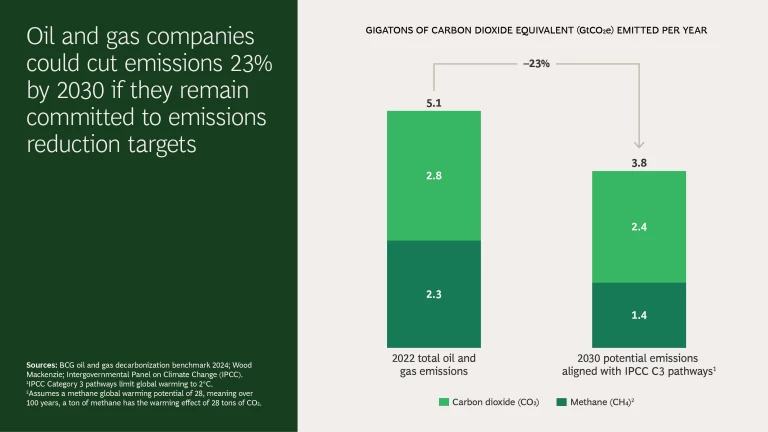

Oil and gas industry assets account for 10% of all the greenhouse gases emitted annually around the world, from Scope 1 and Scope 2 sources. In 2022, that amounted to 5.1 gigatons of carbon dioxide equivalent (CO2e), including carbon dioxide (CO2) and methane.

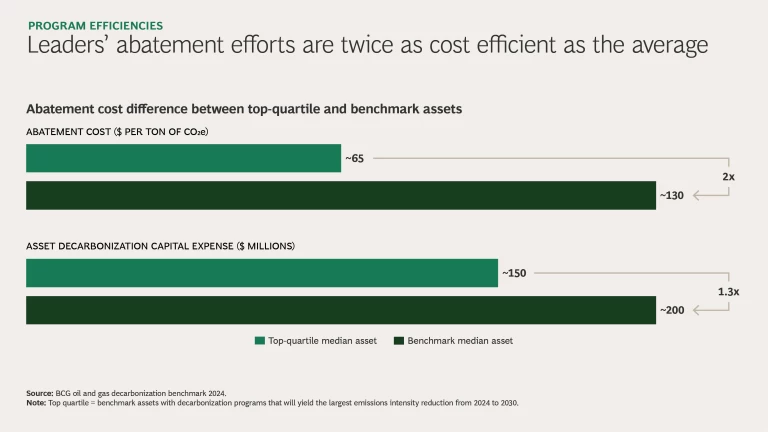

The industry is actively working to reduce such emissions. According to a first-of-its-kind oil and gas sector benchmark created by BCG, industry decarbonization leaders are on track to hit self-imposed targets of cutting emissions from assets 23% by 2030. Moreover, leaders are able to reduce emissions at half the cost per ton of CO2e, on average, compared to abatement efforts conducted by their peers.

But this strong progress is overshadowed by decarbonization laggards, some of which operate assets that produce more greenhouse gases or have a higher emissions intensity today than three years ago.

The industry must pick up the pace if companies are to meet their decarbonization goals and capitalize on opportunities to monetize hydrocarbons that otherwise would be burned up or lost. Failing to act could open them up to greater scrutiny and bigger financial liabilities from regulatory penalties and changes to emissions-trading schemes.

To reach the 2030 reduction goals, lagging companies must follow the example of carbon abatement leaders and take a consistent, holistic approach to reducing greenhouse gas emissions. They can go after the most cost-efficient, low capital expense abatement activities first by adopting proven technologies and practices. They also must proactively tap into multiple funding sources and make decarbonizing an enterprise-wide endeavor.

Subscribe to our Energy E-Alert.

Benchmarking Progress Toward Decarbonization

Oil and gas company assets include offshore and land-based facilities and wells, liquified natural gas plants, pipelines, and refineries. All of them produce greenhouse gases during operations—including CO2 and methane—from direct fuel combustion, flaring, venting, and fugitive emissions that are released unintentionally.

Of the 5.1 gigatons (Gt) of CO2e that these assets produce annually, methane accounts for 45%. The amount is worth noting because reducing methane emissions is the fastest way to slow the rate of global warming.

If oil and gas companies successfully reached existing reduction targets, they would cut 1.2 Gt of CO2e from 2022 levels and align with Intergovernmental Panel on Climate Change Category 3 pathways that limit global warming to 2°C. The targets also include cutting methane emissions from operations and routine flaring to nearly zero by 2030.

