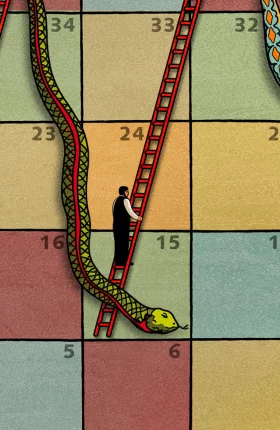

The growth share matrix—put forth by the founder of BCG, Bruce Henderson, in 1970—remains a powerful tool for managing strategic experimentation amid rapid, unpredictable change.

BCG Classics Revisited

Classics

December 23, 2013

The principles of time-based competition—a classic concept among BCG insights—still hold. But today’s companies must be adaptive, as well as fast, in order to succeed.

Classics

May 28, 2013

The experience curve theory still holds, particularly in specific industries. But to succeed in today’s environment, many companies need to develop an additional kind of experience.

Classics

December 4, 2012

BCG founder Bruce Henderson’s rule, conceived in 1976, still holds valuable lessons for companies in many industries.

Explore the Collection of Classic BCG Insights

Classics

January 1, 1968

One of the most well-known BCG insights, Bruce Henderson’s hallmark concept illustrates the direct relationship of costs to accumulated production experience.

Classics

January 1, 1976

A stable competitive market never has more than three significant competitors, the largest of which has no more than four times the market share of the smallest.

Classics

January 1, 1990

John Clarkeson wrote that the winning organization of the future will look more like a collection of jazz ensembles than a symphony orchestra. The future is here.

Classics

January 1, 1981

An example of timeless BCG thought leadership, this piece explains why companies need to absorb the fast-changing lessons of strategic thinking to survive and thrive.

Classics

January 1, 1988

How to deliver the most value for the lowest cost in the least amount of time? George Stalk identified the three tasks you must accomplish to become a time-based competitor.

Classics

January 1, 1973

Bruce Henderson posited that the more experience a business had in producing a product, the lower it would cost to produce it. Read Henderson on the “experience curve.”

Classics

January 1, 1968

Bruce Henderson, the founder of BCG, wrote that all organizations must adapt or die. So why are the forces of corporate culture so set against change?

Classics

January 1, 1970

Only companies with a balanced portfolio of products—as reflected in BCG's growth share matrix—can use their strengths to truly capitalize on growth opportunities.

Classics

October 26, 2006

The lighter-weight business models enabled by Web 2.0 pose threats and present opportunities to traditional players.

Classics

January 1, 1977

A diversified portfolio enables a company to operate on a higher level of complexity. Instead of developing a family of products, it is able to develop a family of businesses.

Classics

January 1, 1989

One of our classic BCG insights explains why managers in network organizations have to empower their people and learn to live with less control.

Classics

January 1, 2002

What can a nineteenth-century Prussian general teach today's business leaders about surviving crises? Plenty.

Classics

June 7, 2007

Strategy requires established players at the center to make regular visits to outsiders on the periphery, where modest investments can produce huge payoffs.

Classics

January 1, 1980

Strategic competition holds the promise of a quantum increase in productivity and the ability to control and expand a company’s potential.

Classics

February 1, 2002

Companies managed by leaders who can connect emotionally to their employees, suppliers, and customers will emerge vastly stronger from these tumultuous times.