Global attention lately has fixated on the challenges and tensions fracturing the Western-led world order, such as “America First” policies, the fraying of decades-old alliances, dramatic US tariff increases on all its global trade partners, and Europe’s struggle to remain competitive.

Less-noticed has been a development with perhaps even greater long-term implications for the global economy—the rise of a “third front” on the world stage spanning more than 130 nations outside the orbits of the West and China and that accounts for more than three-fifths of global population. Nations in the Global South, as this grouping is known, are emerging from the shadows to craft their own paths in a multipolar world.

Several key characteristics illustrate the growing agency of Global South nations. While highly diverse, they share a focus on economic growth and on deepening trade and investment links with the rest of the world. They are multi-aligned and unencumbered by the geopolitical agendas of the legacy major powers. Indeed, they’re increasingly forming new trade, technology, and economic development partnerships that align with their own strategic priorities, rather than simply responding to external pressures. And they’re taking a pragmatic approach to climate action, balancing growth with sustainability.

Perhaps more crucially, the Global South is where the future is being built. These economies will account for the lion’s share of global growth well into the future, defining the next wave of economic opportunity. They also hold what the world needs: critical resources to secure global supply chains, young and expanding workforces, and growing consumer markets.

This combination of economic dynamism and strategic leverage puts Global South nations in a relatively strong position to develop and grow on their own terms, seize new economic opportunities, and serve as crucial “swing players” in a fractured world order. What’s more, in today’s geopolitically charged environment, Global South nations are desirable trade and investment partners for most, some, or all of the world’s main trading players, giving them access that even top economies no longer enjoy. They are generally free to pursue pragmatic policies that keep them open for business to all.

Although a Global South tide has been rising for years, it is now at a tipping point. As the world shifts to a multipolar order, the Global South is seizing its moment.

The Global South Is on the Rise

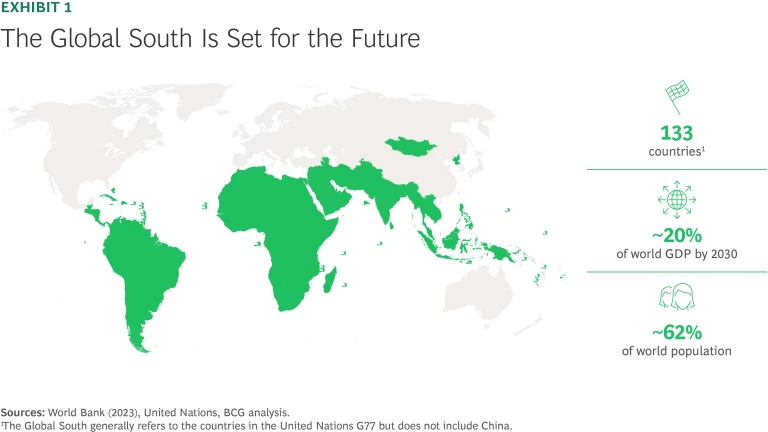

The Global South lacks a formal definition and organization. Rather, it has become a moniker proudly embraced by leaders in a wide range of nations—spanning Asia (not including China), Africa, Latin America, and the Middle East—that Western-led institutions have long referred to as part of the “developing world” and “emerging markets.” (See Exhibit 1.) The term has come to convey these nations’ confidence that they can shape global economic and geopolitical dynamics by pooling their influence and levering their clout.

Subsets of the Global South are linked in various configurations through multinational alliances and trade agreements. One such grouping is

Subscribe to receive BCG insights on the most pressing issues facing international business.

By virtually every measure, the Global South is rapidly gaining economic weight. If the United Nations G77, which encompasses 133 nations not including China, is used as a proxy, the Global South accounts for around 18% of global GDP. But with their combined GDP projected to grow by an average of 4.2% annually through 2029, compared with 1.9% for advanced economies, these nations are likely to drive the lion’s share of global growth. Consumption is growing nearly as fast, fueling dynamic markets for domestic and foreign companies alike.

