Financial institutions face mounting pressure to optimize their corporate lending processes. Persistent issues, including high manual workloads, insufficient risk differentiation, complex governance structures, and inadequate technology integration, impede operational efficiency and erode customer satisfaction. These obstacles leave many banks ill-prepared to compete in today’s fast-paced environment.

Banks can unlock significant improvements by standardizing and simplifying workflows, integrating advanced technologies, and adopting production steering. These strategies have the potential to boost process quality and efficiency by up to 30%, accelerate processing times, and increase the transparency and speed of customer service. Together, the benefits promise to enhance the lending experience for both financial institutions and their corporate clients.

What’s Driving the Urgency?

Three trends underscore the urgency to transform the corporate lending process:

- The Need for Efficiency. Talent shortages and rising cost pressures demand streamlined processes, increased automation, and the elimination of unnecessary tasks to maintain competitiveness.

- Regulation and Sustainability. Heightened regulatory scrutiny and environmental, social, and governance priorities require a strategic overhaul to ensure compliance while embedding sustainability into operations. For example, the European Banking Authority’s Guidelines on Loan Origination and Monitoring emphasize the importance of a consistent lending process for enterprises of all sizes based on key risk indicators.

- Digital Opportunities. Advancements in technology, data analytics, and GenAI offer unprecedented opportunities to automate lending processes, integrate data, and personalize customer interactions for a superior experience.

The rise of fintechs and other nontraditional competitors further emphasizes the imperative for established lenders to innovate and optimize their lending process to remain relevant in an evolving market. These challengers apply advanced technologies and customer-centric models to deliver faster, seamless lending experiences.

Subscribe to our Risk Management and Compliance E-Alert.

Banks Must Address a Variety of Pain Points

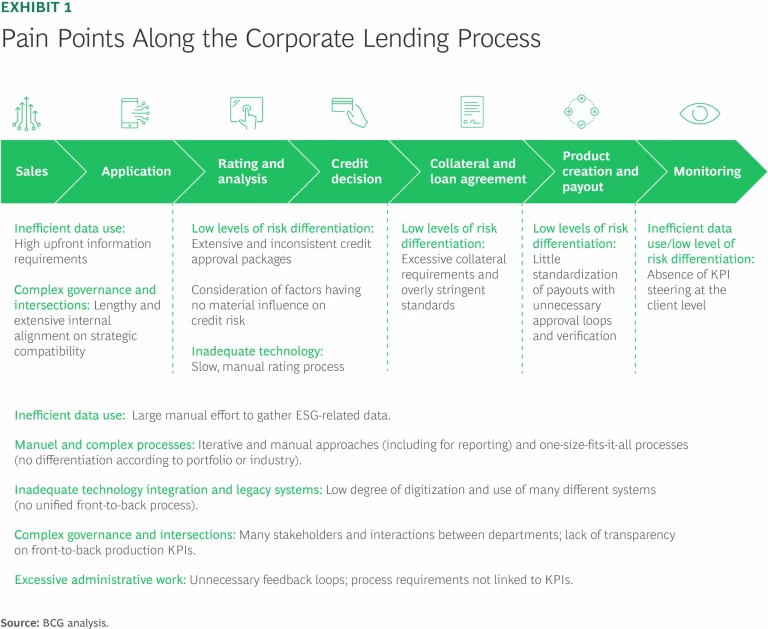

Our experience indicates that financial institutions can unlock significant efficiency gains by addressing pain points at each step of the lending process. (See Exhibit 1.) These pain points fall into six broad categories:

Manual and Complex Processes. Many institutions continue to rely heavily on manual processes and set unnecessarily complex standards. The use of multiple, disconnected systems, combined with low levels of digitization, perpetuates inefficiencies and hinders internal optimization efforts. Overly complex process steps also complicate the onboarding of new employees while increasing the risk of losing institutional knowledge when experienced employees leave the organization.

Low Levels of Risk Differentiation. Banks often adopt a one-size-fits-all approach for lending processes, with little differentiation according to loan size or corresponding risk. This results in overly detailed requirements for industry-specific analyses, collateral evaluations, and strategy assessments. These time-intensive activities add complexity without meaningfully mitigating credit risk.

