In insurance, as in other sectors, artificial intelligence has generated a lot more talk than value. Numerous early-stage demonstrations and proofs of concept have highlighted the immense potential to change the way insurance companies work. But many pilots also have fallen short, and scaling has proved a challenge, raising questions about early-stage practical applicability. The speed of development of AI —including generative AI and, most recently, AI agents —further fuels uncertainty and a wait-and-see approach. Some boards and management teams have pushed ahead while others are understandably hesitant to unleash bold initiatives without a clear view forward to results. The big question for many insurers is still where and how this radical new technology can add value today and in the years to come.

In our view, insurers should approach AI in all its forms with three things in mind. First and foremost, don’t overstrategize the technology. Rather, use AI to narrow your bets and boost your competitive edge. Second, push hard for near-term P&L impact. Transform a few high-value functions and avoid subscale setups. Third, AI needs business leadership and investment in people and processes, so don’t get stuck in a tech silo. These three approaches can set your organization up for success by helping you sort through the inevitable confusion and guarantee certainty in execution.

Narrow Your Bets

As they think through a technological step change as far-reaching as AI, insurers wrestle with such questions as: How can this technology help us achieve our ambitions? Should our ambitions be more ambitious? How does AI change the marketplace, and how do we continue to win? What differentiates us from our competition, and how can AI widen the edge? Where are the high-value areas to concentrate scarce resources?

For a global commercial property and casualty (P&C) group, the answers could involve a material improvement in speed to quote in underwriting. A local health insurer might focus on taking costs out of claims and improving customers’ satisfaction with claims processes. A retail P&C player could try to finally solve its longstanding problem of dramatically underserving customers despite the high cost of its customer service operations.

Subscribe to our Insurance E-Alert.

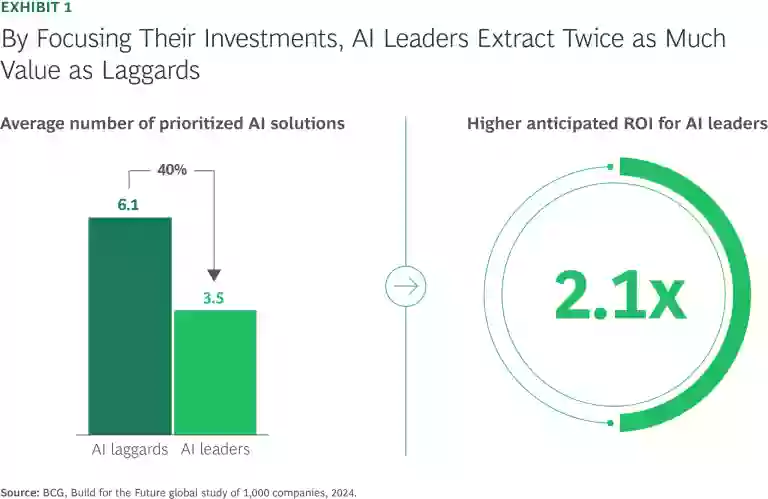

Once the priorities are set, the next question is, Where can AI have the biggest impact? Insurers need to avoid the temptation to spread scarce resources across multiple functions, which generally results in no initiatives gaining the backing or traction necessary to support strategic objectives. Our 2024 global Build for the Future survey, a continuation of our studies into digital transformation and AI maturity, shows that pacesetters expect to extract twice as much value as laggards by focusing their AI investments. (See Exhibit 1.)

Focus on Impact, Fast

AI will help insurers increase productivity in creating, synthesizing, or analyzing any language-like data, including code. This potential is evolving at high speed. The applications that will have the most impact in the near term are those that support processes in which lots of employees perform standardized tasks or where a few specialized staff tackle mission-critical, data-heavy challenges. The degree of impact will vary according to each company's circumstances, such as its digital maturity and ability to quickly connect AI applications to its backend systems.