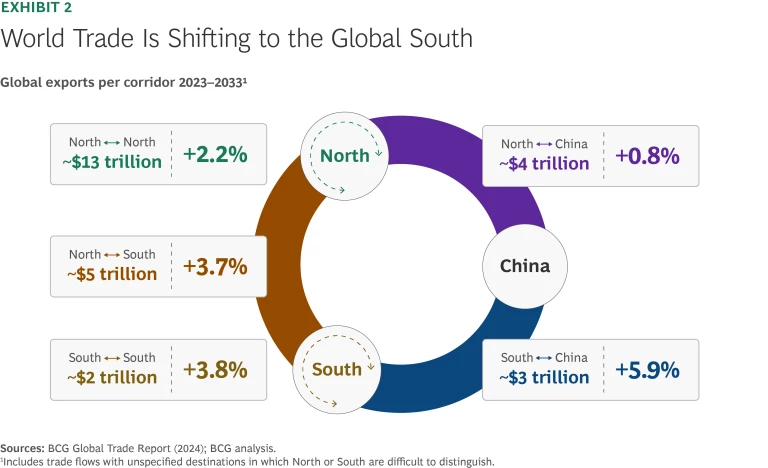

The Global South is also a rising force in trade, which is projected to post 4.4% CAGR over the next five years. By 2033, annual Global South trade is projected to approach $14 trillion. A growing portion of those nations’ trade is with each other: South-South trade is projected to expand 3.8% annually through 2033, compared with 2.2% CAGR for North-North

The recent sweeping reciprocal trade and tariff announcements by the US may alter these flows. But investment in the Global South could still potentially benefit under this new scenario. Negotiations between US and Global South nations, such as those recently proposed by Vietnam, may eventually improve tariff outcomes. And most importantly, players in the Global South are increasingly investing among themselves and building new growth and opportunity bridges, balancing partnerships between the different poles in a multipolar world.

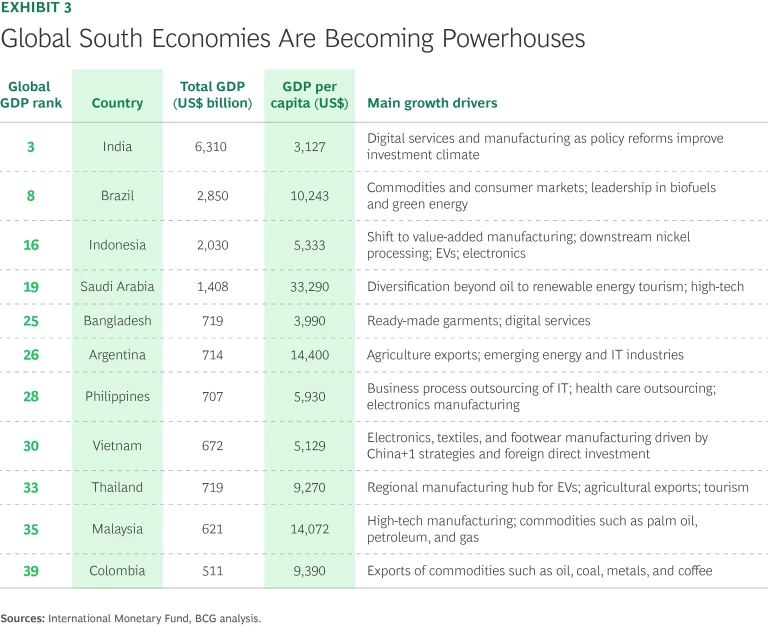

As a result, more Global South nations are joining the ranks of the world’s largest economies. By 2029, India is projected to be the third-largest economy, with a GDP of $6.3 trillion. Brazil is projected to be No. 8 and Indonesia No. 16. Nations such as Saudi Arabia, Bangladesh, Argentina, and the Philippines are climbing rapidly on the list. (See Exhibit 3.)

Relentless Growth, Smarter Trade, Multi-Alignment, and Climate Pragmatism

Global South nations don’t follow a uniform strategy. But four general features characterize the attitude they bring to a fractured global order.

Focus on Economic Growth

The core objective of many Global South governments is to expand economic opportunities and alleviate poverty for their populations. This pragmatic focus on growth keeps them grounded and, in most cases, relatively neutral in today’s geopolitics. Most are pursuing export-led strategies to power GDP growth. They are modernizing and deepening existing industries and establishing new ones—aiming to capture more value through a winning model of investment, affordable talent, technology diffusion, and innovation.

