Ask a telecom company the big questions—how do you spark growth, boost efficiency, or improve customer satisfaction—and chances are, AI is their go-to answer. And increasingly, artificial intelligence , including generative AI (GenAI), has become telcos’ answer to other questions. How, for instance, do you fight back against telephone scammers preying on your customers? For one operator, it’s by developing an AI-generated “granny” that wastes fraudsters’ time with rambling talk about knitting.

That’s the beauty of AI: It’s a multi-purpose enabler. But are telcos truly poised to unleash the technology? Are they making the investments, developing the strategies, and reaching the maturity levels that will let them take AI in new directions?

Findings from this year’s telco IT benchmark (TeBIT) study, jointly developed by ETIS—The Community for Telecom Professionals—and Boston Consulting Group, raise concerns that operators may not be realizing, or be poised to realize, the full value of AI and GenAI. (See “About the TeBIT Benchmark.”)

About the TeBIT Benchmark

Collaboration is a key component of TeBIT. The survey’s goal—like that of ETIS working groups and community gatherings—is to identify, and even shape, the best practices that can help telcos better serve customers in a rapidly changing world. In return for allowing their organizations to be compared with other telcos, TeBIT participants can access a full set of benchmark results along with further trend analysis.

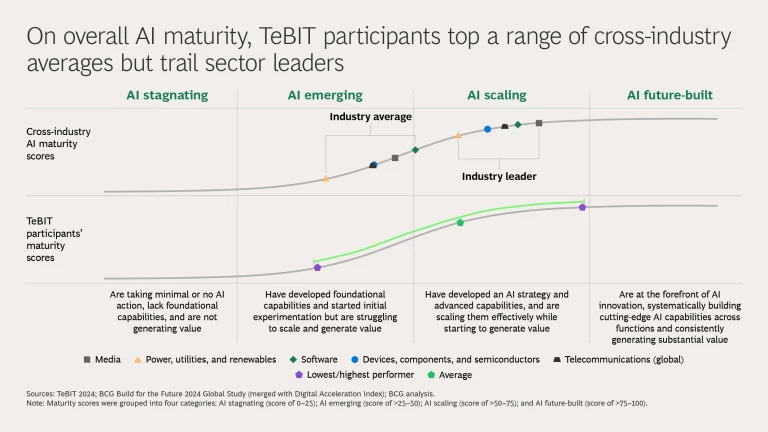

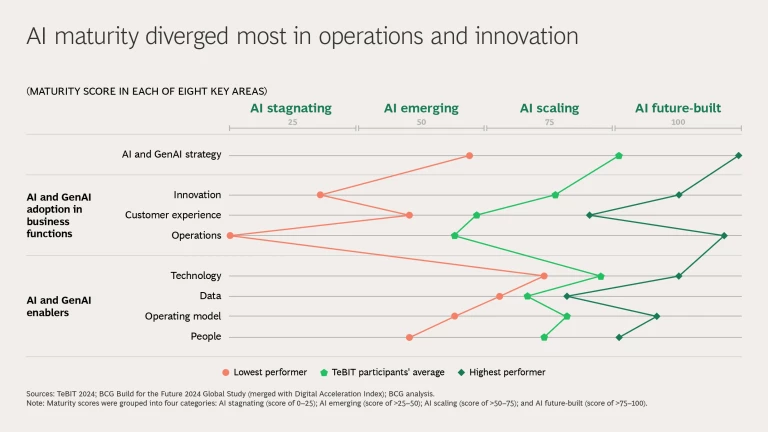

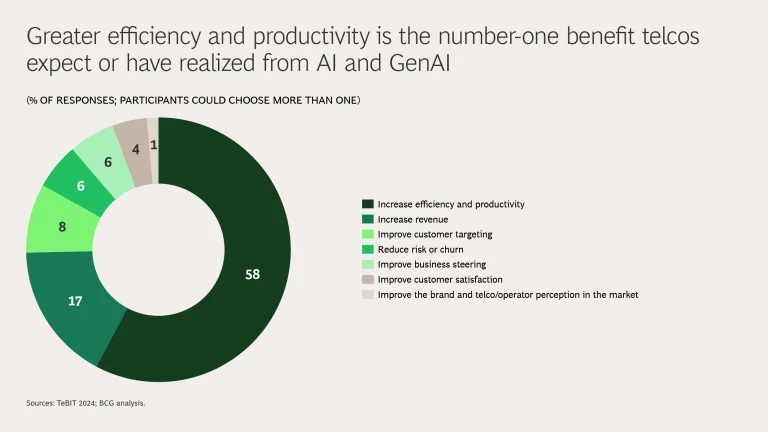

The TeBIT study looked at participants’ AI standing from four vantage points: maturity, investments, use cases, and expected and realized benefits. While the study found that as a group, participants surpassed other industry averages on AI maturity (topping scores from the media, software, and utility and power industries, for example), it also revealed that scaling is uneven, with telcos faring better in some functions, like marketing and sales , than others—notably, network and operations . The distribution pattern suggests that telcos are struggling to deploy AI in areas where out-of-the-box solutions are less prevalent and the necessary data is harder to access.