Complex Governance and Intersections. The governance structures surrounding lending processes are often overly complex. Minimum regulatory requirements are frequently inflated by excessive feedback loops and approvals that span divisional boundaries. These complications can lead to severe disruptions and create power dynamics that distort risk-based credit decisions. Many of these divisional intersections stem from historical practices and are a primary reason for prolonged "time to yes" in credit approvals.

Excessive Administrative Work. Administrative tasks within the lending process are frequently executed with excessive thoroughness, leading to inefficiencies. A lack of standardization and limited decision-making authority for responsible staff create unnecessary interfaces and feedback loops, particularly in legal matters. Additionally, these processes are rarely guided by KPIs or linked to service levels, making it hard to prioritize tasks.

Inefficient Use of Data. A lack of risk-based data collection and analysis methodologies slows processing times and results in suboptimal credit decisions. Much of the information that banks require from potential borrowers adds little value in minimizing credit risks. The tendency to collect unnecessary data increases lead times and the likelihood of errors. Often, data is collected in written form and manually entered into the bank’s systems, exacerbating inefficiencies. Additionally, continuous monitoring is rarely data driven, leading to unnecessary efforts that fail to reduce credit risks.

Inadequate Technology Integration and Legacy Systems. Despite significant digital investments, many institutions have yet to fully realize the potential for efficiency gains. A fragmented landscape of systems across different stages of the process frequently necessitates re-entering data, which disrupts end-to-end workflows. This fragmentation impedes error detection and correction.

Three Transformation Strategies

To overcome these pain points, banks can adopt three strategies to drive a comprehensive transformation of the front-to-back lending process.

Strategy 1: Standardize and Simplify Processes

Banks can boost efficiency by up to 30% through a renewed focus on process improvement.

Process Standardization. Simplifying lending processes and establishing clear, standardized procedures are essential to reducing deviations and ambiguities. This is especially critical for institutions operating in multiple regions, where inconsistent practices are common. Uniform approaches across customer segments and teams facilitate the onboarding of staff, improve cross-segment resource allocation, and accelerate error detection and correction. At the same time, they allow for ongoing process innovation.

Financial institutions can unlock significant efficiency gains by addressing pain points at each step of the lending process.

Volume- and Risk-Based Fast Lanes. Segmenting new business by credit volume allows analysts to focus on higher-risk opportunities, optimizing resource allocation. For smaller credit volumes, documentation requirements and segment-specific analyses can be reduced, as the expected losses are minimal. For loans below a certain threshold, the entire process can even be managed by the customer-facing market division, with only initial approval needed to proceed. A risk-differentiated collateral framework can support the process by aligning collateral requirements with loan size and risk level, thereby reducing unnecessary complexity for lower-risk transactions.

Simplified Administrative Tasks. Many administrative tasks, such as documenting collateral or making minor contract changes, can be significantly simplified with modular systems. These rely on preapproved documents or clauses vetted by the legal department, so employees can use them without requiring further consultation. This approach has proven to significantly reduce interfaces and thereby accelerate time to yes.

Reorganization for Improved Efficiency. Organizational changes can play a pivotal role in reducing handoffs and clarifying responsibilities. In many cases, too many stakeholders are involved in credit decisions, causing inefficiencies. A more centralized or regionally aligned credit risk division can better match the structure of the market division, reducing coordination efforts.

Strategy 2: Integrate Advanced Technologies

By integrating advanced technologies, banks can promote substantial improvements in process efficiency, decision-making capabilities, and the overall quality of credit products and services. These innovations offer the potential to reduce costs and accelerate processes by up to 20%. Two sets of levers are essential.

