At a time when many are saying the era of ESG is coming to an end, we’d like to make a simple point: sustainability and value creation are not inevitably in opposition.

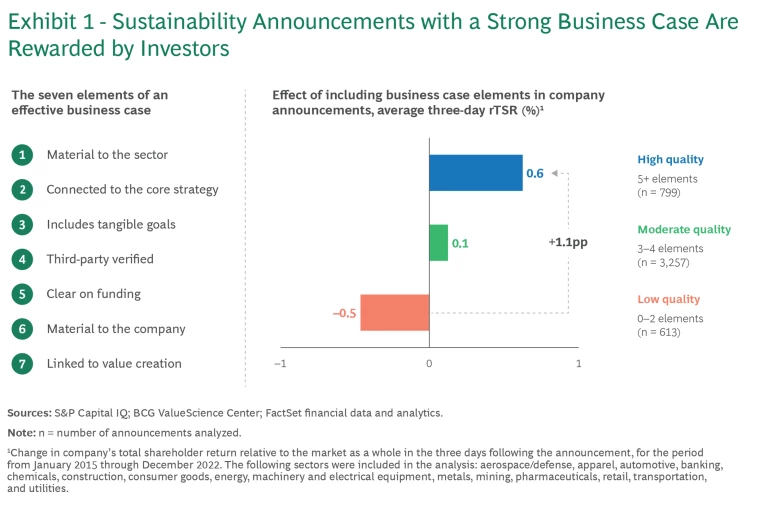

Our earlier research showed that investors wanted to hear the business case for sustainability investments —and that the market disproportionately rewarded those sustainability announcements that included a thoughtful business case.

About the Research

Our approach and hypotheses were derived from earlier BCG research. We took a number of steps to mitigate the effects of confounding drivers of rTSR: using short-term returns (three days following the announcement) as our metric for value creation, merging multiple related announcements on a single day, excluding announcements within three days of earnings calls or investor days, and excluding data from March through December 2020 because of the impact of the COVID-19 pandemic on stock markets. This yielded a dataset of about 14,000 announcements. After that, we filtered the sample once again to focus only on the announcements made by the top 20 companies in each sector by market capitalization as of the end of December 2022, yielding a final dataset of approximately 6,700 announcements.

We then tagged each announcement in our global data set to indicate which of seven business-case elements identified in earlier global, regional, and country-level research were included. We used natural-language processing to tag the full data set and then ran manual checks to verify accuracy.

While investors believe that business leaders are making some progress on this front, there remains significant room for improvement. According to BCG’s global investor survey, between 2019 and 2024 the share of investors that felt companies were effectively communicating the rationale for their sustainability initiatives rose—but only from 37% to 40%.

At the end of the day, of course, what you say to investors can only be as compelling as what you’re actually doing. To get real credit, your sustainability strategy needs to be linked, at least in part, to your value creation strategy . So while this article provides an update on our recently expanded analysis of sustainability announcements, our broader aim is to focus on the types of sustainability initiatives most likely to deliver real returns.

Spoiler alert: they’re the ones that either accelerate the growth rate of free cash flow by boosting revenue or lowering costs—or extend its duration by reducing risks .

The Value Impact of Sustainability-Related Announcements

Our 2023 research on sustainability announcements based its conclusions on an analysis of three sectors:

mining

,

automotive

, and

consumer goods

. It found that investors disproportionately rewarded announcements that included five or more of these seven elements of effective business cases:

- Material to the sector

- Connected to the core strategy

- Includes tangible goals

- Third-party verified

- Clear on funding

- Material to the company

- Linked to value creation

The last three had the strongest value impact—perhaps unsurprisingly, as they are the ones that spotlight a link between the organization’s sustainability and value creation agendas.