This challenge spotlights the importance of investment in the talent, processes, and technologies that help telcos scale AI use cases efficiently and across functions. It also underscores the need for a strategic approach to AI—one where telcos are not building isolated use cases, but reshaping critical functions end to end and inventing new experiences, offerings, and business models. Our analysis suggests, however, that telcos may not be investing or even, crucially, planning to invest sufficiently. In addition, their approach may be more ad hoc than strategic.

Subscribe to receive the latest insights on Technology, Media, and Telecommunications.

Tipping Point or Topping Out?

The TeBIT study finds IT spending up slightly, from 6.6% of revenues in 2022 to 6.9% in 2023. The more significant trend is a shift from capex to opex. This wasn’t unexpected: Moving from on-premise data centers and BSS and OSS solutions to third-party cloud services—a core pillar of telco digital transformation—means less capex, more opex. But it does make an even stronger case for leveraging the efficiencies of AI.

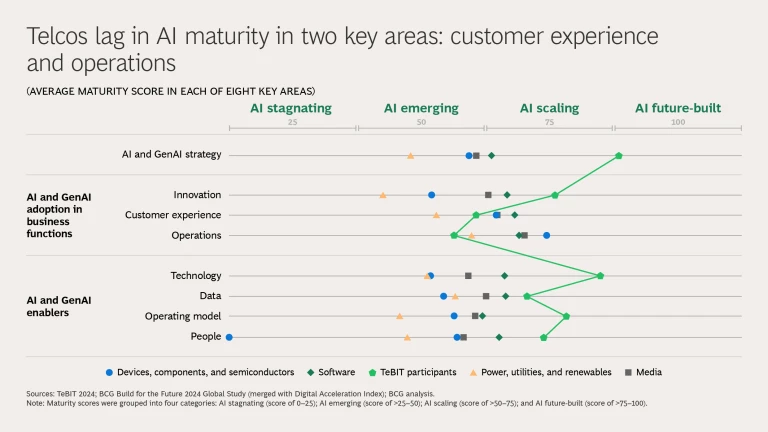

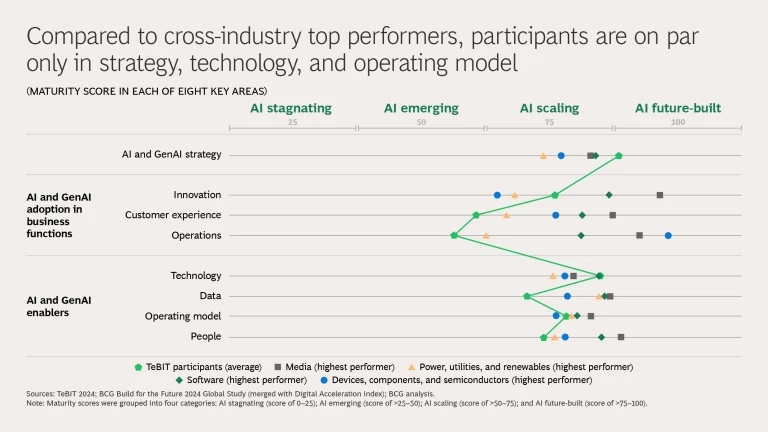

So how, exactly, are telcos positioned on the technology? The TeBIT survey asked respondents to rate their maturity on two dozen capabilities relevant to AI and GenAI. These capabilities covered eight areas: strategy, innovation, customer experience , operations, technology, data, operating model, and people. In preparing an October 2024 report on AI, BCG asked these same questions of companies across industries. The results from that study enabled us to see where TeBIT participants sit on a cross-industry spectrum.

