Europe stands at a crossroads. Legacy industries can no longer sustain economic growth, and the EU has fallen behind the US and China in building a world-class tech sector. Meanwhile, the EU’s workforce is expected to decrease by nearly 2 million workers annually by 2040. Without bold action, Europe risks slipping further in digital innovation and economic leadership, weakening its global influence and resilience.

A central bank digital currency (CBDC), now under consideration by the European Central Bank (ECB), could serve as a transformative force. The proposed digital euro could enhance the region’s digital infrastructure, spur innovation, and foster a competitive and resilient payments market.

But as noted in the European Commission’s original 2023 CBDC proposal, the introduction of a digital euro is, in itself, not enough. The launch must be grounded in a broader vision for the EU’s economy in the digital age. For decision makers and policy leaders, this means developing—and championing—an integrated framework that would leverage all of the benefits a digital euro could offer. And it means creating a governance structure that can oversee the broader digital currency ecosystem—coordinating stakeholders, defining standards, and facilitating innovation through funding and the exchange of ideas.

By building such an ecosystem, the EU can maximize the digital euro’s impact, positioning itself as a global leader in digital currency and digital innovation and paving the way for a new era of economic expansion. This effort could be one of the highest-impact public initiatives for broader competitive advantage—comparable, in its own way, to the US Apollo moon landing program and the creation of Conseil Européen pour la Recherche Nucléaire (CERN) in Switzerland.

Europe’s Productivity Challenge

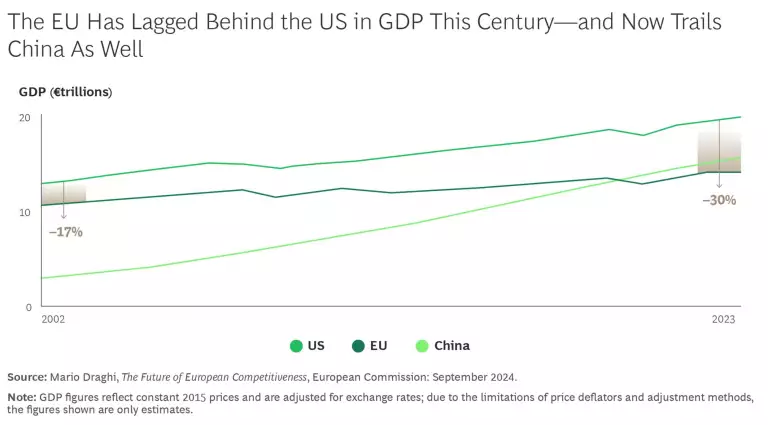

The EU’s economic growth has consistently lagged behind that of the US this century, with the gap widening approximately twofold between 2002 and 2023, according to the Draghi report. (See the exhibit.)

Technological advancements hold the key to achieving desperately needed gains—yet Europe has missed a significant part of the digital revolution and its productivity benefits. The Draghi report points out that only four of the world’s top 50 tech companies are European, and no EU company with a market capitalization of over €100 billion has been founded in the last fifty years. By contrast, the top seven US companies in market cap, each with a valuation above €1 trillion, were all created during this 50-year period.

This broad economic disadvantage often manifests in specific European pain points. For example, the EU’s Capital Markets Union grapples with low participation by retail investors, according to a

Similar challenges are evident in the European payments market, which is lagging behind its American and Asian counterparts. In 2023, transaction revenue in Europe reached $309 billion (€298 billion) compared to $781 billion (€752 billion) in North America. Projected growth rates suggest that the gap will only increase in the coming years: between now and 2028, the North American region is expected to grow by 3.3% annually in transaction revenue, while Europe’s growth is projected at 2.9%. The disadvantage extends to the growth of related industries, such as the Web3 sector, including blockchain—a multibillion-euro market with vast growth potential—where Europe’s share lags well behind that of North America.

A digital euro would provide a substantial opportunity for fostering productivity-based growth. Its status as legal tender would ensure broad acceptance across the EU, helping to unify a fragmented payments landscape and providing a stable foundation for further payments-related innovations.

With the right design features and inducements, the digital euro could provide European tech companies with the infrastructure to develop and scale leading-edge solutions in intelligent supply chains, IoT-based machine economies, and insurance-backed business models—thereby enhancing Europe’s technological sovereignty and positioning it as a global leader in digital financial services and Web3 innovation.

