This is the third chapter of a four-part annual report on the global asset management industry and the trends shaping its future. The full 2025 Global Asset Management Report: From Recovery to Reinvention is available as a PDF download.

The asset management industry is undergoing a wave of consolidation activity as firms seek greater economies of scale and greater scope for their business.

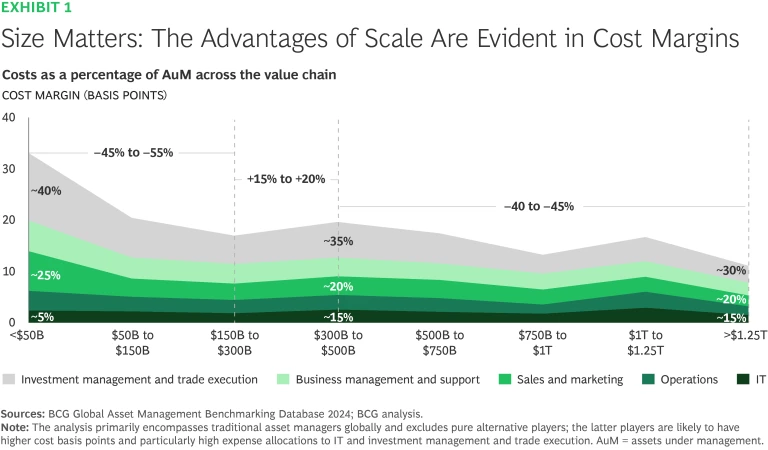

Size matters. In a study of 270 asset managers, we found that the average asset manager doubled its AuM from 2013 to 2023. Those with the largest amount of assets were able to drive costs down through technological synergies, streamlined operations, and process efficiencies.

In our examination of a proprietary benchmarking sample of primarily traditional asset managers, we found that for firms with AuM below $300 billion—often those with lower product or geographic complexity—increasing AuM significantly reduces costs as a percentage of AuM. As firms surpass the $300 billion mark and approach $500 billion, typically by expanding to broader asset classes or client segments, rising complexity and operational challenges emerge. Managing a diverse portfolio while adhering to investment mandates becomes more difficult, leading to a period marked by “diseconomies” of scale. Beyond the $500 billion mark, however, the largest asset managers benefit from optimization at scale. Their size permits them to achieve cost efficiencies despite the complexities associated with managing a vast asset base.

We have also found that both investment management and trade execution (IM&TE) and business management and support costs decrease as a proportion of total costs at greater scale. Larger asset managers are able to distribute these expenses across a broader AuM base. Even so, these larger firms have higher IT expenses as a proportion of costs, owing to their need for scalable IT infrastructure with advanced capabilities. (See Exhibit 1.)

In addition to gaining advantages from scale, asset managers benefit when they increase their scope by expanding their product portfolio, geographic footprint, or capability set. Greater scope enables them to diversify revenue streams, reduce costs, and enhance client offerings through shared resources and expertise.

Five Key Objectives

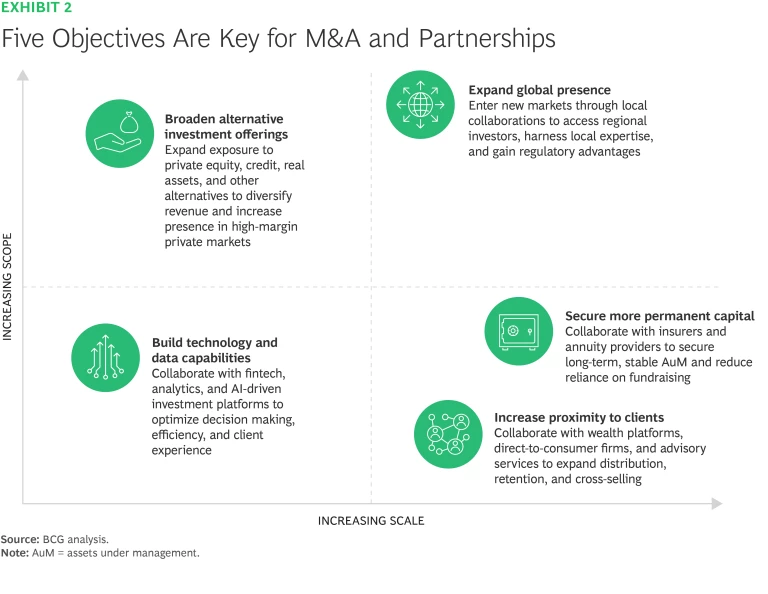

The M&A deals and partnerships that we are seeing in the industry tend to revolve around five key objectives related to improving scale and scope. (See Exhibit 2.)

