This is the second chapter of a four-part annual report on the global asset management industry and the trends shaping its future. The full 2025 Global Asset Management Report: From Recovery to Reinvention is available as a PDF download.

The landscape for products and distribution is evolving in a way that presents two notable opportunities for asset managers to win. First, they can secure a strong position within a shrinking yet strategically important segment of actively managed assets—specifically, in active ETFs, model portfolios, and separately managed accounts. Second, they can mobilize to play a key role in the growing market for delivering private assets to retail clients.

The Active ETF Space

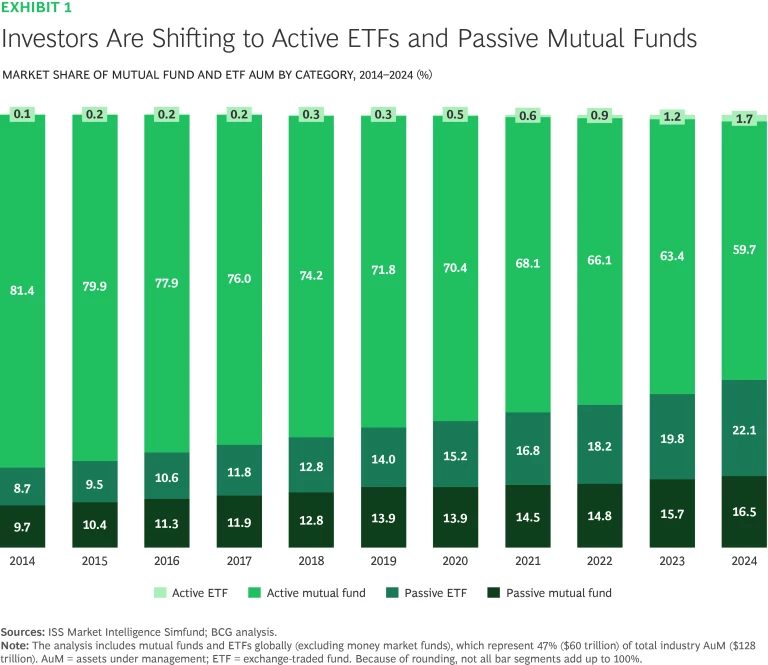

For well over a decade, investors have been shifting out of actively managed mutual funds and into passive products, mostly ETFs. (See Exhibit 1.) Relative to mutual funds, ETFs offer attractive net of fee returns, as well as greater liquidity, tax efficiency (especially in the US), and transparency.

Passively managed ETFs have seen sustained inflows since 2010. The passive ETF market is reaching maturity and has become highly concentrated, with the top ten players controlling 82% of AuM in 2024.

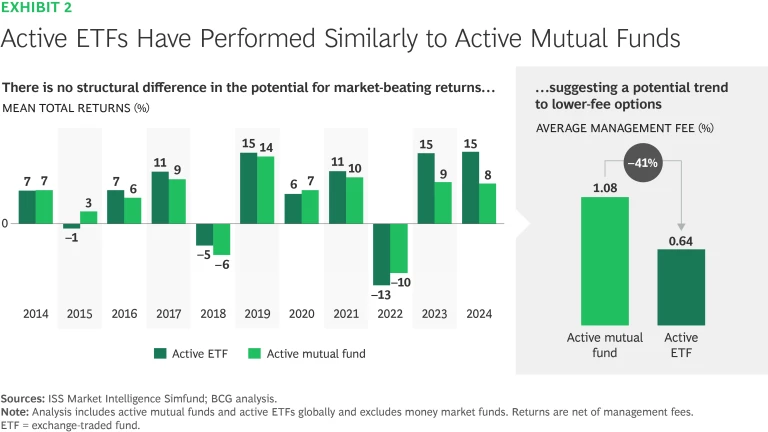

Now a second wave of ETF adoption is bringing investor capital to actively managed ETFs. Globally, active ETF AuM grew at a compound annual growth rate (CAGR) of 39% over the past ten years. It is not hard to see why investors are drawn to these funds. There is no structural difference between active ETFs and active mutual funds in terms of potential for market-beating returns, but the fees are only 0.64% on average versus 1.08% for mutual funds. (See Exhibit 2.)

The active ETF market is at an attractive inflection point for asset management firms interested in entering this space. It is growing quickly across geographies, and 44% of all ETFs launched in 2024 were actively managed. Yet it is still a nascent business, holding only 7.0% of the total AuM in ETFs. It is also a relatively fragmented market, with the top ten players controlling 65% of AuM.

