“Here we go wasting our time with another fact-free discussion.” —Former defense official

Governments are getting investment decisions wrong at a time when the stakes couldn’t be higher. We are in a time of extraordinary changes in defense spending. The US government is accelerating modernization programs while simultaneously pursuing fiscal restraint; EU countries plan to increase defense spending by more than $600 billion to shore up their defenses; and China has increased its defense spending by more than 20% since 2020. Given these changes, defense ministries face significant pressure to make the right investment decisions and ensure that every dollar spent delivers the most relevant capabilities.

Historically, defense investment decisions have lacked a strong supporting fact base, resulting in a number of high-profile debacles. The US Navy spent about $1.8 billion to modernize four Ticonderoga-class cruisers, none of which ever returned to service. European countries developed more than 30 variants of the NH-90 helicopter, resulting in reliability issues and canceled orders. Germany spent $800 million on the Euro Hawk drone, which sits in a museum instead of on the battlefield. The list of poorly spent investment dollars is long.

To help ministries of defense make better investment decisions, BCG has developed, tested, and co-deployed (with several defense ministries) an approach to evaluating investments in the context of mission priorities: Mission-Based Return on Investment™ (abbreviated MBROI™). The Mission-Based ROI approach identifies and assesses key decision-making criteria to deliver a concise, transparent view of the tradeoffs among investment options. It shifts the conversation from subjective criteria to objective facts, enabling leaders to enhance mission outcomes, optimize spending, and justify their portfolios.

Subscribe to our Public Sector E-Alert.

In one program example, an MBROI analysis resulted in roughly $3 billion of savings by eliminating planned investments that didn’t lead to improved mission outcomes. In another, it helped acquisition, user, and requirements stakeholders balance cost versus asset capability when facing a multi-billion-dollar budget deficit. In a software application, it prioritized use cases based on their mission and financial benefits. Defense teams that apply this methodology typically reallocate 8% to 15% of funds from low-value projects to better uses elsewhere.

Critical Investment Mistakes to Overcome

In our work with defense ministries around the world, we see several common mistakes that defense teams make when assessing investment options:

- Basing Investment Decisions More on Costs Than on Capabilities. As a former official at the US Department of Defense (DoD) put it, “Final budget decisions are always made on cost. Capability is a subjective afterthought.”

- Evaluating Individual Investment Decisions in a Silo. Most stakeholders can typically agree on the biggest threats to national security, but they also fight to preserve their own programs and fiefdoms in defense budgets. As a result, defense ministries don’t evaluate a portfolio holistically, with a fair assessment of the tradeoffs among choices.

- Considering Development and Procurement Cost Rather Than Total Lifetime Cost. In a recent survey of defense leaders, only 43% said that they consider the total cost of ownership in validating ideas, even though maintenance and sustainment expenses far outweigh initial development costs for most programs and platforms.

- Overemphasizing Requirements, Platforms, or Additional Volume. Leaders reported focusing on detailed capability requirements, new platforms, or production of additional volume, instead of on capability delivery.

- Dismissing Commercial Off-the-Shelf (COTS) Solutions. Only 45% of defense leaders said that they incorporate commercially available technology, even though these solutions are often cheaper and less time-consuming to deploy and are sufficient for the mission.

Smarter Investment Decisions Using Mission-Based ROI

To avoid these common mistakes, Mission-Based ROI approaches defense decision making with a rigorous, rapid quantification and evaluation of defense investments. It assesses a broad spectrum of criteria to identify the most relevant dimensions and then provides senior leaders with the information they need to make objective, fact-based decisions. This comprehensive, proven approach is customized for each situation, delivering the critical ability to compare one investment decision with another even across portfolios of disparate assets.

In addition to delivering more effective and comprehensive decisions, Mission-Based ROI consistently leads to faster decision making for leaders, as it identifies and quantifies key criteria quickly, cutting through the more subjective and less orderly approaches that defense ministries have historically used.

