不確実性の高い時代、企業リーダーにとって、世界的な潮流を読み取ることは自社の戦略の方向性を定めるうえで欠かせません。本書は、今後10年先の事業環境を見据え、2025年時点で優先的に検討すべきとBCGが考える経営上の重要論点を提示しています。

Featured Insights

おすすめコンテンツ

Article

2024年11月8日

Article

2024年5月30日

日本企業が今後も持続的に企業価値を高めていくためには、ガバナンス改革に加え、事業ポートフォリオの大胆な見直しを含め、事業の本質的な収益性や資本効率向上を実現すること、そして投資家と真摯に向き合い、長期投資家を呼び込むことが重要です。

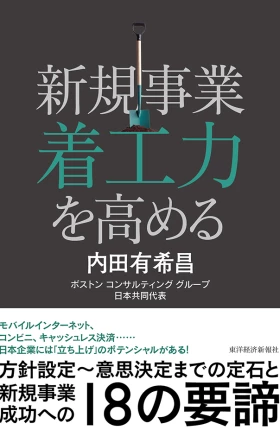

Article

2023年8月23日

再成長に向けて日本企業が新規事業の成功数を増やすために、筆者は組織としての新規事業「着工力」を高めることが必要と説きます。「着工力」に焦点を当てて、経営リーダーと事業企画・推進チームの双方が共通の認識をもち、効果的なプロセスで新規事業を進めるためのヒントをご紹介します。

Article

2024年5月24日

不確実性が高まる今、大胆な計画を生み出ためには従来の計画プロセスを再考する必要があります。本稿では、シナリオを取り入れた、4段階から成るプランニングプロセスを紹介します。

Article

2023年7月31日

BCG Future Winning Modelシリーズ前編では、日本企業の競争力低下の実態と原因について、直近5~10年間を中心に分析しました。BCG、およびBHI独自のデータソース等から浮き彫りになる日本企業の現状を明らかにしたうえで、グローバル市場で勝つための第一歩として必要な「5つのグローバル標準の成功要諦」について論じています。

Article

2023年11月17日

「グローバル標準の成功要諦」を押さえて競争優位を築いている日本のベストプラクティス企業は、日本企業に認められる特徴を独自の強みへと進化させています。長期的なトレンドを踏まえた「未来に向けた成功要件」も考察したうえで、Future Winning Model実現のためになすべき4つのアクションを提示します。

Finance Function Excellence

Article

2025年2月17日

Women who reach the top in finance are reshaping the profession and creating newfound value for their organizations. Female CFOs tell us how.

Article

2025年1月30日

Companies that optimize their balance sheet can improve earnings by an average of 5% across industries.

Article

2024年10月10日

Companies are extending the art of what’s possible by achieving a quantum leap in reporting via systematic reframing and approaching reporting from new perspectives.

Article

2023年8月22日

Now is the time for CFOs to learn about the most impactful applications of generative AI and prepare to capitalize on emerging capabilities.

Perspectives on Strategy and Value: Insights on creating sustainable value in an uncertain world.

From the C-Suite

Video

2025年3月12日

A Time for Bold Decisions in the EU

Former European Commission president José Manuel Barroso shares his views on how the EU can prepare for the possibility of a trade war while improving its competitiveness and recalibrating its climate transition policy.

Video

2024年12月13日

Aptiv’s Future-Forward Innovations Are Driving Change in the Auto Industry

In an incredibly dynamic market, Kevin Clark, CEO of Aptiv, explains how the company is using technology to improve safety and efficiency while also creating solutions for its customers.

Video

2024年12月11日

Pinhook CEO Alice Peterson on Leading a Bourbon Business

Alice Peterson, CEO of Pinhook, discusses the core capabilities CEOs need and how problems may suggest their own innovative solutions.

The CFO Agenda

Our CFO insights help leaders excel in balancing the CFO agenda, managing daily operations, and driving transformation for long-term success.

Strategy and Strategic Planning

Article

2024年10月1日

Companies must be ready not only to mitigate the negative consequences of risk but also to capitalize on the positive ones.

Article

2024年9月17日

There’s no one-size-fits-all strategy to drive revenue growth. Our latest research reveals six starting-point archetypes, each associated with a different path to success.

Interview

2023年10月9日

What’s behind IBM’s hybrid cloud and AI strategy? The company’s lead strategist offers an inside scoop.

Interview

2023年9月28日

Transactions have been central to Moody’s transformation from bond-rating giant to integrated risk management leader. The company’s lead strategist shares his philosophy.

Zero-Based Budgeting

Article

2024年10月31日

Cost management is a top corporate priority today. But so is investing in talent, critical technologies, and strategic opportunities. A ZBO approach offers a solution to this dilemma.

Article

2023年1月17日

ZBT can do much more than inject cost discipline—it can help companies maintain their strategic momentum even amid difficult economic conditions.

Article

2022年11月9日

The best approach to zero-based transformation comes from treating all spending as investment and making the CFO a key strategist for generating value.

CEOアジェンダ

先を見据えたCEOアジェンダの重要性は、これまでになく高まっています。BCGの論考などが、将来を読み解くヒントとなり、経営リーダーのみなさまが自信を持って進んでいく助けとなれば幸いです。

BCG Classics Revisited

Classics

2013年5月28日

The experience curve theory still holds, particularly in specific industries. But to succeed in today’s environment, many companies need to develop an additional kind of experience.

Classics

2013年12月23日

The principles of time-based competition—a classic concept among BCG insights—still hold. But today’s companies must be adaptive, as well as fast, in order to succeed.

Classics

2012年12月4日

BCG founder Bruce Henderson’s rule, conceived in 1976, still holds valuable lessons for companies in many industries.

Classics

2014年6月4日

The growth share matrix—put forth by the founder of BCG, Bruce Henderson, in 1970—remains a powerful tool for managing strategic experimentation amid rapid, unpredictable change.

Corporate Finance and Strategy on LinkedIn

Visit our LinkedIn Showcase page for the latest on corporate finance and strategy from BCG.