The UK economy was forecast to improve in 2025. Not long ago there was significant optimism that we would see stronger growth and business performance. However, in recent months we have witnessed falling business and consumer confidence, as a result of a rising cost base, stubborn inflation and global economic uncertainty. Meanwhile, economic growth underperformed expectations at the end of 2024 — despite overperforming across the year as whole. The upshot of this is that business leaders remain confident in the outlook for their own businesses this year, but are much more pessimistic about the prospects for the wider UK economy.

BCG’s third annual ‘State of UK Business’ survey from our Centre for Growth — a broad and comprehensive survey of over 1,500 UK business leaders — digs into exactly how the UK’s most senior business leaders are feeling and what their businesses are planning at a critical time for the UK economy.

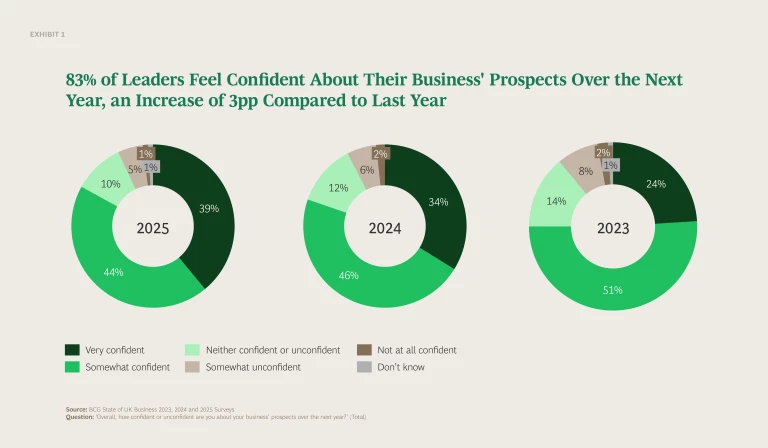

Business leaders currently feel positive about their prospects in 2025. 83% of business leaders say they are ‘confident’ about their prospects over the next year, with 39% ‘very confident'. This compares to 80% and 34% respectively in 2024. They also believe their profits will improve: 56% of business leaders think their profits will grow this year, up from 51% last year. This optimism is reflected across most of the UK.

Surprisingly, business leaders we surveyed also appear unlikely to reduce headcount this year. 75% plan to either grow or maintain their headcount (up 2pp from 2024), while 23% expect their headcount to fall (down 3pp). While there is some variance between business size, with large businesses both more likely to hire and lay off workers, all business sizes are more likely to say they will grow rather than shrink their headcount.

While businesses feel more confident about their own prospects, this isn’t true of their sentiment towards the UK economy more broadly. Concerns of an economic downturn have risen, with 57% of business leaders fearing a recession in the next 12 months, compared to 50% last year, although this is still considerably below the 75% in 2023.

Perspectives on the strength of the UK economy in the medium term have also declined significantly. There has been a fall of 11pp in businesses thinking economic growth will be ‘better’ in two years' time (from 62% last year to 51% this year), a 15pp fall in the share of businesses saying consumer confidence will be better, and an 11pp fall in those who think the business environment will be better.

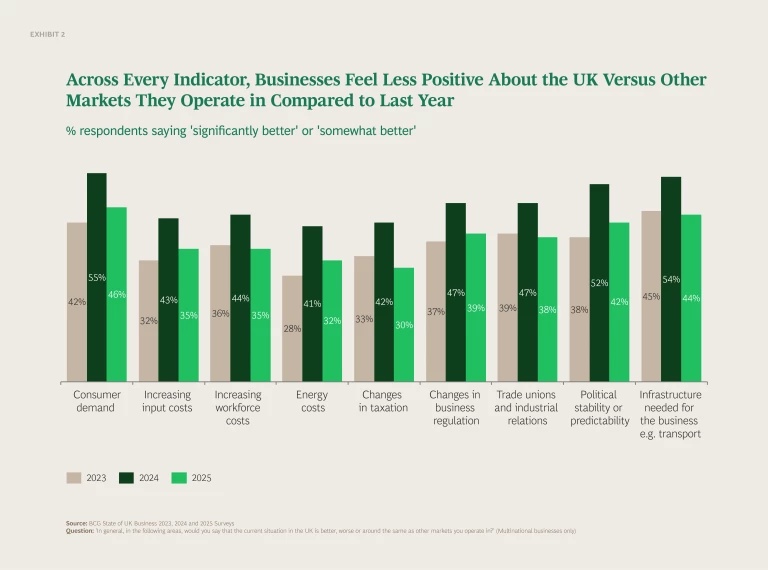

Meanwhile, multinational businesses are also much more pessimistic about Britain’s competitiveness. There has been a 9pp fall in business leaders believing consumer demand is better (to 46%), a 12pp fall in the share of businesses believing ‘changes in taxation’ are better (to 30%) and an 8pp fall in businesses believing that business regulation is better (to 39%). In some cases, sentiment is even more negative than it was in 2023.

It is these headwinds that look to be driving the disconnect between business leaders’ attitudes towards their own companies and their attitudes towards the health of the economy. Moreover, while it is still early days, the emerging signs suggest that the bleaker outlook nationally may be starting to eat into business confidence.

In particular, it appears to be leading to rising fears around the impact of higher taxes. The share of business leaders calling out higher taxes as a threat to their business has risen by 11pp since last year, with a third now citing it as a key concern. Meanwhile, concerns around energy costs — the primary threat foreseen by businesses over the last two years — have fallen by 5pp. While this could be seen as a positive, energy costs are now rising again. This means there is a risk that businesses face significantly higher costs this year as they have to contend with increases in taxes and energy costs.

