In response to the past couple of challenging years for private infrastructure investing, funds are broadening their traditional mandates, seeking out new sources of investment capital and continuing to up their operational game.

Already, the results appear positive, if cautiously so. While investment activity in 2024 was still down significantly compared to the peak year of 2022, infrastructure assets under management reached an all-time high in 2024, and fundraising is up modestly from the previous year.

To nurture and build on these signs of recovery, infrastructure funds are devising new strategies to attract capital, including from retail investors. They are also expanding their mandate to provide limited partners (LPs) with more differentiated risk/return-profiles and to offer investments in new. nontraditional next-generation infrastructure.

As detailed in this year’s report on the state of private infrastructure investing, funds continue to face an uncertain macroeconomic and interest rate environment. But shifts in strategy, together with the ongoing need for investment in energy, transport, digital infrastructure, and social infrastructure, suggest that the early signs of renewed growth will gain strength.

By the Numbers

A quick look at 2024 results tells the story. Infrastructure assets under management (AuM) rose to $1.3 trillion in 2024, an increase of more than 8% over the previous year. This was due in part to the $87 billion in funds raised in 2024, a 14% increase over 2023 and a major improvement over the significant decline in fund-raising from 2022 to 2023.

On the other hand, the relatively weak fundraising environment and ongoing capital deployment led to a 9% decline in dry powder as of June 2024, to $324 billion. Dealmaking, too, dropped further in 2024, falling by 8% after 2023’s 19% decline.

Still, LPs’ average allocation to infrastructure rose to 2.1% in 2023, and more than three-quarters of LPs surveyed by Preqin in 2023 said that their infrastructure allocations would either increase or remain the same in 2024. Clearly, investors remain confident about the asset class’s capacity to provide consistent returns, despite the volatile economic and political situation.

Digging deeper into the geographic and sector-specific data for 2024 reveals, first, that the great majority of portfolio companies owned by the top 58 infrastructure funds are still based in either Europe or North America. Moreover, those regions saw the greatest growth in the number of infrastructure assets over the past year.

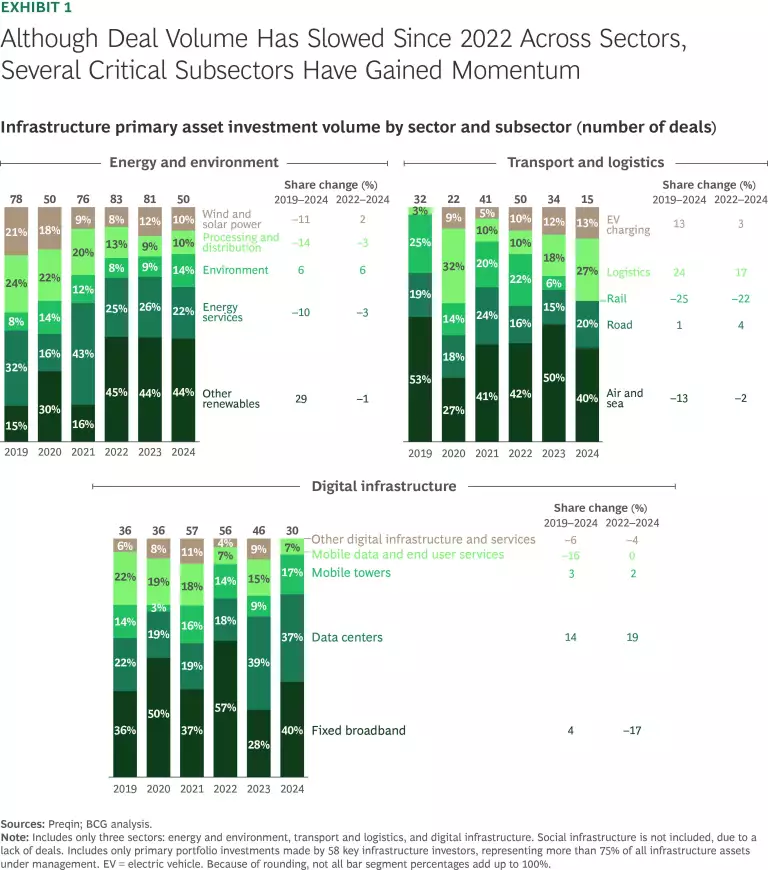

Second, although deal volume is still down from 2022 levels across the board, a closer look at individual sectors and subsectors reveals areas where activity is relatively brisk. (See Exhibit 1.) We note the following results from the four major infrastructure sectors:

- Energy and Environment. Deal volume fell in every region except Asia and Australia, but this sector still comprises half of all private infrastructure assets. Investment in renewables, energy efficiency, and energy storage continued to accelerate.

- Transport and Logistics. Investments in this sector fell by 44% globally. Although traffic, freight volume, and rates have stabilized since 2022, uncertainty regarding the timing and scope of future tariffs may impact transport and logistics going forward, depending on the investments’ exposure to specific commodities and trade lanes.

