BCG's Centre for Growth conducts a monthly Consumer Sentiment Snapshot to track public attitudes towards spending habits, disposable income and the UK's economic outlook.

Despite marginally lower inflation following the latest CPI announcement, this month’s snapshot reveals that consumers are still feeling pressure on their household budgets.

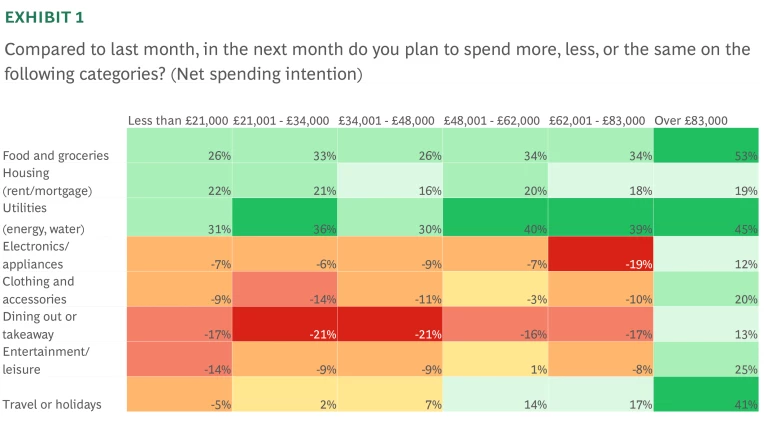

- For the third month in a row, individuals from lower income households plan to cut back on discretionary spending such as on dining out or buying new clothing, while essential spending on food, housing and utilities continues to rise.

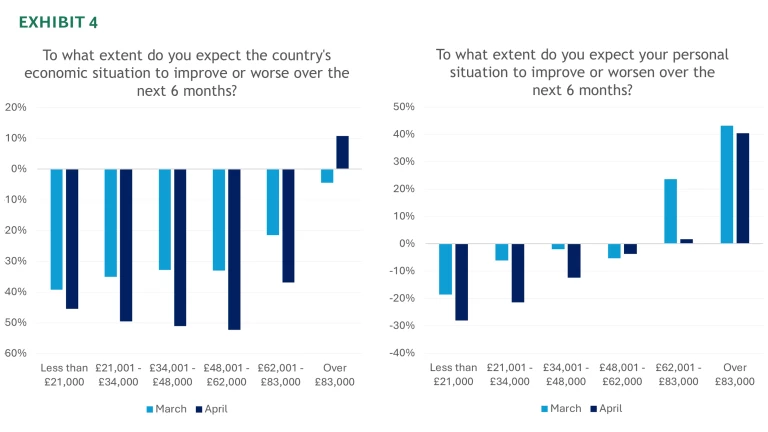

- There is declining confidence regarding the country’s economy. Two thirds of individuals with a combined household income of £62K or less think the country’s economic situation will worsen over the next six months, up 10pp from last month.

Consumers expect to be spending more on essential goods and services and less on discretionary goods and services this April compared to last month. The only exception to this, those from higher income households (combined income £83K+) who plan to spend more across every spending category, including net +20% more on clothing and accessories and +25% more on entertainment or leisure. Meanwhile, lower income households are cutting back the most on discretionary goods. This trend has broadly been true for the past three months. Higher income individuals have planned to spend more month on month, whereas medium to lower income individuals expect to spend less on discretionary goods this month versus March.

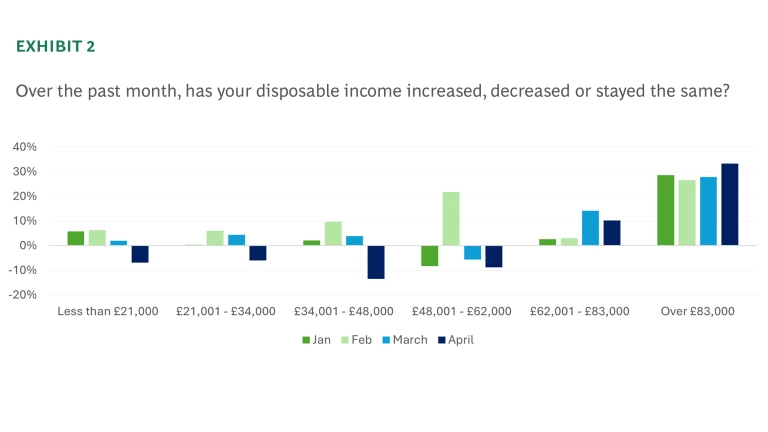

Lower income individuals are seeing their disposable income fall, while higher income individuals are seeing their disposable income rise month on month. April saw a marked shift in disposable incomes overall, with over 30% of those in groups with combined income under £62K a year saying their disposable incomes had fallen in the past month, likely reflecting higher spending on essential goods and services.

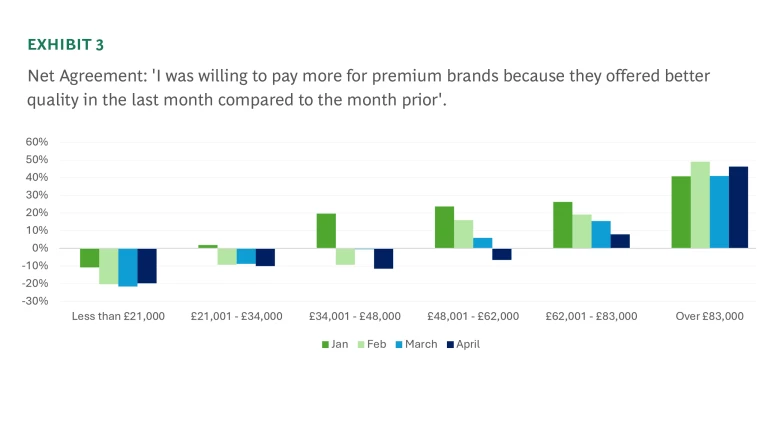

Willingness to spend on premium brands differs considerably across income groups. In April, a net +46% of the highest income individuals said they were willing to pay more, while a net –20% of the poorest earners said they were (as a greater share did not agree that they were willing to pay more for premium brands). The middle to high income groups – those earning £48K-£62K and £62K-£83K – have not followed the trend of the highest earners. Instead they appear increasingly less willing to spend on premium brands month on month this year.

Higher income consumers were more optimistic about their personal financial situation improving (net +40% for those earning over £83K) and more optimistic about the country’s economy (net +11% for those earning over £83K). Those earning over £83K were the only group net positive about the country’s economic situation, with every other income group at least -30% net (meaning they expect it to worsen instead of improve).

Raoul Ruparel, Director of BCG’s Centre for Growth, said: “Consumers are still holding back on discretionary spending; a troubling sign given the UK’s historic reliance on consumer-driven growth. Global economic uncertainty and falling asset prices, driven by US tariffs, are likely to further encourage some consumers to be cautious. What’s more, we’re seeing a growing divide between higher and lower income groups when it comes to disposable income and spending intentions. Overall, consumers also feel that the UK economy is going in the wrong direction, with people feeling noticeably more downbeat about the economy and their own finances than they were just a few months ago.”

For further information on the findings, please contact Mel Walker.