The growth in cargo owners’ willingness to pay (WTP) a premium for green shipping is slowing in a market that remains largely unregulated and reliant on voluntary actions. As a result, the previous momentum toward zero-carbon shipping is stagnating. As the International Maritime Organization’s (IMO’s) Marine Environment Protection Committee (MEPC) prepares to announce critical regulatory updates in April 2025, uncertainty looms over the shipping industry, leaving carriers and cargo owners searching for optimal long-term strategies.

These trends were among the principal findings of BCG’s fourth annual Shipping Decarbonization Survey, a study aimed at assessing the readiness of shipping customers to pay a premium for green transportation solutions. In late 2024, we engaged 125 decision makers, including heads of logistics, supply chain directors, and other executives who determine cargo owners’ choice of maritime providers. We found that cargo owners now fall into three distinct segments— laggards, followers, and frontrunners—and that each have distinct priorities and approaches to green shipping. Frontrunners are pulling ahead, exhibiting markedly higher WTP and consolidating available pockets of value, while laggards and followers are staying idle or falling behind.

Our survey also found that overall transparency, traceability, and trust in green fuel options have emerged as paramount concerns for cargo owners, underscoring the need for clear global regulation in areas such as fuel standards and book-and-claim systems (through which buyers “book” a certain amount of sustainable fuel when purchasing it and later claim the emissions reduction as part of their sustainability goals).

Of course, slower growth in green shipping does not mean no growth at all. And with four out of five cargo owners surveyed reporting a willingness to pay at some level—the average WTP premium is 4.5%—the potential for real expansion presents an important opportunity for carriers. Those that do not seize the moment will leave an estimated $10 billion market untapped, as calculated by the total demand forecast until 2030, as well as by likely adoption rates and WTP by those currently unserved within each cargo owner segment.

Yet a central question remains: Should cargo carriers wait for regulatory clarity before taking proactive steps toward achieving zero-carbon shipping? The short answer is no, they should not hesitate. Rather, they should act judiciously by identifying and capturing the most attractive pockets of growth and positioning themselves optimally in the seascape. Unlocking long-term value will require targeted action and a sophisticated go-to-market (GTM) strategy that includes competitive pricing in green premiums.

Rather than wait for regulatory clarity, carriers should act judiciously by identifying and capturing the most attractive pockets of growth.

Growth in Green Shipping Is Decelerating

The remaining strong interest in green shipping is driven primarily by European customers, especially those with high value to volume cargo and a strong internal commitment to decarbonization. Larger companies, those with annual revenues over $500 million, remain at the forefront of adoption, leveraging their scale to align with sustainability targets.

Despite such engagement, however, the overall pace of green-shipping growth is decelerating globally. The average WTP premium increased by only half a percentage point in 2024, compared with the one percentage point in annual growth observed between 2021 and 2023. External factors are contributing to this stagnation, as pending regulation is leading to reluctance to take action, and setbacks in alternative fuel production markets have had a ripple effect on the industry. Moreover, geopolitical tensions have at times created critical chokepoints, disrupting the stability of global trade (as illustrated by the Houthi attacks in 2023 and 2024 on vessels in the Red Sea). Such challenges further highlight the need for coordinated efforts to sustain decarbonization momentum.

The primary measures under consideration at the IMO include a goal-based marine fuel standard to gradually reduce the intensity of greenhouse gases (GHGs) and the introduction of economic mechanisms such as maritime GHG pricing. Efforts to align IMO policies with regional frameworks—such as the EU Emissions Trading System and FuelEU Maritime Regulation—are also underway and further demonstrate the complexity of the regulatory landscape. (See the sidebar “The IMO MEPC Is Poised to Act.”)

The IMO MEPC Is Poised to Act

Development of Mid-Term Measures. The IMO MEPC is working on a “basket of candidate mid-term measures” aimed at reducing greenhouse gas (GHG) emissions from ships. These include both technical elements, such as a goal-based marine fuel standard to regulate the phased reduction of marine fuel’s GHG intensity, and economic elements, such as a potential maritime GHG emissions pricing mechanism.