Their growth pathways are diverse and rooted in their local context. Many West African nations, for example, are funding growth through abundance of natural resources. Export manufacturing nations in Southeast Asia—such as Indonesia, Malaysia, Thailand, and Vietnam, which enjoy significant labor- and material-cost advantages—are moving beyond low-cost assembly to higher-value industries such as automobiles, consumer electronics, and renewable energy systems.

India is pursuing a multi-pronged strategy. The country is investing in infrastructure to strengthen its role as an important export manufacturing destination, especially as global companies seek low-cost alternatives to China. India is modernizing a range of heavy industries. Its digital economy contributes 11% to GDP and is growing fast. Already a major global provider of information technology services, India is leveraging its immense pool of technical talent, growing broadband penetration, and the world’s third-largest start-up ecosystem (boasting 117 unicorns as of January 2025) to become a major player in such areas as artificial intelligence and advanced computing.

Granted, these development pathways face significant challenges in many nations, such as rising income inequality, limited finances, and political instability. But this relentless focus on growth and value creation is strengthening domestic ecosystems, creating jobs, driving innovation, and building more self-sustaining and competitive economies.

Strengthening Trade Footprint

At a time when the world’s major powers are gearing up for trade wars and even pulling back from post-WWII multilateral institutions, many Global South nations and regions continue to broaden and deepen their trade ties—with advanced economies as well as with each other.

Global South commerce is bolstered by an extensive network of free-trade arrangements. It includes intraregional agreements such as ASEAN, Asia’s Regional Closer Economic Partnership, the 54-nation African Continental Free Trade Area, South America’s Mercosur, and the Pacific Alliance in Latin America. Asia-Pacific Economic Cooperation (APEC), a broader framework that includes the US and China, continues to facilitate trade liberalization and economic integration. It engages the private sector through the APEC Business Advisory Council.

Global South nations are expanding trade ties with other developed economies. In December 2024, the EU and Mercosur announced they had reached agreement on a free-trade pact after over 20 years of negotiations, while the Comprehensive and Progressive Trans-Pacific Partnership features Global South countries of the Asia-Pacific as well as Japan, Australia, Canada, and the UK.

In many cases, Global South nations are suspending long-standing rivalries and differences to enhance economic growth and their relevance in the global order. The thaw between India and China is great recent example. The two nations have elected to briefly overlook border disputes to collaborate more on trade with each other and resume direct flights. India has opened its market to Chinese companies like Shien. Cross-border trade through the strategically sensitive Nathula Pass resumed in October 2024. While it’s too early to call this a reset in relations, the shift underscores India’s pragmatic understanding that it needs to trade more with China to become a credible global manufacturer.

Global South nations in general are collaborating more with China. The country’s Belt and Road Initiative, which emphasizes connectivity and infrastructure development in the Global South, and the transfer of some production from China to other low-cost nations has propelled this shift. It’s an open question whether the current trade frictions stemming from the United States will accelerate this process.

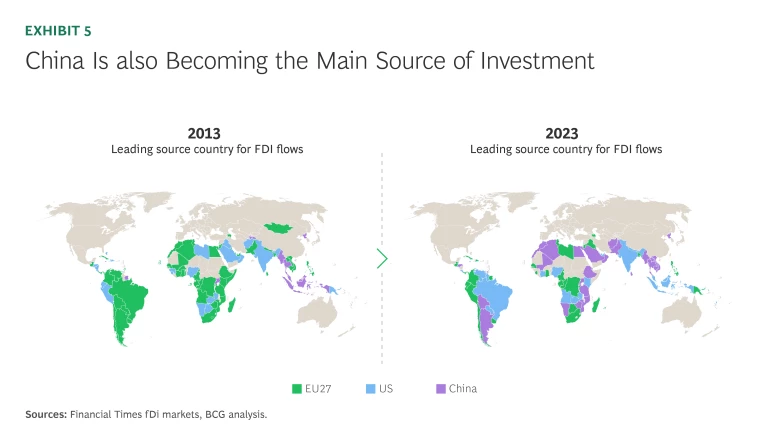

A decade ago, the US and EU were the dominant trading partners with South America and most of Africa and the Middle East. Today, China is the top partner for 63 Global South nations, including Brazil, Chile, Saudi Arabia, and Kenya, compared with 36 in 2013. (See Exhibit 4.) Through 2033, trade between the Global South and China is projected to average 5.9% annual growth, compared with 3.7% CAGR with North-South trade. China has also displaced the US and EU as the leading investor in many Global South economies. (See Exhibit 5.)