Firms that launch new active ETFs must make some difficult choices, however. For example, an asset manager with existing mutual funds will need to decide whether to convert its legacy funds into ETFs or create new active ETFs. Either way, the firm is likely to find itself cannibalizing its higher-fee mutual fund business, given that ETFs do not offer material cost advantages from a production and distribution perspective. Yet from a long-term perspective, the new ETF products are likely to capture otherwise unavailable capital flows and allow the firm to get closer to customers of the future.

Players entering the active ETF space will also need to build a series of capabilities. These include bespoke product specialists, marketing teams, and vendor management. They will need tie-ins with advisor and brokerage platforms, legal counsel, and tax experts—the last especially in the US where ETFs offer certain tax efficiencies. Although firms that have an established passive ETF business may already have the necessary capital market, tax, and tech functionalities in place, they will probably need to bolster their research, portfolio management, and trading executions. Conversely, players that have an established active mutual fund business will need to set up product specialist teams, tax and legal experts, and, notably, a capital markets team.

An alternative option to making costly up-front investments in these capabilities is to work with ETF accelerators or white-label providers that specialize in market entry facilitation. In this case, responsibility for portfolio management and distribution remains with the asset manager, while the accelerator takes on the tasks of legal structuring, regulatory communications and filings, portfolio implementation, and capital markets execution. In effect, the asset manager trades some operational control and revenues in return for speed-to-market and lower upfront costs.

Private Assets for the Retail Market

Another big opportunity lies at the intersection of private markets and retail customers. On the demand side, investors are eager to access the risk-adjusted returns that top private market funds can deliver. On the supply side, private market managers are jockeying to tap into the 48% of global assets controlled by retail wallets.

Alternative assets, including those that invest in private instruments, now generate more than half of all global revenues, although they hold less than 25% of global AuM. From 2014 to 2024, the combined AuM for private equity, private debt, real estate, and infrastructure funds grew at a CAGR of 11.1%, far outpacing the asset management industry’s 6.5% compound annual AuM growth excluding these asset classes. Private asset growth reflects strong long-term performance and steadily increasing demand. Both investors and managers have incentives to keep the party going.

Asset managers who want to join in, however, must overcome obstacles in product design and distribution.

The product itself must satisfy the relatively rigid liquidity and regulatory requirements associated with the retail market. On the distribution side, a product sponsor is required to educate investors and advisors, create and amend capital formation and onboarding procedures, and ensure compliance across a more fragmented customer base. Private market investors need to clear additional accreditation, know-your-customer (KYC), and anti-money laundering (AML) procedures, for example. These are tried and true processes for institutional and high-net-worth (HNW) investors, but an asset manager must adapt them to the concerns of clients in a lower wealth bracket.

So far, efforts to place private assets in retail products have broadly taken two forms: technology-enabled feeder funds and evergreen semi-liquid funds.

Technology-enabled feeder funds pool client assets to clear minimum investment thresholds. The limitation of this option from the perspective of investors is that the structure does not provide interim liquidity or keep clients perpetually invested; instead, exposure winds down as the fund manager distributes returns. For the advisor, the roadblock involves the administrative burdens associated with facilitating repeated subscription agreements, managing capital calls and distributions, and handling tax documents for each individual client.

The other route is evergreen semi-liquid funds. Over the past four years, semi-liquid funds have grown more than fivefold, reaching a net asset value of over $300 billion in 2024, according to data from Goldman Sachs. These structures partially solve the issue of liquidity constraints by accepting capital on a continuous basis, allowing periodic redemptions and reinvesting the realized proceeds in perpetuity. That said, the sponsor must warehouse the assets to build the initial portfolio and to create liquidity backstops to generate interim cash conversion without eroding investor returns.

We foresee significant experimentation with private market structures in the years ahead. Asset managers might consider placing private assets in active ETFs or model portfolios, for example, or creating hybrid public-private evergreen or interval vehicles. Naturally, each approach comes with its own suite of operational challenges and risks.

The active ETF solution may be the most accessible option for retail clients, but it requires managers to bear the risk of holding the underlying assets. Model portfolios allow a firm to capture a significant share of client assets, but they don’t inherently resolve the illiquidity mismatch.

As competition intensifies, we expect product innovation to be a core differentiator for winning firms. For example, blockchain and cryptocurrency can play an important role in disruption by enabling tokenization, reducing friction, enhancing transparency, and giving rise to programmable and fractional products. In private assets for the retail market, we are seeing experimentation with tokenized funds, automated private credit pools, tradable fractions of illiquid assets, and integration into mainstream financial vehicles—all backed by blockchain rails.

There is no single answer, but the opportunities in private market retail products are too big to ignore. Asset managers recognize the potential rewards if they can meet the challenges, and one of the results has been a surge in M&A deals and partnerships involving entry to private markets.