Alignment with Regional Regulations. Efforts are underway to align IMO measures with regional GHG regulations, such as the EU Emissions Trading System and the upcoming FuelEU Maritime Regulation, in order to ensure cohesive global compliance.

Cargo Owners Have Varying Priorities

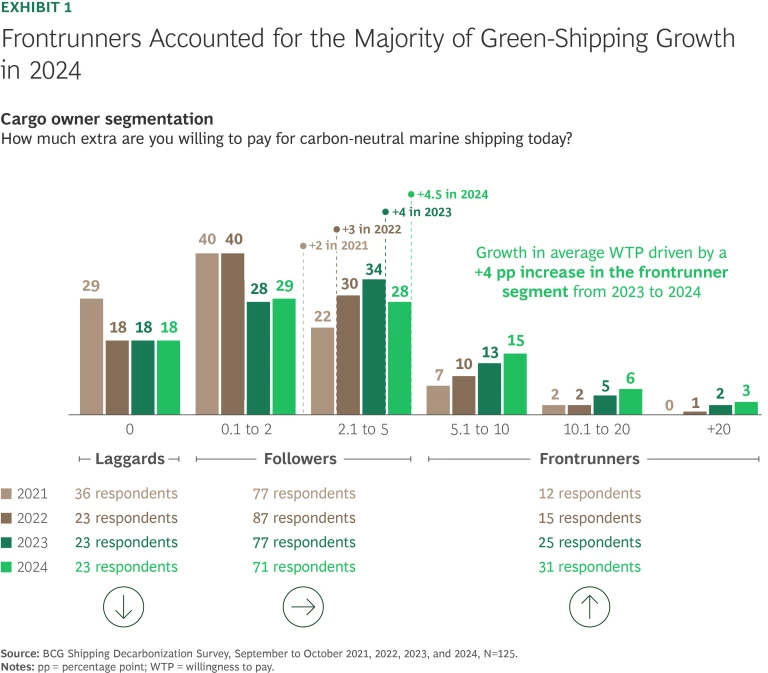

Of the three segments of cargo owners—laggards, followers, and frontrunners—the latter group was responsible for most of the green-shipping growth in 2024. (See Exhibit 1.) The vastly differing attitudes among these segments are shaping the industry’s trajectory and value pools.

Laggards. This group remains firmly resistant, unwilling to pay any premium for zero-carbon shipping and hesitant to adopt green fuels until regulation absolutely mandates it. More than 60% of these cargo owners do not have Scope 3 commitments—emissions for which a carrier is indirectly responsible throughout its value chain but does not generate itself—and only one out of nine that do have such commitments allocate budgets to achieve them. Regulatory incertitude is the primary driver of this group’s unwillingness to pay and the reason cited by more than half of survey respondents. In addition, skepticism regarding potential loyalty to shipping providers, competitive advantage, and the financial benefit to be gained from green shipping keep them firmly in the status quo. The automotive, basic materials, chemicals, and consumer goods industries are prominent in this segment.

Subscribe to receive the latest insights on Transportation and Logistics.

Followers. This middle segment is cautiously optimistic, with a WTP premium between 1% and 5%. Represented by a broad range of industries—with a larger share of industrial goods and personal consumer goods companies compared with other cargo owner sectors—this group recognizes the opportunities tied to regulatory developments and potential new demand. Most followers have Scope 3 commitments (76%), although only 60% have aligned their budgets to support them. Regulatory shifts remain their largest concern, cited in almost half of responses, while customer demand and financial market pressures split the remaining share. With limited focus on pricing benefits, these companies reflect the broader market stagnation as they wait for clearer rules to shape the playing field.