Stay ahead with BCG insights on the public sector

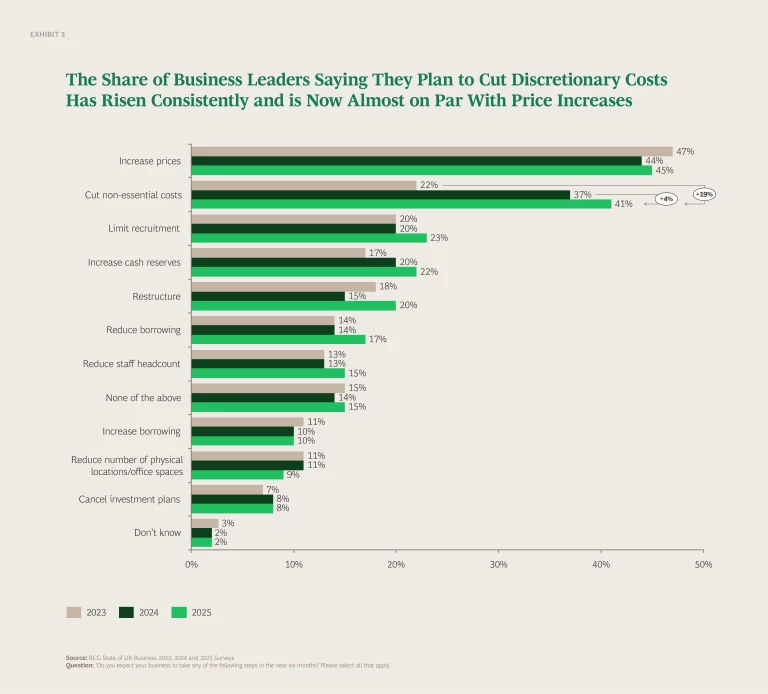

The only consolation to these growing challenges is that businesses appear to be reacting to higher costs in a way that mostly limits negative implications for the economy more broadly. We see almost double the share of business leaders planning to cut non-essential costs compared to 2023, rising from 22% to 41%, putting it just behind increasing prices in the order of priorities. When asked specifically about price rises, three-quarters of business leaders plan to raise prices this year, however by marginally less than they planned to last year.

But crucially, there does not seem to be huge willingness to cut headcount or investment. While there has been a slight increase in the share of business leaders (23%) expecting to refrain from new recruitment rounds in the coming year, plans to cut staff or investment are a low priority. In fact, there has been a slight increase (+3pp) in the share of businesses who foresee investing in technology as an opportunity for their business this year, climbing to 29%.

Digging deeper into business investment plans, which will be key for the government’s mission to boost economic growth, the outlook appears surprisingly positive. Most leaders say they are planning on investing in their business in some form in the coming year (only 13% say they do not plan to) and over three times the number of businesses think the UK offers good returns on investment (42%) compared to those who believe returns are bad (12%). Where businesses choose not to invest, judgements on the financial returns and economic environment trump supply-side considerations such as the availability of skills and infrastructure (although for more profitable businesses, finding the right skills was seen as a more important consideration when investing). In particular, there has been a 6pp jump in business leaders reporting that high taxes are deterring investment.

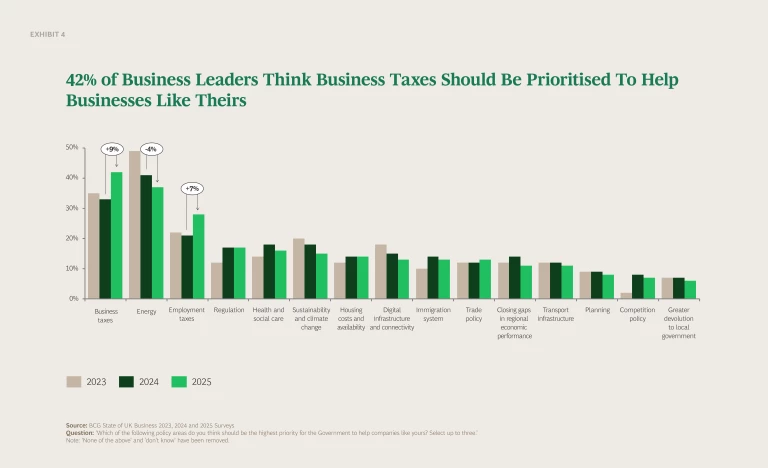

Unsurprisingly, therefore, leaders feel that action on taxes should take the highest priority to help businesses like theirs. 42% felt business taxes should be the highest priority, a 9pp increase from last year, and 28% felt it should be employment taxes, a 7pp increase. Following a similar theme, energy has shrunk slightly as a priority. For the first time, a majority of business leaders (53%) say they would prefer lower taxes and less government spending.

Taken together, the early signs present a potentially disappointing picture. Last year was a strong year for business confidence and business leaders still appear to be feeling the benefits of it. But that momentum has not been built on and, if anything, is at risk of falling away. The key question is whether businesses will be able to maintain their optimism and improve the national picture, or if economic headwinds will prove too challenging.

So far, business leaders appear resilient. Their reluctance to cut staff or investment plans is a positive signal that, if it continues, may mean the that the knock-on effects for the UK economy are more limited than they might have been, as businesses grapple with higher costs. With tax cuts unlikely given the economic context, the task for government is to embrace alternative ways to reduce the burden on business and send a more positive message. Reducing the regulatory burden which adds cost to business, providing maximum certainty around direction of policy and taking action to bear down on energy costs can all help to ensure that the level of confidence business leaders currently feel is maintained.

About Us

BCG's Centre for Growth brings together ideas, people and action to drive the UK forward. We work with our global expert network to identify transformational opportunities, connect key decision-makers and build coalitions for change. We offer long-term strategic insight, extensive cross-sector expertise, platforms for dialogue and bias to action.