Most industrial goods companies are underinvesting in their pricing functions—and therefore missing opportunities to create competitive advantage and improve margins and market share.

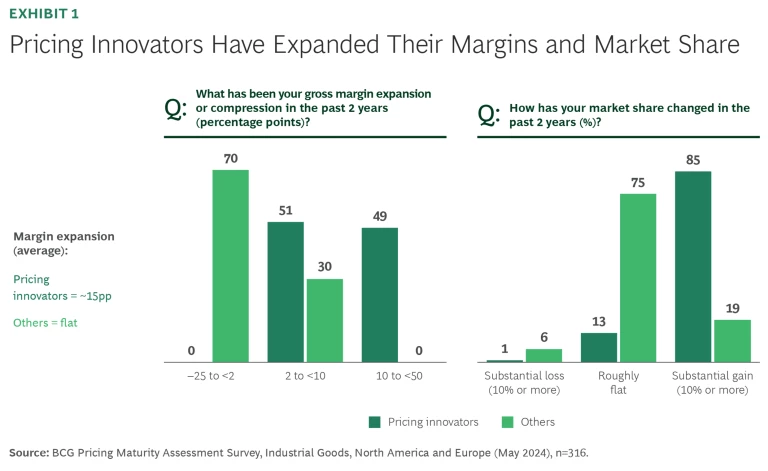

Our 2024 survey of 400 IG companies—including chemical, building-materials, and engineered-products firms, as well as dealers and distributors—reveals that only a small fraction of them have embraced the kind of next-generation data, technologies, and change management capabilities that have helped companies unlock above-average revenue and profit growth in other sectors, such as technology and consumer goods. We refer to this small set of IG companies as pricing innovators. Almost half of them have expanded their margins by more than 10 percentage points in the past two years while simultaneously gaining market share. (See Exhibit 1.)

By departing from traditional advice on how to develop and deploy pricing capabilities and by making a step change in their analytical tools, these innovators have also redefined what pricing excellence means in their industries.

Pricing as a Profit Center, Not a Cost Center

The innovators think of pricing as a profit center that can generate more cash than other functions—and can generate it more quickly. They position their pricing capabilities as intellectual property and a source of competitive advantage. The remaining companies, meanwhile, are leaving substantial value on the table by underutilizing or neglecting pricing as a strategic business imperative. Their C-level executives tend to view pricing as a cost center or a necessary evil that handles the administrative work of managing contracts and price lists or the recovery of cost inflation.

Our assessment of the IG pricing environment derives not only from the survey results but also the hundreds of BCG client engagements in IG over the past three years.

Although the COVID-19 pandemic forced IG companies to adapt their pricing processes quickly, we are now seeing many IG companies backslide to pre-COVID-19 norms. Some are executing fewer price changes per year with smaller pricing teams that have low-skilled talent. Others are going through lengthy third-party software installations that equip them with the same algorithms the rest of the market has, but they aren’t investing in change management for decision makers on the front lines. These moves are not restoring a previous and desirable equilibrium—rather, they are pulling companies further away from state-of-the-art pricing excellence.

To change the game, IG companies need to do more than follow generic high-level pricing advice, which includes giving pricing a seat at the table, building analytical capabilities, and having a larger organization. Such guidance often falls short because the seat at the table has no authority or ability to influence P&L owners, the analytical capabilities are neither differentiated nor core IP of the company, and the larger organization lacks the right mix of strategic, technical, tactical, and administrative talent.

Five Recommendations to Innovate Your Pricing Function

By pulling a set of tangible and novel levers, pricing innovators in the IG sector are achieving higher margins, stronger commercial positions, and better growth prospects. The five recommendations below—drawn from the innovators’ success stories—are redefining pricing excellence.

IG pricing innovators are achieving higher margins, stronger commercial positions, and better growth prospects.

Link your commercial strategy to everyday price decisions. The flood of day-to-day requests coming from the commercial team makes it easy for pricing functions to lose sight of whether portfolio-wide pricing outcomes are delivering on the company’s commercial goals.