We recently enlarged the research to include 12 additional

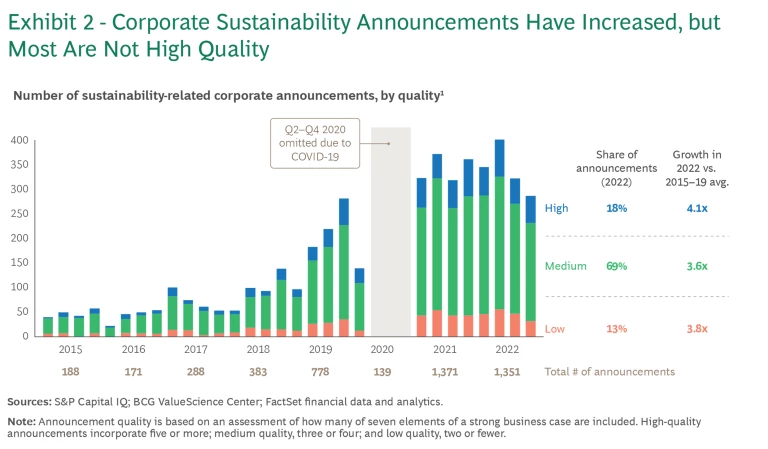

Unfortunately, even though we’ve seen an improvement in announcement quality over time, high-quality announcements are still the minority. Exhibit 2 shows the growth in announcements by quarter and quality. The number of announcements in 2021 and 2022 was nearly twice the level of the prepandemic peak year of 2019. And in 2022, the share of high-quality announcements was 18%, two percentage points higher than the average from 2015 to 2019. That said, over four-fifths fell short of best practice.

Of course, to craft sustainability announcements that create value, the underlying investment has to have attractive business economics. And ultimately value creation is a risk-adjusted function of two factors: the growth rate of free cash flow and how long each stream of cash flow lasts. In the coming sections, we’ll look at both of these factors—and under each, discuss three potential ways sustainability investments can contribute.

Accelerating Cash-Flow Growth

Any current valuation is based on a forecast of future cash flows. And valuations increase as the level and growth rate of free cash flow increase. As a result, those sustainability initiatives that enhance cash flow will drive value growth.

Achieving Price Premiums. In many (but not all) cases, customers are willing to pay more for products that offer a sustainability benefit. Maybe the product or service enables the customer to make a more attractive offer to its end consumers or helps it to accelerate progress toward its sustainability commitments. Or perhaps the more expensive input makes it possible for the customer to reduce its downstream costs—for example, disposal costs for manufacturing -related waste.

Indorama Ventures Limited (IVL), based in Thailand, is a $15 billion integrated global chemicals company and a leading producer of polyethylene terephthalate (PET), a critical ingredient in soft drink bottles and other packaging solutions. Attracted by both the high growth potential of recycled PET (rPET) and the opportunity to capture a price premium over virgin PET, the company decided to position itself at the forefront of the rPET revolution, committing to invest $1.5 billion in the initiative. As of today, the company has twenty rPET facilities distributed across Asia, Europe, and the Americas.

Recycling the equivalent of 50 billion plastic bottles per year, the company has already gained a leadership position in the industry, a position it will seek to strengthen further by doubling capacity by 2030. Getting there will require the company to go beyond mechanical recycling to embrace chemical approaches, as exemplified by IVL’s joint venture with the French biotech company Carbios, which will convert 50,000 tons of postconsumer PET into high-quality rPET using an enzymatic technology.

As scale effects materialize, feedstock constraints relax, and conversion costs decrease through technological innovation (for example, AI-powered machine vision to streamline the sorting process), business economics will improve. Most analysts see the move into rPET—in addition to contributing to a more sustainable world—as having substantial profit potential for IVL.

Reducing the Cost Base. There may be options to lower costs by embracing more sustainable inputs. Perhaps wind or hydroelectric energy is plentiful and attractively priced near your facilities and thus offers current savings while reducing exposure to future energy price volatility. Or perhaps greener upstream materials may yield overall system savings.

Locking in a long-term cost advantage by securing privileged access to scarce inputs is another approach. GM, for example, has made major moves to secure supply, reduce exposure to price volatility, and support the development of potentially lower-cost technologies to support its electric vehicle (EV) ambitions.

On the supply side, lithium is a critical ingredient in EV batteries. GM has made major investments in two US-based lithium projects—the Hell’s Kitchen geothermal brine project in California and the Thacker Pass project in Nevada. GM has first rights on lithium produced in Hell’s Kitchen’s first phase and is guaranteed 100% of Thacker Pass’s Phase 1 production and rights of first offer on its Phase 2. Thacker Pass alone is estimated to be able to produce enough lithium for 1 million EVs per year.

On the new technology side, GM has, for example, made a $60 million investment in Mitra Chem, which is working on cheaper iron-based cathode technologies that can eliminate the need for increasingly scarce cobalt and nickel. And overall, our analysis found that 45% of GM’s sustainability announcements were high-quality compared with just 17% in our full sample.

Accessing New Profit Pools. This could entail investments in the core, such as improving the sustainability profile of an existing successful product, service, or business model and then expanding its distribution to new sectors or geographies. Or it could involve launching entirely new offers in the core, near adjacencies or new frontiers—maybe even pivoting the entire existing business model to capture new sustainability-driven opportunities.

