No one yet knows what trade policies President-elect Trump will enact once in office, but three things are clear: First, during his first term, he imposed new punitive tariffs. Second, he has repeatedly said he plans to levy new or increased tariffs quickly once inaugurated for his second term. Third, US trading partners could—and probably would—retaliate with measures of their own.

The impact on many industries, and on individual companies, could be rapid and significant. Business leaders who move quickly to assess the impact of multiple scenarios can both prepare their companies for new tariffs and trade restrictions as well as establish an advantage over slower-moving competitors. Many companies, for example, have already started to build up stocks of critical inputs.

We detail multiple mitigation strategies below. Some are relatively quick and straightforward. Others are more difficult and require lead time. Companies can build their tariff muscle with senior leadership engagement and cross-enterprise response teams. They can also ramp up their data and analytical capabilities to identify exposures to their product lines across their supplier network, production sites, and end markets. (For insights into coming changes in global trade flows, please see Great Powers, Geopolitics, and the Future of Trade.)

Scenarios and Timing

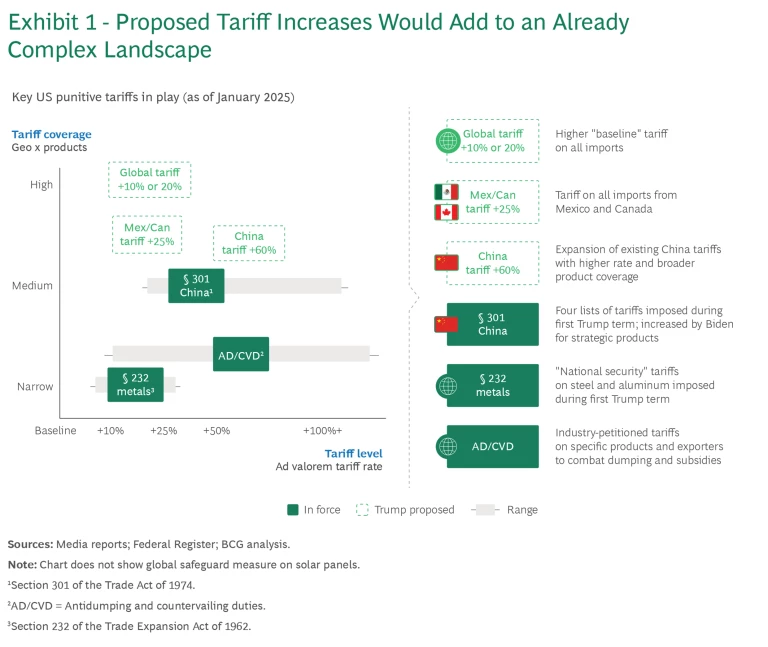

President-elect Trump has made differing comments regarding his planned tariff policy. For instance, he has suggested increasing tariffs on Mexico, Canada, China, and other countries at various levels. Any of his suggested moves would mark a significant departure from the current tariff regime. (See Exhibit 1.)

We see three potential scenarios, each with some historical precedent.

- Targeted Tariffs. The new administration could focus on a set of high-profile countries, products, or policy goals. For example, on the campaign trail, then-candidate Trump proposed very high tariffs on vehicles imported from Mexico, tying this to other political concerns. In the 1980s, the US increased tariffs on electronics and semiconductors imported from Japan and imposed quotas on Japanese auto imports, moves that were related to concerns about Japan’s industrial and monetary policy.

- Patchwork Tariffs. The president-elect could use tariffs as a negotiating tool, mixing threats with real measures and granting selective company-, product-, or country-specific exclusions. In 2018, the US imposed a tariff on worldwide steel and aluminum imports under Section 232 of the Trade Expansion Act of 1962. But after political pushback and retaliation from key trading partners, the US offered conditional or unconditional exemptions, or tariff-free quotas, to Mexico, Canada, and the European Union, among several other trading partners.