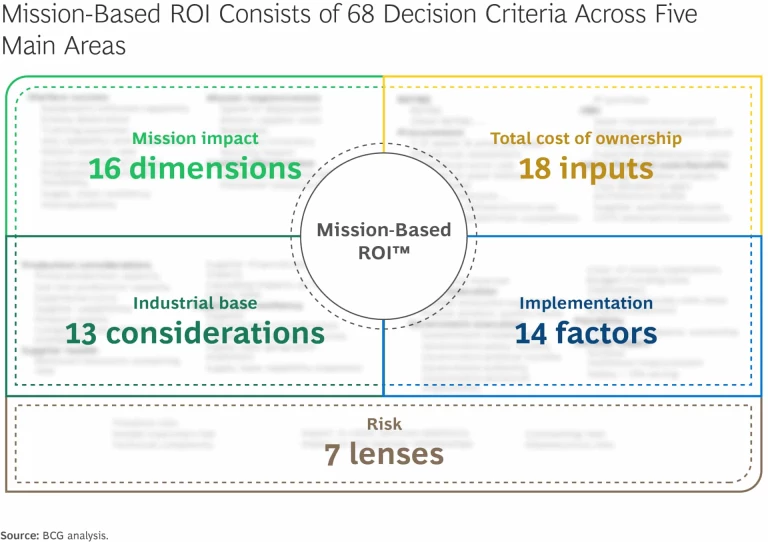

Specifically, the Mission-Based ROI approach consists of 68 dimensions distributed across five categories, covering the full spectrum of key decision-making criteria. (See the exhibit.)

This structure provides a comprehensive starting point that teams can quickly tailor to specific investment decision to identify the critical relevant decision-making factors. Mission-Based ROI systematically analyzes these dimensions and enables leaders to focus on the factors that have the greatest impact on a specific investment. Government officials report that their ministries typically consider less than 5% of these factors, with individuals routinely focusing on the wrong dimensions. The five categories that hold the 68 dimensions are these:

- Mission Impact. Criteria in this category assess the quantitative and qualitative mission benefits of an investment across 16 dimensions such as improved capability, increased readiness, and better mission outcomes. Crucially, mission impact also provides a framework for making apples-to-apples comparisons of mission outcomes across assets, shifting from long lists of technologies and investment projects to a structured, capability-based approach.

- Total Cost of Ownership. Items in this category generate a systematic and independent assessment on the true cost of delivering and sustaining a capability over its anticipated life cycle. Total cost of ownership includes 18 inputs across research, development, acquisition, and sustainment spending, as well as such often-omitted considerations as how changes in the industrial base may impact unit costs.

- Industrial Base. This category comprises 13 parameters that gauge the ability of a defense department’s supply base to achieve the desired outcome, as well as the industrial base benefits of the investment, such as making the supply chain more resilient and flexible.

- Implementation. The implementation category contains 14 elements, including feasibility of execution, government policy constraints, intellectual property ramifications, and budget constraints.

- Risk. This category covers seven key factors, such as the technological complexity of a given investment, and which investments may carry significant timeline risks.

Success in Applying Mission-Based ROI to Drive Increased Government Efficiency

BCG has partnered with defense ministries to use the Mission-Based ROI approach and improve investment outcomes across an array of scenarios, from individual platforms and software investments to wide-ranging portfolios of multiple asset types. For example:

- Portfolio Rationalization. A defense procurement team was looking to reduce spending across a diverse portfolio of assets. Historically, the team had focused on how much to invest in each asset or platform, with little emphasis on managing across the portfolio. The Mission-Based ROI approach identified the most relevant decision-making criteria for the team to consider across the entire portfolio. This resulted in a reprioritization of investments to shift funds to higher-mission-value uses. MBROI can be applied to portfolios of other assets as well, such as exquisite and dumb munitions, drone platforms across all defense branches, satellite portfolios, and IT systems.

