Telcos face a pressing value creation challenge. The telecom industry’s total shareholder return has recently lagged other sectors, with a median five-year annual average of just 4%, compared with the cross-industry median of 11%. Saturated markets, declining prices, and intensifying competition—particularly from technology companies tapping into telcos’ value pools—have made it increasingly difficult to drive sustained growth and profitability. As shareholder scrutiny mounts, telcos must take decisive action to redefine their competitive positions.

Strategic M&A presents a critical lever for driving value, offering a path to expansion, operational efficiencies, and resilience against industry disruptions. The telecom industry’s M&A landscape is more dynamic than ever, with diverse deal archetypes reshaping the market and deal activity surging across regions. From traditional consolidations to infrastructure deals and adjacency-focused acquisitions, these strategies reflect telcos’ efforts to drive innovation, expand market reach, and strengthen competitiveness.

To seize these opportunities, telcos must elevate M&A to a CEO priority, continually scan the market for opportunities, and approach deal making creatively in order to unlock new growth pathways. Clear stakeholder communication and disciplined execution are also critical to ensure that each strategic move translates into measurable impact and delivers long-term value.

M&A Delivers Value in a Tough Market

In the telecom industry’s tough environment, smart M&A moves can promote a variety of benefits:

- Driving Growth. Organic growth is becoming harder to achieve in both fixed and mobile segments, owing to fierce competition in mature markets. Inorganic growth by means of M&A offers a faster route to scale and expansion through the acquisition of existing market share or entrance into adjacent markets. Telcos can also broaden their addressable market, such as by serving both fixed and mobile customers.

- Optimizing Costs and Efficiency. M&A enables telcos to reduce redundancies, lower procurement costs, and integrate shared services, leading to greater operational efficiency. Besides affording traditional economies of scale, strategic telco mergers allow for network optimization, IT rationalization, and streamlined infrastructure investments. For instance, integrating IT operations and back-office functions can reduce development and maintenance costs, while consolidating sales and distribution channels leads to a more efficient go-to-market strategy. Additionally, network sharing and integration of data centers can generate significant savings by reducing infrastructure duplication. Cost synergies range from 5% to 20%, depending on the category and deal type.

- Enhancing ROIC. M&A-driven consolidation helps streamline competition, leading to improved pricing, operational efficiencies, and, ultimately, higher returns on invested capital. By reducing market fragmentation, telcos can optimize network investments, lower customer acquisition costs, and achieve more sustainable profitability.

- Diversifying Revenue. Acquiring businesses outside of traditional telecom operations enables telcos to expand their offerings, reduce dependence on core services, and cross-sell products. This includes integrating complementary offerings in "close to core" areas of the value chain where they already hold a competitive advantage—such as access to customer households—or selectively targeting sectors with high growth potential. Additionally, telcos can establish a "right to play" in new markets through strategic M&A or partnerships.

M&A enables telcos to reduce redundancies, lower procurement costs, and integrate shared services, leading to greater operational efficiency.

Telcos should seize the moment and aggressively pursue these benefits. After peaking in 2020 and 2021 and contracting during the following two years, M&A activity is rebounding across industries, including telecommunications. Low market growth rates and profitability pressures are motivating mergers and divestments, creating opportunities for strategic players to strengthen their positions.

At the same time, telcos’ lower valuations compared with other industries make their assets particularly attractive. As financial markets exert pressure and telcos prepare for the next wave of capital expenditure investments, many are offloading noncore or underperforming assets at competitive prices. However, it remains critical for buyers to focus on acquiring assets that align closely with their strategic objectives to ensure long-term value creation.

M&A Battlefields Have Become More Diverse

As telcos prepare for deal making, they must first clarify the rationale behind their pursuit of M&A—whether to drive growth, enhance innovation, or diversify the business. Once the rationale is clear, identifying which assets to buy or sell becomes critical.

