After a turbulent 2024, defined by pivotal elections in major economies and shifting central bank policies, the M&A landscape appears poised for a long-anticipated revival. Declining inflation, lower interest rates, and recovering valuations through much of last year have heightened expectations among dealmakers and their advisors for increased M&A activity in 2025.

However, BCG’s M&A Sentiment Index has yet to fully reflect this optimism. Although the index’s current value of 77 marks a recovery from its low point of 66 in December 2022, the index remains well below its ten-year average of 100 and has declined from 88 in October 2024.

This heightened uncertainty is fueled by a combination of ongoing geopolitical tensions, debates over tariffs, snap elections, and other political volatility. Together, these factors underscore the complexity of the current M&A landscape, even as the broader outlook for dealmaking in 2025 appears promising.

Sentiment Is Improving Across Most Regions

Dealmakers around the globe are poised to reengage more assertively in 2025.

Optimism is especially high in the Americas, where BCG’s M&A Sentiment Index jumped from 81 in August 2024 to 91 in January 2025. The improved sentiment is propelled by strong momentum in the US, where expectations about regulatory easing could drive a resurgence in the volume of larger deals. The region’s technology sector, especially in software and semiconductors, is emerging as a key area of activity, driven by the ongoing AI boom and resulting demand for chips and technologies. The recent Synopsys-Ansys deal, for example, may signal the beginning of a broader wave of similar transactions.

Momentum is also building across most sectors in Europe, with our index rising from 76 in November 2024 to 84 in January 2025. The region’s financial services sector stands out, spurred by notable developments such as UniCredit’s interest in acquiring Commerzbank and Banco BPM, as well as BBVA’s takeover offer for Banco Sabadell. Recent activity in the asset and wealth management space is further energizing the market.

In Asia-Pacific, by contrast, deal activity remains sluggish. Our index value of 45 reflects uncertainty over economic policy, among other factors. In the longer term, however, substantial fiscal stimulus in China could revive the country’s currently subdued M&A market. In Japan, reforms targeting corporate governance and capital management, along with investor pressure to improve valuations, are fostering greater deal activity. In Australia, substantial changes to competition and merger laws, which are slated to take effect in 2026, may prompt companies to accelerate deals in 2025 to avoid potential uncertainty or delays under the new regime.

Technology remains a dominant M&A theme across the Asia-Pacific region. India's deepening ties with the US and Europe are creating opportunities for cross-border transactions even as regulatory tensions persist between China and the West. In Southeast Asia, M&A activity is poised to benefit from strong economic prospects, digital transformation, and further increases in inbound or intraregional cross-border transactions.

Stay ahead with BCG insights on M&A, transactions, and PMI

We anticipate that Middle Eastern strategic investors and financial sponsors will continue to look beyond the region for attractive targets that align with their growth and diversification strategies. In Africa, South Africa appears to be ready for a rebound in deal activity. The materials sector may help sustain deal activity more broadly in Africa, driven by growing demand for rare earth elements and other critical materials.

From an industry perspective, BCG’s index highlights relatively robust deal sentiment in the health care, energy, and technology, media, and telecommunications (TMT) sectors. Transportation industries (including airlines, logistics, and supply chain services) and the materials sector also present promising opportunities for increased deal activity. However, caution persists in several industries—such as the consumer and industrial sectors—despite some recent large deals.

The number of companies going public—a data point that often aligns with M&A volume—is also likely to rise in 2025. The pipeline is full of promising candidates that are awaiting the right moment to enter the public markets.

