The End of an Era in Fuel Retail

A number of far-reaching trends are disrupting the fuel retail market . Among the most powerful of these are the rise of alternative fuels (particularly electricity) for mobility, the emergence of new models in mobility, and the evolution of heightened consumer expectations around convenience and personalization. The impetus for these disruptions comes from an array of powerful new digital technologies—everything from artificial intelligence (AI) to robotics to the Internet of Things (IoT).

The ongoing shifts will alter the contours of competitive advantage in the industry and require a fundamental transformation of the standard business model. Fuel retailers must develop a comprehensive response that adjusts the products and services they sell, adapts their network and business model, alters the layout of their service stations and convenience stores, and harnesses new digital tools.

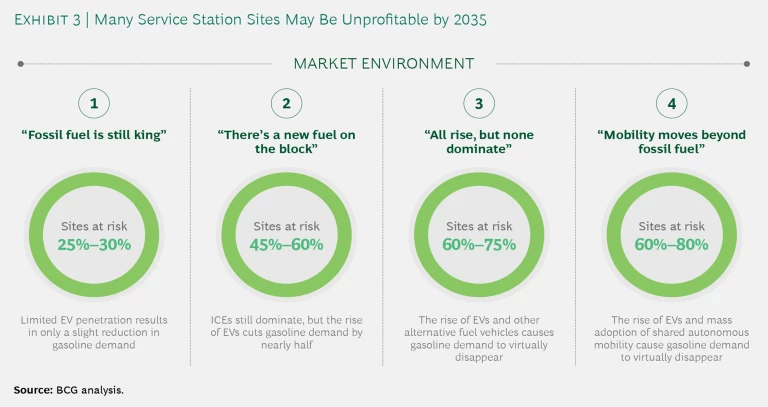

To help companies understand what the future will look like and what they can do to adapt to it, BCG has conducted an in-depth study of the fuel retail industry, detailing four very different market environments that are likely to emerge around the world, each defined by changes in mobility and consumer lifestyles. Fuel retailers can use these market environment scenarios to analyze how their business might fare in the years ahead under different conditions and to position themselves to adapt over the short, medium, and long terms. Although the environments differ from one another markedly, a significant portion of the fuel retail network in some markets could be unprofitable by 2035—even in the scenarios in which new mobility models are less disruptive and fossil fuel sales do not decline precipitously. In a market environment in which electric vehicles (EVs), autonomous vehicles, and new mobility models take off rapidly, up to 80% of the fuel-retail network as currently constituted may be unprofitable in about 15 years.

BCG has conducted an in-depth study of the fuel retail industry, detailing four very different market environments that are likely to emerge around the world.

To prevent such a decline, fuel retailers need to take action in three areas. First, they need to move from a vehicle-centric business model to a customer-centric one in order to capture new product and service opportunities. This effort entails reinventing the overall customer journey and using digital tools to extend the customer relationship beyond occasional visits to the service station. Second, retailers need to transform their network of service stations and assets. This process includes changing formats in some locations to meet customer demand, divesting locations that will not be profitable, and investing in assets that support the push into new products and services. Third, they need to develop new capabilities—including digital expertise and, in some cases, capabilities related to entirely new areas such as last-mile logistics or real estate.

To successfully adapt, fuel retailers must embrace a new mindset. Making modest changes or tweaks to the business will not suffice. Instead, companies must fundamentally rethink their business and aggressively embrace innovation and new technology. Those that boldly seize the opportunity will find themselves in a winning position. Those that do not may be left behind.

The Forces of Disruption

The pace of disruption in the fuel business is breakneck, as alternative fuels grab share, The Reimagined Car , and consumers expect greater convenience, quality, and personalization. (See Exhibit 1.) In all three areas, advances in digital technology—including big data and analytics, AI, the IoT, robotics and automation, and virtual and augmented reality—are driving and enabling change.

