This is the first chapter of a four-part annual report on the global asset management industry and the trends shaping its future. The full 2025 Global Asset Management Report: From Recovery to Reinvention is available as a PDF download.

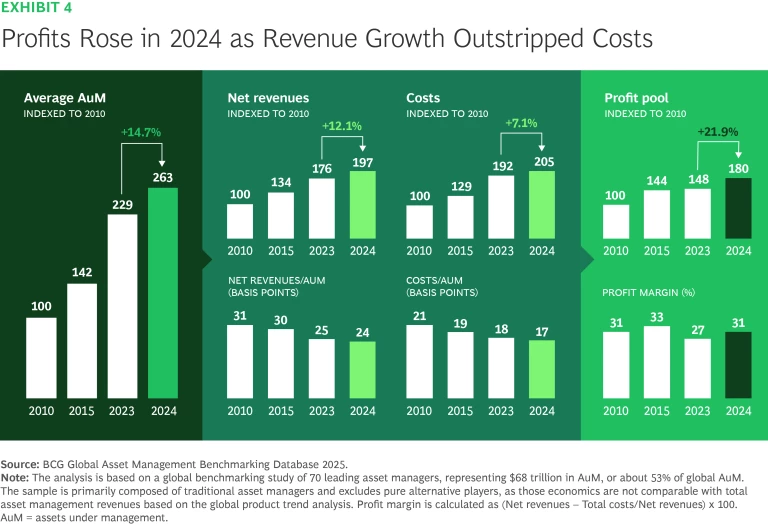

The global asset management industry reached a record $128 trillion in assets under management (AuM) in 2024, up 12% from the previous year. The gains marked a strong continuing rebound from the decline that occurred in 2022. Nevertheless, that growth can’t mask the deeper structural challenges that the industry faces, including margin pressures, shifting investor preferences, and intensifying competition.

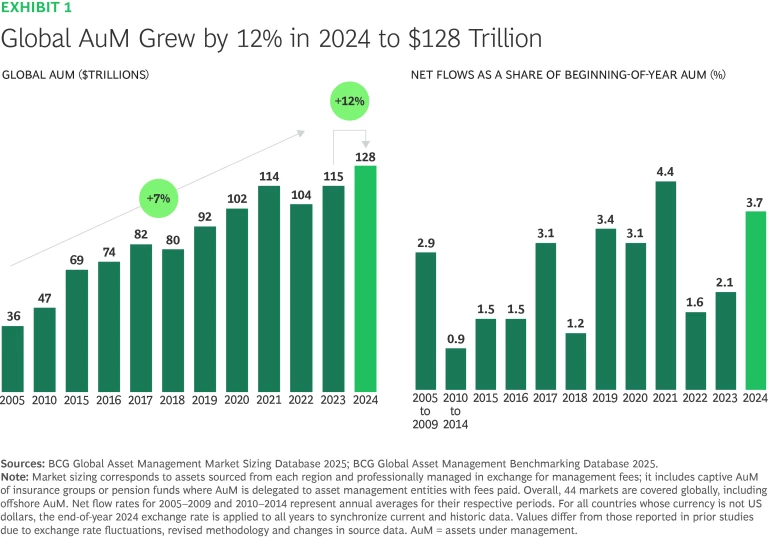

Notably, market performance drove 70% of revenue growth in 2024, underscoring the industry’s vulnerability to external conditions—especially in a period marked by extreme market volatility, rapid shifts in sentiment, and heightened economic uncertainty arising in part from the disruptive effects of the US tariffs. To remain competitive and to navigate an increasingly uncertain future, firms must move beyond the recovery that has characterized the past two years and focus on reinventing themselves for the future.

Three Forces Reshaping the Industry

Three forces in particular are reshaping the industry: shifts in product offerings and approaches to distribution; industry-wide consolidation; and the need for radically leaner cost structures. In this report, we examine the transformation strategies that asset managers will need to adopt in order to meet these forces head-on and win in the next five to ten years.

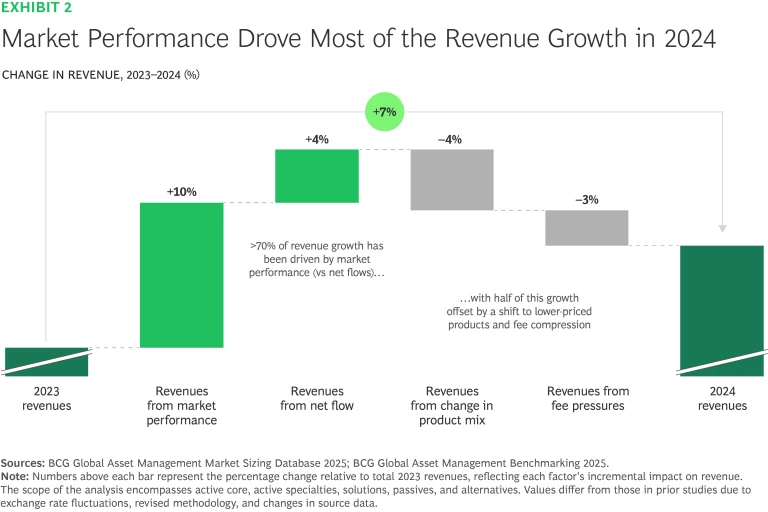

Product offerings and distribution approaches are shifting. Increasingly, investors are demanding low-cost, efficient products such as exchange-traded funds (ETFs). Although ETFs command lower fees than legacy mutual funds do, they offer the potential for closer long-term customer ties. This is especially important at a time when the economics of the industry are tilting more and more toward the entity that owns the investor relationship—the distributor. In particular, asset managers might consider developing products in the relatively fragmented and nascent active ETF space.