Based on their overall score, respondents fell into one of four buckets: AI stagnating, AI emerging, AI scaling, and AI future-built (in order of increasing AI maturity). On average, TeBIT participants ranked in the third-highest category, AI scaling—higher than global telcos ranked as a group (AI emerging). But no participant ranked in the highest category, AI future-built. And drilling down, we saw that the TeBIT group lagged other industries in adopting AI in two key areas: customer experience and operations (though they were better positioned on AI enablers like technology and data).

The underperformance in customer experience and operations was somewhat surprising, as these are typically focal points for companies that embrace AI and GenAI. On the other hand, telcos have unique areas where these technologies have high potential, such as network automation. So their focus may have a wider spread. Either way, the takeaway is clear: Telcos would benefit from developing AI maturity and use cases in customer experience and operations.

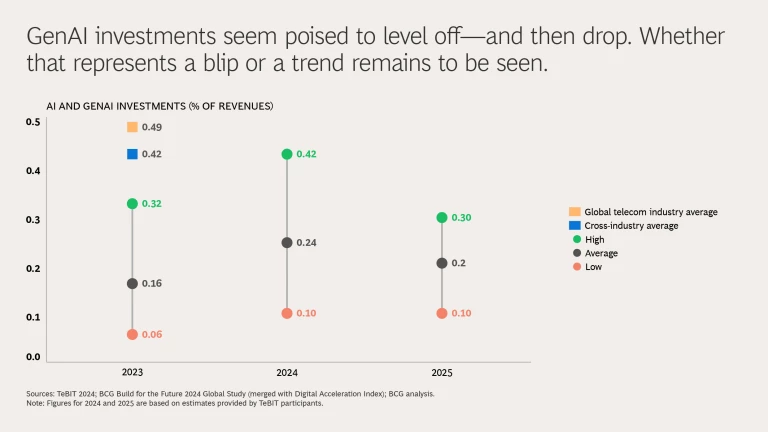

This raises the issue that developing, building, and scaling use cases requires investment. The TeBIT study found that on average, participants’ AI and GenAI spending amounted to 0.16% of revenues in 2023, less than both the global telco industry average (0.49%) and the cross-sector average (0.42%). Further, we see evidence that investment may be leveling off. For 2024, TeBIT participants expect their AI and GenAI spending to amount to 0.24% of revenues before dropping to 0.2% for 2025. This, too, is surprising. We would expect investment levels to increase for at least the next few years.

This “topping off” could be temporary, but if it does signal an investment peak, that begs the question: Are telcos deploying and planning to deploy AI and GenAI as they should?

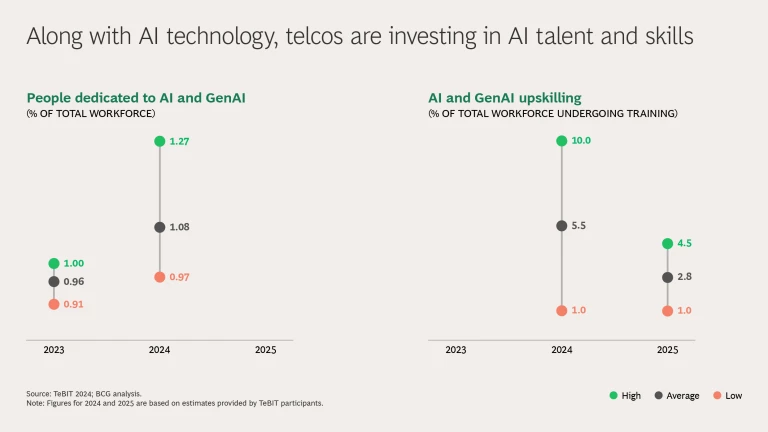

Of course, investment is about people, too. On average, participants anticipate that by the end of 2024, 1.27% of their total workforce would be dedicated to AI and GenAI through activities such as developing AI use cases, training LLMs, and integrating AI tools into the IT landscape. This is up from 1.0% in 2023. And telcos expect that, all told, they will have upskilled 10% of their employees in AI and GenAI knowledge and use during 2024. How many of these employees will go on to work with AI and GenAI? That’s an open question. But the upskilling does demonstrate that telcos are committed to addressing the impact of the technology on their people.