The Takeoff of Alternative Fuels

Two forces are spurring the rise of electricity and other alternative fuels. The first is the rollout of regulations aimed at limiting greenhouse gas emissions. For example, the UK has mandated that, by 2040, all new cars and vans sold in the country should be capable of achieving zero greenhouse gas emissions, a requirement that will increase demand for battery electric, plug-in hybrid electric, or hydrogen-fueled vehicles.

The second force is technology. As battery costs continue to decline, automotive OEMs are investing heavily in EVs. By 2030, more than a third of all new vehicles sold will be fully or partly electric . This development poses a major threat to fuel retailers, particularly those that operate numerous stations where fuel purchases account for a significant share of profits.

Other alternative fuels are also beginning to gain ground in some markets. For example, automakers such as Toyota are investing in developing hydrogen fuel cell vehicles. Meanwhile, in other parts of the world, a sizable proportion of vehicles already run on alternative fuels such as liquefied petroleum gas (LPG) and compressed natural gas (CNG), and biofuels are increasing their share in the gasoline and diesel pools. Vehicles that use an alternative fuel such as LPG or CNG still require refueling through a traditional fuel retail location—unlike EVs, which users may charge at home, at work, or in parking lots, and which therefore pose a substitution threat to service stations.

The Emergence of Advanced Mobility Models

Nearly two-thirds of the global population will live in cities by 2030 , and new digital-centric business models will be critical to ensuring efficient urban mobility. Already, ride-hailing services such as Uber and Lyft have ushered in the first phase of the era of shared mobility, reducing the car ownership aspirations of younger generations. By 2030, the shared mobility market is likely to be worth nearly $300 billion—and by 2035, we project, shared mobility solutions will account for nearly 20% of on-road passenger miles.

As shared mobility continues to gain ground, another significant shift will support it: the emergence of autonomous vehicles (AVs). Numerous companies—including both traditional OEMs such as Ford and Toyota and new digital players such as Google and Uber—are investing heavily in the development of autonomous driving capabilities. As a result, we expect that nearly 25% of new cars sold in 2035 will have the ability to drive themselves with no human involvement whatsoever—with most of those AVs likely to be electric. As autonomous vehicle systems replace human drivers, shared mobility services will become less and less expensive for customers, encouraging further growth of such services.

The implications for fuel retailers are significant because the refueling or recharging of shared-mobility-service AVs will commonly occur while the vehicles are empty of passengers, at dedicated AV parking areas located outside urban areas. The result will be a decline in customer traffic at service stations and lower fuel and convenience store sales.

The Evolution of Consumer Expectations

Retail customers—including those shopping in convenience stores—have become more demanding across the board. They are looking for high-quality, fresh, healthy food options; better value; and more attractive store formats. They also want more personalized products and services and a seamless, convenient experience through options such as self-service checkout.

In this environment, retailers are leveraging a vast amount of data from their customers to gain an unprecedented level of insight about their preferences. And those efforts will grow increasingly sophisticated. Whereas businesses in the past grouped consumers into segments, retailers in the future will be able to target each individual and tailor products and services to that individual’s needs.

Retailers in the future will be able to target each individual and tailor products and services to that individual’s needs.

These dramatic changes in the retail environment will pose a major challenge for fuel retailers, which stand to lose customers both to more advanced retailers that offer fast and easy purchases and to increasingly innovative e-commerce players. In fact, convenience will increasingly come to mean “delivered to the home,” as e-commerce companies that offer instant delivery emerge as a significant alternative to the traditional convenience store. Companies such as Amazon are already testing delivery by drone as a way to substantially reduce last-mile delivery time. Others are addressing the last-mile challenge through partnerships with companies such as Instacart and Uber. In the United States alone, investors have committed $9 billion to some 125 startups operating in this space. In addition, retail players are leveraging technology to create a true omnichannel experience that seamlessly integrates online and offline retail. Voice-activated shopping, made possible by the IoT and by AI, is emerging as a powerful new model in both physical and virtual stores.