Managers also have an opportunity to develop private market funds for retail investors, who are eager to tap into the higher risk-return profile that these asset classes offer. When it comes to matching private market assets with the liquidity and regulatory requirements of the retail market, firms must deal with some obstacles. But as a result, those that develop viable products and scalable distribution networks stand to benefit from a largely untapped market.

Industry-wide consolidation activity is increasing. Because no one-size-fits-all approach is available, many asset managers will need to consider enhancing their scale and scope through strategic partnerships or M&A to stay relevant. The consolidation we are seeing tends to revolve around strategies for broadening product offerings, expanding global presence, building technology capabilities, securing more permanent capital, and increasing proximity to clients.

Regardless of deal rationale, the key to success will lie in the execution. For example, as private and public managers converge to leverage their respective expertise in product formation and distribution, they will need thoughtful strategies for integrating their legacy differences in such areas as culture, compensation structures, and value creation.

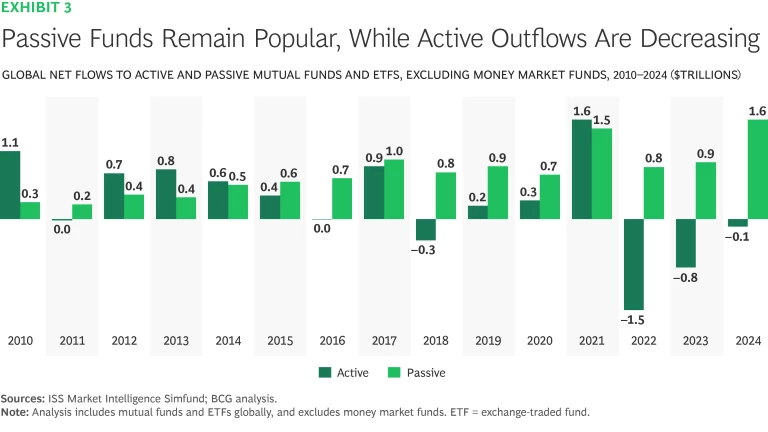

Cost structures need to be radically leaner. Amidst ongoing pricing pressures and a shifting market landscape, the issue of costs has magnified. In response, many firms are increasingly adopting one of three strategic models to shape their cost structures—focusing their spending on investment management and trade execution; sales, marketing, and operations; or IT.

Although these models differ in focus, all of them can benefit further from a zero-based approach to cost management. This approach entails reexamining all costs and may lead to such changes as outsourcing noncore functions, automating processes with generative AI (GenAI), and avoiding dual-run costs, especially in headcount.

The Year in Review

Global asset management AuM grew by 12% in 2024, reaching a record $128 trillion, with all regions contributing to the increase. (See Exhibit 1.)

Strong market performance drove this growth. Major indexes such as the S&P 500 (up 23% for the year) and NASDAQ (up 29%) rose significantly. Global revenues for the industry rose by $58 billion, and more than 70% ($42 billion) of that gain came from market performance compared to only 30% ($16 billion) from net inflows.

Half of the revenue increase, however, was offset by a shift to lower-priced products and by fee compression. (See Exhibit 2.) Although the industry can celebrate another year of growth, asset managers must be aware of the underlying threats to their legacy products and distribution channels, as well as to the operational models behind them.

Last year, investors continued a long-term trend of shifting from actively managed funds to passively managed products. Active AuM declined from 65% in 2023 to 61% in 2024 for mutual funds and ETFs. Net new flows reflected this trend, with $0.1 trillion in outflows from active funds, excluding money market funds, versus $1.6 trillion in inflows to passive funds. (See Exhibit 3.)

Although mutual fund and ETF ownership skews toward retail clients, institutional investors are shifting to passive products, too. In this market, over the past five years, passive AuM grew from 17% to 20% of assets while active AuM shrank from 44% to 38% of assets.

Breaking down the shift to passive across mutual funds and ETFs by geography, however, reveals a strong regional tilt, in which North America’s $337 billion in outflows from active funds was enough to drag global net flows into negative territory. All other regions saw positive net flows into active funds, driven largely by fixed-income funds and actively managed ETFs. Fixed-income funds attracted $700 billion in net new flows globally, while active ETFs drew positive net new flows of $325 billion, nearly $300 billion of which came from North America.

Revenue growth outpaced cost growth in 2024, resulting in a rise in profits of about 22%. (See Exhibit 4.) However, fees on 2024 net inflows were, on average, about 40 basis points less than fees on 2023 existing AuM across mutual funds and ETFs. The changing fee structure is a clear indication of revenue pressure that asset managers will need to address with product innovation and a search for scale.