BCG’s benchmark gauges the efficacy of the industry’s efforts to date. To create it, we collected data from multiple companies in all major oil and gas producing regions, ranging from small independents to enterprises with global portfolios. We analyzed companies’ strategies and costs for decarbonizing individual assets, including cutting overall CO2e and the amount of CO2e emitted per barrel of production—a measurement of emissions intensity.

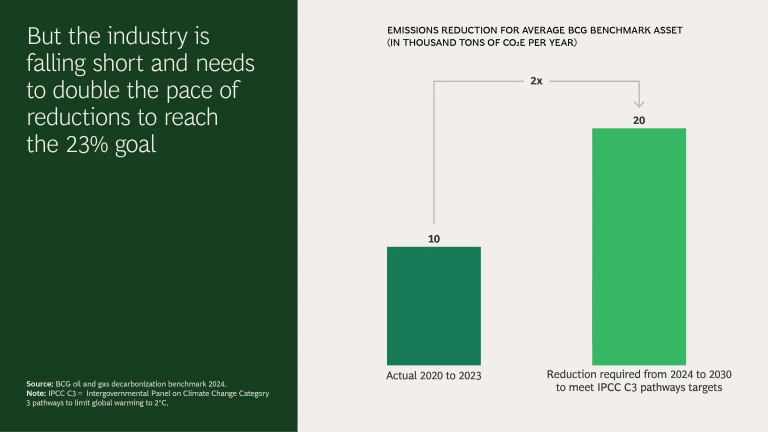

We found that overall decarbonization has been positive on average, but has been slower than expected because companies’ efforts vary widely:

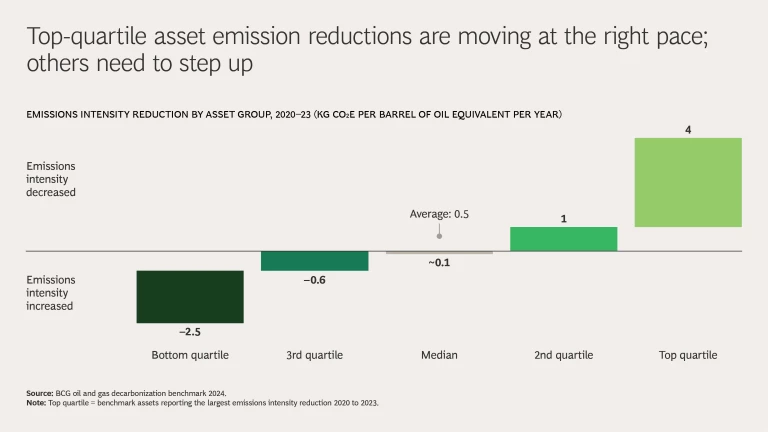

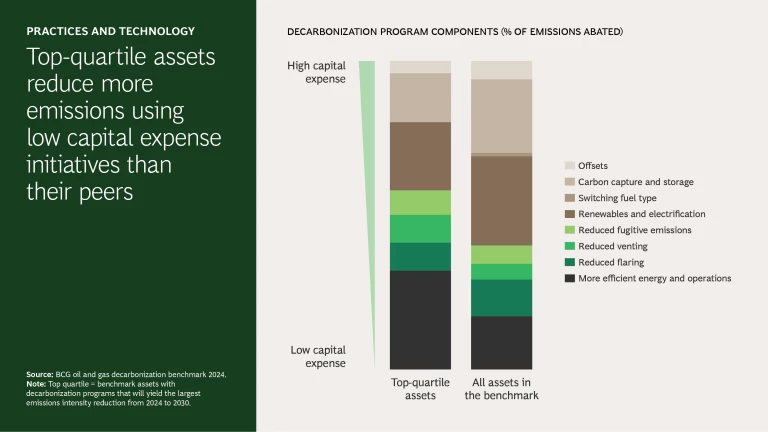

- Between 2020 and 2023, benchmark companies with assets in the top quartile of decarbonizers reduced CO2e intensity by at least 1 kilogram of CO2e for every barrel of oil equivalent (boe) a year—twice as fast as the average. Top quartile assets’ decarbonization programs address 85% of their total emissions, compared to 70% for all assets.

- During the same three-year period, however, 40% of all the assets in our benchmark saw CO2e intensity increase. The median asset increased emissions intensity by 0.1 kg of CO2e per boe a year. Assets in the bottom quartile increased emissions intensity by more than 0.6 kg of CO2e per boe a year. The increases came from late-life assets—oil and gas facilities and wells that are nearing the end of their economic lifespan—along with assets that added production with relatively high emissions intensity.

For the industry to meet 2030 greenhouse gas emissions reduction goals, companies must double the current pace of asset decarbonization, accelerating emissions reduction from 10,000 tons to 20,000 tons of CO2e a year.

