In 2014, The New York Times published a study declaring Canada’s middle class the most affluent in the world—a headline that resonated with pride. Nearly a decade later, the narrative has shifted.

In our ongoing examination of Canadian consumer sentiment, we explore the “Insecure High Earners.” This segment is too big to lose, but they are currently in austerity mode and increasingly skeptical of businesses.

These consumers can be won back; BCG data reveals significant pent-up demand. But businesses will need to adapt their marketing and communications playbook significantly to do so.

A Powerful Spending Block Is Under Strain

They might look like the typical Canadian family—owning a home, juggling a mortgage, and raising kids—but this group of earners has gone from feeling financially secure to pinched. Although this segment appears comfortably above average on paper, their responses to BCG’s national consumer study show them to be one of the most anxious (and disgruntled) segments of the Canadian consumer landscape.

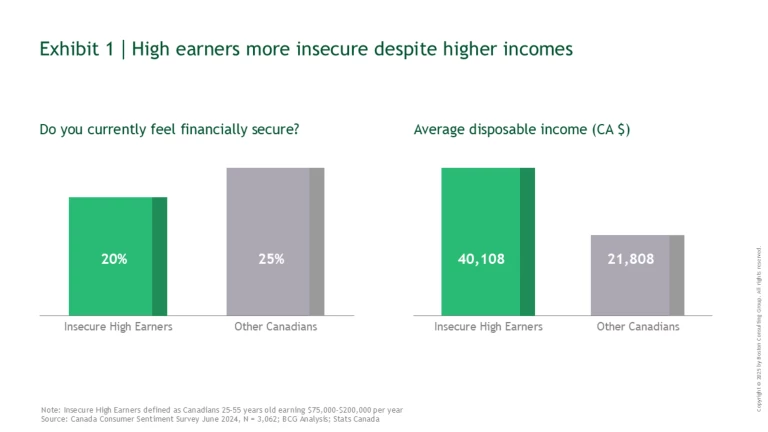

That finding should be a wake-up call to businesses across industries. This higher earning group is a major economic force. Comprised of individuals aged 25 to 55 who earn between $75,000 and $200,000 annually, they control about 20% of Canada’s disposable income. Their spending exerts enormous pull-on categories from home renovations to travel. Not only do they drive a significant share of housing spend (60% have active mortgages), they spend heavily on groceries, childcare and other basic essentials, owing to their larger average household size.

Yet, BCG’s survey of more than 3,000 Canadians found that just 20% of this segment feel financially secure. Despite a disposable income that is nearly twice that of the average Canadian, close to one third in this high earning segment say they feel less secure today than they did just twelve months ago. (See Exhibit 1.)

Behind the declining sentiment are a bevy of financial pressures, among them rising mortgage costs. Although interest rates have come down from their pandemic peak, they remain about 2 percentage points higher than the 2018 to 2022 average. As a result, Canadians renewing their mortgages in the past two years are paying an average of $600 more per month—a sharp increase that directly impacts their disposable income.

Rising costs are another worry. Inflation is easing, but many consumers still feel as though costs are going up, highlighting a psychological gap that drives purchasing caution. The average Canadian perceives a 10% annual price increase in everyday goods, compared to the actual average of about 2%.

Adding to the concerns, unemployment in Canada has risen from 4.8% in 2022 to around 6.8% at the end of 2024. Although this rate is still low by historical standards, 40% of this segment fears being laid off.

Taken together, these pressures are reshaping buying attitudes and behaviours.

Value Is the New Currency

The insecure high earners are savvy and disciplined. Our research found that 80% set spending budgets and follow them—much higher than other demographics. They also care deeply about product quality and durability and eschew classic “disposable consumerism.”

In the near-term, these trends will define spending patterns among the insecure high earners.

- Discretionary items are out—for now. Nearly 40% of the insecure high earners say they plan to spend less in the near term, particularly on fashion, cosmetics, electronics, and home goods.

- Bulk buying is up. Already the most likely to purchase in bulk, 11% of this segment report an increase in their bulk buying over the past year—to make their dollars stretch and reduce the frequency of trips.

- Loyalty is up for grabs. While not exclusively price-driven, the insecure high earners are 25% more likely to change brands when a better overall value surfaces compared to the average consumer.

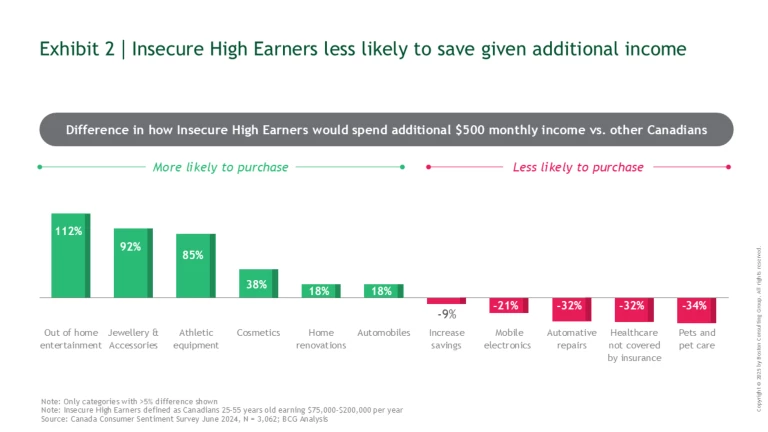

Yet, beneath this caution lies significant pent-up demand. Given an extra $500 monthly, the insecure high earners are more likely to spend that money than save it—even compared to lower earning segments. (See Exhibit 2.)

Even more revealing is what they’re eager to do with this newfound cash. Given a small uptick in discretionary income, members of this segment would be twice as likely as the average Canadian to spend on out-of-home entertainment—perhaps a night out, a live event, or travel. Fully 90% would be more likely to spend on jewellery or athletic equipment than other demographics, suggesting a strong desire for smaller luxuries that provide a sense of reward. And 20% would be more likely to invest in home renovations or a new car, reflecting their longer-term aspirations and lifestyle goals.

These figures confirm that if financial stressors ease, the insecure high earners are poised to rebound.

Stay ahead with BCG insights on the retail industry

Now Is the Time to Act

Our research shows that Canada’s vibrant, but depressed upper middle class remains an essential—and winnable segment. By meeting this segment where they are today, companies can build back loyalty and trust. These three actions can lay the groundwork.

- Focus on long-term value, not just discounts. While price promotions can spark interest, the insecure high earners aren’t merely hunting for the cheapest deals. They’re also looking for products with durability and reliability—and are willing to justify a higher initial spend to get them. Leaders will use their marketing activities to stress the differentiated quality, warranties, and customer service their goods and services offer.

- Make value visible and easy to find. Because this segment is highly willing to switch brands, businesses must be transparent in their pricing, offers and product comparisons. Targeted marketing and communications are essential to making the value proposition clear and personalized.

- Prepare for the rebound. While discretionary spending is currently constrained, leaders will address today’s demands and plan for tomorrow’s—experimenting with offers that are smaller or more limited in scope now and expanding that mix as conditions improve.

Regaining the trust and loyalty of the insecure high earners requires a clear-eyed understanding of their financial struggles and a value proposition that goes beyond price-cutting to deliver real quality, transparency, and consistency.