Deploying AI Technology at Scale

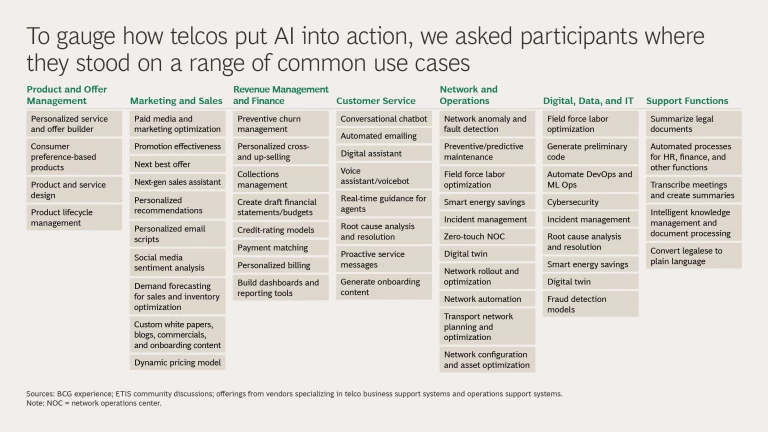

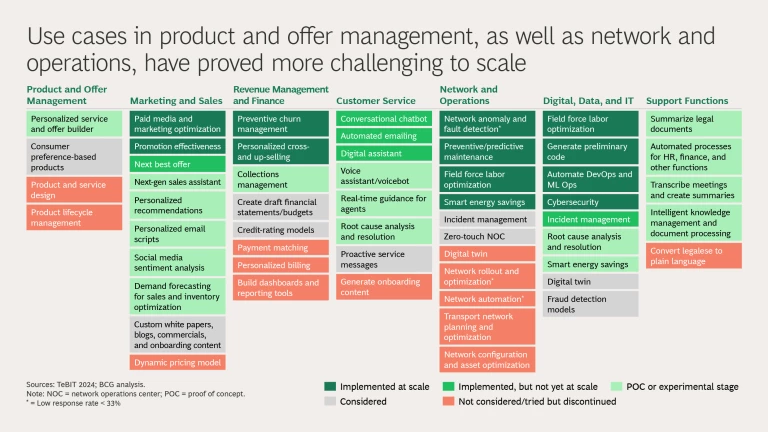

To see where telcos stand on putting AI and GenAI into action, we compiled a list of common use cases, based on BCG experience, discussions in the ETIS community, and out-of-the-box solutions. The use cases covered areas including customer service (conversational chatbots, automated email generation, real-time guidance for agents); marketing and sales (next-gen sales assistants, among other use cases); revenue management and finance (churn management, personalized cross-selling and upselling); and digital, data, and IT (code generation, cybersecurity , and so on).