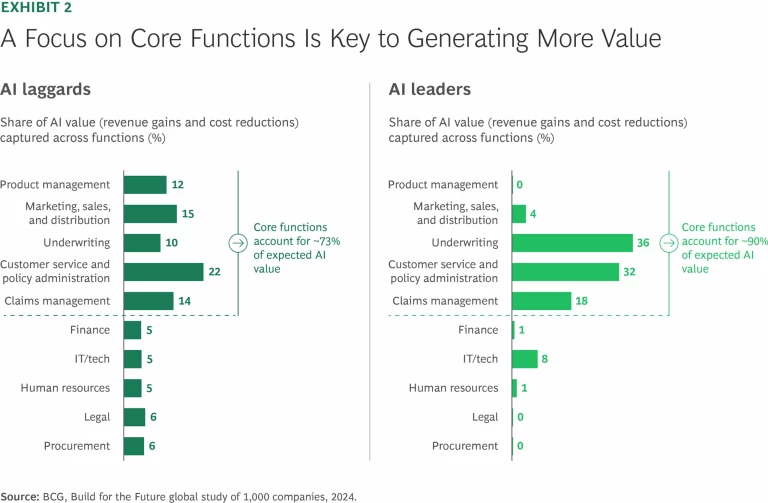

The insurers that are already achieving P&L impact concentrate their efforts. We have seen AI leaders generate significantly more value than other companies by focusing on one of a few core areas—such as underwriting, customer service, claims processing, or sales —before moving on to the next. (See Exhibit 2.) The choice of where to double down depends on the company’s strategic priorities and technological context. AI holds promise in other fields, such as marketing, product development, and support functions, but the immediate P&L impact in these areas will be more limited, especially in the early stages of implementation.

Here are the areas where we have seen leading insurance companies create early impact.

Underwriting. Our AI work with US and UK commercial P&C insurers suggests that efficiency in complex lines of business can be improved by as much as 36%, primarily by augmenting manual underwriting processes. We also expect up to a 3 percentage point loss-ratio improvement through better use of data and the ability to factor unstructured, and previously inaccessible, information into underwriting decisions.

Customer Service. BCG’s work involving more than 20,000 insurance service and operations employees has shown productivity gains of more than 30% from equipping these workers with AI-empowered tools. At leading insurers, knowledge assistants so far account for almost two-thirds of the productivity gains, making them a strong starting point in a transformation. Other applications, which can be added later, include document generators, call transcribers, and sentiment analyzers.

Claims. AI will transform claims management in two fundamental ways. First, for more complex claims, standalone applications that automate such processes as first-notice-of-loss data extraction, document processing, and smart triaging can enhance efficiency and reduce manual workloads. We are seeing cost reductions of up to 20% and increases in the speed of claims processing of as much as 50%.

Second, for most simple claims, a fully automated end-to-end process redesign will embed AI across the entire claims journey, from data capture and triage to automated decision making and settlement. This kind of comprehensive transformation will enable real-time resolution for up to 70% of simple claims, cut operational costs by 30% to 50%, and significantly improve customer satisfaction through faster, more transparent claims handling.

Sales. AI’s impact on insurance sales depends on the distribution model. For direct writers, autonomous sales agents will play a key role, particularly in the upper stages of the sales funnel. These AI-driven agents can efficiently process large volumes of unqualified leads, directing customers to the most suitable sales journey—fully digital, phone assisted, or in-person. AI-assisted agents can deprioritize low-potential leads, enhancing conversion rates and reducing customer acquisition costs. Such automated processes also appeal to the expectations of younger, tech-savvy consumers.

In agent- and broker-driven channels, AI can boost salesforce productivity primarily by automating administrative tasks, preparing for and summarizing sales meetings, and making complex information and analysis more easily accessible. Administrative tasks currently consume more than 50% of an agent's or a broker's time, limiting the opportunity for client engagement and business development. Insurers can reduce this burden with AI, potentially freeing up hours per day for agents to focus on high-value interactions.

IT. The tech function is a primary testing ground for AI in insurance. Nearly all of our clients are running pilots spanning current-business and change initiatives. One leading EU insurer, for instance, is implementing an AI-driven “smart migration” program to transition more than 50% of its products from legacy to cloud-based architectures. By using AI to analyze legacy code, extract business rules, and automate data mapping, the company expects to cut migration time in half and reduce the costs of transition by 30%.