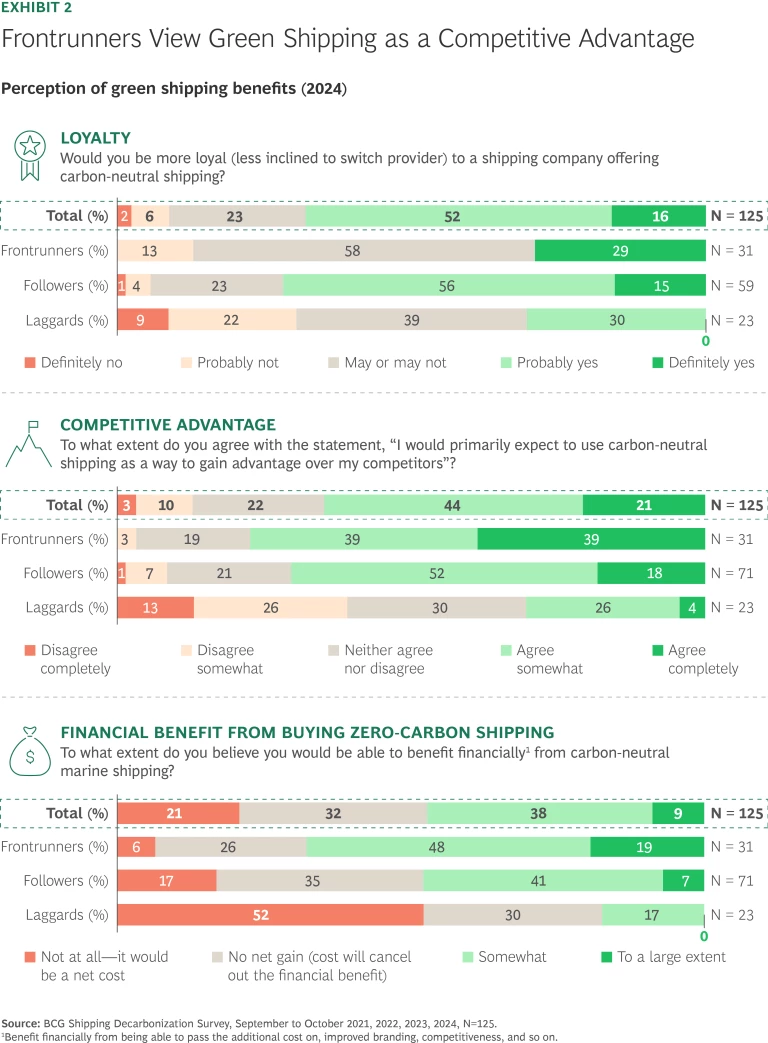

Frontrunners. Frontrunners view zero-carbon shipping as a strategic opportunity and are willing to pay a premium of higher than 5%. These companies actively use green shipping to differentiate themselves. More than 90% of frontrunners have Scope 3 commitments, with 75% allocating sufficient budgets to meet their goals. Unlike laggards and followers, their WTP is linked to and driven by customer demand (45%) rather than by regulatory pressures (42%), and their motivation for using zero-carbon shipping stems from internal CO2 reduction targets. These customers—led by the fashion and beauty, food and beverage, and health care industries—believe that green shipping can lead to improved loyalty, competitive advantage, and financial benefits. (See Exhibit 2.)

Indeed, although the overall share of cargo owners (80%) that are willing to pay a premium is unchanged from 2023, average WTP has increased through a larger group of frontrunners (up four percentage points from 2023) with an even higher WTP. As such, frontrunners are effectively condensing existing value pools further while other segments are holding back. Simultaneously, frontrunners are becoming increasingly sophisticated and improving the value capture of green shipping. Those that actively use it for branding purposes target specific customer sectors or product lines, while laggards and followers tend to endorse green shipping for general branding purposes across their companies, thus leaving the full potential of the green premium on the table.

Frontrunners believe that green shipping can lead to improved loyalty, competitive advantage, and financial benefits.