- Broad Tariffs. The new administration could impose new or higher tariffs on all major trading partners with few or no exceptions. This scenario could see a combination of the most aggressive tariffs proposed to date: a 20% tariff on all global imports, an increase to a 60% tariff on all imports from China, and a 25% tariff on all imports from Mexico and Canada. Such a move would be without precedent in recent US history, though it is worth recalling that in 1971, then-President Nixon imposed a 10% tariff on all dutiable imports in an attempt to address balance of payments and currency misalignment issues (the measure was dropped after less than five months).

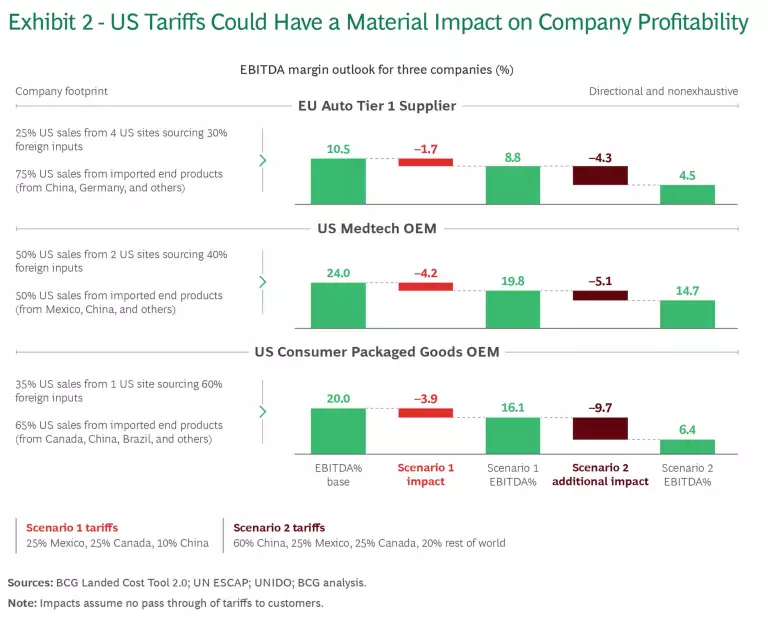

The impact of any of these scenarios could be hard felt by individual companies. Those with a high proportion of US sales or with supply chains predominantly outside the US face the highest risk. Many companies could see material impact on their EBITDA margins under various scenarios, from 6 percentage points to nearly 14 points, depending on industry and supply-chain footprint. (See Exhibit 2.) While companies with higher margins may have the capacity to absorb tariff-related costs instead of passing them on to customers, doing so often comes at the expense of profitability.