To avoid this, the innovators create explicit links between management’s strategic direction, price-setting algorithms, and frontline governance. The management team of one equipment OEM, for example, uses its annual planning process to define top-down objectives related to margin or share in its product lines. An AI optimization engine then translates these into product-level decisions using management’s guidance as the objective function. A metal parts distributor with a high transaction velocity runs a weekly governance process with its CEO and business unit presidents to adjust pricing guidance and escalation parameters in its quotation tool, on the basis of observed margin and win rates. They then communicate these expectations for the week directly to the front line.

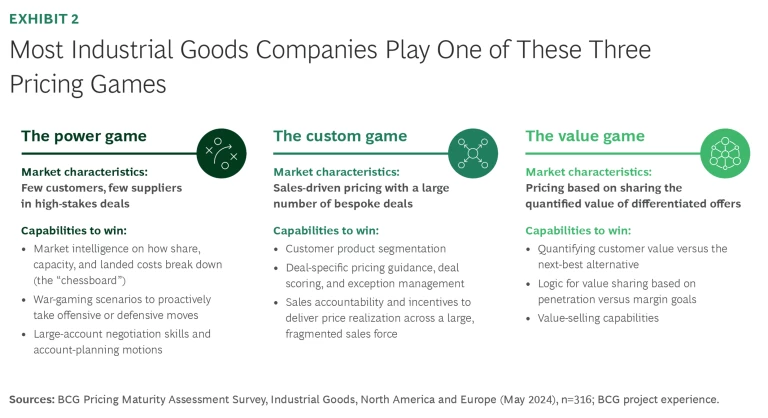

Tailor your pricing capabilities to the game you play. Exhibit 2 shows the capabilities needed to win the three pricing games we commonly observe in IG sectors. But we often see misalignments between where IG companies are investing relative to what their specific pricing game requires for success.

IG companies choose to play a pricing game—usually power, custom, or value—depending on their objectives and market characteristics. The sectors or areas where the power game applies include critical components sold to the aerospace or automotive industries, the steps in the chemicals paint and coating value chain, many mining material subsectors, and the services supplied to power generation OEMs. The custom game is common in building-materials distribution, specialty chemicals, plastic or containerboard packaging, and components sold to industrial facilities such as sensors. Examples of where companies play the value game include capital goods and digital capabilities for asset performance improvement.

Many IG companies invest resources and capabilities in elasticity modeling, even though it is not fundamental to any of the games in Exhibit 2. Elasticity modeling is best suited for sectors such as retail, which have high transaction velocities and sell few products to a large number of customers. In IG sectors, elasticity modeling is most relevant for small and midsize businesses in the distribution and aftermarket parts spaces, such as maintenance, repair, and operations (MRO) or vehicle parts, but it is not the primary driver elsewhere.

Subscribe to our Pricing and Revenue Management E-Alert.

Our survey shows that most IG companies have not aligned their capabilities with the game they are playing. Only 22% of the companies in the power game, for example, have sufficient information to model or predict competitive responses.

Invest in pricing data assets, especially market intelligence. IG companies have far more internal and external data available to use for pricing than they realize. The innovators use these novel sources of data to differentiate their pricing and optimize outcomes. Three examples of novel data sources are geolocation, e-commerce competitive intelligence, and a database of contract terms.

IG companies have far more internal and external data available to use for pricing than they realize.

Companies are analyzing geolocation data, satellite imagery, and trade data to accurately model competitor supply locations, capacities, and landed cost. A business can use such information to differentiate pricing for customer locations, on the basis of cost-to-serve advantages. This is especially relevant for material processing and commodities such as cement, steel, wood products, mining, plastics, and agricultural products.

E-commerce competitive intelligence creates a wealth of optimization opportunities not only in pricing but in assortment, product development, and merchandising. As B2B buying continues to migrate online, companies are sharing an array of public information, such as assortment detail, stocking status, lead time, and, in some cases, pricing. The innovators mine this data relentlessly and now use methods powered by generative AI (GenAI) to compare product lines and pricing to find and tap optimization potential. This data source is relevant for businesses with online catalogues and wide assortments, including equipment OEMs, the manufacturers of engineered components and capital goods parts, and distribution sectors such as MRO.