- Platform Modernization Strategy. A defense planning team was facing a complex investment decision regarding more than 50 potential upgrades for a platform. Using the Mission-Based ROI approach, the team assessed mission outcomes versus the cost of each, enabling it to make an informed decision to buy a smaller number of more capable assets. Governments can use this approach to modernize fleets with a portfolio of platforms, different configurations, and priorities, including aircraft, vehicles, ships, munitions, drones, and other assets.

- Asset Replacement Strategy. An asset management team needed to decide between investing in an old platform to extend its life or replacing it with a new platform. Mission-Based ROI assessed a broad range of cost inputs to quantify the total cost of ownership of the legacy platform and the new asset, as well as the impact each option would have on mission delivery. The analysis identified a multi-billion-dollar reduction in lifetime cost that would result from switching to the new asset, with acceptable impact on capability. Other applications include ships, vessels, vehicles, or aircraft that are near end of their service life or becoming technologically obsolete.

- Software Business-Case Development. Senior leaders in a defense ministry wanted to deploy new commercial software but needed a way to identify which of the 100-plus use cases were worth funding. Mission-Based ROI systematically quantified the various new missions that the technology could enable and prioritized the 15 use cases that had the strongest prospective return on investment, generating hundreds of millions of dollars in savings. MBROI can be used across all types of software, including communications solutions, GenAI implementation, machine learning, software-defined radios, 5G technology, aircraft navigation, and targeting algorithms.

- Software Life Cycle Management. A defense team needed to expand the use of a software program but struggled with prioritizing the new user requirements versus the tasks involved in sustaining the existing product. Mission-Based ROI developed a framework for comparing the mission benefits of the new use cases versus the sustainment requirements of the core product. It allowed members of the team to reprioritize their work, accelerating a smaller number of projects while sustaining critical core product applications. Other applications for this approach include enterprise resource planning, audit systems, command and control, business systems, and database management.

- COTS Adoption. A defense team was facing substantial costs for a component that was becoming obsolete, and the team wanted to consider a COTS alternative. Mission-Based ROI assessed the total lifetime cost of the choice, including the substantial upfront costs to qualify a new vendor. It then weighed this lifetime cost against the desire to have greater capacity and flexibility in the industrial base and to reduce supply chain risks. As a result of this analysis, the team opted to use the COTS component and to shift from single to dual sourcing, making the supply chain more resilient. Other applications include printed circuit board assemblies, batteries, engines, transmissions, raw materials, satellites, and sensing components.

- Make-Versus-Buy Assessment. A defense ministry was facing an investment decision to source a capability via one of three options: direct commercial purchase, purchase from a foreign government, or local investment. Mission-Based ROI quantified the tradeoffs, weighing mission outcomes, cost, speed, and industrial base impacts. The ministry decided to source the capability quickly from a foreign government, forgoing the long-term investment required to build the capability locally. Additional applications include purchase and development of capital assets such as munitions, aircraft, submarines, vessels, and carriers.

Implementing Mission-Based ROI

As noted earlier, BCG has applied this new approach in many situations, leading to billions of dollars in savings or reallocation opportunities. Our approach and expertise help overcome common challenges, including variable data quality and formats, and enable clients to navigate complex stakeholder dynamics. Projects range from one-off prioritization efforts to repeatable, embedded tools that use AI and advanced statistical algorithms to optimize across large data sets. These advanced tools can be—and have been—installed on government systems to transfer this capability to governments at the conclusion of a project. We have applied Mission-Based ROI in a wide range of settings, from smaller-scale projects where a rapid diagnostic is needed in a matter of a few weeks, to large projects with significant complexity covering multiple months of analysis and the generation of complex alternative options for future investment.

Changes in the geopolitical landscape are driving governments to derive more mission benefit from every investment dollar. In this environment, traditional decision-making approaches are no longer adequate. Defense ministries must carefully weigh their investment options to best achieve their national security goals. The Mission-Based ROI approach enables defense leadership to optimize and justify their decision making by using objective data and quantifiable insights. It provides a way to allocate funding to the most impactful projects and capabilities.