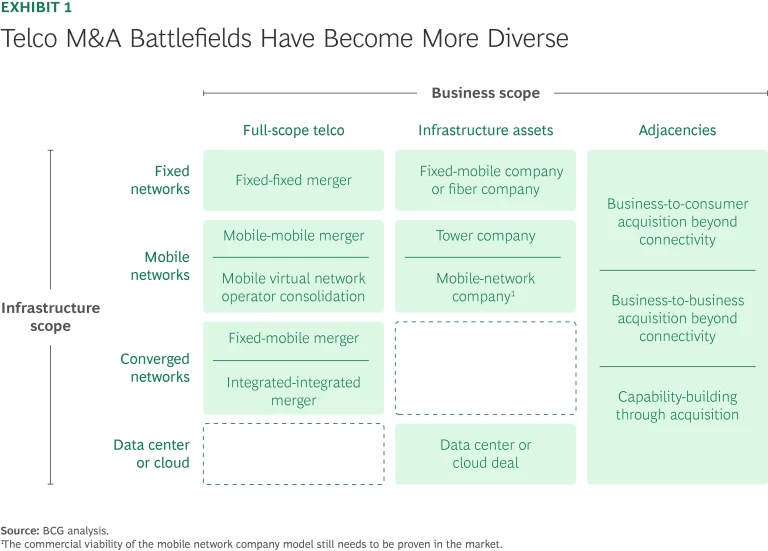

The telco M&A landscape has evolved beyond traditional consolidations to include a variety of deal archetypes, each tailored to specific strategic objectives. Understanding these distinct archetypes helps telcos navigate opportunities that align with their priorities, from scaling operations to unlocking new capabilities or revenue streams. (See Exhibit 1.)

Full-Scope Mergers for Traditional Consolidation. Full-scope mergers—including fixed-fixed, mobile-mobile, or fixed-mobile combinations—represent the traditional approach to telco consolidation. A few years ago, many believed that the era of large-scale telco mergers was over, particularly in developed markets. The consensus was that markets had stabilized with three to four mobile or fixed-mobile convergence (FMC) players and a small number of fixed operators per country, many of which were part of multinational conglomerates.

Subscribe to receive the latest insights on Technology, Media, and Telecommunications.

Now, however, full-scope mergers are experiencing a resurgence, driven by a combination of economic pressures and strategic opportunities. Economic challenges are encouraging telcos that once valued independence to pursue consolidation to improve returns. Mobile-to-mobile mergers, for instance, focus on cost synergies and strengthening competitive positioning, while FMC deals combine customer bases and enhance product offerings. A notable FMC example is Verizon’s planned acquisition of Frontier Communications, the largest pure-play fiber internet provider in the US. Verizon anticipates at least $500 million in annual cost synergies within three years, arising from increased scale and network integration.

At the same time, large multinational operators are divesting assets that lack meaningful cross-border synergies, creating fresh opportunities for acquisitions. For instance, Vodafone recently undertook significant divestitures in Spain and Italy as part of its strategic initiative to streamline operations and concentrate on core markets. Meanwhile, the global rollout of fiber networks has spurred the rise of numerous smaller fixed-line players, triggering a wave of consolidation activity.

Infrastructure-Centric Deals to Unlock Capital. Infrastructure carve-outs and joint ventures play an increasingly important role in the telco M&A landscape, especially in an era of sustained high interest rates. For companies under financial pressure, selectively carving out assets such as fiber networks or towers can unlock capital for reinvestment. At the same time, joint ventures are a strategic alternative to full acquisitions, enabling telcos and their partners to share risks and scale efficiently. Notable examples include fiber network partnerships and collaborations aimed at accelerating 5G deployment. In 2024, for instance, T-Mobile and private equity firm EQT announced a joint venture to acquire Lumos, a fiber network operator, with the goal of expanding broadband access across the US. Infrastructure asset deals have made the telco sector increasingly attractive to private equity investors.

Adjacency Expansions for Growth Beyond Connectivity. Telcos are increasingly pursuing adjacency-focused deals to diversify revenue streams and enhance capabilities. Examples include acquisitions in business process outsourcing and AI-enhanced services, which enable telcos to enter high-growth markets and offer differentiated solutions. For instance, Telus, a Canadian telco, acquired LifeWorks, a provider of tech-enabled solutions, to expand its offerings in employer-focused health care services.

Unlike other M&A categories, adjacency expansions lack a small set of successful archetypes. Instead, telcos are exploring a broad spectrum of approaches, from full acquisitions aimed at driving top-line growth to minority investments designed to tap into new capabilities.

Although some adjacency acquisitions have proven successful, it is essential for telcos to critically assess their "right to play and win" in the adjacent industries they aim to conquer. This strategic clarity ensures alignment between the acquisition and the telco’s core strengths, increasing the likelihood of long-term success.