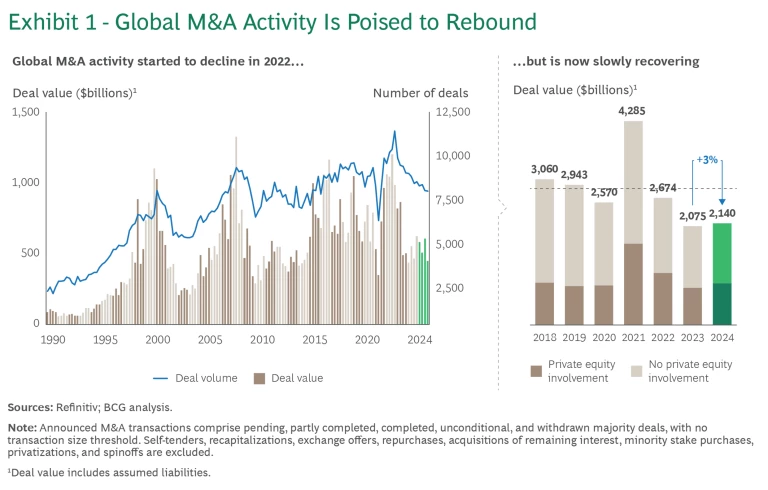

M&A Activity Was Moderate in 2024

The cautiously optimistic outlook for M&A in 2025 follows a modest recovery in 2024. (See Exhibit 1.) Even amid improving financial conditions, executives exercised caution. Lingering economic uncertainty, persistent inflationary concerns, evolving monetary policies, and ongoing regulatory and geopolitical challenges kept many dealmakers on the sidelines.

The global value of M&A activity in 2024 was $2.1 trillion. Although this figure is 3% higher than the one for 2023, it is below the ten-year average of $3.0 trillion. The number of deals continued to decline, falling to 32,000—down from 34,200 in 2023 and significantly below the record high of approximately 41,200 in 2021.

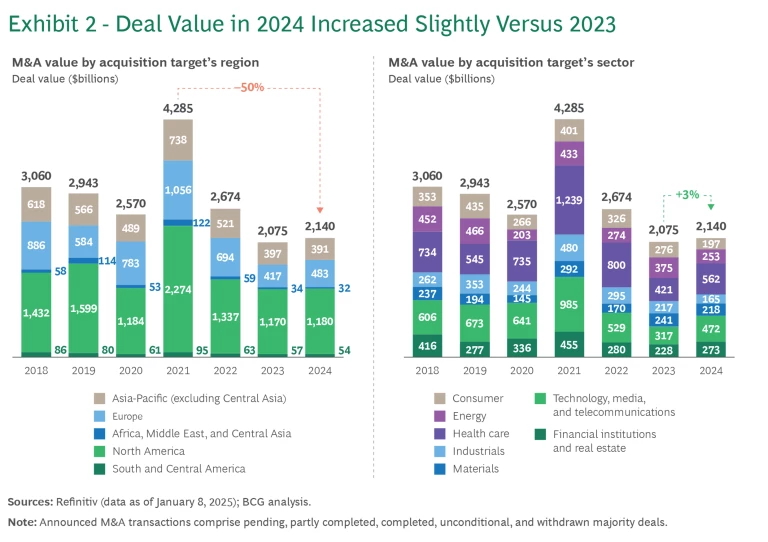

Regional differences during the year were significant (see Exhibit 2):

- Deals involving targets in North America had a total value of $1.2 trillion, an increase of approximately 1% versus 2023. The vast majority (worth $1.1 trillion) involved targets in the US, accounting for 52% of overall global M&A activity. US companies acquired most of these targets.

- Targets in South and Central America accounted for $54 billion in deal value, marking a decline of 5% from the previous year.

- The value of European M&A totaled $483 billion, a 16% increase versus 2023. Deal value increased in the UK (120%) and in France (45%) but decreased significantly in Germany (–41%), Italy (–31%), and the Netherlands (–24%).

- In Africa, deal value increased by 44% to $13 billion, while in the Middle East it decreased sharply (–21%) to $18 billion.

- Asia-Pacific deal value was $391 billion in 2024, a 2% decline from 2023. The regional total was marked by declines in China (–14%) and in Australia and New Zealand (–9%). Brighter spots included India (+73%), Japan (+25%), and South Korea (+21%).

In 2024, the financial institutions and real estate sectors posted the strongest gains in aggregate deal value, rising by 49% over the previous year’s numbers. The TMT sector grew by 34%, driven largely by technology deals, while the consumer sector saw a 19% increase, fueled by a few high-value transactions. In contrast, the energy (–33%), health care (–29%), and industrials (–24%) sectors experienced notable declines, primarily owing to fewer large-scale deals.