An Ecosystem for Orchestrating and Supporting Growth

While the ECB continues to deliberate on key aspects of the digital euro, discussions thus far have focused primarily on pragmatic considerations: distinguishing the digital euro from credit card providers and offering consumers greater reassurance of data privacy. However, this emphasis lacks ambition and risks falling short of realizing the digital euro’s transformative potential.

The current digital euro design proposals are bound by the ECB’s limited mandate, which does not specifically include CBDC’s broader impact on innovation. While the ECB is facilitating some input from external stakeholders—for example, through innovation partnerships—the initiative is still caught up in a classic chicken-or-egg dilemma: Without an active ecosystem of digital innovators developing and exploring new use cases and value-adds, the ECB lacks committed advocates to provide input on the necessary regulatory foundations and technological prerequisites. Without that input, it may never get the following and consideration it deserves.

Creating a digital ecosystem will require a clear, broadly articulated vision for using the CBDC as a catalyst for growth. (See “What Do We Mean by a Digital Ecosystem?”)

What Do We Mean by a Digital Ecosystem?

Participants in the ecosystem will include a diverse range of stakeholders: technology actors, academic institutions, merchants and manufacturers that conduct transactions with digital currency, financial institutions like commercial banks and payment service providers (PSPs), regulatory authorities, and the broader public. The ecosystem will foster innovation and create the conditions that support the sustainable implementation of the CBDC while also leaving room for technological experimentation.

As with all ecosystems, the platform of a new public digital currency needs to be goal-oriented and transparent to potential participants. It could include these three elements:

Ambitious Vision. If the ECB’s introduction of the CBDC is to be integrated into a comprehensive statement of the broader goal of economic growth for the entire digital finance ecosystem, the EU Commission has a crucial role to play. The clearer the link between the holistic digital innovation ecosystem and a brighter future for Europe, the more that ecosystem can unlock opportunities for investment and entrepreneurship, amplifying the impact of a new European payments infrastructure.

Aspirations for the currency infrastructure also need to align with the surrounding policy environment. Ideally, considerations by the ECB, the European Securities and Markets Authority, and the Commission would be combined under a single vision, serving innovation and growth. This vision would shape the design and the regulatory framework of the digital euro.

Regulatory Clarity. Downstream from the overall vision, a regulatory framework can create investment certainty, foster stakeholder collaboration, and provide ample opportunities for business and technological innovation. Regulatory clarity is particularly crucial for technologies like blockchain and digital payments; it will build trust and establish the legal guardrails for using these new technologies and infrastructures.

The Markets in Crypto-Assets (MiCA) regulation, active in Europe as of December 2024, exemplifies a clear and balanced approach that can facilitate technological growth in the distributed ledger technology (DLT) space. Indeed, regulations on DLT in other countries, including the US, are lagging behind MiCA in clarity and consistency, providing Europe with a competitive advantage.

Process and Design Clarity. Trust and public acceptance are paramount for a CBDC innovation ecosystem. Therefore, all decisions regarding feature design, governance, proposal outcomes, and funding allocations should be recorded transparently and explained diligently to both the public and expert communities. This practice should especially apply to incoming legislative guidance, which may be integrated into the CBDC design process at any point.

Throughout the design process and into the implementation of the digital euro, clarity and transparency will be critical factors. Design choices must be open to influence from a wider range of ecosystem contributors. Regular audits and performance reports could be issued, including financial audits, ecosystem growth metrics, and assessments of each organization’s contributions and effectiveness in meeting ecosystem goals.

A Comprehensive and Continuous Governance Structure

There are numerous innovation agencies and organizations across Europe with a stake in the development of the digital euro. They include national institutions like Vinnova in Sweden and Sprind in Germany as well as the European Institute of Innovation and Technology (EIT), an innovation network vested with a public mandate by the European Commission. The EIT maintains support programs and connects stakeholders in innovation hubs. (See “The Example of EIT InnoEnergy.”)

The Example of EIT InnoEnergy

In 2017, the European Commission tasked InnoEnergy to lead the European Battery Alliance’s industrial development program, called EBA250, alluding to an estimated annual global battery market value of up to €250 billion by 2025. In chairing EBA250, InnoEnergy has brought together more than 800 stakeholders from industries across the battery value chain as well as from academia and finance.