Regional Differences Reveal Distinct Trends

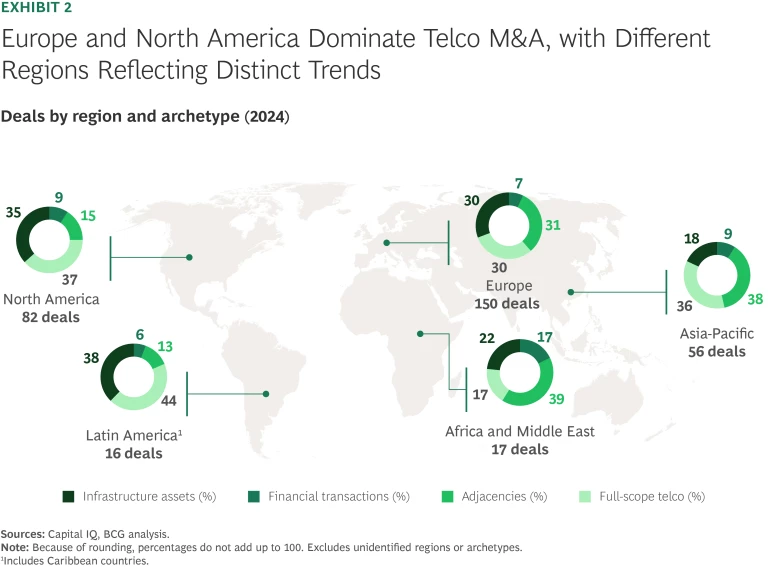

Telco M&A volumes are rising globally, with regional differences in activity in 2024 revealing distinct trends across key markets. (See Exhibit 2.)

- Europe is leading in deal volume and diversity, reflecting the region's mature market dynamics and mix of strategic transactions and infrastructure-focused deals.

- North America also demonstrates robust activity, showcasing the continued consolidation and strategic partnerships within its highly competitive market.

- Emerging markets show a rising trend of full-scope telco M&A and adjacency deals, driven by expanding connectivity demands and untapped high-growth opportunities. However, infrastructure deals remain less prevalent than in developed markets. As emerging markets accelerate network investments and improve their regulatory frameworks, infrastructure deals are expected to gain traction in the coming years.

The M&A Imperatives for Telco C-Suites

The complex and competitive telco M&A landscape demands bold leadership and decisive action from C-level executives. To navigate this dynamic environment, they must focus on a number of imperatives.

Make M&A a CEO priority. Successful M&A requires dedicated attention and ownership at the highest level. CEOs must lead with a clear vision and drive alignment across the organization to unlock maximum value.

Adopt an “always on” M&A strategy. Maintaining a real-time perspective on the market is essential. M&A teams should continuously scan for new opportunities and monitor competitors’ actions. CEOs can drive this proactive mindset by regularly challenging their organizations with questions like "What are we not doing that we should be doing?" This approach fosters agility and ensures that the organization is ready to seize the right opportunities as they arise.

The complex and competitive telco M&A landscape demands bold leadership and decisive action from C-level executives.

Think beyond traditional boundaries. Explore innovative deal archetypes in the M&A battlefields, such as adjacency expansions and infrastructure-centric deals, as well as strategic divestments. Creative deal making can unlock unique pathways for growth and transformation.

Define a clear value creation strategy and a compelling storyline. A clearly articulated value creation strategy is essential to realizing a deal’s full potential. Telco leaders must define their financial, operational, and strategic objectives early on, ensuring that every transaction aligns with broader business goals and delivers measurable outcomes. The strategy should be supported by a compelling storyline, with M&A decisions linked to a clear value narrative that resonates with investors and markets.

Demonstrating how each move drives growth, profitability, and long-term transformation is critical to earning buy-in.

Use integration as a platform for transformation. M&A should serve as a catalyst for fundamental change across all units and functions of the merging organizations. The integration process presents an opportunity to challenge the status quo and pursue initiatives that would have been necessary even without the merger. Telco leaders should use the process to rethink business models, accelerate digital transformation, and unlock new synergies beyond cost cutting. To maximize impact, companies must execute these programs with agility and discipline.

As the telecom industry evolves, telcos face a pivotal moment in shaping their future. The rise of diverse M&A archetypes and distinct regional trends underscores the immense potential for innovation, efficiency, and growth. By leveraging these opportunities in the context of a holistic portfolio approach, telcos can not only navigate today’s challenges but also secure a competitive edge in the years to come. With the right moves, telcos can create lasting value for shareholders and customers in an increasingly interconnected world.