Other efforts aim to make the in-store experience more efficient and convenient. For example, emart24 has rolled out unstaffed stores, and Farmer’s Bridge has developed walk-in vending machines. Also new to the scene are mobile stores such as Robomart and Mobymart and chains such as AmazonGo and JD.com’s 7Fresh (in China) that offer automated checkout. Fuel retailers must take steps to create options that match the speed and ease that these formats offer.

The World Is Changing—And Local Implications Vary

The full impact of the trends that are remaking the fuel retail business will be evident within the next 10 to 15 years. In the meantime, however, some markets will change more rapidly than others. For example, the demand for electric and other alternative-fuel-powered vehicles, the penetration of AVs, and the adoption of new shared mobility solutions will be much higher in Northern Europe, North America, and some fast-developing economies such as China than in most countries in Middle East or Africa, for example.

Four Future Market Environments

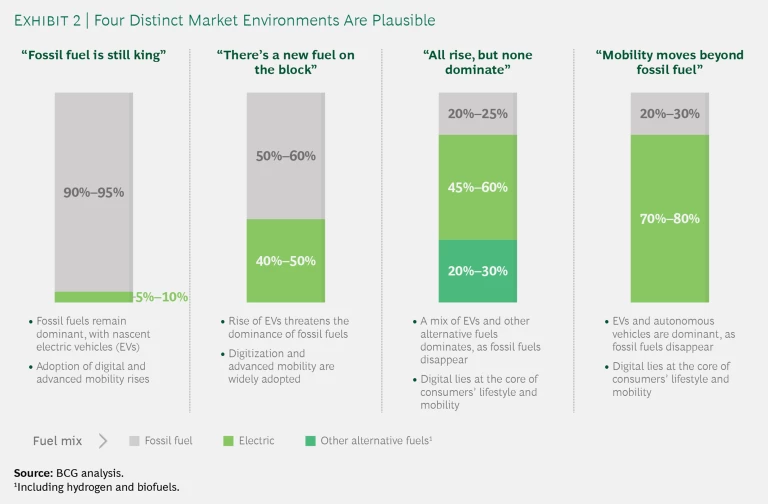

To reflect the disparate pace of change in different parts of the world, we have identified four distinct market environments that are likely to play out between now and 2035, each of which will have a different impact on fuel retailers’ profitability. (See Exhibit 2.) These four basic environments can serve as signposts for the future, helping companies identify signals of change in the market and assess the impact on their business. Their key features are as follows:

- Market environment 1: Fossil fuel remains king. This environment reflects conditions under our most conservative projections. Internal combustion engine (ICE) vehicles continue to predominate, with limited penetration of electric vehicles. People continue to rely heavily on personal vehicles, with shared mobility solutions making up only 5% to 10% of all road mobility. In this environment, the consumer shopping experience will be digitally enabled, and seamless purchasing and checkout will be commonplace. Businesses will still target segments of customers (not individual customers), and traditional human-powered last-mile delivery will remain the norm. Despite the dominance of ICE vehicles, as well as population growth and the emergence of an expanding middle class in developing countries, demand for fossil fuel will stagnate or decline slightly. This will be due in part to increasingly fuel-efficient vehicles and in part to further—albeit limited—penetration of EVs. As a result, by 2035, under a “do nothing” scenario in which fuel retailers have not adapted to the changing environment, 25% to 30% of fuel retail outlets will earn returns below their weighted average cost of capital and be at risk of closure.

- Market environment 2: There’s a new fuel on the block. In the second market environment, countries are in a transitional state before having achieved a critical level of penetration of EVs. In this environment, government regulations and incentives foster EV adoption, and electricity powers nearly half of the cars on the road. But electric charging infrastructure remains limited to public spaces in urban locations and to public spaces and homes in surrounding suburbs, with little infrastructure available in rural and remote areas. Consumers in this environment will expect levels of integration between online and offline shopping that go beyond the click-and-collect approach. Advanced digital in-store and out-of-store experiences—for example, ordering products through personal digital assistants at home or using automated checkout in stores—will be common. AI-driven innovation will permit highly personalized offerings in traditional stores and via self-driving mobile on-demand stores. Alternative last-mile delivery models using drones and autonomous robots will be on the rise. Although EVs won’t completely dominate this environment, their impact will be powerful. If fuel retailers do not adjust their model, the decline in their fuel sales will render 45% to 60% of service stations potentially unprofitable by 2035 and will push the average return on capital employed (ROCE) of the sector to the low single digits.