A database of contract terms is applicable for nearly all IG sectors. The ability of GenAI to process unstructured text enables pricing innovators to rapidly assemble a structured database and then systematically assess and address contract risk as well as compliance leakage. We have found that correcting compliance leakage is usually a quick win when IG companies struggle with the challenge of understanding and managing compliance across hundreds of unstructured contracts.

Take control of your pricing engine and add sophistication. Our survey reveals that 33% of IG companies still use Excel to manage pricing. That is one reason executives are tempted to upgrade to third-party software, including enterprise resource planning (ERP) modules. We find that these software applications work best for pricing execution and workflow tasks such as price list management or configuring a quote. In such uses, the software can improve productivity and responsiveness while reducing leakage, audit, and compliance risk in administrative processes.

But for the core price-setting algorithms, third-party software often leaves IG companies in an “average-at-best” dilemma. Either the firm has the same or similar pricing logic to its competitors, or it needs to shoehorn its unique business dynamics into a product not configured to handle them. This risks leaving the company with price recommendations that are difficult to explain and hard to update without costly change requests. This breakdown can occur when an organization wants to modify its pricing logic to use market data beyond historical sales transactions or when a company in an industry such as material processing has pricing spreads on volatile commodity costs.

The innovators, in contrast, pull ahead of the pack by building their own price-setting logic and production-grade code base to treat their pricing algorithms as IP. Doing so not only allows a broader set of data to inform the engine but also enables the use of fit-for-purpose machine-learning methods and rapid incorporation of user feedback. This creates a clearer link between the strategic direction from leadership and the price recommendations delivered to the front line. Companies that involve their own organization in the design of the pricing algorithm can also foster understanding and adoption in day-to-day operations.

Build a larger, more strategic, and technically savvy pricing team. In our survey and experience, we find that IG companies systematically understaff their pricing teams across several dimensions. They tend to have too few people, a mix of employees that skews toward administrative roles, and a limited talent level in each role, often because they have a low cap on salaries. While the numbers vary depending on the size of an organization, the example below shows how pricing innovators invest in talent to differentiate themselves:

- The pricing leader is either a Level 3 IT professional or senior vice president. The individual must be a strategic thinker, data-driven, and able to influence P&L owners and commercial team leadership.

- Dedicated strategic-pricing staff track how the pricing function creates value, identify strategic initiatives, and implement them.

- A team of data scientists concentrates on pricing. They build capabilities in many areas, depending on the pricing game the company plays. These capabilities include frontline decision support tools, volume response modeling and performance attribution, deal segmentation, and price recommendation logic. The pipeline of user feedback and improvements is always full for such a team. It is critical to dedicate these roles to pricing, not outsource them to IT shared services or a third party.

- A group of data asset professionals focuses solely on building and improving market intelligence capabilities as well as internal data sources used to drive pricing.

- A sales decision-support team is embedded within the commercial organization. They support analytics, the development of offers and value propositions, and economic scenario modeling related to customer opportunity response.

For companies with more than $1 billion in revenue, the annual cost of the example above ranges from $1.5 million to $3 million, before considering administrative pricing staff. Such an investment in strategic pricing talent is typically small relative to the ROI that the pricing function generates in basis points of margin and share improvement.

Pricing remains one of the most powerful and immediate sources of profit impact and market share gains. Most IG companies manage pricing with a few lower-skill employees and make only a limited investment in new capabilities. But a small fraction of IG companies—the pricing innovators—deliver materially better margin and share performance by investing in more and better resources. Their focus areas include data science and novel data assets to supplement internal transaction data. Perhaps most important, they own and continually improve their pricing engine as core IP, create a direct link between management’s guidance and deal-level pricing outcomes, and tailor their capabilities to the pricing game they play.