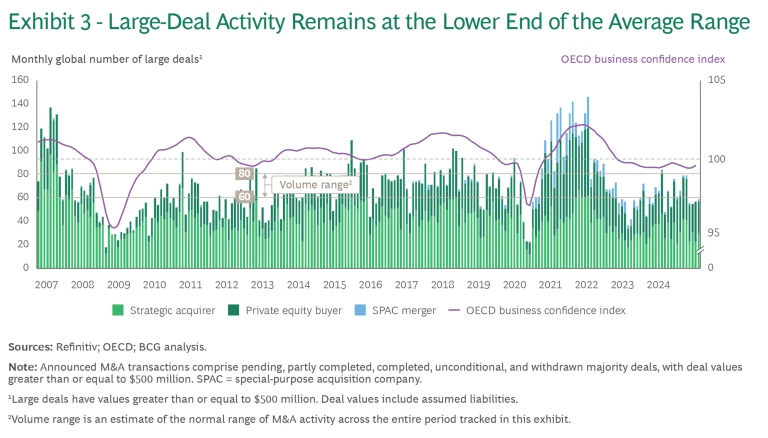

Altogether, 24 megadeals (those valued at more than $10 billion) were announced in 2024, compared with 27 in 2023, 33 in 2022, and a staggering 51 in 2021. More broadly, large deals (those valued at more than $500 million) remained on the lower end of the average range of roughly 60 to 80 globally per month, reflecting dealmakers’ cautious mindset throughout the year. The fourth quarter of 2024, with an average of approximately 60 large deals announced per month, did not show an uptick in activity. (See Exhibit 3.)

The five largest announced deals of 2024 were:

- Canada-based Alimentation Couche-Tard’s $38.7 billion bid for Japanese retailer Seven & I Holdings

- Australian BHP Group’s bid for UK-based Anglo American, valued at $36.4 billion, which has since been withdrawn

- Capital One Financial Corporation’s merger with consumer lending services provider Discover Financial Services, valued at $35.3 billion

- Synopsys’s bid for simulation software publisher Ansys, valued at $32.5 billion

- Mars’s bid for breakfast cereal maker Kellanova, a fellow US firm, valued at $29.7 billion

Private equity deal activity followed the broader M&A trend in 2024, with deal values increasing by 11% compared with 2023. Still, financial sponsors remain under pressure to invest their large reserves of dry powder. Early- and later-stage funding for startups showed signs of recovery, particularly in the final quarter of the year. However, activity levels remain well below the highs of 2021, even as enthusiasm for AI-focused startups continues.

Cautionary Notes amid the Optimism

As dealmakers gear up for an active 2025, a few cautionary notes are warranted. Even with the anticipated easing of scrutiny in some jurisdictions, regulatory and policy changes will continue to influence M&A activity. Antitrust regulations, in particular, often complicate larger transactions, creating challenges in navigating approval processes and increasing uncertainties around outcomes and timelines. Regulators frequently require remedies, such as divestitures, to secure deal approvals. Beyond antitrust, dealmakers must also address hurdles related to foreign direct investment restrictions, national security considerations, and sanctions.

Adding further complexity, M&A processes are subject to heightened scrutiny stemming from evolving data privacy laws, cybersecurity threats, and regulatory frameworks centered on ESG and climate change. These factors are reshaping how companies structure, evaluate, and execute deals.

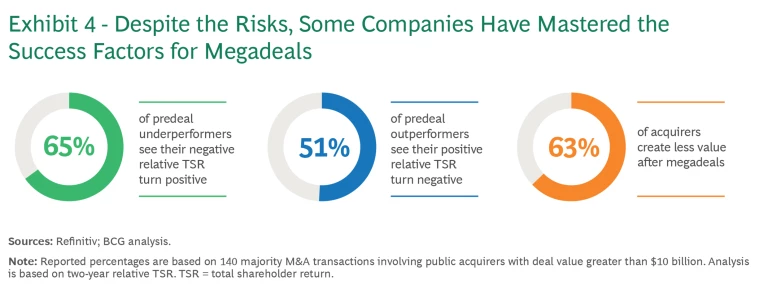

We expect a resurgence in M&A activity to bring a wave of larger transactions, including megadeals. Although these deals are inherently more risky, a recent BCG analysis highlights that some companies have developed best practices to consistently deliver higher value and mitigate potential downsides. (See Exhibit 4.)

With the stakes so high, a disciplined approach to mastering megadeals remains critical to ensuring success.

The stage is set for a potentially dynamic year in M&A. Renewed confidence among dealmakers, based on the expectation of stabilizing economic conditions and the prospect of eased regulatory hurdles (especially in the US), signals a fertile environment for transactions. Nevertheless, challenges remain, from navigating evolving regulatory frameworks to ensuring the success of megadeals. A strategic approach to dealmaking is therefore essential—not just to close transactions, but to create lasting value. With new opportunities on the horizon, 2025 holds promise for dealmakers that are ready to seize the moment with agility, insight, and a clear vision for the future.