Global South nations aren’t just trading more. They’re also trading smarter by moving from cost-driven to value-driven models. Rather than merely exporting natural resources needed by the world, they are leveraging them to create broader domestic industries and value chains. Indonesia, for instance, has stopped exporting nickel ore and is focusing on processing it locally and manufacturing downstream products, such as lithium-ion batteries. Chile has established a new national lithium policy that promotes adding value to the mineral.

Maintaining stable trade, of course, will be challenging given rising economic nationalism around the world and high borrowing costs that disproportionately impact export-oriented economies. It also requires delicate diplomacy due to traditional tensions between neighboring nations and growing manufacturing overcapacity in China that threatens to flood the Global South with cheap imports and undermine domestic industries.

Nevertheless, Global South nations are strategically becoming a backbone of global value chains, especially as businesses seek China+1 alternatives. No longer on the sidelines, Global South nations are emerging as driving forces in global trade with “made-in-South” solutions that are steadily gaining ground worldwide.

Geopolitical Balance

Rising Global South powers have moved far beyond the symbolic roles they played in the Non-Aligned Movement during the Cold War. They are using their geopolitical and economic leverage to achieve key goals, such as strategic investments and the acquisition of technology. They are engaging in a sophisticated balancing act amid competition between the US, China, and other major powers. While still highly heterogeneous, the Global South is keen to work across geopolitical fault lines by championing multi-alignment in the multilateral system through BRICS+, ASEAN, and other fora to shape the future global order.

India illustrates this skillful balancing act. The country has enjoyed a rapidly growing trade relationship with the US that is expanding beyond IT services to manufacturing. It is managing trade tensions by adjusting tariffs and importing more from the US, such as crude oil and defense equipment. At the same time, India maintains strong ties with Russia in similar areas despite Western sanctions. And regardless of border tensions with China, India is actively engaging its neighbor through BRICS+ and trade, particularly in the electronics, pharmaceutical, and automotive sectors.

Similarly, Brazil is strengthening ties with China through BRICS+, trade partnerships, and energy and transportation infrastructure projects. Meanwhile, it is collaborating with the EU on the environment through initiatives such as the Amazon Fund and strengthening trade ties through deals such as the EU-Mercosur Association Agreement, the most progressive trade agreement Brazil has signed to date, expanding disciplines and coverage.

Pragmatic Approach to Climate

The Global South has no choice but to confront a warming planet, as its economies and societies face disproportionate damage from extreme heat, drought, flooding, wildfires, and other climate events. Even though they historically have emitted far less greenhouse gas, up to 15% of combined Global South GDP is at risk of climate change impacts by 2050, compared to 4% for advanced economies.

Sustainability standards in key export markets intensify pressure on the Global South to accelerate its energy transition. The EU, for instance, is implementing a system that assesses a tax on the CO2 footprints of many imported materials and products and a ban on goods sourced from recently cleared rainforests or made with forced or child labor.

Many Global South nations are taking a pragmatic approach to climate, however, by prioritizing solutions that benefit both their environments and their economies. Given their dependence on fossil fuel exports and more energy-intensive industrialization, such nations are maintaining growth-centric policies and gradual energy transition pathways. ASEAN’s strategy for becoming carbon neutral exemplifies this balance. The bloc seeks to unlock $5.3 trillion in economic opportunity while advancing sustainable growth. (See “ASEAN Illustrates the Keys of Global South Success.”)

ASEAN Illustrates the Keys of Global South Success

ASEAN illustrates the four key themes characterizing the rise of the Global South.

Focus on economic growth.