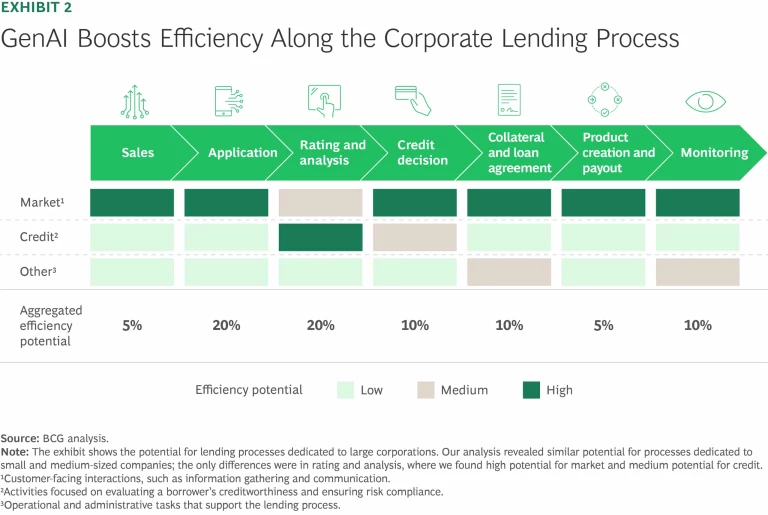

Advanced Analytics and AI. Digital solutions and advanced analytics play a pivotal role in streamlining decision making and enhancing risk assessment. Given that credit decisions are inherently data driven, implementing AI-powered analytics offers significant opportunities for efficiency gains. As shown in Exhibit 2, GenAI, in particular, can optimize every stage of the end-to-end corporate lending process:

- Sales. GenAI-driven tools enable continuous automated assessment of customer needs. The technology leverages diverse sources, such as newspaper articles, to generate insights and inform targeted strategies.

- Application. Automating repetitive tasks, such as pre-filling fields, simplifies application preparation, saving time and reducing errors.

- Rating and Analysis. GenAI processes unstructured data and aggregates qualitative insights, enhancing the speed and accuracy of risk assessments.

- Credit Decision. GenAI supports the creation of customer-specific credit recommendations.

- Collateral and Loan Agreement. The technology expedites decision making by performing initial collateral analyses and risk assessments.

- Product Creation and Payout. Automation streamlines product creation processes, such as pre-filling withdrawal documents, to improve efficiency.

- Monitoring. GenAI enhances early-warning systems and enables persistent risk screening through automated analysis of qualitative and quantitative data. By identifying high-risk cases, the technology allows human workers to focus their attention where it is most needed.

These advancements deliver measurable results. For instance, efficiency gains of up to 20% can be achieved during the application and rating stages, with improvements of 5% to 10% across other phases.

Data Architecture, Digitalization, and IT Modernization. A unified data model is critical for ensuring data integrity and enabling data-driven decisions, highlighting the importance of a robust IT infrastructure. Replacing fragmented legacy systems with an end-to-end workflow tool—potentially integrated with customer relationship management capabilities—can significantly enhance efficiency and minimize errors. This transformation also improves data quality and availability, laying a strong foundation for advanced-analytics solutions. Additionally, digital customer interfaces for submitting applications and data can streamline the overall customer journey, dramatically reducing lead times.

Advanced technologies offer the potential to reduce costs and accelerate processes by up to 20%.

While technological advancements are critical for driving efficiency gains, prioritizing process improvements in the sequencing of implementation is essential. A streamlined and optimized process creates a solid foundation for the effective application of digital measures, helping to realize their full potential.

Strategy 3: Adopt Production Steering

Drawing on methodologies from the manufacturing industry, production steering utilizes continuous, KPI-driven measurement to quantitatively evaluate and optimize lending workflows. Essential KPIs include throughput and productivity, capacity utilization, processing time, quality and process discipline, reliability, and degree of automation.

To promote successful end-to-end delivery of credit services, production steering in the lending process operates across two complementary dimensions:

- Value Streams. Focused on customer needs, value streams aim to enhance satisfaction during the lending process. Improvements target specific elements of the process, including prospecting and onboarding, credit sales and closing, payment processing, customer servicing and problem resolution, credit servicing and recovery, and fraud management.

- Production Lines. Centered on the bank’s internal processes, production lines prioritize the efficient delivery of credit services. They organize processes by product families, such as corporate financing, financial institutions, and structured finance.

By implementing production steering, banks can achieve a 20% to 30% improvement in process quality and efficiency, along with a two- to fourfold acceleration in processing times.

Optimizing front-to-back corporate lending processes is crucial for financial institutions striving to succeed in an era of rapid technological innovation and stringent regulatory requirements. By standardizing and simplifying workflows, integrating advanced technologies, and adopting production steering, banks can unlock gains in efficiency, cost savings, and service quality. This transformation should be implemented progressively to maintain control and fund subsequent improvements. Banks that embrace these strategies will position themselves as leaders in the dynamic corporate lending landscape.