What Decarbonization Leaders Do Differently

BCG has previously identified actions that oil and gas industry decarbonization leaders are taking to reduce CO2e abatement costs, including implementing changes at individual assets and integrating work across assets and regions to optimize results. The benchmark enables us to translate insights into actions that set decarbonization leaders apart. These can be divided into four categories.

Program efficiencies.

Decarbonization leaders launch abatement programs that are more cost efficient than those of their peers. The costs associated with steps that leaders take to reduce combustion, flaring, venting, and fugitive emissions are 8 to 12 times lower than costs for more capital-intense actions, such as replacing fossil fuel sources with lower emissions alternatives or adopting carbon capture and storage.

Practices and technologies.

Leaders do more without incurring higher capital expenses because they adopt practical, proven practices and new technologies that make their abatement programs as cost efficient as possible. In the short-term, they emphasize initiatives that build on their existing capability and proven technologies and approaches, such as operating equipment at optimal load to minimize fuel use and methane slip, and increasing equipment reliability to eliminate routine flaring. In addition, they deploy new technologies to detect, measure, pinpoint, reconcile, prevent, and mitigate methane emissions. And they use deep expertise and capability to design abatement projects.

Funding.

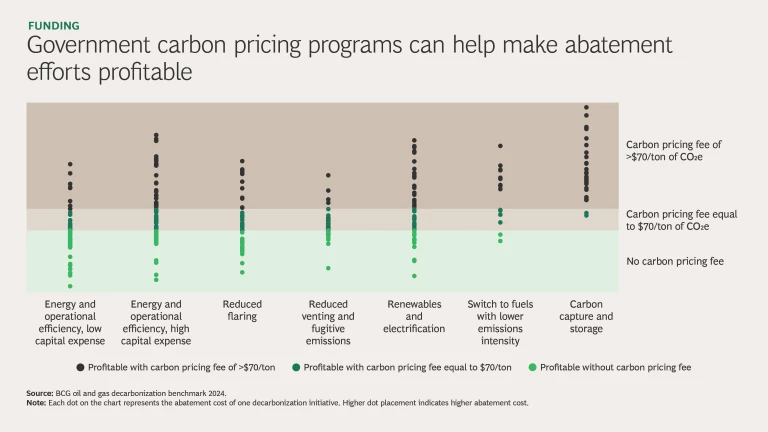

Lack of funding can be a major hurdle to ramping up abatement programs. Decarbonization leaders start with what is available. They make use of existing government incentives and work closely with regulators to put sufficient funding, efficient licenses, and permits in place to make multi-million dollar decarbonization projects more financially viable. They also don’t rely solely on external funding to subsidize abatement costs. They maximize the financial benefits to be gained from controlling emissions, including funneling recaptured gases from emissions back into running operations or selling them in new or existing ventures. They also establish governance systems and controls that enable decarbonization investments.

Decarbonizing could be hard for companies to achieve without outside encouragement. Governments can help by incentivizing companies to decarbonize through programs such as carbon pricing, where fines or fees are imposed on emissions. In common carbon pricing schemes, greenhouse gas producers have the option to pay a fine or fee to continue emitting at the same level, or avoid it by emitting less. Benchmark findings bear out the difference that such programs can make in cutting emissions and making abatement efforts more profitable. From 2020 to 2023, oil and gas industry assets in regions with carbon pricing cut average emissions intensity twice as much as assets in areas without it—2% compared to 1%. Our research also found that if benchmark companies operated in regions with a carbon pricing fee of $70 per ton of CO2e, twice as many of their abatement initiatives would show a profit—60% compared to 30%. That’s because more of them would opt to spend on initiatives to lower emissions over paying penalties that ultimately would end up costing more.

Enterprise-wide transformation.

Decarbonization leaders maximize their efforts by involving the entire organization in abatement efforts from day one. They start with a solid program that incentivizes low-emissions choices. They give asset teams ownership for making changes but use key performance indicators and other metrics to measure progress toward goals. They use

initiatives to reduce costs and improve productivity

per barrel. And they use upskilling, reskilling, and outside experts to ensure that the workforce has the capabilities necessary to put decarbonization programs into practice.

By getting decarbonization efforts back on track, the oil and gas industry can show its commitment to reducing greenhouse gas emissions fast. For companies that have been slow to decarbonize, this may mean making radical choices about how they operate assets, starting with implementing easy changes that don’t require major capital investments. They also need to tap into all available funding sources, deploy best practices and new technologies, and get the entire organization on board with abatement efforts.