smaller overall savings. Still, it’s important to involve the entire organization in the transformation.

Key Enablers

As shown in Exhibit 2, three capabilities are essential to bringing about an effective cost transformation. The first is a robust management of change capability. Companies need the tenacity to drive implementation and overcome setbacks along the way. An activist program management office is pivotal to guaranteeing delivery by synthesizing inputs from multiple workstreams into clear action plans and redesigning refinery processes to match best industry practices. It can oversee baselining performance, defining value levers and opportunities, prioritizing improvement areas, tracking progress, and implementing corrective actions.

The second capability is a reworking of the operating model. Changes in processes often require shifts in ownership and accountability to ensure that decisions are being made at the appropriate asset or field level. Leadership should be focused on creating value and empowering frontline teams. Embedding a high-performance culture may require revising recruiting and promotion practices, redefining career paths, and modifying performance management and incentive systems. Above all, the operating model should allow for implementation of improvement initiatives by removing unproductive activities and bottlenecks and roadblocks in workflows.

Making such changes can involve a major transformation in one or more functions. For example, leading refiners are breaking down information barriers between technical, commercial, and operational departments. They are empowering console operators with real-time economic information to squeeze additional throughput and yield out of the refinery, reducing cost per barrel of production.

Third, digital tools and AI are the single largest enablers for achieving a step change in cost performance. We have identified a comprehensive set of solutions in seven areas (planning, operations, asset management, maintenance, safety, support, and commercial trading) that are relevant for refiners. Together, they can contribute to reducing refining costs by $0.40 to $1.45 per barrel of crude. Leading refineries are already leveraging AI and advanced analytics across planning, scheduling, optimization, and asset management, enhancing profitability and competitiveness. These tools enable refiners to reimagine process workflows, simplify instructions to operators, and provide optimization guidance in real time. GenAI and AI agents are driving the next wave of AI disruption, unlocking even greater efficiencies.

But building the necessary capabilities can be a big challenge. Our latest

cross-industry research

into AI, for example, which involved more than 1,000 companies worldwide, shows that only 4% have developed cutting-edge AI capabilities across functions and are using them consistently to generate substantial value. Another 22% have an

AI strategy

and advanced capabilities and are starting to generate value. The remaining 74% are struggling to scale and demonstrate tangible value. It’s not just—or even mostly—about the technology. The research also shows that successful firms focus 70% of their resources on people and process challenges, allocating 20% to technology challenges (such as data and platforms) and 10% to algorithm quality. Companies that focus their efforts on a limited number of high-potential processes capture the most value at scale.

Funding the Journey and Making the Transformation Stick

Top-down, one-time cuts have only a limited impact. A sustainable transformation requires long-term thinking, strategic investment, and robust management of change. Management needs to identify structural inefficiencies and eliminate low-value activities to free up resources for transformative initiatives.

Quick wins can build momentum. High-value initiatives with near-term payback, such as digital use cases that deliver immediate benefits, can raise money to fund longer-term actions and build organizational confidence in the transformation process. Early movers will benefit from faster and deeper cuts, but for all refiners, operating model redesign and culture change will likely be necessary to embed sustainable cost-savings behaviors.