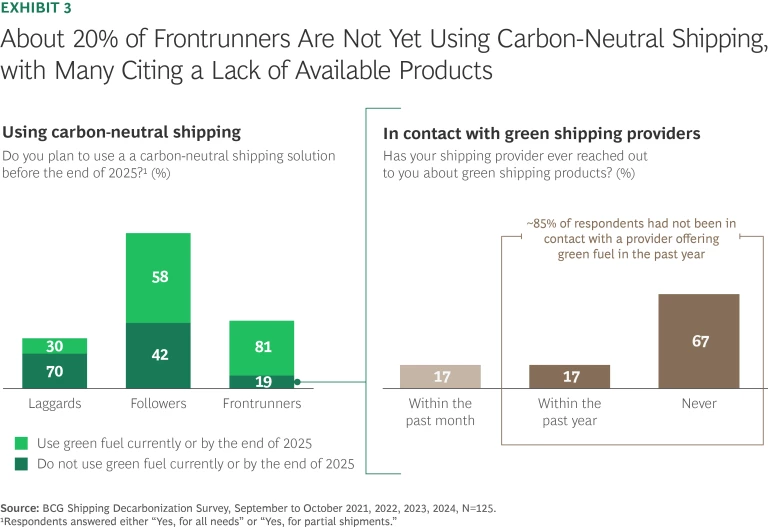

Nonetheless, about 20% of frontrunners are not yet opting to use green transportation solutions; two out of three report that they have never been offered zero-carbon options by their carrier, indicating that shippers are not fully capturing the available value. (See Exhibit 3.) At the same time, 60% of frontrunners use green shipping for only a portion of their cargo, meaning that further adoption is possible across this segment. Barriers holding back further adoption include cost versus benefit and a shortage of sufficient alternative fuels. For about one-third of frontrunners, a potential lack of transparency, traceability, and provider trust is also cited as a key reason to decline some carrier-suggested green fuel offerings. Green product options can be a poor fit for the cargo owner’s specific business, or providers simply may not clearly demonstrate their value.

Transparency, traceability, and provider trust are also important to laggards and followers. When asked by carriers, roughly 65% of these segments pointed to unclear pricing as the key barrier to choosing a green-shipping solution, indicating that some products currently brought to market are not yet able to convey their merits. Such cargo owners are not always sure of the benefits they would gain by paying the premium.

How Shippers Can Unlock Value in Choppy Waters

Carriers must act decisively in order to capitalize on the largely untapped market for zero-carbon shipping. Success will require balancing foundational improvements with strategic moves to secure competitive advantage, particularly in an ever-shifting regulatory environment.

Based on the BCG framework for the green fuels journey, carriers must take three critical steps: build a technical and commercial understanding for alternative fuels in shipping, develop a competitive fuel sourcing and asset strategy, and commercialize green shipping products effectively.

Success for carriers will require balancing foundational improvements with strategic moves—particularly in an ever-shifting regulatory environment.

Build a technical and commercial understanding for alternative fuels. Cultivating an in-depth expertise around alternative fuels is the foundation for success in green shipping. Carriers must develop dynamic capabilities to assess and adapt to evolving fuel options, ensuring competitiveness now and in the future. As fuel technologies and regulations shift, shippers that navigate this complexity with agility will secure a leading position in the market.

Develop a competitive fuel sourcing and asset strategy. Securing access to green fuels at scale while maintaining a competitive cost base is critical. Fuel costs are the top driver of shipping expenses, making sourcing strategies and asset alignment essential for safeguarding shareholder value. Strategic decisions made now will define carriers’ ability to stay competitive throughout the rest of the decade.

Commercialize green shipping products effectively. To unlock the green premium, carriers must commercialize their green offerings with transparency and precision. Clear emissions verification and pricing structures are essential to building trust with cargo owners, as clearly indicated by laggards and frontrunners. A targeted GTM strategy based on in-depth market knowledge and smart segmentation is also crucial to engaging frontrunners, expanding adoption, securing trusted relationships, and leveraging the benefits of green fuel investments.

Finally, carriers with sufficient scale have the potential to create markets for themselves. By securing substantial alternative fuel supplies and improving zero-carbon offerings, they can shape demand while maintaining the transparency and trust required to win over frontrunners. Clarity in product definitions and technical capabilities will be vital to capturing this group’s full potential.

The current stagnation in green shipping does not mean that carriers should wait. Instead, they should take proactive steps—including tailored GTM efforts and offerings anchored in transparency—to open up the available opportunity. Shippers that act now can secure both competitive leadership and strengthened relationships with cargo owners before regulation reshapes the seascape. A potential $10 billion market awaits.