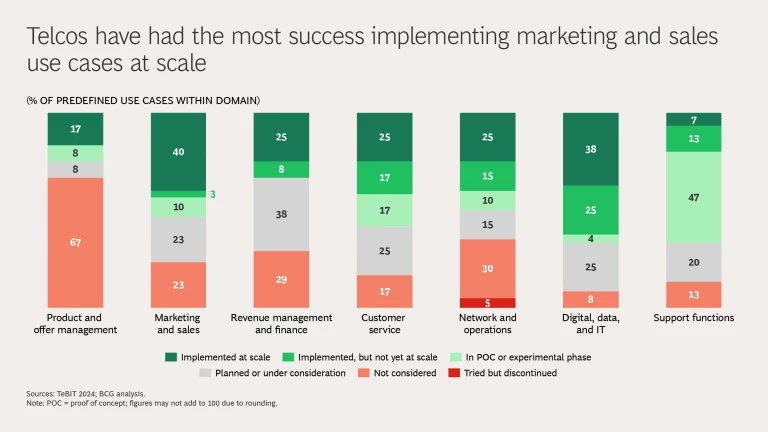

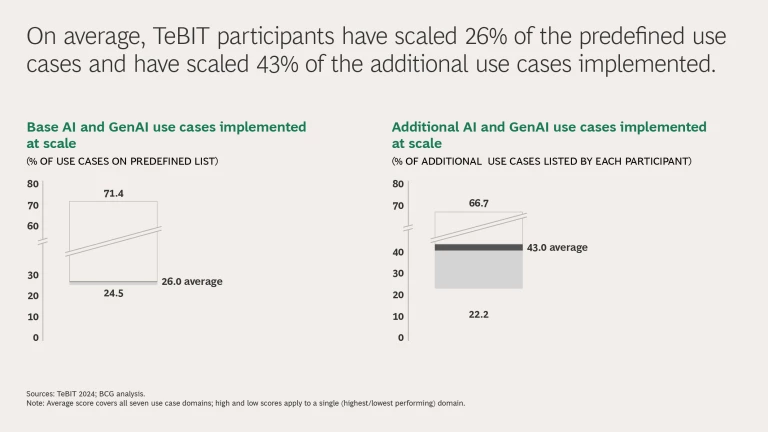

On average, TeBIT participants have implemented at scale 26% of the predefined use cases. But across functions, it wasn’t an even spread. Marketing and sales led the pack, with telcos deploying 40% of these use cases at scale. Digital, data, and IT followed at 38%. Other areas lagged far behind. In product and offer management, telcos deployed just 17% of use cases at scale, but perhaps more tellingly, they hadn’t even considered 67% of our list of use cases. In network and operations, where only a quarter of use cases were running at scale, telcos had tried and abandoned 5%.

While marketing and sales is a key lever for stabilizing revenues, and thus would seem a logical focus for AI and GenAI, there’s another perspective worth considering. The data that these use cases need tends to be independent from operational data, which is often spread across the enterprise. There is also a growing portfolio of out-of-the-box (or nearly so) AI and GenAI solutions. These factors often make marketing and sales use cases easier to scale than, say, network use cases, which typically require customized solutions and much broader data. So, are telcos scaling the use cases that they need to scale or those that they can scale? If the answer is the latter, that’s another signal that telcos may want to redouble investments.

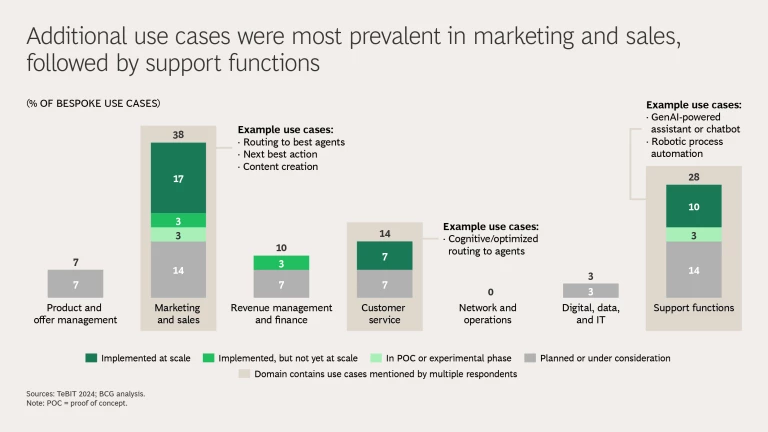

We also found that telcos often go their own way on use cases. We asked participants to describe use cases they have implemented—or have in the works—that weren’t on the predefined list. Telcos reported that they have implemented at scale 43% of this bespoke list. Given that nearly 40% of the additional use cases were in marketing and sales, which may be easier to scale, the higher proportion of successes—use cases that have moved beyond pilots or otherwise limited deployment—might not be surprising.

The majority of these company-specific use cases were essentially more specialized or customized versions of the base list applications. Still, it speaks to the experimentation telcos are conducting in AI and GenAI as they try different tools to learn what works best for their needs.

These patterns of investment, deployment, and experimentation suggest that telcos are still taking a segmented, ad hoc approach to AI and GenAI and developing use cases opportunistically rather than strategically. Companies in other industries that are considered to be leading in AI aren’t deploying use cases one at a time, when and where possible, but in a structured way, from a well-defined blueprint. While telcos talk about the transformative impact of AI, they’re not yet using it to activate a transformation. Doing so requires telcos to invest strategically. It’s not enough to bump up the funding (though that’s important). Telcos need to know where to invest, to prioritize use cases in a way that aligns with business value and organizational goals. They shouldn’t treat AI as an add-on, but as a core driver of efficiency and growth. And they should plan their investment volume and priorities accordingly.

At the same time, telcos need the flexibility to seize new possibilities as both AI technologies and operators’ AI maturity evolve. To this end, telcos should adjust their tech stacks to enable and accelerate the development and integration of AI and GenAI. They should optimize processes and spark an AI innovation culture. By taking these steps, telcos can quickly identify, build, and scale use cases—and AI can live up to its billing.