- Market environment 3: All rise, but none dominate. In this environment, adoption of EVs is widespread, but there is also significant demand for alternative fuels such as hydrogen, LPG, CNG, and biofuels, as governments and other entities support their development. As a result, the overall share of fossil fuels is relatively low. At the same time, many consumers prefer shared mobility solutions to owning cars that largely go unused during the day. The upshot: nearly 20% of all passenger kilometers in cities are traveled in some shared mode of transport. In this environment, the shopping experience will reach its maximum level of online and offline integration. Drones and autonomous robots will be commonplace, bringing products to customers’ doorsteps from urban micro-hubs. Humans will participate directly in only half of all last-mile deliveries. The financial situation for fuel retailers in this environment will be challenging. Although fuels such as LPG and CNG will replace some of the lost volume of gasoline, they won’t completely offset the effect of rising EV use. By 2035, assuming that the fuel retail model doesn’t significantly change, we expect 60% to 75% of fuel retail outlets to be at risk of unprofitability, with average sector ROCE in negative territory.

- Market environment 4: Mobility moves beyond fossil fuels. In the most advanced of the market environments, EVs are dominant, and the AV revolution is well underway. About 10% to 20% of all new cars sold will be both electric and fully autonomous. Fossil fuels will power only about a quarter of all road mobility energy needs. In addition, the infrastructure needed to serve a growing fleet of AVs—to transport goods and people throughout the day, and to charge overnight and during idle times in dedicated areas—will be in place. On-demand mobility will account for nearly 30% of all passenger kilometers in cities, as more and more people opt for shared mobility over vehicle ownership. The retail environment will be similar to the one outlined in market environment 3. But market environment 4 will require fuel retailers to make even more dramatic changes: in the absence of changes to the current model, 60% to 80% of the network may be unprofitable, and the average ROCE for the sector will be negative by 2035.

It is important to recognize that these market environments do not represent the full range of possibilities over the next 16 years. Rather, they reflect market archetypes that may exist before or during 2035. Moreover, these are not end-state scenarios: the forces of disruption will continue to evolve over time, creating significant uncertainty overall and increasing the likelihood that multiple scenarios may exist simultaneously in different geographies. Also, while the degree of financial impact of each of these scenarios varies by market environment, the profitability of the fuel retailer network takes a sizable hit in every case. (See Exhibit 3.)

The Burning Platform for Fuel Retailers

The impact across all projected market environments reflects the harsh reality that traditional sources of revenue will evaporate. In market environments 3 and 4, we expect gasoline demand for light-duty vehicles to drop by 50% to 70% by 2035. That development would trigger a decline in the total average throughput for fuel stations (as measured in liters of gasoline and diesel sold) in the range 30% to 50%. The service stations’ convenience store business will suffer, too, as fewer people come in to refuel or purchase other products and services.

Although the disruption will affect all service stations, the impact on each one will vary by location. Between now and 2035, highway locations are likely to be more resilient and enjoy a longer residual economic life than other locations, for two main reasons. First, the electrification of heavy-duty vehicles such as trucks will probably take longer than that of light-duty vehicles such as cars and vans. Consequently, heavy-duty vehicles will continue to make fuel stops in highway locations for the foreseeable future. Second, even consumers who drive electric vehicles may stop at highway service stations for recharging, nonfuel purchases such as food, or both.

