In a freight market clouded by economic uncertainty and rising costs of labor, equipment, insurance, and technology, less-than-truckload (LTL) freight has emerged as a beacon of resilience. This segment, benefiting from higher barriers to entry and other structural advantages, has retained solid pricing power and margin stability. Operators can continue to harness their advantage, and investors can benefit by tapping into a business that is less cyclical and more protected than other freight segments.

LTL’s Structural Advantages and Challenges

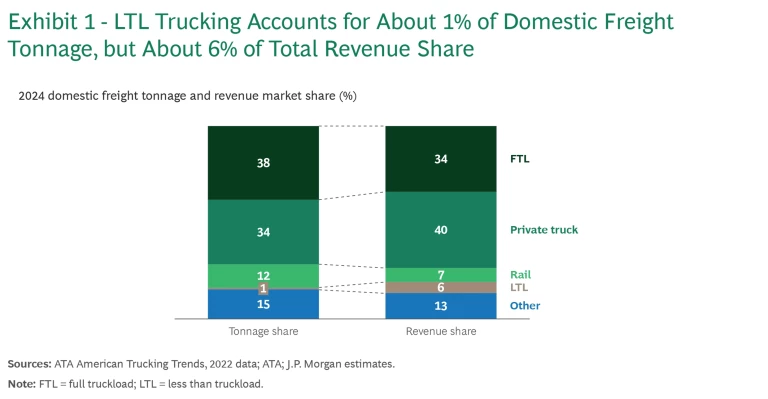

LTL moves smaller shipments for customers by combining freight from multiple shippers onto a single truck. This small but in-demand segment accounts for just 1% of domestic freight tonnage but 6% of revenue. (See Exhibit 1.) Several structural advantages have been driving this performance.

- Hub-and-Spoke Model. LTL players operate a network of terminal hubs and line-haul spokes to consolidate, move, and sort freight from origin to destination. This larger asset base creates a competitive moat in comparison to point-to-point full truckload (FTL) freight, where the primary assets are the trucks themselves. This has also reduced the threat from digital-only disruptors.

- Consolidation. The LTL industry has become more consolidated, particularly after the bankruptcy of Yellow Corporation, and the top 10 players now hold 60% to 70% of revenue. This differs starkly from the FTL market, where the top 10 carriers command less than 10% of the market. The consolidation in LTL has reinforced the barriers to entry in the sector while also contributing to pricing power.

- Capacity Discipline. Operators have been cautious about adding capacity even after Yellow’s bankruptcy eliminated 8% to 10% of domestic capacity. Only about 60% of that capacity is expected to return by 2026. This discipline has helped prevent oversupply that might otherwise lead to underutilized trucks or idle workers (which recently occurred in the FTL market), and it has helped players maintain healthy margins.

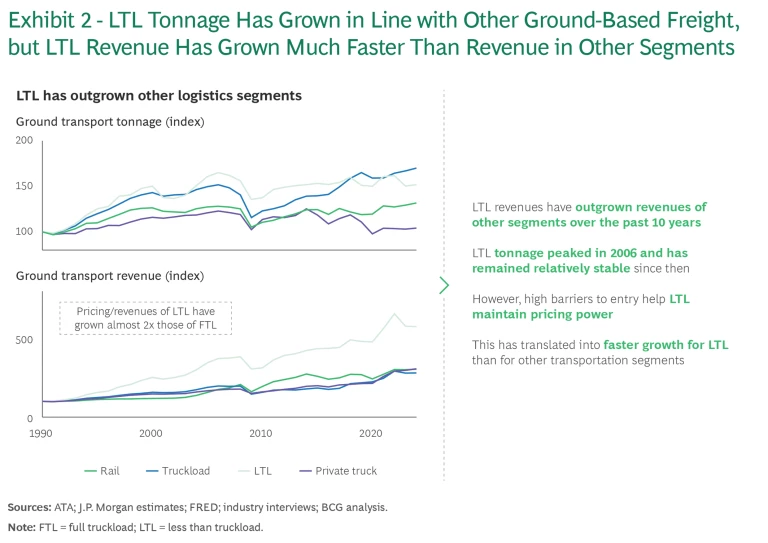

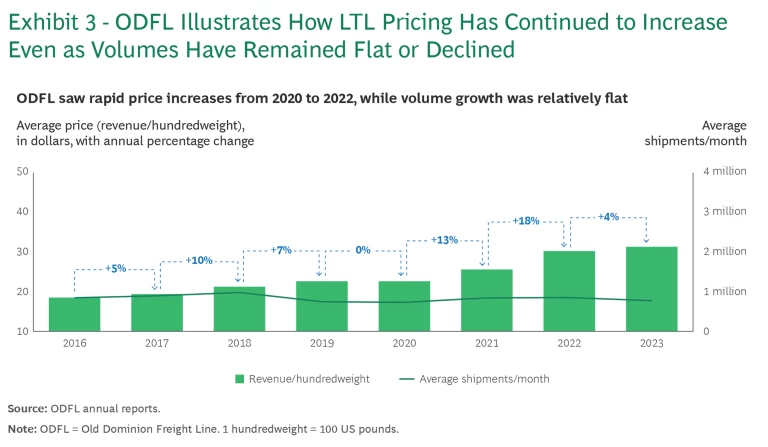

- Pricing. Consolidation and capacity discipline give LTL carriers a price advantage that FTL carriers do not enjoy. Since 2004, LTL prices have grown faster than FTL prices even as tonnage has been broadly flat. (See Exhibit 2.) For example, Old Dominion Freight Line, one of the largest LTL carriers, increased its prices by 15% to 20% year over year from 2021 to 2023, while the truckload spot rate dropped by more than 40% over roughly the same period. (See Exhibit 3.)

