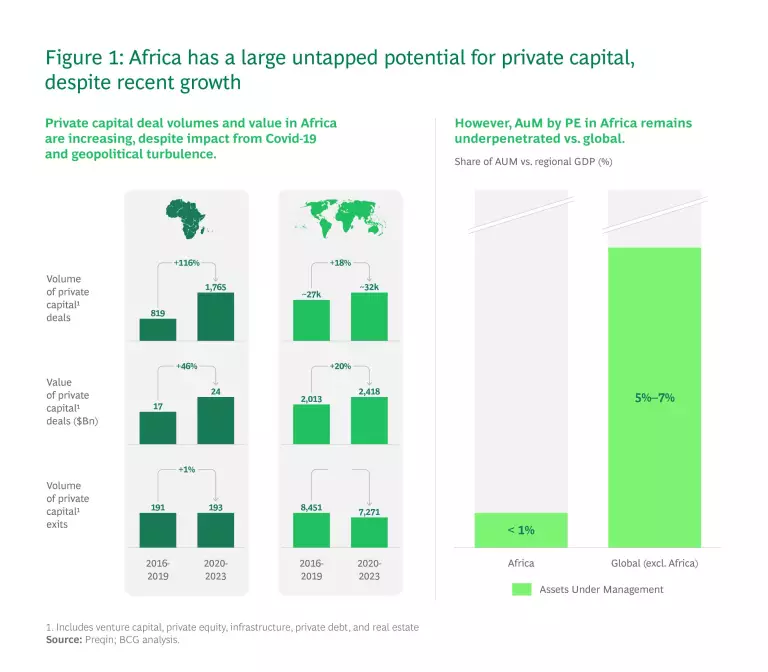

Africa today offers opportunities across key growth sectors for private investors. Growth in private capital deals on the continent has outpaced global averages in both volume and value, rising by 116% and 46%, respectively, between 2016 – 2019 and 2020 – 2023. Yet assets under management remain underpenetrated; they represent less than 1% of GDP, compared to the global average of 5% to 7%, indicating there is substantial room for growth.

While average PE returns in Africa have historically underperformed relative to global assets, the upside potential is substantial for investors with targeted strategies. Over the past decade, 24% of Africa-focused funds achieved US dollar-denominated net internal rates of return exceeding 15%. Challenges such as limited liquidity, the high cost of debt, political instability, and currency volatility persist, but can be mitigated with thoughtful investment approaches.

This report offers an in-depth perspective on Africa’s private capital landscape, highlighting opportunities to achieve differentiated returns in the coming decade. It examines the prospects for private investment across key sectors, driven by five overarching trends we refer to as the “5Gs”: Generation Alpha (the demographic shifts fueling future consumption); GenAI and digital transformation (the rapid adoption of AI and digital technologies that are reshaping industries); Green initiatives (the accelerating focus on sustainability and climate-resilient investments); Geopolitics (evolving trade routes and regional cooperation that are fostering investment); and Global debt (the implications of high interest rates). The report covers macroeconomics, trade, the regulatory environment, operational complexities, and the realities of deal-making on the continent.

We identify four key investment themes favorable for long-term returns and their risk considerations and distill actionable success factors for private investors to maximize their impact and outcomes.

What’s Driving Growth

Africa’s growth is anchored in its young and rapidly expanding population, which is creating scalable opportunities in high-growth sectors. In five years, half of all Africans will be of Generation Alpha (people born after 2010), accounting for 30% of the global population in this age group. This demographic shift underpins substantial consumer market potential, notably in industries such as smartphones, data centers, and financial services—areas where investment is already well-penetrated in OECD economies.

The continent also has a pivotal role in the global energy transition. Africa holds significant reserves of the critical minerals vital for global decarbonization and a vast store of arable land that can enhance food security and support export-driven growth. Meanwhile, geopolitical tensions and conflicts are reshaping global trade routes, positioning Africa to capitalize on nearshoring opportunities. Growing regional economic cooperation, as exemplified by the African Continental Free Trade Area (AfCFTA), is expected to spark intra-African trade by 32% by 2035. More liberalized regulations are making private capital investments more accessible to global funds. These factors, amplified by rapid urbanization, greater mobile connectivity, and innovative financing solutions, are creating fertile ground for investment across sectors.