The trends are much more challenging for service stations in urban locations, where relatively high penetration of EVs and AVs and increasing adoption of advanced mobility options such as car sharing and ride hailing are likely. Those trends will reduce gasoline demand and service station traffic as many people charge their vehicles either at home or at work, depending on the infrastructure in their city, and as fleets recharge at dedicated hubs. Unmanned service stations, which have achieved significant penetration in many European countries thanks to their convenience and discount prices, will also be vulnerable to these changes in usage patterns. Many lack a convenience store component and therefore depend on fuel sales. Faced with a significant reduction of fuel throughput, such stations will be at risk, if their owners do not transform and repurpose them.

The bottom line here is that fuel retailers must take aggressive action, including shuttering some stations, in order to ensure that their operations remain profitable.

Three Steps for Adapting

What can fuel retailers do to prepare themselves for such a future?

It is clear that fuel retailers won’t be able to influence future gasoline and diesel demand. So instead they need to act now to offset the future decline in their traditional income streams. To achieve this and build long-term competitive advantage, fuel retailers must focus on taking action in three areas: enhancing existing offerings and pushing into new value pools; transforming their network and asset portfolio; and developing new capabilities and expertise. (See Exhibit 4.)

Enhance Existing Offerings and Push into New Value Pools

Fuel retailers need to improve and expand what they offer customers in their traditional business while also pushing into adjacent value pools—segments that are new, but related to their core business.

Success in both areas demands a new way of thinking. Today, the primary business of fuel retailers consists of fueling and servicing vehicles—providing products and services such as gasoline and diesel fuel, automotive products, auto maintenance services, and car washes. At the same time, they sell coffee, snacks, and other products to consumers through their convenience store. Although these nonfuel offerings account for a sizable share of profits—and for many players outstrip the profits from fuel-related services—the fuel retail business is typically oriented to the vehicle, not to the person driving it. In an era of disruptive change, however, fuel retailers must move from vehicle centricity to consumer centricity, which means focusing on addressing the needs of customers in end-to-end fashion.

We have identified a series of strategic initiatives in both traditional and adjacent spaces that can help fuel retailers remain relevant in the future. This is not the full list of moves that fuel retailers should consider, but rather a set of initial steps that a business can use to begin its transformation. Many of these initiatives are “no regret” moves—actions that all fuel retailers should embrace. Others, which we call “options plays,” make sense in only some of the market environments outlined above.

Enhance the customer fueling experience. Fuel retailers can use digital technologies to increase the sophistication of their loyalty programs and payment solutions. The goal is to create a seamless, engaging customer experience by digitizing the entire journey, from providing information on promotional deals while the customer is en route to the site to supporting easy mobile payments on the customer’s way out. Such efforts allow retailers to create personalized offerings for customers and create opportunities to monetize data through third-party partnerships.

There are also some important option plays in the core fueling operation. In market environments 1 and 2, where fossil fuel retains a sizable share of the market, fuel retailers can offer services such as fuel delivery. They should also adjust their fuel mix based on consumer demand, expanding offerings of alternative fuels such as CNG and hydrogen in markets where those products have high penetration.

Invest in EV infrastructure and advanced mobility. As EVs take off, fuel retailers need to figure out how compete in the market for EV charging. Such moves will help them attract traffic to the service station, partially compensating for the loss of ICE customers. The offset will not be complete, however, because some EV owners will charge their vehicles at home, at work, or elsewhere.

Companies have already deployed the first pilots of ultrafast charging technology in several markets. BP, for example, is rolling out Chargemaster ultrafast charging points across its 1,200 UK service stations. In addition, emerging technologies may further reduce charging time while limiting damage to batteries. By 2030, technologies may be able to reduce vehicle charging time to less than 10 minutes.

EV charging can be attractive in some markets, but fuel retailers must address several potential challenges to ensure that such investments earn a decent return. First, EV charging points will not be profitable unless their utilization rate is relatively high. Second, rolling out EV charging points poses significant technical issues in many urban and suburban areas. That’s because some locations have constrained grids that cannot provide the required high voltage, or because they have limited space to accommodate new charging points. Third, fuel retailers will have to identify and set a charging fee that yields a reasonable a return and yet is acceptable to users. In contrast, most fee arrangements today focus on acquiring users, rather than on earning a sustainable return. If technology advances and resourceful fuel retailers successfully address these constraints, ultrafast chargers may succeed in keeping some urban service stations afloat by offering a charging experience that is comparable in speed to traditional car fueling.