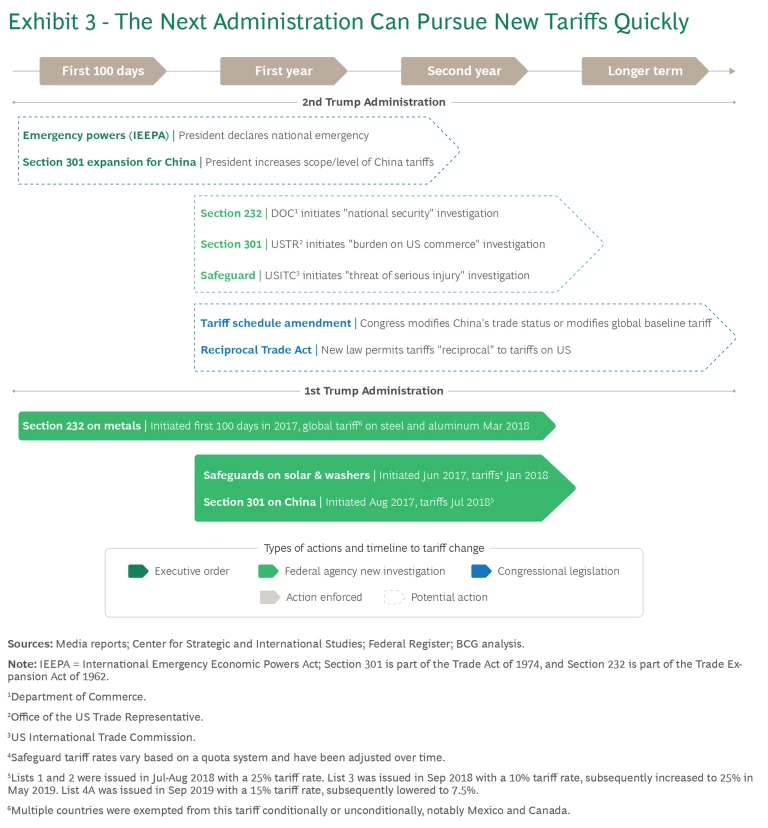

Whichever tariff scenario plays out, the initial trade policy moves could come fast—shortly following Inauguration Day, January 20, as occurred during the first Trump Administration. Some of the tariffs levied in 2017 are still in place today. (See Exhibit 3.) The president could act alone, using executive orders, under the International Emergency Economic Powers Act (IEEPA). He could also expand the tariffs imposed during his first administration, without the need for Congressional action or a lengthy new investigation. Alternatively, the new administration could order the Department of Commerce or another federal agency to begin an investigation to build the factual and legal basis for additional tariffs.

Mitigation Levers

Companies can act in four main areas to get ready for new or higher tariffs. The applicability, cost, timeline, and tradeoffs in each vary, both broadly and by firm. It pays to start planning your approach now.

Shaping Policy. It may be possible in some instances to influence the provisions or implementation timelines of a tariff policy or to obtain exemptions for certain products. The Wall Street Journal has reported that some companies are already pursuing this route. The first Trump Administration granted four types of exemptions from punitive tariffs in different contexts: individual-company exemptions for specific products, exemptions for all importers of the product in question, exemptions for an entire source country, and quotas that allowed defined quantities of imports to enter the US without a punitive tariff. It should be noted that pursuing exemptions can be costly and time-consuming, with no guarantee of a favorable outcome, and that in the past several exemption measures came with expiration dates.

Refining Go-to-Market Approaches. Whatever happens with tariffs, the impact will be shared by manufacturers, importers, retailers, end buyers, foreign exporters, and, ultimately, consumers. Pricing can be a key mitigation lever. The most straightforward solution to higher tariffs is to pass the added costs through to customers, which can be challenging but is often achievable with disciplined, analytical approaches and good change management.

Companies have all kinds of reasons to raise prices, including higher freight rates, increases in materials costs, and expectations of more inflation in the broader economy. In this context, tariffs become part of broader pricing discussions internally and with customers.

Companies should also consider other pricing factors: How much price elasticity is there in the product mix? How far can you raise prices without a significant impact on sales volume? Product differentiation and market concentration are key determinants.

Additional strategies may be available at the product level, such as making product-specific changes to reduce cost of goods sold (COGS) or optimizing product families around tariff criteria, although the potential benefits of these strategies should be balanced against the disruption to existing market strategies.

Dealing with a new tariff also is a good time to rethink product assortment. What are the high-margin or high-growth products you want to prioritize? These merit extra hard work to mitigate the impact of new tariffs. In turn, tariffs could expedite decisions to deprioritize or phase out other products.

Optimizing Trade Compliance. Companies can lower duties through smart “trade compliance,” which is essentially ensuring that traded goods and services follow the most favorable applicable customs rules. For example, companies may be able to reduce dutiable value through the first sale rule, under which a previous transaction in the value chain sets the dutiable value, or through delivery duty paid (the seller delivering the good assumes responsibility for the duty payment). Importers also can claim duty drawbacks on items that are ultimately re-exported. When tariffs are low, securing drawbacks may not be worth the trouble and expense. With higher rates, drawbacks can accrue significant savings.

Rethinking the Value Chain. Geography and location may matter—a lot—in the coming years. Companies face three types of decision: one related to their suppliers, another to their manufacturing footprint, and a third to their choice of end markets.