Broaden alternative investment offerings. By collaborating with alternative providers, a firm can diversify its revenues and build a wider capital base. In addition to their potential in efforts to develop products for the retail market, alternative products can help capture additional institutional and HNW investor capital.

Expand global presence. Emerging markets, in particular, present significant opportunities to serve the investment needs of a growing middle class. Entering these regions through M&As or joint ventures with established local firms yields regulatory advantages and facilitates market entry.

Build technology and data capabilities. Collaborating with fintechs, analytics firms, and AI-driven investment platforms can be among the most efficient ways to invest in advanced technology. For larger players and those with specialized technology and data requirements, acquiring an in-house product suite can lower costs and strengthen their quantitative investment models. In some cases, it can also provide alternative revenue streams.

Secure more permanent capital. To gain access to more permanent capital, a number of asset managers have entered into partnerships with insurers and annuity providers. (See the sidebar “Stronger Together: Insurers and Asset Managers Team Up to Invest in Private Markets.”) The long-term, stable nature of insurance assets reduces the need for continuous fundraising and mitigates exposure to market cycles. These partnerships also create distribution opportunities, as asset managers can serve insurance customers with tailored investment solutions.

Stronger Together: Insurers and Asset Managers Team Up to Invest in Private Markets

For their part, insurance companies are increasingly recognizing the value proposition of seeding new private market investments. In a survey of insurers, BlackRock’s 2024 Global Insurance Report found that 91% of the respondents plan to increase their investments in private assets in 2025 and 2026.

A key attraction for insurers is the opportunity to extract an illiquidity premium from private markets. As a result, they can boost returns—especially in comparison to traditional fixed-income assets— when they invest their own accounts or those of their policyholders. For asset managers, insurance capital provides a patient, long-term base that enables them to invest with a long-term strategic outlook in illiquid strategies such as private equity, private debt, and real estate.

These partnerships also generate broader strategic advantages. With insurance capital as a stable anchor, asset managers can scale their private market offerings more effectively, supporting revenue growth and long-term competitiveness. Insurers, meanwhile, benefit from the asset manager’s expertise in navigating complex private market deals that align with long-duration liabilities.

Private market partnerships also serve the growing market for retirement products. As global demographics shift and longevity increases, conventional pension structures face mounting pressures with regard to ensuring retirees’ financial security.

Traditionally, pension portfolio managers have weighted their holdings heavily in fixed-income instruments, which struggle to meet long-term return targets. In response, firms are introducing alternative strategies—including private equity, infrastructure, and other illiquid assets—to boost portfolio resilience.

For insurers, pension-related collaborations make it possible to develop products that balance stability with long-term capital appreciation, ensuring both security for policyholders and enhanced profitability for financial institutions. For asset managers, pension channels offer greater scale and scope for their investment products as they cater to a wider and more diverse investor base.

In parallel, new technologies such as AI and digital distribution channels are transforming the way firms manage, distribute, and market their pension products. Technology is also reshaping the design and delivery of pension solutions, making it possible to create highly personalized offerings to match with individual retirement goals and risk preferences.

When partnering with insurers, asset managers must navigate regulatory, legal, and capital constraints that are stricter than the ones they encounter with other institutional pools. Tax rules, solvency ratios, and capital requirements, which vary by country, necessitate more complicated portfolio construction. Success in these partnerships requires specific capabilities, careful risk management, and long-term strategic planning, but the rewards can include long-term resilience for both parties.

Enhance proximity to clients. Many firms are deepening their client relationships by collaborating with wealth management platforms, direct-to-consumer firms, and financial advisory services. Such partnerships enable asset managers to increase retention while reducing dependence on traditional intermediaries such as brokerages.

Execution Is Essential

Although selecting the right target or partner is critical, the long-term success of any consolidation deal depends on effective execution. The participating parties should ensure, from an early date, that they are unlocking the best of both organizations. That makes the role of corporate development teams more important than ever.

In M&A, well-executed postmerger integration (PMI) is essential, as it ensures a smooth transition in leadership, operational efficiency, and cultural alignment. Minimizing disruption to investors is critical to maintaining AuM stability and ensuring client retention. The organization should communicate proactively with investors about its investment philosophy, portfolio management continuity, and fee structures.

In partnerships, all parties should agree on the distribution strategy and product design, as well as on the boundaries where collaboration ends and competition begins. The partners should establish a well-defined go-to-market strategy that outlines a plan for product positioning, client targeting, and branding. They should also ensure regulatory and operational alignment—including compliance frameworks, IT systems, and reporting structures—to streamline processes and prevent roadblocks.