Schneider Electric identified a major opportunity to help organizations address the tension between the imperative for climate action and the growth in energy demand driven by digitization and the rise of AI. The company, already a powerhouse in electrical equipment, transformed itself into a leading provider of

energy-efficiency solutions

for companies and data centers, electrification solutions for building owners, and

decarbonization

solutions for energy suppliers. Investors have rewarded the company’s sustainability announcements with twice the rTSR uplift of their industry average—and for the five years ended December 2023, Schneider Electric outperformed its peer group in TSR by 12% per year.

Extending the Duration of Cash Flows

Another way to enhance value creation is with initiatives that enable existing streams of cash flow to last longer. This typically involves moves to mitigate sustainability-related risk factors—and thus build investor confidence in future cash flows.

Mitigating Regulatory Risk. Here the goal is to make innovative investments that drive compliance with existing regulations—and to earn a seat at the table to shape the direction of future ones.

In the early 2020s, Antofagasta, a $6 billion copper mining company based in Chile, faced the risk that regulators could limit its water rights, and thus its mining output, given the potential competing needs of local communities. In response, the company made significant investments in water efficiency and reuse—and most critically, it invested over $2 billion in a desalinization plant in Los Pelambres that had the potential at full capacity to supply 90% of Antofagasta’s water needs.

Those investments enabled the company to sustain production levels while decreasing groundwater use. By 2023, desalinization accounted for 60% of actual water use, with the 90% goal expected to be achieved by 2027. The market applauded Antofagasta’s moves, with the company’s median sustainability announcement outperforming the sector median by 50% over the period we analyzed.

Mitigating Customer Risk. By definition, competitive advantage is a matter of comparison with rivals. As customers seek ways to realize their ESG goals, they will most value those suppliers that offer solutions that, for instance, decrease their Scope 2 and Scope 3 emissions; increase the circularity of their offerings; or strengthen their sustainability value proposition to consumers.

Consider Nestle’s approach to addressing the potential environmental and reputational impacts of palm oil, a critical ingredient in many food products. Nestle’s focus has been on ensuring that its supply chain is deforestation-free. On the supply side, the company has reached out with educational offerings and incentives to smallholder farms and mills, supported critical multistakeholder initiatives to enhance the traceability of the supply chain, and has used technologies such as satellite imagery to monitor the field boundaries of all its palm oil suppliers.

On the demand side, it has developed programs such as Beneath the Surface that engage consumers in the critical tradeoffs the company is navigating—and the actions it is taking—to ensure its palm oil is deforestation-free. By 2023, 100% of the company’s crude palm-oil purchases—and 96% of its full palm-oil supply chain—were certified deforestation-free. Overall, the portion of Nestle’s sustainability-related announcements that are of high quality is 36% higher than the sector average.

Mitigating Operational Risk. In this bucket, we include investments that adapt operations to sustain cash flows by, for example, finding substitutes for scarce or problematic inputs; decarbonizing the supply chain; or increasing recycling and reuse of critical inputs.

Heineken, as part of its EverGreen strategy that seeks to balance growth, profit, capital efficiency, and sustainability and responsibility, has invested in simplification, decarbonization, and water self-sufficiency. Breweries use a lot of water, and in water-stressed regions the company has reduced its water consumption to 3.0 hectoliters of water per hectoliter of beer, with a goal to achieve a reduction to 2.6 hectoliters by 2030.

In Ethiopia, for example, Heineken avoided the need for production cuts through process innovations that nearly halved the operation’s water use, as well as by partnering with local stakeholders to improve groundwater storage by constructing sand dams. Analysts understand and broadly support Heineken’s approach—and our review of the TSR impact of Heineken’s sustainability announcements finds the median performer yielded triple the uplift of the median announcement for the consumer products industry as a whole.

Investors are a highly rational stakeholder. Their business is to evaluate your strategy and investments through a value creation lens. What is the anticipated level, growth, duration, and certainty of your cash flows—and how do your implied returns compare with those from other potential investments? Investors understand that not every important sustainability-related investment can create value. Some are driven by regulatory requirements, others by the need to be a good corporate citizen, and some because they have an attractive return on investment.

Since attractive green opportunities exist in almost every sector, investors expect management to take full advantage of those where the organization’s capabilities and competitive advantage give it a right to win. If companies pursue thoughtful strategies that balance the mandates and needs of all corporate stakeholders, sustainability can be advanced at scale.

The authors would like to thank Eden Cottee-Jones and Sara Roque Loureiro for their help with the analysis.