A thorough analysis of suppliers, including those in Tier 2 and 3, under various tariff scenarios is a priority. It may point to several options, including renegotiating terms, encouraging suppliers to move operations to new locations, and certifying new suppliers. There will almost certainly be tradeoffs among reducing tariff costs, heightening strain on vendor relationships, and incurring switching costs.

Manufacturers can also explore the costs and benefits of reconfiguring their facility footprint to lower- or no-tariff locations, although these decisions could require multi-year plans and substantial capital expenditures. There may be value in developing options for dual- or multi-site production.

Finally, in a trade environment characterized by tit-for-tat actions and asymmetrical retaliation, certain formerly open-export markets may become closed or restricted for US companies. Understanding the risks and opportunities of different end markets could be critical.

How to Get Ready

Three capabilities will help companies prepare for new or increased tariffs. The first is strategic business leadership from the top that maintains focus on business impacts and links trade policy risk to strategic objectives such as revenue growth, market share, and earnings. Second is the ability to iterate plans in an agile manner, leveraging supplier data and strong analytics to respond more surely and quickly to new policies than the competition. Third is effective cross-enterprise collaboration. There is no room for silos.

One approach is to build cross-functional teams of experts from all relevant functions, including strategy, finance, legal and compliance, procurement, and pricing, as well as company- or industry-specific functions such as retail operations and assortment planning. Another is to establish a central team focused on geopolitics, tariffs, and risk that consolidates risk assessment and works on mitigation bilaterally with each function.

Most companies have experience managing tariff costs, but they can activate a broader series of mitigation levers through a structured and phased approach.

Most companies have experience managing tariff costs, but they can activate a broader series of mitigation levers through a structured and phased approach. They can start by assessing their direct tariff risks, as well as the impact of possible new tariffs or trade restrictions on goods made by suppliers, based on their analysis of various scenarios. The assessment should include segmenting the portfolio by revenue at risk and prioritizing high-impact products and brands for fast response. A rigorous self-assessment will also identify blind spots—situations in which companies don’t know where their vendors are sourcing or what the true exposure is. In addition, companies should benchmark their exposure vis-à-vis peers, taking into account where their competitors source inputs and final products.

The next step is to develop a framework that balances risk and return, lead time, and the external environment for specific responses. This process can identify no-regret moves, event-based responses, and potential longer-term actions for consideration. Management can then build its mitigation plans with an emphasis on priority products or brands and set an initial phased implementation roadmap with specific signposts for action.

At the appropriate time, based on scenario triggers, the company is ready to implement its mitigation plan on the schedule it deems most beneficial. Dashboards can measure ongoing progress and provide mechanisms for continuing discussion of future resets and actions.

One Company’s Plan

In response to the increase in US tariffs on China-origin products in 2019, during the first Trump Administration, a US-based retailer developed an action plan. The company estimated that an increase in tariffs from 10% to 25% would have a profit impact of about $1 billion, split roughly 60%-40% between direct and indirect imports. It mobilized a cross-functional team to develop the tools to diagnose the potential tariff impact, establish best-in-class COGS practices, and guide the organization for longer-term trade disruption and action.

The company’s approach included the following actions:

- Identifying gaps or shortcomings compared with other best-in-class players.

- Establishing the operating and governance models for tariff responses and how they interact with existing processes and teams.

- Identifying the largest impact categories not yet mitigated and actions to fill in gaps for large and challenging categories and suppliers.

- Identifying opportunities to offset tariff costs through vendor negotiation and developing a corresponding negotiation strategy.

The company developed and implemented mitigation plans for thousands of SKUs across dozens of categories, reducing the projected profit impact under the unmitigated scenario by more than $350 million.

Tariffs represent part of the new normal of greater uncertainty in geopolitics and trade. While the current focus is predominantly on the US, companies face the potential of rising tariffs in many markets, depending on how other countries retaliate. The next several years could see a raft of new policies, each setting off complex responses. Tariff diagnosis and mitigation efforts matter. For global players, they are timely priorities.