On behalf of the EU Commission, InnoEnergy is prioritizing actions, coordinating initiatives, and mobilizing funding. In the latter capacity, it has collaborated with a variety of funding sources: targeted Horizon research grants, European Investment Bank loans and guarantees, and member state activity under the Important Project of Common European Interest (IPCEI) framework, a European Commission initiative that allows EU member states to provide funding for industry projects.

These organizations provide valuable insights and best practices for promoting innovation.

However, Europe currently lacks a specialized innovation body dedicated to payments and its related innovative potential. Europe’s trailing position in the tech sector and the payments market highlights the need for a tailored governance structure and innovation platform for this rapidly advancing field. This platform would be open to public and private participants and set up to foster entrepreneurship in specific locations throughout Europe.

Elements of a tailored governance structure could include:

Collaboration. Bringing together legal, business, and technological expertise is essential to the continuous development of an innovation hub. A governing body could facilitate the exchange of ideas among regulatory bodies, central banks, the private sector, academia, and civil society, balancing the needs of innovators and consumers with the technical and regulatory requirements of a CBDC.

A collaborative platform associated with the digital euro could facilitate informal exchange and build trust, allowing organizations to access talent, information, and ideas. Effective governance should not conflict with spontaneous innovation and healthy competition; rather, they should underpin one another.

Resource Access. A specialized unit could oversee a treasury-based funding system that would help the entire ecosystem. One component, akin to the European Battery Alliance, could be driven through EIB involvement, funding targeted investments in high-risk projects with asymmetrical potential. Another could support fundamental research, backed by Horizon Europe or other EU-based funding resources. In combination, these efforts could support continuous technological advancement in digital payments, help test new solutions, and prevent innovators and entrepreneurs from growing impatient and leaving Europe too soon .

Open Standards. The governance structure can ensure seamless integration of new payment technologies with existing systems. It could set standardization and interoperability as priorities while ensuring security and resilience. The overall framework can be made public to enable market innovation; an open-source platform would allow external developers, fintech companies, and academic researchers to contribute innovative solutions and applications. Within the open-source approach, funding and ecosystem access could be limited to European participants to prevent them from being squeezed out by legacy players from outside the EU.

Standardization and interoperability would spur adoption and facilitate ecosystem growth. In turn, a growing ecosystem could respond to diverse user needs and business opportunities more comprehensively, contributing to the overall economic growth potential.

What’s Next?

Europe has a unique opportunity to boost its innovation potential through the launch of the digital euro. Public authorities can make this a priority by taking three actions in the short term:

- Develop a goal-oriented policy approach. Articulate a comprehensive and ambitious vision for the innovation ecosystem—a vision that helps set up the digital euro design features accordingly. Ensure that the surrounding regulatory framework enables European innovators to capitalize in full on this new European payments infrastructure.

- Set up a European digital payments alliance. Propose a governance model, including the appointment of an innovation agency to coordinate stakeholders and allocate resources for standards and channels. The agency could be modeled on the role of EIT InnoEnergy within the European Battery Alliance, and it should be given sufficient funding and authority.

- Fund the innovation program. Make funds available to support both the design and the technical implementation of the digital euro, along with the development of a wider innovation ecosystem. Funds could be made available at all stages of the innovation cycle, including grants for fundamental research, guarantees for investment risks, and complementary loans for business scaling.

Competitiveness in the digital age is not just an R&D priority or a private-sector consideration. It’s a necessity for maintaining growth and stability amid the expected economic and geopolitical turbulence of the next few years. There is growing demand for solutions—for example, some private organizations and banks are forming consortiums to establish stablecoins, seeking the same features that the digital euro could provide.

By introducing the concept of the digital euro, the EU and ECB have already raised a potential driver for economic growth. When embedded within an innovation ecosystem, a CBDC could strengthen the digital sovereignty of the Eurosystem and serve as a vital catalyst for the innovation culture that Europe’s economy so urgently requires.

The authors wish to thank Patrick Bauer, Tim Figures, Bernhard Kronfellner, and Ulrich Pidun for their contributions to this article.