Fuel retailers should also consider striking partnerships and collaborating in other ways with players in the mobility and retail ecosystem, including government authorities and utilities, to create incentives for deploying new distributed energy solutions and energy management systems.

In market environments 2, 3, and 4, fuel retailers may find it attractive to deploy out-of-station charging points. And some companies should explore expanding into the EV value chain, including through the construction, installation, operation, maintenance, and servicing of charging infrastructure, either through direct investment in R&D or through M&A. Some nonfuel retail players in Tokyo and Oslo have already built profitable businesses around providing such services.

Beyond the core fueling business, fuel retailers may be able to expand into related mobility businesses. They can leverage their connections to and insight about customers to build digital mobile platforms—businesses that offer reasonably high margins and yet require a relatively modest investment of assets. Possibilities include predictive maintenance solutions that monitor when a car needs a tune-up, repairs, or cleaning and connect the car owner with companies that do that work, and platforms for financial products, mobility services, entertainment, and e-commerce. Fuel retailers should also make a major push to monetize their data in the broader mobility ecosystem.

Fuel retailers operating in market environment 4 should explore the possibility of providing AV support services—for example, developing an AV hub that offers overnight parking, charging services (both in-station and out-of-station), or maintenance and repair services for AV fleets. The most suitable locations for these hubs are low-cost areas near but outside city centers.

The most suitable locations for these hubs are low-cost areas near but outside city centers.

Drive the evolution of the convenience store. As consumer demand for convenience, speed, and high-quality food rises, the convenience store format is ripe for change.

In urban locations, convenience stores need to shift from the traditional limited offerings (and often a poor look and feel) to neighborhood stores selling a wide variety of high-quality products and food to go. They can make less dramatic changes at highway locations, where the format can remain that of a more traditional convenience store with food to go and rest areas for travelers.

Fuel retailers should also explore the unmanned store model, which saves money while offering customers a quick, seamless, digital experience. They should give their customers an array of delivery models for their products such as click-and-collect and home delivery; some of these options are rapidly emerging as standard options in any retail experience.

Finally, fuel retailers should embrace personalization. They have unique insight into multiple customer journeys, including convenience store purchases and can use information they have gathered on customer activity to develop personalized communications, recommendations, and offers to consumers.

Become a player in last-mile delivery. As EV penetration takes off, the elimination of fuel pumps and less competitive convenience stores will free up retail space, particularly at urban sites. Such square footage will become available just as the demand for last-mile delivery support ratchets up. This creates an opening for fuel retailers, particularly in market environments 3 and 4, to leverage underutilized space.

One possibility is for fuel retailers to play in most steps of the parcel delivery value chain, including warehousing (pickup and sorting) and last-mile delivery. The proximity of their urban sites to city centers—and the millions of consumers living there—can make them attractive locations for networks of microhub warehouses. Already, fuel retailers can enter the last-mile delivery space by building their own traditional fleet of bicycles or cars. In the future, as AVs become commonplace, they can shift toward those vehicles. They may also be able to offer drone charging and parking service.

Leverage the service station’s real estate more effectively. In many markets, fuel retailers own and occupy central—and valuable—locations. They need to think about how to capitalize on that advantage by reimagining the products and services they can build into their model.

Fuel retailers operating in market environments 3 and 4 should consider shifting their sites from vehicle-centric operations to multipurpose destinations.

The goal should be to create a world in which consumers visit service stations because they want to, not because they need to. To achieve this, fuel retailers operating in market environments 3 and 4 should consider shifting their sites from vehicle-centric operations to multipurpose destinations that offer a broad range of products and services in one convenient location. The universe of possible services is vast, ranging from shared office space to medical clinics, and from fitness centers to laundry and dry cleaning. (See “The Service Station of the Future.”)