Other high-potential areas include software development, test automation, and IT service management, where AI can significantly boost efficiency. AI-powered coding assistants (such as GitHub Copilot and emerging tools such as Vercel’s vO and Cursor AI) help developers write, refactor, and test code faster, while virtual agents can automate level 1 IT support, resolving routine issues instantly. With a growing number of off-the-shelf AI solutions, insurers can achieve rapid IT efficiency gains without having to build custom models from scratch.

Our client experience indicates that the impact of AI tools and AI-facilitated process redesign in IT will be profound. Early adopters will gain (or regain) a competitive edge in

innovation and delivery

while curbing ever-increasing IT costs. Many insurers are already moving quickly, and we expect the gap between leaders and laggards to widen.

Invest in People and Processes

Because of uncertainty about how to proceed, many insurers are adopting a late-follower strategy. This is a mistake. Building the necessary capabilities—particularly the human skills—takes time, so slower movers risk falling behind speedier competitors. Companies that move more quickly will likely reap significant strategic benefits in the longer run as well. Those engaging their employees early, reskilling them faster and hiring sooner, establish a mindset for change. Prioritizing staff talent and skills will ensure that AI complements human ingenuity and innovation. Capturing early benefits will allow these companies to invest more, accelerating progress.

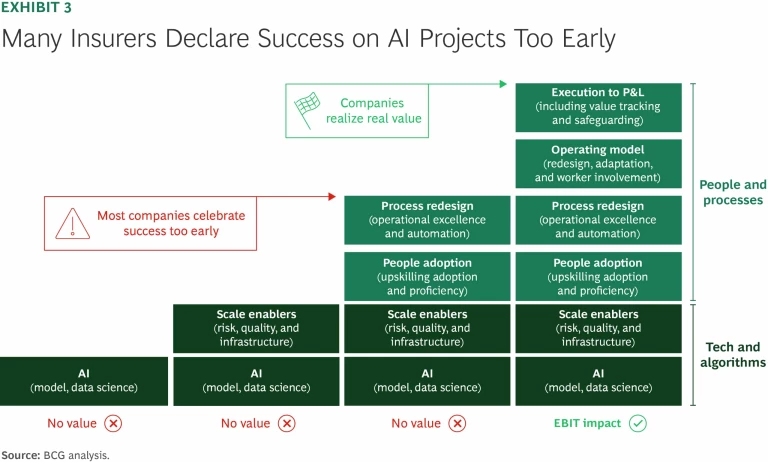

Another common mistake is declaring the success of AI projects too early, a result of focusing too much on algorithms and technology at the expense of people and processes. (See Exhibit 3.)

Our rule is to devote 10% of available resources and effort to the algorithms, 20% to technology and data, and the balance to the human dimension. Our most recent survey on value from AI bears this out. Four of the top five challenges that insurers cite in implementing AI are people related: AI literacy, prioritizing opportunities, establishing ROI from identified opportunities, and reimagining workflows and implementing processes. Plenty of companies acquire the technology, build the scale enablers, engage people, and redesign the processes. Then they declare victory. But end-to-end measures and what we call “executional certainty” are required to achieve value. Most companies do not go the extra mile of redesigning the operating model and value tracking to the P&L.

To achieve the anticipated high levels of return, management teams must recognize that they are embarking on a functional transformation, the success of which depends on substantive changes to the operating model. The focus of the program (and accountability as the focus changes) will evolve over time, from defining desired outcomes (the responsibility of the C-suite) to implementing and scaling up the technology (the CIO) to putting the necessary people, processes, and structures in place (business leaders) to making the functional transformation happen (the organization as a whole). The new operating model depends on close cross-functional collaboration between the businesses and IT. Business functions need to take responsibility for defining AI priorities and delivering value in their respective areas. IT should be building reusable AI assets that align with the overall strategic roadmap. The tech function needs to manage and maintain assets, platforms, and an ecosystem of partnerships (avoiding early lock-in effects).

AI will reinvent many functions in the insurance industry. Insurers will be able to scale unprecedented efficiencies and redraw their value chains. For industry leaders, the best path to realizing this potential requires setting the right transformation targets and following a well-charted journey based on leveraging AI in critical functions. In the end, AI does not replace any existing strategy. Rather, the technology supercharges current efforts, empowering insurers to accelerate progress toward their existing goals and set even more ambitious targets for the future.