- Digital Infrastructure. European and North American investors hold most of the digital assets in this sector. They saw declines of 52% and 24% in deal volume, respectively. High valuations limited M&A and consolidation activity in many areas. But interest in data centers remained strong, due in no small part to the rise of generative AI.

- Social Infrastructure. Despite demonstrable need, this sector remains the least active of the four main infrastructure sectors, as only a couple of major transactions took place in 2024. Health care and education will likely continue to be the most active subsectors, although interest in leisure may pick up as the travel and hospitality industry continues to recover from the pandemic.

The Evolving Mandate

In their fundraising efforts, infrastructure funds are going beyond their traditional mandates to create new, more differentiated investment opportunities designed in part to attract capital from a wider range of LPs.

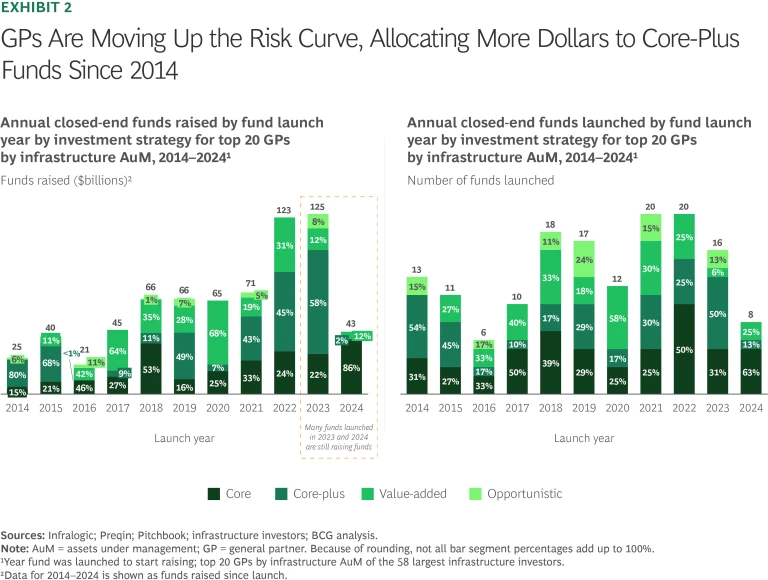

For example, general partners (GPs) are looking to satisfy investors’ appetite for higher returns by moving up the risk curve, launching various core-plus, value-added, and opportunistic funds. And these funds are increasingly investing in nontraditional next-generation infrastructure assets such as infrastructure-related services, software supporting infrastructure operations, and contract manufacturing. (See Exhibit 2.)

Similarly, in response to LPs’ demand for more focused investment opportunities, GPs are offering a greater number of sector-specific funds. Accounting for 43% of all new funds launched in 2023, up from 11% in 2021, these funds most often invest in energy assets, although the number of digital infrastructure funds is on the rise.

Even as GPs are launching new funds that cater to more specific investment aims, they are also consolidating. Multiasset managers—such as CVC, General Atlantic, and Bridgepoint—that haven’t previously invested in infrastructure are acquiring infrastructure specialist funds that offer new opportunities to LPs. And established infrastructure investors such as BlackRock and Apollo are consolidating their positions by purchasing other infrastructure funds to increase AuM, put the scale of their platforms to use, and further diversify their offerings.

To diversify and expand their sources of capital, GPs are also raising capital from retail investors. Structured to give retail investors access to the stability long associated with infrastructure investments, these vehicles require lower minimum investment thresholds and offer enhanced liquidity structures.

Subscribe to our Principal Investors and Private Equity E-Alert.

The Operational Imperative

As GPs refine their investment offerings to attract new capital, they aim to boost portfolio value creation and improve returns to LPs through a more deliberate focus on operational excellence at their portfolio companies. Generating a detailed value creation blueprint at the due diligence stage is becoming the new standard, enabling funds to get a head start on immediate priorities for improving operational efficiency and financial performance during the critical first 100 days after completing the acquisition.

Moving forward, GPs are quickly developing target operating models for new companies to guide them in carrying out key value creation initiatives, taking advantage of potential efficiencies, and filling any gaps in needed capabilities. Finally, GPs are establishing a disciplined finance function to optimize operational control, reduce inefficiencies, and improve financial discipline, thereby providing real-time insights into the company’s performance to both management and investors.

Conclusion

The overall outlook for infrastructure investing in 2025 and beyond remains positive. As interest rates stabilize and the pressure to return capital to LPs grows, momentum for fundraising and deal activity is on the rise, and infrastructure firms are exploring new strategies to gain advantage as the industry continues to mature. In short, infrastructure’s critical role in addressing global challenges, from climate resilience to digital connectivity, ensures its continued relevance and appeal as a fundamental asset class.