ASEAN’s economic growth is underpinned by strategic policies and cooperation that balance the region’s collective strengths with the unique development paths of each member state.

High-value industrialization in sectors as diverse as textiles, automotive components, and electronics drove ASEAN’s 4.7% CAGR in GDP, outpacing the global average. By absorbing advanced technologies and deepening its value chains, ASEAN is in position to replicate China’s success as a global manufacturing platform.

ASEAN is a pioneer in digital transformation through initiatives that are accelerating adoption of fintech, e-commerce, and artificial intelligence. The ASEAN Digital Economy Framework Agreement, the world’s first such pact that will be regionally binding, is expected to double ASEAN’s digital economy to $2 trillion by 2030 through new business models, greater economies of scale, and innovation.

Strengthening trade footprint.

So far, ASEAN is successfully navigating rising protectionism, supply chain shifts, and other complexities that are reshaping global trade. This is enabling the region to emerge as a key global trade hub.

Total ASEAN trade reached $3.5 trillion and foreign direct investment reached $234 billion in 2023; both are expected to climb. BCG projects that ASEAN trade will grow 3.7% annually over the coming decade, driven by expanding manufacturing capabilities and deeper integration into global value chains. Promotion of “China+1” strategies is paving the way for new investments, particularly in electric vehicles and advanced manufacturing. Trade with China is expected to grow 5.6% annually through 2033.

The region is upgrading its ASEAN Trade in Goods Agreement and its free trade agreements with China and India. It is also negotiating a free trade agreement with Canada that would be ASEAN’s first with a North American nation. ASEAN also participates in the Regional Comprehensive Economic Partnership to strengthen the region’s competitiveness.

Geopolitical balance.

ASEAN’s strategic autonomy enables it to remain a neutral economic hub. This stance helps prevent the region from being drawn into rivalries among major powers and capitalizes on shifting supply chains as companies around the world seek to geographically diversify manufacturing and procurement.

ASEAN aims to further strengthen its geopolitical and economic influence as a stabilizing force in the Indo-Pacific through such platforms as the East Asia Summit and ASEAN Regional Forum.

Climate pragmatism.

The region’s approach to sustainability is to be practical, inclusive, and aligned with broader development goals.

The ASEAN Strategy for Carbon Neutrality sets the course for ensuring a collective regional transition to a low-carbon future by complementing national policies. The strategy is projected to generate $5.3 trillion in GDP, attracting $6.7 trillion in green investment by 2050. Implementation is well underway.

As Secretary-General of ASEAN Dr. Kao Kim Hourn puts it: “ASEAN stands as a testament to the power of regional cooperation in the world. Through unity and resilience, we have transformed our economic landscape, proving that sustainable development and shared prosperity are within reach for all nations.”

Indeed, much of the Global South has natural advantages in the green transition. The vast forests and wetlands of Southeast Asia, Sub-Saharan Africa, and the Amazon are among the world’s largest “carbon sinks” and have significant potential to sequester carbon through nature-based solutions. This can unlock major economic opportunities in carbon markets.

Some Global South nations are becoming leaders in sustainability. Brazil, for instance, not only has one of the world’s cleanest mixes of energy but is also the second-largest supplier of biofuels and plans an additional $40 billion in investment by 2037. Chile aspires to be among the world’s largest suppliers of green hydrogen by 2040.

Unlocking the Global South’s potential for the green transition, however, will require sustained international support. By some estimates, these nations will need to invest an estimated additional $1.3 trillion a year in technology to mitigate and adapt to climate change.

How Global South Governments Can Unlock Opportunities

Shaping and adopting the right policies is crucial to facilitate opportunities and address challenges for Global South economies. Here are four strategies government leaders can consider:

Build trade resilience to prepare for supply chain shifts.

In a trade environment that is being reshaped by economic protectionism and near-shoring, it is becoming easier for Global South nations to participate in global supply chains. But it’s becoming harder to compete with other nations with low manufacturing costs. Global South nations can diversify their exports, reduce trade costs through measures such as customs reforms and trade facilitation, and invest to build brands and improve quality. Regional trade agreements and partnerships can facilitate talent and skills transfer. On the other hand, in some cases governments may need the flexibility to enact new trade actions to protect domestic industries from big import surges as trading partners seek new markets to absorb excess capacity. Monitoring geopolitical shifts, establishing export stabilization funds, and enhancing trade promotion capabilities can help build resilience.