The Service Station of the Future

The Service Station of the Future

The service stations that thrive in the future will probably look almost nothing like those we see today. To help visualize just how different those sites will be, BCG commissioned an artist to create detailed illustrations of future service stations.

The service station in market environment 4, which is the most advanced of our four scenarios, will be completely converted and repurposed. In urban areas, where people are less likely to have convenient home charging options, the service station will function as an electric charging hub. Given its strategic location, it can also serve as a site for warehousing and last-mile delivery services. The company may dedicate space to building a service hub for AV fleets, offering overnight parking and charging, as well as a maintenance and repair shop. The transformed convenience store will include personalized offers for customers. And the site may devote additional space to new lifestyle hubs that include office space or health and fitness services.

Making smart moves to leverage the company’s real estate—and taking action in the other four areas outlined above—can help fuel retailers tap into new and lucrative value pools. (See “Competing in New Value Pools.”)

Competing in New Value Pools

Competing in New Value Pools

Fuel retailers that successfully push into adjacent businesses can reap significant rewards. We see the emergence of two significant new value pools involving such adjacent opportunities.

The first, which we call “people mobility,” includes on-demand mobility services such as ride hailing and car sharing. The second, which we call “goods mobility,” includes product delivery through a new, modernized convenience store that offers last-mile delivery and logistics. Opportunities to maximize the value of company-owned real estate are essentially split between those two value pools. (See the exhibit.)

How large are these pools? With a rapidly growing number of companies and customers, the people mobility value pool (as measured by earnings before interest and taxes) should increase in magnitude by 4 to 7 times between 2017 and 2035 while the goods mobility value pool will nearly triple in size over that period.

By targeting both areas, fuel retailers can expand their customer base to include businesses, non-car-owning travelers, and customers seeking convenience and other new lifestyle services. At the same time, they can expand and deepen their relation-ship with existing customers.

Transform the Network and Asset Portfolio

In order to prepare for the future, fuel retailers must take a hard look at their service station network. In particular, they need to consider how to consolidate and optimize the network in order to extract maximum value from their traditional assets in the face of decreasing returns. In many geographical areas, the bulk of remaining business volume will shift toward the last-man-standing stations.

In reviewing and optimizing the network, fuel retailers need to move beyond the traditional site segmentation approach, which focuses on fuel throughput and demographic attractiveness. Some of today’s best sites may not be profitable in future, and some previously unattractive sites may become significantly more appealing. For example, some high-volume unmanned sites that currently generate high-volume fuel sales may be particularly hurt by declining fuel sales. But at the same time, some large, readily accessible but less attractive current sites in suburban locations may prove to be excellent hubs for last-mile delivery services, AV parking, and new retail space.

The fuel retailer of the future must also learn how to manage an asset portfolio that is diversified beyond service stations and other related physical assets such as fuel trucks. This broad portfolio may include a new set of physical assets, including warehouses for last-mile delivery, drones, AVs, and robots, and digital assets such as mobility platforms and apps, personalization platforms to help deliver tailored offers to customers, and analytics solutions.

To build the new asset base, fuel retailers will need to leverage venture capital, M&A, joint ventures, and alliances. These approaches will be critical to building a portfolio of early-stage investments in both new digital products and services. Several players, including international oil companies, are already using their own venture capital arms to invest in such areas. Shell, in particular, has been quite active, investing in mobility startups such as Ample, Aurora, and Openbay; digital players such as Maana; and new energy companies including Sunseap.

Develop New Capabilities and Expertise

To successfully meet the challenges ahead, fuel retailers need to up their game in a number of areas. First, they need to hone customer-centric capabilities, including ways to understand the needs and demands of on-the-go consumers. This entails investing in developing new digital functions, new technology capabilities, and expertise in new verticals such as logistics. Second, they must ensure that the organization can master heightened levels of complexity, including building and managing an ecosystem of partnerships. Third, they need to embrace agile ways of working to drive innovation.