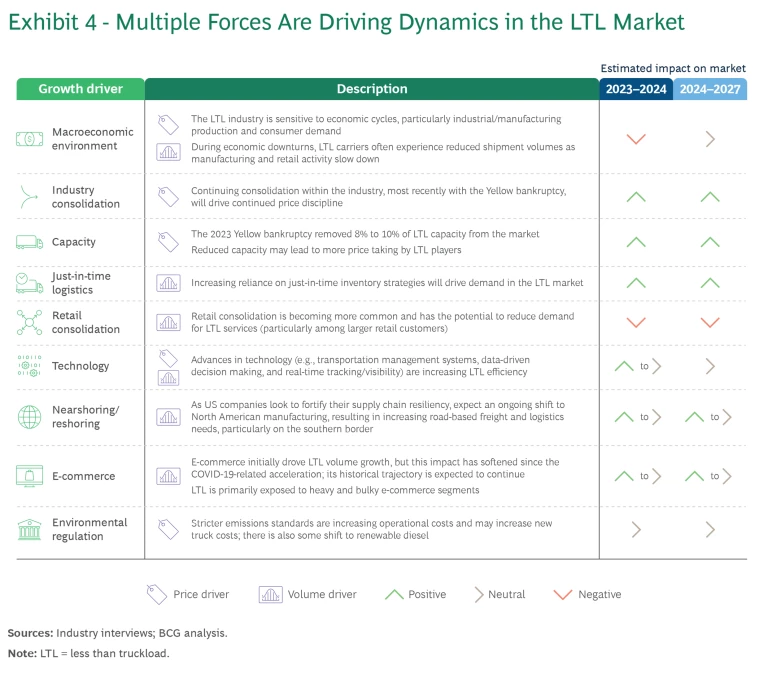

LTL operators must keep pushing forward to ensure that their business remains strong and grows. Beyond following underlying economic activity, they should pay close attention to changes in the domestic manufacturing base and near-shoring activities, the trend toward more just-in-time supply chains, retail consolidation plays, and e-commerce. (See Exhibit 4.)

Although growth during the past three to five years has been solid thanks to LTL’s structural advantages, we expect that future growth will require investment in tools and technologies that increase the efficiency of existing networks to better serve customers. This is particularly necessary for regional carriers that don’t win on scale, but serve their geography through LTL services and thoughtful asset management.

Implications for Operators

LTL players can continue to drive revenue and margin growth—even in a challenging freight environment—by pursuing several initiatives:

- Strengthen the customer value proposition. To grow market share, LTL carriers should focus on strengthening their customer value proposition. This includes improving reliability and transparency with customers while maintaining competitive pricing. For example, LTL players should explore GenAI tools to enhance customer service and back-end operations (such as labor scheduling and equipment allocation), and invest in technology to drive real-time visibility and make transit information readily available to customers.

- Invest in dynamic pricing and improved accessorial surcharges. LTL players can use dynamic pricing to adjust prices in near real-time to improve profitability. Pricing should reflect available capacity, type of freight, lane competitive dynamics, time of day, day of week, and other factors. Meanwhile, LTLs can use accessorial pricing to provide high-quality service to shippers while also protecting margins. This requires a sophisticated understanding of the cost-to-serve for specific activities (such as home delivery) and the ability to precisely calculate appropriate surcharges.

- Target attractive new verticals. LTL players should develop a comprehensive view of the market to understand their starting point and to identify verticals with secular tailwinds and attractive margin potential that they can double-down on. Examples include cross-border LTL shipments, health care cargo, and expedited and priority shipments.

- Enhance safety with analytics. LTL carriers should leverage machine learning and advanced analytics to better understand factors that contribute to accident risk. This will help to reduce injuries and fatal accidents, while also lowering insurance costs and the likelihood of “nuclear verdicts” (adverse verdicts that lead to awards of damages in excess of $10 million), which are increasingly common in trucking. The opportunity here is not only to develop in-house solutions, but also to integrate them with commercially available technology.

Opportunities for Investors

LTL is a stable, high-margin business with promising potential for margin expansion and revenue growth. Investors have several options to gain exposure to LTL, depending on their risk appetite and strategic intent:

- Target niche subsegments. LTL has several subsegments for investors to explore. For example, expedited LTL offers access to a hub-and-spoke network focused on accelerated and priority freight. Regionally focused LTL players offer exposure to economic tailwinds within specific parts of the US market.

- Consolidate to create new at-scale players. LTL has not yet consolidated as much as other logistics sectors such as parcel and rail. Plenty of regional players and smaller national players are still operating. Ambitious investors could integrate several existing players to drive greater density, reduce underutilized capacity, and improve network efficiency.

- Enter LTL brokerage. Another option is to enter or deepen investment in LTL freight brokerage—the business of matching transportation demand with third-party LTL capacity. This asset-light activity could complement an existing freight brokerage business focused on segments such as FTL, intermodal, and heavy haul.

LTL’s significant structural advantages offer opportunities for operators to continue to press their advantage on several fronts—by strengthening the customer value proposition, investing in dynamic pricing, and targeting new verticals. The segment offers investors a range of possibilities, depending on their risk appetite, from tapping into niche subsegments to more aggressively rolling up regional and small players in order to create a new operator with greater scale.