Engage closely with the Global North.

Some Global North economies are seeking new avenues of growth as they face competitive challenges and shrinking key traditional export markets. As US protectionist policies restrict trade with Canada, for example, that nation’s companies are pivoting toward new markets. Global South economies have the opportunity now more than ever to position themselves as key trade and investment partners to the Global North and integrate more broadly and deeply into supply chains.

Invest early in innovation and skills training.

Falling behind in science, technology, and innovation risks stagnation and exclusion from high-value industries like AI, renewable energy, and biotechnology. Global South nations on average spend only about a quarter of what advanced economies invest in R&D as a percentage of GDP, according to the World Bank. Governments therefore need strategies to foster a sound environment for early-stage risk capital and innovation. That can entail supporting innovative SMEs and upgrading the business ecosystem. Governments can also invest more in robust digital infrastructure, innovation hubs, and public-private partnerships. It is also essential to develop human capital, such as through science and technology education, recruitment of offshore talent, and incentives for employers to upgrade their workers’ skills.

Address social and environmental development along with growth.

Inequality and the climate crisis can impede economic growth. Rising inequality is already triggering the polarization of populations and leading to anti-incumbency. Redistributive policies, regional development initiatives, and social safety nets can help prevent social unrest and promote inclusive growth. Environmental protections reduce exposure to climate-related risks. Sustainable practices are also necessary to maintain access to certain markets. Advancing climate mitigation and adaptation requires clear national commitments, regulatory frameworks, and funding.

How Business Leaders Can Position for the Future

Global South-based companies now have a generational opportunity to find new investment opportunities, establish cost-efficient value chains, and gain access to growing markets. To win in this dynamic and competitive landscape, they can consider these strategic moves:

Invest in supply chain resilience.

Forge strategic procurement alliances with suppliers, leveraging synergies within the region. Source and manufacture locally where necessary. Leverage technologies such as AI and the Internet of Things and implement agile processes to improve visibility and efficiency in supply chains. Develop contingency plans, such as inventory buffers, to reduce risk from disruptions.

Build geopolitical muscle.

As uncertainty and volatility become the new normal, companies can no longer afford to view geopolitics as an external factor. Strengthening geopolitical radar—the ability to detect and timely read geopolitical events—enables early detection of shifts, while geopolitical muscle ensures businesses can act swiftly and strategically in response. This means embedding talent, real-time intelligence, scenario planning, and geopolitical foresight into decision making, with a dedicated team to proactively identify risks, seize opportunities, and adapt operating models.

Localize strategies to win in fragmented markets.

Set up differentiated operating structures and technology stacks designed for a range of markets. Consider a decentralized decision-making structure and maintain the flexibility to switch, when necessary, to business approaches that leverage local agents or distributors. Use localized pricing playbooks to manage inflation and currency volatility in specific markets. Track consumption patterns, demographics, and technological adoption by analyzing proprietary data. Recognize customer preferences for local, value brands over premium, international brands; domestic products are increasingly important in the Global South. Keep in mind that building market trust will require sustained investment and patience.

Embrace sustainability as a growth lever.

In a rapidly evolving business landscape, sustainability can become a powerful competitive edge. Efficient use of natural resources, socially responsible

operations,

and leadership in the green transition can unlock new market opportunities, mitigate risks, and build more resilient value chains. Decarbonization is becoming increasingly important to maintain access to key markets like the EU, while fair labor practices, transparency, and public engagement enhance a company’s reputation and build trust among both local communities and investors.

As the Western-led world order erected after World War II frays and fragments, Global South nations are collectively emerging as a new driving force that appears destined to redefine global dynamics on their own terms. By forging a new consensus for promoting economic growth, building stable trade relationships, maintaining geopolitical balance, and demonstrating pragmatic environmental stewardship, they are creating unprecedented opportunities for governments and businesses alike. Those who recognize this shift early and actively engage will not just quickly adapt to the new global reality, but help define it.