Consider the actions required to adopt a truly customer-centric approach. Data and analytics have enabled companies to know their customers better than ever before, and fuel retailers must master such skills in order to anticipate and meet customers’ needs.

To succeed in these efforts, companies must expand their industry and functional expertise in such areas as digital product development, AI, blockchain, and IoT. They should attract and retain new talent, including data scientists, user experience designers, and software developers. They need to develop their expertise in new verticals such as last-mile logistics, real estate, and mobility overall. And they must break down the silos that exist today in many organizations around marketing (including the CRM systems and the loyalty programs it manages), payment cards (such as digital wallets), and fuel and nonfuel operations.

At the same time, fuel retailers need to build an operating model that can run an increasingly complex business. At any moment, a global fuel retailer may be operating in multiple market environments and geographies, each of which requires tailored business responses. For example, a global fuel retailer might wish to deploy ultrafast EV charging stations in one market while investing in expanding its traditional gasoline fuel station network in another market. To manage such complexity successfully and ensure that they realize potential synergies across markets, fuel retailers require efficient and effective governance and management. In the above situation, for example, the fuel retailer may be able to deploy a common platform for digitizing customer fueling in both markets.

Increased complexity will extend to the variety of approaches that must collaborate within the broader mobility and retail ecosystems. In some cases, fuel retailers will want to partner with other players. BP, for example, has a partnership that permits digital food delivery service Deliveroo to use BP service stations as collection points for purchases. In other instances, it may make more sense for them to integrate their new product or offering into an existing value chain. And in still other cases, fuel retailers will compete head to head with other players in a broad ecosystem with a new offering. BP, for example, has acquired the UK’s largest electric vehicle charging company, which owns and maintains 40,000 chargers in homes, businesses, and public spaces around the country.

Finally, fuel retailers need to ensure that as they experiment and innovate—developing various new products, services, formats, and partnerships—they embrace an agile way of working. Under the agile approach, companies can deploy cross-functional teams to innovate, test, and learn quickly. They should be willing to embrace a new, disruptive, fail-fast culture that allows the organization to innovate via quick sprints. By doing so, the company can identify customer pain points, develop fast prototypes and minimum viable products to address those needs, and quickly gauge market fit and desirability before scaling up. Shifting toward an agile mindset will be a major challenge for many traditional fuel retailers, since they have spent decades using the standard “waterfall” engineering approach to major projects. But making this shift will be critical to successful innovation.

The Imperative for Change

As the future begins to take definite shape, the implications for fuel retailers are both clear and severe. Fuel retailers no longer have the luxury to wait and see what happens. Rather, they must move now to leverage digital technology and expand into fast-growing, adjacent value pools. In markets where the changes are most dramatic, remaining relevant will require a complete reimagining of the service station.

In order to meet these challenges head-on, leaders of fuel retail organizations must ask themselves a few key questions:

- What is the environment in the company’s most important markets likely to be in the years ahead?

- What will the service station of the future look like? Which formats will win? How can the company reinvent its in-station and in-store experience?

- What steps must the organization take to optimize its service station network? Which formats fit best in each location?

- What new products and services should the company offer in and outside its service stations?

- What adjacent value pools in people and goods mobility are the most attractive?

- How can the company gain consumer insights, personalize its offering to customers, and monetize customer insight data?

- What are the company’s current capabilities in new digital technology such as AI, and where does it need to catch up?

- How effective is the company at striking and managing partnerships, joint ventures, and M&A?

- How can the company begin to transform its overall organization to embed the new capabilities, manage complexity, and focus on the customer journey?

- How can the company adopt a more agile and fail-fast culture in the organization?

Answering these questions will disclose critical areas for action. By seizing these opportunities, fuel retailers can carve out critical roles for their business in the lives of consumers around the world. In this way, they will not only survive but thrive in the years ahead.