Four Key Investment Themes

We have identified four major investment themes that private investors will want to consider over the next decade.

- Climate, clean energy, and the energy transition. The transition to renewable energy sources is crucial for sustainable development in Africa. Meanwhile, many African nations still face energy shortages. With abundant wind, solar, and critical mineral resources, the continent is well-positioned to become a global hub for clean energy generation. Investments in renewable energy can unlock economic returns while helping to circumvent green protectionism measures such as the EU’s Carbon Border Adjustment Mechanism. Opportunities extend to downstream industries like green hydrogen production and critical mineral mining and processing—both central to the global decarbonization agenda.

- Growth in digital adoption and financial access. The rapid expansion of mobile money platforms, coupled with breakthroughs in digital technologies like AI, is unlocking financial inclusion and productivity. Together, these technologies are facilitating the growth of fintechs and other service businesses, such as e-commerce and telehealth. These businesses will fuel—and be fueled by—the growth of digital payments and expanding access to credit. Investing in digital infrastructure, such as long-distance fiber and hyperscale data centers, can catalyze growth in other emerging sectors like e-commerce, telehealth, and online education.

- Efficient infrastructure to support trade. Africa’s logistical challenges, coupled with geopolitical ones, have historically impeded the flow of goods. Due to the scale and importance of infrastructure development projects, governments typically play a bigger role in both funding and in serving as primary off takers. Infrastructure funds with the scale and inclination for such investments (with their typically longer holding periods and experience with governments) can boost economic growth. At the same time, they can achieve solid returns with investments in ports and surrounding Special Economic Zones, as well as roads, rail, airports, and logistics and distribution infrastructure. These investments are critical to overcoming trade bottlenecks and unlocking the potential under the AfCFTA.

- The Advancement of essential consumer services. Healthcare, agriculture, education, and consumer goods present prime opportunities for private investment in Africa, fueled by population growth, urbanization, and rising GDP. Healthcare offers potential in care providers, insurance, pharma and medtech, addressing current low per-capita expenditure. With Africa’s below-average crop yields and $100 billion in annual food imports, investments in agritech, farm inputs (such as animal feed, fertilizers, and farm machinery) and high-value food processing can transform the agriculture and agri-food sectors. Education is poised for growth, with scalable opportunities in online education, secondary schools, and EdTech. Finally, growing consumer spending—projected to reach $2.1 trillion by 2025—and e-commerce drive demand for fast-moving consumer goods such as packaged foods and hygiene products.

The full report delves into the most promising products and services within each of these themes, providing estimates of potential returns and pinpointing the countries of greatest opportunity.

Despite its potential, deal-making in Africa requires careful planning to unlock outsized returns. First, it requires thorough asset selection; investments should tap the value in demographics and growth sectors, while mitigating macroeconomic risks (such as B2B or assets with natural currency hedges). Second, given the high cost of debt in Africa, investors should emphasize value creation over multiple expansion; for example, by taking an active role in managing growth and operational efficiencies. In addition, investors should start with the exit in mind, planning their exit early while maintaining flexibility in terms of investment horizon and stakes in order to weather macro fluctuations. Finally, they should make use of innovative financing models, such as blended finance, leveraging public and private funds to reduce risk and enhance the viability of their investments.

Private investment in Africa is more than a financial opportunity: it’s a chance to shape the continent’s sustainable development, while capitalizing on transformative, high-growth opportunities to achieve attractive returns. Investments in key sectors can empower Africa’s next wave of growth, and at the same time, address global challenges and contribute to a greener, more equitable world.

Explore how smart private investment can unlock Africa’s vast potential; download the full report to uncover actionable insights, investment strategies, and success factors tailored for private investors.